Grifols (BME:GRF): Reassessing Valuation After Recent Share Price Momentum

Grifols (BME:GRF) has been quietly grinding higher, with the stock up around 5% over the past month and roughly 20% over the past year, as investors reassess its long term earnings power.

See our latest analysis for Grifols.

The latest 1 day share price return of 4.63 percent and 1 year total shareholder return of 20.25 percent suggest that momentum has picked up again, even after a weaker 90 day share price performance.

If this move in Grifols has you rethinking the sector, it may be a good moment to explore other potential opportunities across healthcare stocks as well.

Yet with shares still trading at a sizeable discount to analyst targets and intrinsic value estimates despite improving earnings, the real question is whether this momentum signals a genuine buying opportunity or whether markets are already pricing in future growth.

Most Popular Narrative: 26.3% Undervalued

With Grifols last closing at €11.20 against a narrative fair value of €15.20, the implied upside hinges on ambitious profitability assumptions taking hold.

Disciplined cost management, deleveraging efforts, and normalization of business operations are strengthening Grifols' balance sheet and enabling higher free cash flow generation, supporting reinvestment and the resumption of shareholder returns, positively impacting net margins and overall earnings quality.

Curious how modest revenue growth can still justify a double digit earnings ramp and a richer future valuation multiple, all under an 8 percent discount rate? The most popular narrative lays out a detailed playbook of margin recovery, balance sheet repair, and earnings power that aims to bridge today’s price to that higher fair value. Want to see exactly which forecasts make that gap look achievable on paper?

Result: Fair Value of €15.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this playbook could unravel if pricing pressure in key markets intensifies or high leverage constrains Grifols' ability to continue funding growth.

Find out about the key risks to this Grifols narrative.

Another Angle on Value

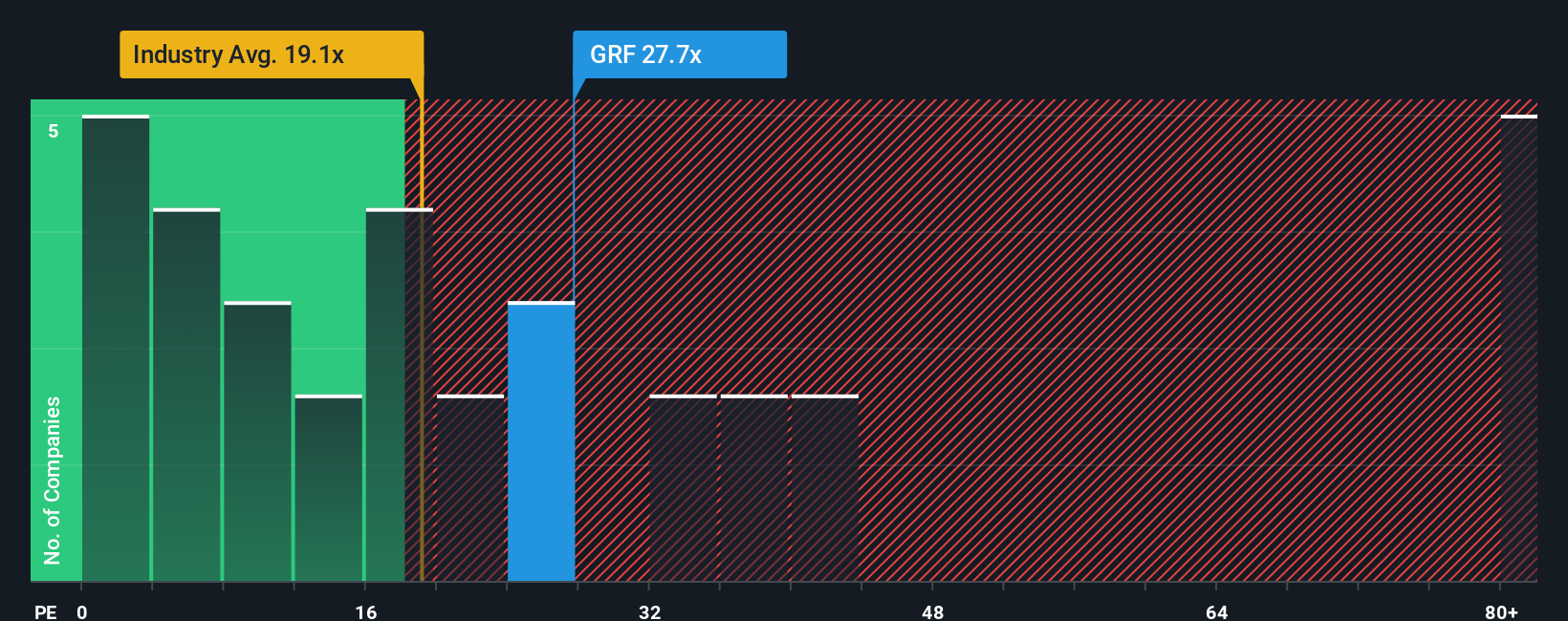

On earnings, the picture gets more complicated. Grifols trades on about 20.4 times earnings, richer than the European biotech average of 16.1 times but below peers at 36.7 times, while our fair ratio suggests 37.6 times. Is that a safety margin or a value trap if growth disappoints?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grifols Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized view in minutes: Do it your way.

A great starting point for your Grifols research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, explore fresh stock ideas tailored to your style using the Simply Wall Street Screener.

- Identify potential double digit mispricings by targeting companies that appear inexpensive on a cash flow basis using these 875 undervalued stocks based on cash flows.

- Build a growth watchlist with innovative names in automation and smart computing through these 25 AI penny stocks.

- Focus on your income stream with companies that generate cash and offer attractive payouts via these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal