Allegiant Travel (ALGT): Has the Recent Rebound Left the Stock Overvalued or Fairly Priced?

Allegiant Travel (ALGT) has quietly staged a sharp rebound over the past few months, and that kind of move usually makes investors ask whether this is the start of a durable recovery or just a bounce.

See our latest analysis for Allegiant Travel.

The stock’s recent surge stands out against a weak 1 year total shareholder return of minus 6.3 percent. However, a 90 day share price return of 37.7 percent suggests momentum is clearly rebuilding around Allegiant’s recovery story.

If Allegiant’s rebound has you reassessing opportunities in travel and transportation, it might also be worth exploring aerospace and defense stocks for other companies showing interesting risk reward profiles right now.

With earnings recovering faster than revenue, but the share price still below long term highs, is Allegiant Travel quietly undervalued after years of turbulence, or is the market already pricing in the next leg of its growth?

Most Popular Narrative: 27% Overvalued

Compared with Allegiant Travel’s last close at $88.01, the most followed narrative sees fair value much lower, framing today’s rebound as potentially stretched.

Recent and ongoing fleet modernization, specifically ramping up MAX aircraft to 20% of available seat miles by 2026 and retiring older, less efficient Airbus jets, should reduce fuel and maintenance costs. This could drive down CASM and improve net margins as operational efficiency and gauge increase, especially as utilization is strategically shifted toward peak periods.

Want to see what kind of revenue runway and margin reset could justify that future earnings leap and low multiple? The narrative’s projections may surprise you.

Result: Fair Value of $69.58 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, soft leisure demand and rising labor costs, including pilot contract pressures, could quickly undermine the efficiency gains this recovery story relies on.

Find out about the key risks to this Allegiant Travel narrative.

Another Angle on Value

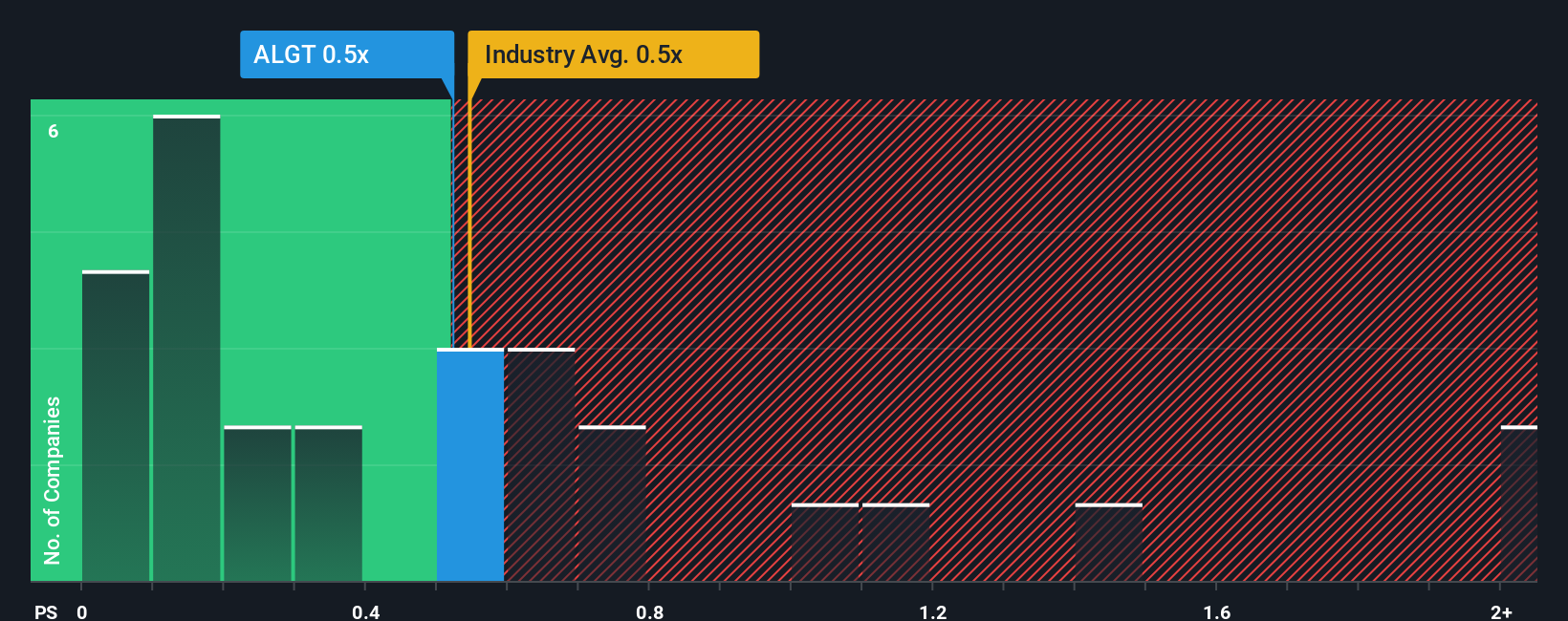

While the narrative driven fair value of $69.58 implies Allegiant Travel is overvalued at $88.01, a simple price to sales check tells a softer story. At 0.6 times sales, the stock looks roughly in line with the 0.6 times industry average and just under a 0.7 times fair ratio. This hints at limited upside but not obvious excess. Is this a margin of safety, or just a thin cushion if the recovery wobbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Allegiant Travel Narrative

If you see Allegiant’s story differently or want to stress test the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Allegiant Travel research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with Allegiant when the market is full of opportunities. Use the Simply Wall Street Screener today so fresh ideas never slip past you.

- Lock onto potential multi baggers early by scanning these 3571 penny stocks with strong financials that already show resilience in their financial foundations.

- Position yourself at the forefront of intelligent automation by targeting these 29 healthcare AI stocks transforming diagnostics, treatment pathways, and hospital efficiency.

- Secure stronger portfolio income potential by focusing on these 14 dividend stocks with yields > 3% that combine reliable payouts with solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal