Arista Networks (ANET): Reassessing Valuation as AI Networking Growth and Investor Optimism Accelerate

Arista Networks (ANET) is back in the spotlight as investors reassess its role at the center of AI data center build outs, with strong demand, a sizable backlog, and rich valuations all converging.

See our latest analysis for Arista Networks.

The stock has cooled off after an AI fueled surge, with a recent 1 day share price return of 1.96 percent and a 1 year total shareholder return of 15.97 percent signaling that momentum is moderating but still clearly positive in a longer term context.

If Arista has you thinking about the broader AI infrastructure wave, this is a good moment to explore other high growth tech and AI stocks that could benefit from similar tailwinds.

With revenue and net income compounding far faster than many AI darlings, and the stock now trading below consensus targets after a recent pullback, is Arista quietly undervalued or already pricing in years of hyperscale growth?

Most Popular Narrative: 18.2% Undervalued

With Arista Networks last closing at $133.60 against a most popular narrative fair value of $163.37, the story points to meaningful upside driven by sustained AI networking demand rather than short lived hype.

The migration of AI networking from proprietary standards (InfiniBand, NVLink) to open Ethernet solutions is expanding Arista's addressable market, expected to drive sustained multi year revenue growth as hyperscalers and enterprises favor open, scalable architectures for both back end and front end AI clusters.

Want to see what happens when rapid top line expansion meets only modest margin compression, and still commands a premium future earnings multiple? Unlock the full narrative to discover the precise growth and profitability glide path supporting that higher fair value.

Result: Fair Value of $163.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated reliance on a few hyperscale customers and intensifying AI networking competition could quickly derail the premium multiple that underpins this upside case.

Find out about the key risks to this Arista Networks narrative.

Another Lens on Valuation

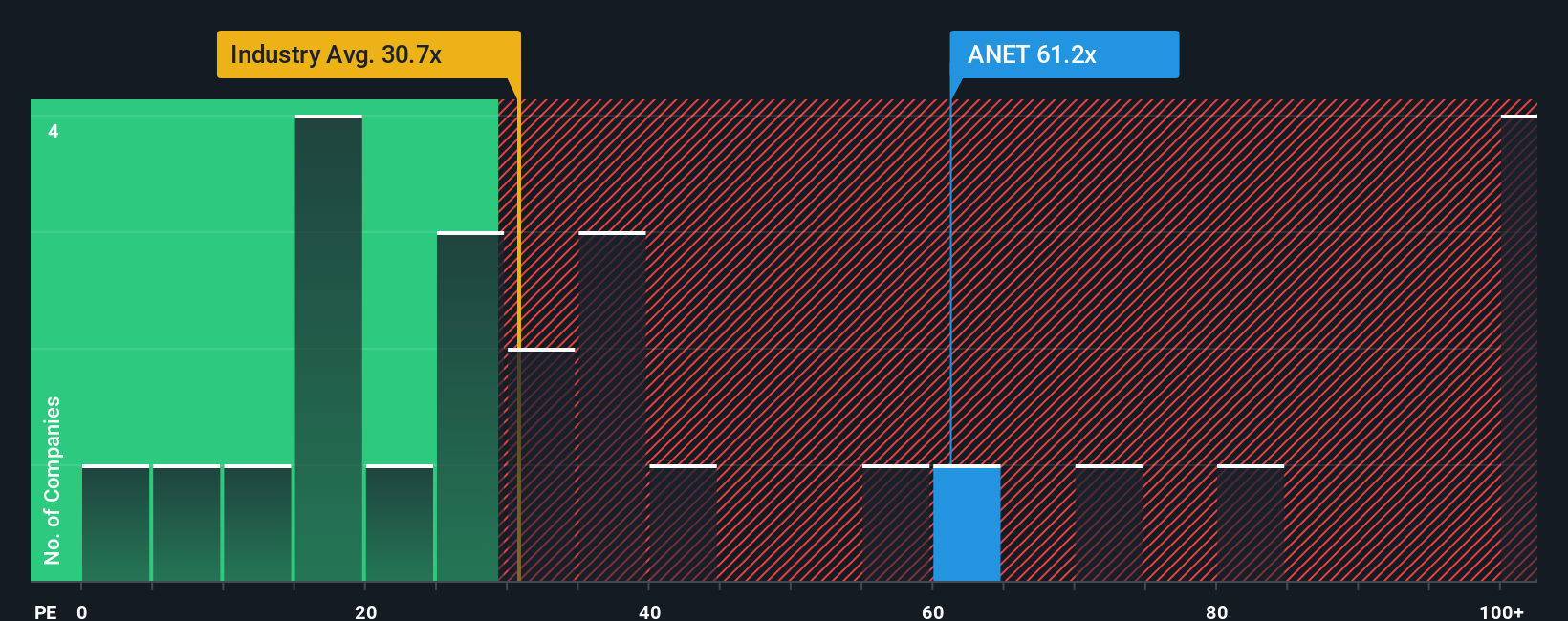

While the consensus narrative argues Arista is around 18 percent undervalued, our valuation using a single earnings multiple tells a different story. On 50.1 times earnings versus a fair ratio of 39.8 times and a peer average of 31 times, the shares look stretched, not cheap. If sentiment cools, that premium could unwind faster than bullish forecasts assume.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arista Networks Narrative

If you see the numbers differently, or want to dig into the data yourself, you can craft a personalized take in just minutes: Do it your way.

A great starting point for your Arista Networks research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more actionable investment ideas?

Before you move on, set yourself up for the next opportunity by scanning curated stock ideas on Simply Wall Street that fit different strategies and risk levels.

- Capture early stage potential by tracking these 3571 penny stocks with strong financials that already show solid fundamentals instead of pure speculation.

- Target structural growth by reviewing these 25 AI penny stocks positioned at the heart of AI adoption across multiple industries.

- Lock in income today and tomorrow with these 14 dividend stocks with yields > 3% that combine attractive yields with underlying financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal