TeraWulf (WULF): Assessing Valuation After Regulatory Win, AI Data Center Financing and Executive Equity Grants

TeraWulf (WULF) just logged a double digit jump after a cluster of company milestones, from fresh regulatory approval in New York to big ticket AI data center financing and new executive equity grants.

See our latest analysis for TeraWulf.

Those catalysts are landing on top of a volatile backdrop, with the $12.74 share price rebounding from a weak 1 month share price return but still supported by a powerful 1 year total shareholder return and an exceptional 3 year total shareholder return. This suggests momentum is rebuilding rather than fading.

If TeraWulf’s mix of crypto exposure and AI infrastructure has your attention, it is worth seeing what else is out there across high growth tech and AI stocks.

With revenue and earnings ramping fast but losses still deep, and the stock trading well below analyst targets despite a huge three year run, is TeraWulf a genuine mispriced growth story, or is the market already baking in its AI upside?

Most Popular Narrative Narrative: 40.6% Undervalued

With TeraWulf last closing at $12.74 versus a narrative fair value near the low twenties, the valuation case leans heavily on its rapid infrastructure shift.

Long term partnerships and investments from marquee players (Google's $1.8B lease backstop and equity stake) signal institutional validation, enhance creditworthiness, and are likely to lower WULF's future cost of capital, directly supporting margin expansion and accelerated infrastructure growth.

Want to see what powers that bold upside view? The narrative leans on relentless revenue compounding, a sharp profit margin turn, and a future earnings multiple more typical of elite growth names. Curious how those moving parts connect into a single fair value number? Dive in to see which assumptions really carry the valuation.

Result: Fair Value of $21.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat view could be challenged if capital intensive AI build outs strain the balance sheet, or if key counterparties like Fluidstack or Google alter commitments.

Find out about the key risks to this TeraWulf narrative.

Another Angle on Valuation

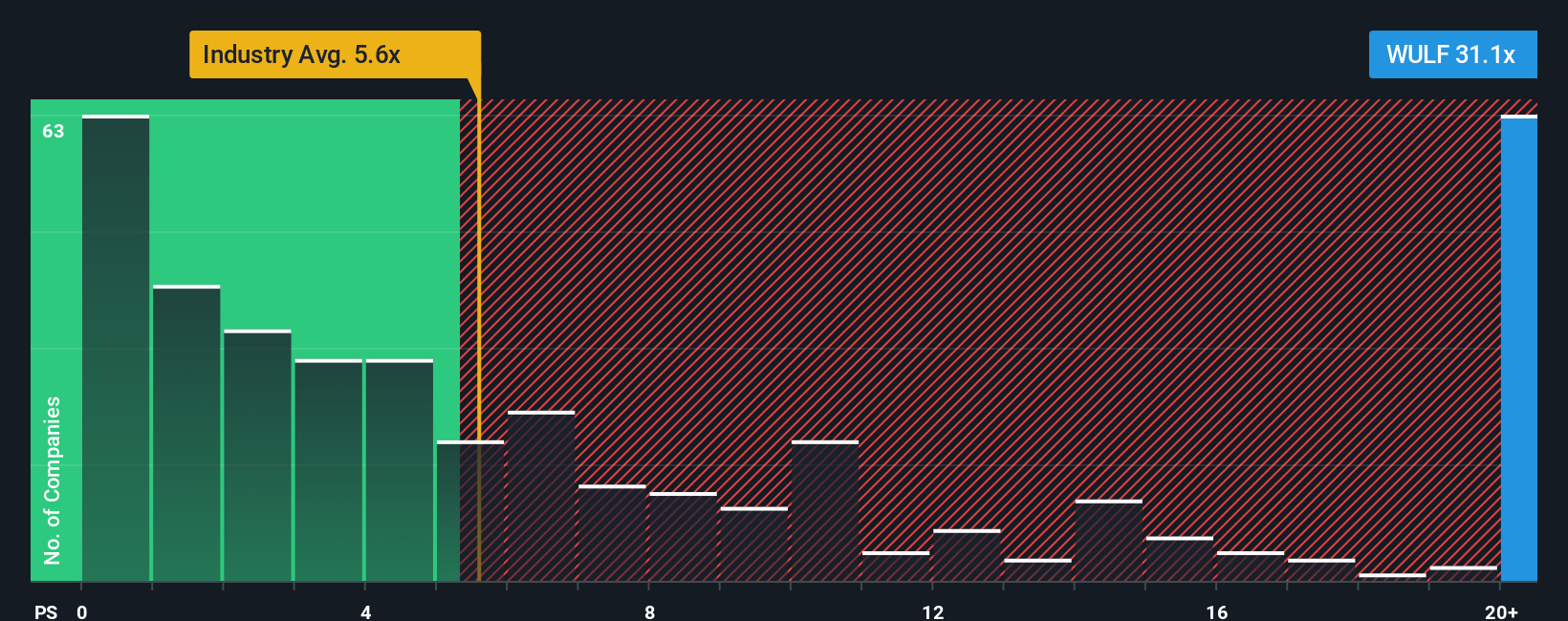

On simple sales metrics, the picture flips. TeraWulf trades at about 31.8 times revenue, versus roughly 17.2 times for peers and 4.7 times for the broader US software group. This is also above a fair ratio near 11 times, which raises the risk that sentiment, rather than fundamentals, is driving today’s price.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TeraWulf Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just a few minutes: Do it your way.

A great starting point for your TeraWulf research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single stock. Put your research edge to work by scanning targeted, data driven shortlists that surface opportunities most investors will overlook.

- Capitalize on mispriced potential by hunting through these 875 undervalued stocks based on cash flows where solid businesses trade at meaningful discounts to their estimated cash flow value.

- Ride the next wave of intelligent automation by focusing on these 25 AI penny stocks packed with companies building and enabling powerful AI driven technologies.

- Strengthen your portfolio’s income engine by reviewing these 14 dividend stocks with yields > 3% and evaluating reliable yield backed by sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal