How Investors May Respond To Airbus (ENXTPA:AIR) Beating Its 2025 Aircraft Delivery Target

- In 2025, Airbus SE delivered 793 aircraft, surpassing its revised annual target after earlier A320-related recalls and extra inspections had disrupted operations.

- This overachievement suggests Airbus was able to recover production momentum and operational discipline more quickly than its earlier setbacks implied.

- We’ll now explore how beating the revised 2025 delivery target could influence Airbus’s investment narrative and outlook on future cash generation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Airbus Investment Narrative Recap

To own Airbus, you need to believe in sustained demand for fuel efficient aircraft and the company’s ability to convert its deep backlog into cash, despite supply chain and regulatory headwinds. Beating the revised 2025 delivery target is encouraging for the near term delivery and cash generation story, but does not remove the biggest current risk, which is whether engine and component suppliers can reliably support higher production rates without repeating the recent disruption.

The recent 3Q and nine month 2025 results, showing higher sales and net income versus the prior year, are particularly relevant here, because they frame the 793 aircraft deliveries within an already improving earnings and cash flow picture. For investors, this combination of better execution and rising profitability could strengthen confidence in Airbus’s ability to sustain higher shareholder returns, including its expanded dividend payout range and ongoing buyback program, if operational stability holds.

Yet behind the delivery beat, investors still need to weigh how exposed Airbus remains to engine supplier reliability and the risk that...

Read the full narrative on Airbus (it's free!)

Airbus' narrative projects €98.7 billion revenue and €7.9 billion earnings by 2028. This requires 12.1% yearly revenue growth and about a €3.0 billion earnings increase from €4.9 billion today.

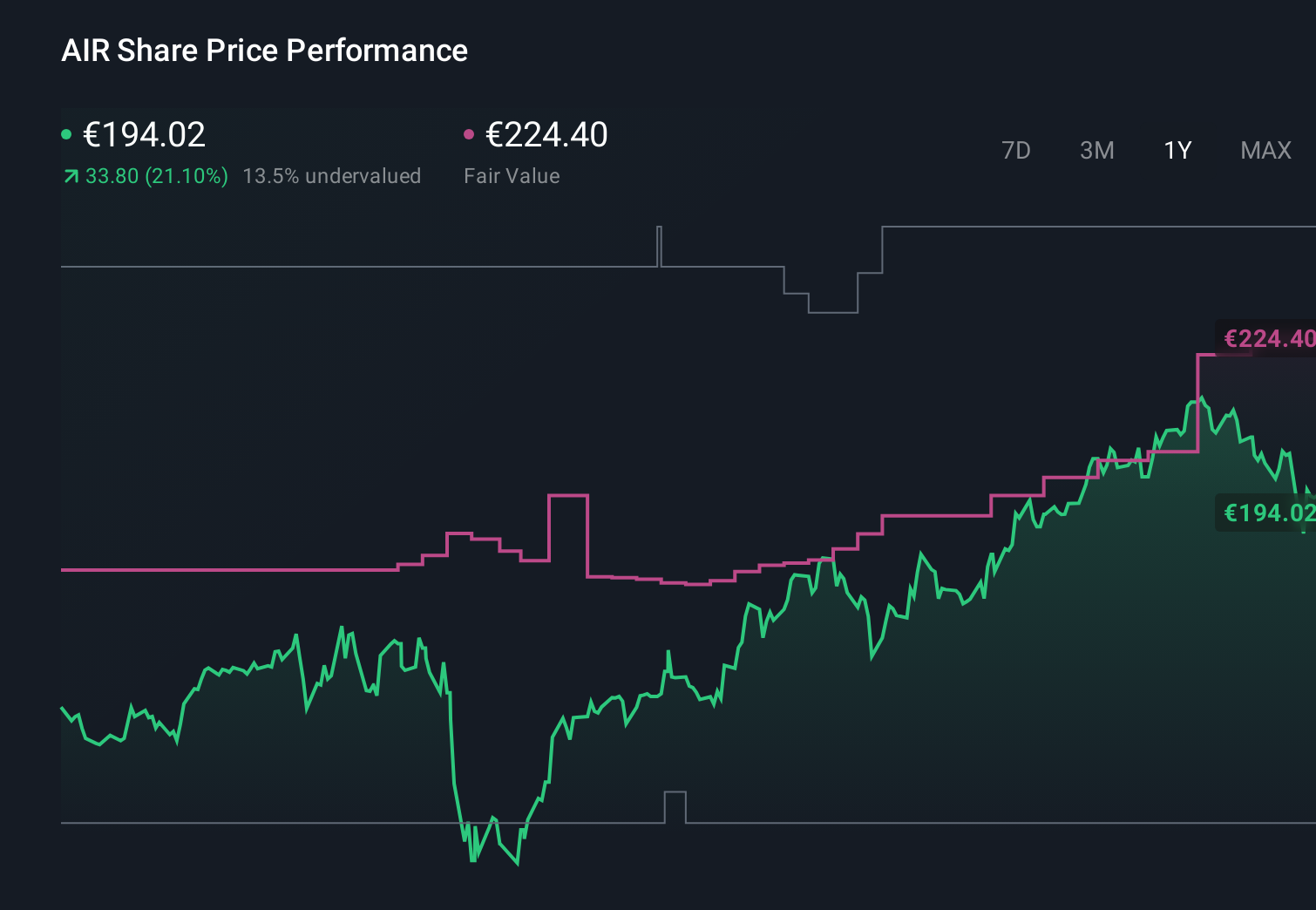

Uncover how Airbus' forecasts yield a €224.75 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Twenty fair value estimates from the Simply Wall St Community span roughly €145 to €282, underlining how far apart individual views on Airbus can be. You can set those varied opinions against Airbus’s reliance on engine suppliers to support higher production rates, which may ultimately shape how much of its aircraft demand backlog turns into sustainable earnings and cash flow.

Explore 20 other fair value estimates on Airbus - why the stock might be worth as much as 38% more than the current price!

Build Your Own Airbus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Airbus research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Airbus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Airbus' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal