Wayfair (W): Reassessing Valuation After a Strong Three‑Month Share Price Rebound

Wayfair (W) has quietly staged an impressive turnaround, with the stock up about 12% over the past month and 27% in the past 3 months as investors reconsider its path to profitability.

See our latest analysis for Wayfair.

That strength sits on top of a powerful recovery story, with the latest 90 day share price return of 26.57% feeding into a 134.04% one year total shareholder return. This suggests momentum is building as investors reassess execution risk and potential upside.

If Wayfair’s rebound has you rethinking where growth could come from next, it might be worth scanning fast growing stocks with high insider ownership for other under the radar names with conviction behind them.

With shares still trading at roughly a 6% discount to Wall Street’s target and implying a far steeper gap to some intrinsic value estimates, is Wayfair a genuine mispriced turnaround, or is the market already baking in years of growth?

Most Popular Narrative: 6.5% Undervalued

With Wayfair last closing at $106.56 against a most-followed fair value of $114, the narrative leans toward a modest upside built on steady execution.

The analysts have a consensus price target of $81.207 for Wayfair based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $105.0, and the most bearish reporting a price target of just $51.0.

Want to see what justifies a fair value above both today’s price and the analyst consensus? The narrative leans on rising margins, restrained growth, and a surprisingly rich future earnings multiple. Curious which assumptions really carry the valuation load?

Result: Fair Value of $114 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on execution, with a weak housing market and heavy marketing and tech spending both capable of pressuring margins and delaying returns.

Find out about the key risks to this Wayfair narrative.

Another View: Market Ratios Flash a Caution Sign

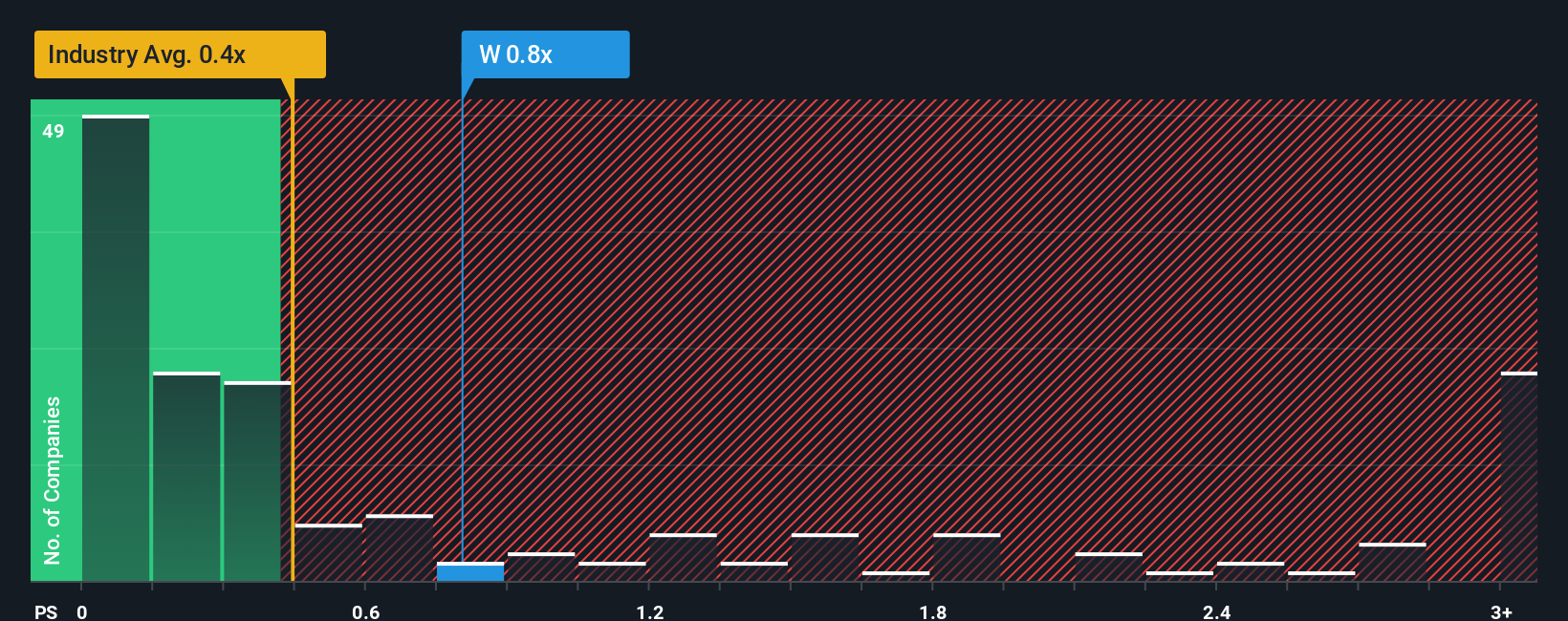

While our narrative fair value suggests upside, the market’s own yardstick sends mixed messages. Wayfair trades on a price to sales ratio of 1.1 times, richer than the US Specialty Retail average of 0.5 times and above its 0.7 times fair ratio, yet still below peers at 1.4 times. That leaves investors weighing whether sentiment has already run ahead of fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wayfair Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at Wayfair, the Simply Wall Street Screener surfaces hand picked opportunities so you can move first, not watch from the sidelines.

- Capture income potential by targeting reliable payouts through these 14 dividend stocks with yields > 3% that combine attractive yields with underlying business strength.

- Ride powerful technological shifts by zeroing in on these 25 AI penny stocks positioned at the heart of machine learning and automation growth.

- Position ahead of the next financial paradigm shift by examining these 80 cryptocurrency and blockchain stocks reshaping payments, infrastructure, and digital asset ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal