What Does Thor Explorations' (TSXV:THX) New Feasibility Detail Reveal About Its Long-Term Strategy?

- Thor Explorations previously held a special call to discuss its Preliminary Feasibility Study, signaling that new technical and economic details on key projects were made available to the market.

- This focused discussion of feasibility outcomes offers fresh insight into Thor’s potential project timelines, capital needs, and future production profile, which can be critical for investor expectations.

- We’ll now explore how fresh details from the Preliminary Feasibility Study discussion could reshape Thor Explorations’ broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Thor Explorations Investment Narrative Recap

To own Thor Explorations, you need to believe it can convert its West African pipeline into sustainable, diversified production while keeping costs in check and funding growth prudently. The special call on its Preliminary Feasibility Study directly affects the key near term catalyst of advancing new projects toward development, while also sharpening visibility on the biggest risk right now: whether future projects can be built economically without straining the balance sheet or diluting shareholders. If that impact proves limited, investors may treat the update as incremental rather than transformational.

Among recent announcements, Thor’s steady reaffirmation of 2025 production guidance at 85,000 oz to 95,000 oz of gold, alongside AISC guidance of US$800 to US$1,000 per ounce, feels especially relevant. The Preliminary Feasibility Study details now sit against this backdrop of consistent operational delivery, giving investors more context on how upcoming development decisions could affect future output, cost levels, and ultimately the durability of the company’s relatively low valuation multiples and new dividend stream.

But while the growth pipeline looks promising, investors should be aware that project economics and funding choices could...

Read the full narrative on Thor Explorations (it's free!)

Thor Explorations' narrative projects $128.9 million revenue and $65.3 million earnings by 2028. This implies a 20.1% yearly revenue decline and a $72.1 million earnings decrease from $137.4 million today.

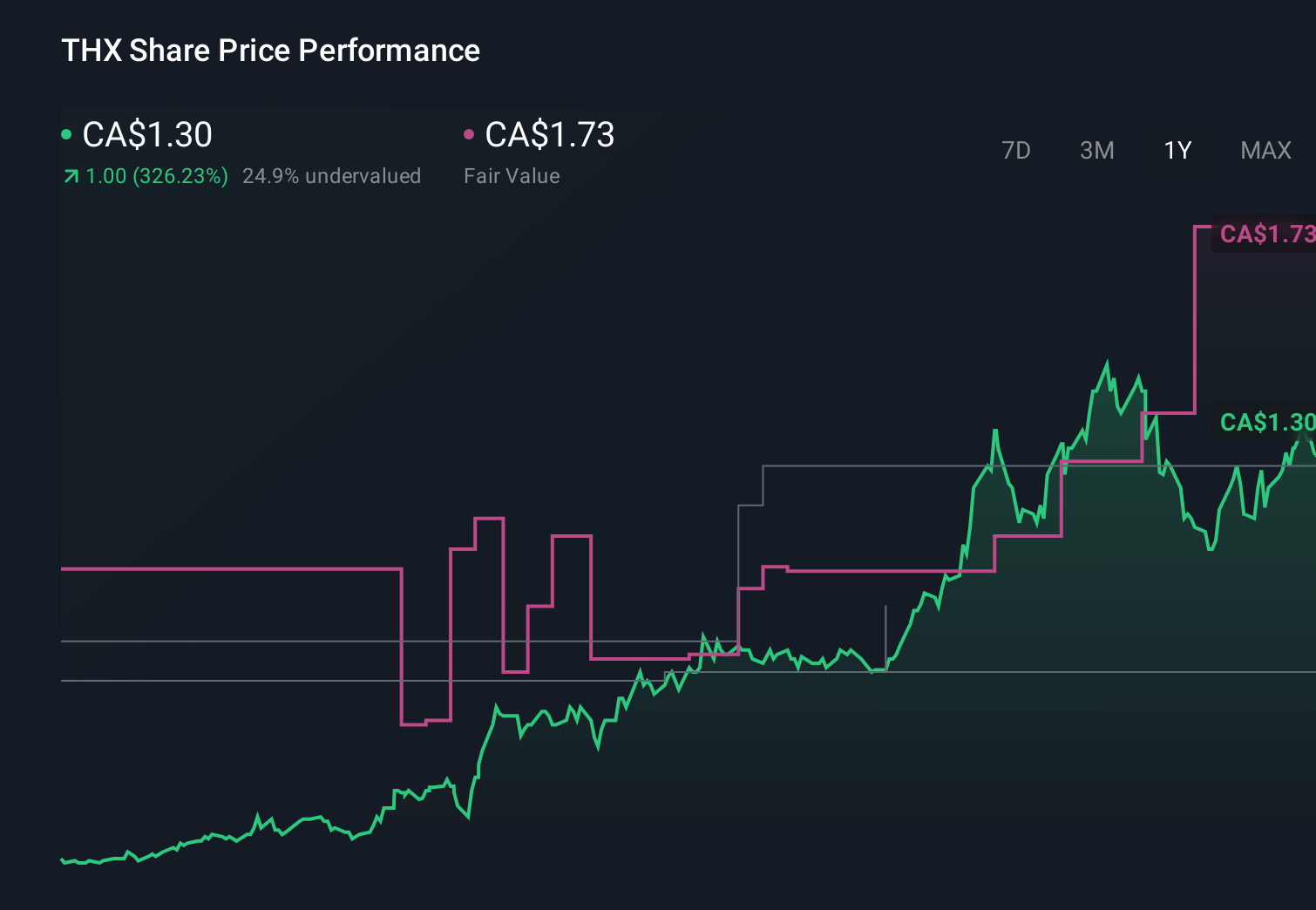

Uncover how Thor Explorations' forecasts yield a CA$1.73 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span from CA$0.16 to CA$3.32 per share, showing sharply different views on Thor’s worth. Set against the current focus on project feasibility and funding risk, these contrasting opinions remind you to weigh multiple scenarios for future cash flows and production.

Explore 9 other fair value estimates on Thor Explorations - why the stock might be worth over 2x more than the current price!

Build Your Own Thor Explorations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thor Explorations research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Thor Explorations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thor Explorations' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal