SentinelOne (S) Valuation Check After Recent Pullback And Cooling Momentum

SentinelOne (S) has been grinding through a choppy stretch, with the stock down over the past 3 months but slightly positive over the past month, leaving investors reassessing its risk reward profile.

See our latest analysis for SentinelOne.

At a share price of $14.64, SentinelOne’s recent pullback, including a weak 90 day share price return and double digit negative 1 year total shareholder return, suggests momentum has cooled as investors reassess how much growth they are willing to pay for.

If SentinelOne’s ride has you rethinking your options, this could be a smart moment to scout high growth tech and AI stocks and see what else is setting up for the next leg higher.

With shares lagging over the past year but still growing double digits on the top line, the key question now is simple: Are investors overlooking SentinelOne’s potential, or has the market already priced in its next wave of growth?

Most Popular Narrative: 32.1% Undervalued

With SentinelOne last closing at $14.64 versus a narrative fair value near $21.55, the most followed view implies a sizable disconnect in pricing.

Expansion beyond endpoint security into high demand adjacent markets such as cloud security, identity, and data protection including the Prompt Security acquisition for GenAI risk unlocks significant cross sell opportunities and is expected to elevate average contract value and diversify revenue streams, laying the groundwork for outsized multi year revenue growth.

Curious how this story justifies such a steep gap to today’s price? The narrative leans on accelerating revenue, rising margins, and a bold future earnings multiple. Want to see exactly how those moving parts combine into that fair value call?

Result: Fair Value of $21.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, international regulatory hurdles, or partners prioritizing their own security stacks, could slow growth, pressure margins, and challenge the bullish undervaluation narrative.

Find out about the key risks to this SentinelOne narrative.

Another Take: Rich on Sales Despite Fair Value Gap

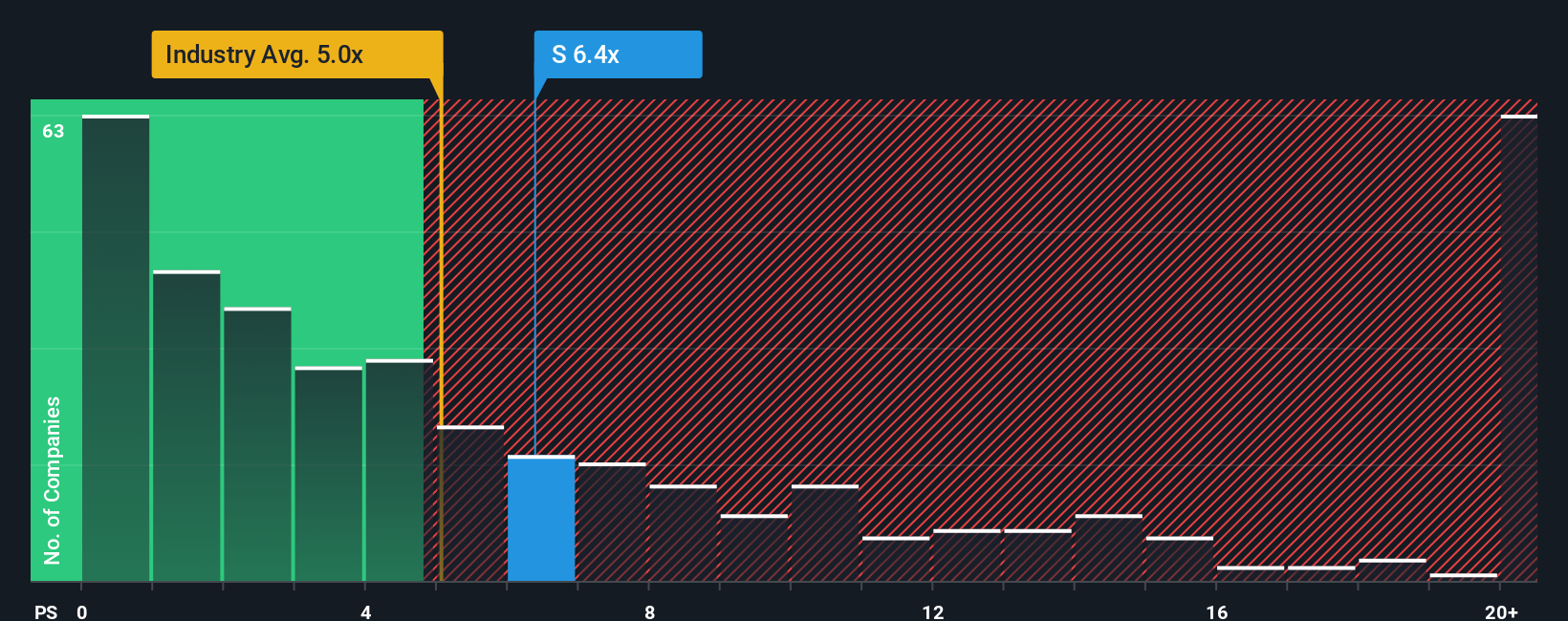

There is a twist when you look at SentinelOne through its price-to-sales lens. At 5.2 times sales, the stock is slightly more expensive than the wider US software sector at 4.7 times, yet still cheaper than close peers at 6 times and our fair ratio estimate of 5.9 times.

This split picture highlights potential upside if sentiment normalizes, but also some valuation risk if sector multiples compress first. Which way do you think the market will lean from here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SentinelOne Narrative

If you are not fully convinced by this angle or want to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your SentinelOne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Before the market’s next shift leaves you watching from the sidelines, put the Simply Wall St Screener to work and line up your next high conviction ideas.

- Target potential multibaggers early by scanning these 3571 penny stocks with strong financials where smaller companies with powerful fundamentals are already starting to separate themselves from the pack.

- Identify emerging breakthroughs by focusing on these 25 AI penny stocks that are applying artificial intelligence to real world problems with growing demand.

- Find quality at sensible prices by reviewing these 875 undervalued stocks based on cash flows that show solid cash flow support yet still trade at appealing valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal