Intercontinental Exchange (ICE): Revisiting Valuation After a Recent Pullback in the Share Price

Intercontinental Exchange (ICE) has been quietly grinding higher over the past year, and the recent pullback from about $160 offers a useful moment to revisit how its data and exchange engine is really driving earnings.

See our latest analysis for Intercontinental Exchange.

That pullback sits against a steady grind higher, with the latest share price at $159.99 and a solid 1 year total shareholder return of about 8 percent, building on an impressive 3 year total shareholder return near 59 percent. This points to momentum that is soft in the near term but still very much intact over the longer term.

If this kind of steady compounding appeals to you, it is also worth scanning other financial infrastructure and market platform names through fast growing stocks with high insider ownership for fresh ideas.

With earnings still growing faster than revenue and the share price sitting well below consensus targets, is Intercontinental Exchange quietly undervalued, or is the market already baking in years of future growth?

Most Popular Narrative Narrative: 16.1% Undervalued

With the narrative fair value sitting around $190.79 versus the $159.99 last close, the story leans bullish on ICE's earnings and margin engine.

The continued expansion and integration of ICE's global electronic trading platforms across asset classes including record energy, interest rate, and equity contract volumes suggests ongoing benefits from digitization and greater market electronification, which are likely to drive sustained double digit growth in transaction revenues and operating leverage.

Curious how steady mid single digit revenue growth, rising margins, and a richer future earnings multiple can still justify upside from here? The narrative lays out a tight, numbers driven roadmap from today’s earnings base to a much larger profit pool, then prices it using a premium valuation that rivals many growth franchises. Want to see exactly how those assumptions stack up to reach that fair value?

Result: Fair Value of $190.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained softness in mortgage technology and a deeper cyclical pullback in energy volumes could quickly challenge the upbeat earnings and valuation path outlined here.

Find out about the key risks to this Intercontinental Exchange narrative.

Another View: Cash Flow Signals More Downside

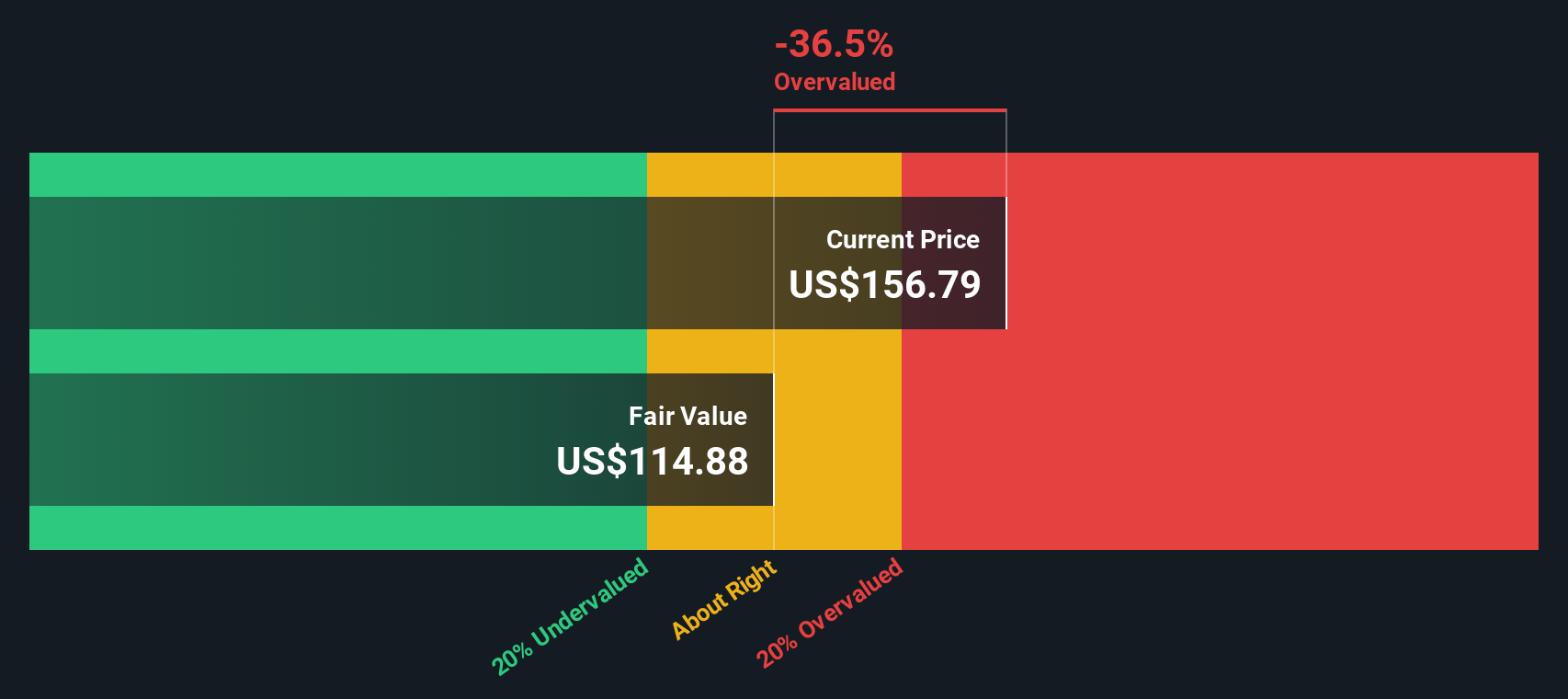

While the narrative fair value suggests upside, our DCF model lands much lower, around $115 per share versus today’s $159.99. This implies ICE trades well above that cash flow based estimate. Is the market right to pay up, or are expectations simply running too hot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Intercontinental Exchange for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Intercontinental Exchange Narrative

If you see the story differently or simply want to test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A great starting point for your Intercontinental Exchange research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single opportunity when you can quickly scan targeted stock ideas on Simply Wall St’s screener and line up your next potential winner today.

- Explore potential market mispricing by reviewing these 875 undervalued stocks based on cash flows that may merit further analysis as sentiment and fundamentals evolve.

- Research structural growth themes using these 25 AI penny stocks to find companies developing businesses related to artificial intelligence.

- Identify potential income opportunities by targeting these 14 dividend stocks with yields > 3% that combine dividend payments with underlying business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal