Lattice Semiconductor (LSCC): Assessing Valuation After AI-Fueled Sector Rally and sensAI Platform Momentum

Lattice Semiconductor (LSCC) kicked off the year with a 6% jump as investors piled back into AI oriented chip names, supported by a sector wide rally and buzz around its sensAI edge AI platform.

See our latest analysis for Lattice Semiconductor.

The latest 6.89% 1 day share price return, taking Lattice Semiconductor to $78.65, comes after a year where a 39.75% 1 year total shareholder return signaled steady, AI themed momentum rather than a sudden reversal.

If sensAI has caught your eye, this could be a good moment to see what else is building buzz in high growth tech and AI stocks and compare potential AI winners side by side.

With shares already near analyst targets after a powerful multi year run and AI excitement firmly in the narrative, the real question now is whether Lattice remains mispriced to the upside, or if the market is already discounting its next leg of growth?

Most Popular Narrative: 3.2% Undervalued

With Lattice Semiconductor last closing at $78.65 against a narrative fair value of about $81.23, the story leans toward modest upside while hinging on powerful AI and edge computing drivers.

The ongoing AI and edge computing boom is driving hyperscale data center spend and increasing Lattice's attach rate as a companion chip for AI accelerators, servers, and networking equipment, leading to higher ASPs and robust design wins. This could accelerate revenue growth and support gross margin expansion.

Want to see what kind of revenue runway and margin lift this narrative is baking in, and how that translates into a premium future earnings multiple? The underlying assumptions connect aggressive profit scaling, resilient top line growth, and a valuation usually reserved for market darlings. Curious how those moving parts stack up into that fair value estimate? Dive into the full story to see which projections are doing the heavy lifting.

Result: Fair Value of $81.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising low end and mid range FPGA competition, along with tighter export controls, could compress margins, unsettle demand, and challenge today’s upbeat AI centric thesis.

Find out about the key risks to this Lattice Semiconductor narrative.

Another View: Rich on Sales Metrics

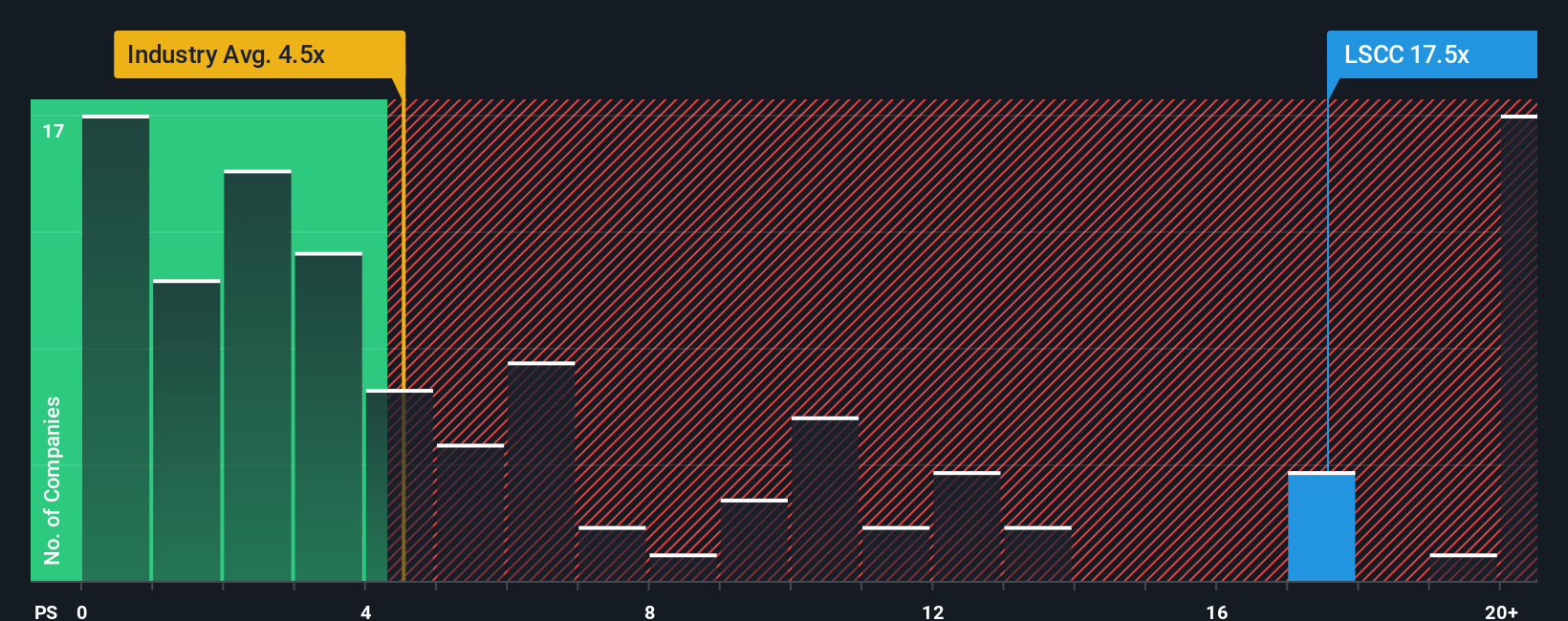

While the narrative fair value points to about 3.2% upside, a simple price-to-sales check paints a tougher picture. Lattice trades at roughly 21.7 times sales, far above the US semiconductor average of 5.6 times and a fair ratio closer to 9.3 times.

That gap suggests the market is already paying up heavily for AI and edge potential, leaving less room for error if growth stalls or margins disappoint. This raises the question: are investors stretching too far ahead of the fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lattice Semiconductor Narrative

If you see the story differently, or simply want to dig into the numbers yourself, you can build a personalized thesis in minutes using Do it your way.

A great starting point for your Lattice Semiconductor research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning fresh opportunities on Simply Wall St, where curated screeners surface ideas many investors overlook.

- Enhance your search for mispriced opportunities by exploring these 875 undervalued stocks based on cash flows, which highlights companies pairing strong cash flows with potentially attractive entry points.

- Target innovative businesses by reviewing growth names in these 25 AI penny stocks that are positioned to benefit from the adoption of intelligent automation.

- Explore potential income and stability by focusing on companies in these 14 dividend stocks with yields > 3% that combine appealing yields with payout profiles described as sustainable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal