Kratos Defense & Security Solutions (KTOS) Valuation Check After Strong 1-Year Share Price Surge

Kratos Defense & Security Solutions (KTOS) has been quietly rewarding long term holders, with the stock nearly doubling over the past year, even after a choppy past 3 months.

See our latest analysis for Kratos Defense & Security Solutions.

That recent 4.45% 1 day share price gain to 79.29 comes after a sharp 90 day share price pullback, yet the 1 year total shareholder return of 188.54 percent shows the broader uptrend is still very much intact.

If Kratos has you rethinking defense exposure, this could be a good moment to explore other opportunities across aerospace and defense stocks that might complement your portfolio.

With revenue and earnings climbing and the share price still sitting at a notable discount to Wall Street targets, is Kratos underrated at these levels, or is the market already factoring in years of future growth?

Most Popular Narrative Narrative: 21.2% Undervalued

With Kratos last closing at 79.29 against a most popular fair value estimate around 100.56, this valuation framework implies a sizeable upside still on the table.

Strategic wins on generational programs (e.g., Poseidon, MACH-TB, Prometheus, GEK), ongoing facility expansions, and deepening partnerships with primes and government agencies are creating a strong multi year visibility into revenue and cash flow growth. As these large scale awards transition into full rate production, Kratos is set to leverage operational scale for improved net margin, increasing the company's earnings power and long term intrinsic value.

Want to see the engine behind that triple digit fair value? The narrative leans on steep revenue ramps, sharply higher margins, and a punchy future earnings multiple. Curious how those moving parts interact? Dig into the full story and test whether these assumptions match your own expectations.

Result: Fair Value of $100.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy upfront investment and reliance on major government programs mean that any contract delays or budget shifts could quickly challenge the bullish growth narrative.

Find out about the key risks to this Kratos Defense & Security Solutions narrative.

Another Angle on Valuation

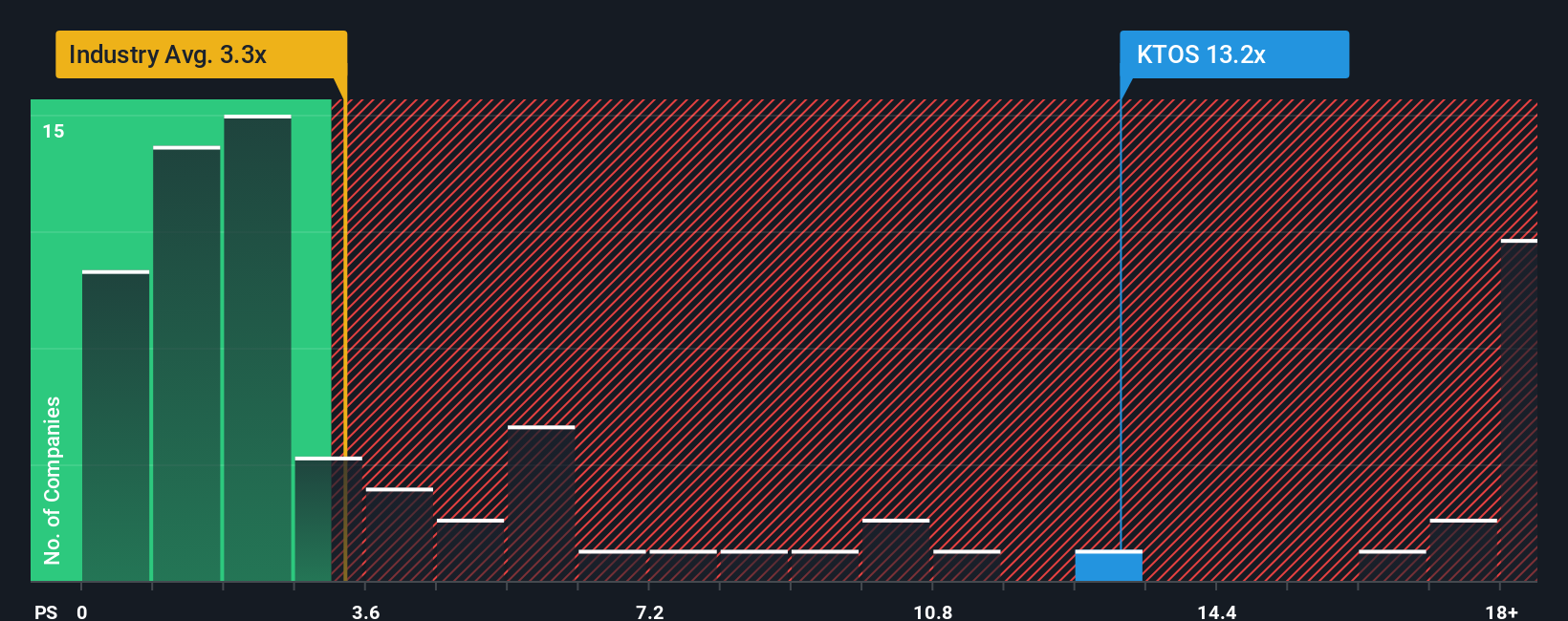

Looking beyond the upbeat fair value estimates, Kratos can appear expensive through a simpler lens. Its price-to-sales ratio of 10.4 times stands well above the US Aerospace and Defense industry at 3.5 times, peers at 4 times, and even a fair ratio of 2.7 times. This may increase the risk that any stumble could trigger a sharp reset in expectations.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kratos Defense & Security Solutions Narrative

If you see the story differently, or simply want to stress test the assumptions against your own research, you can build a complete view yourself in just a few minutes: Do it your way.

A great starting point for your Kratos Defense & Security Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by using the Simply Wall Street Screener to uncover focused opportunities that most investors are still overlooking.

- Capture potential bargains by targeting companies trading below their estimated cash flow value through these 875 undervalued stocks based on cash flows and sharpen your hunt for mispriced quality.

- Explore the next wave of innovation by scanning these 29 quantum computing stocks that could influence computing, security, and data processing over the coming decade.

- Identify income potential by filtering for steady payers using these 14 dividend stocks with yields > 3% and avoid missing out on consistent yield opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal