RM4.00 within reach

AFTER years of volatility and persistent weakness, the ringgit closed 2025 on a noticeably stronger note, raising cautious optimism that the currency’s recovery could extend into 2026.

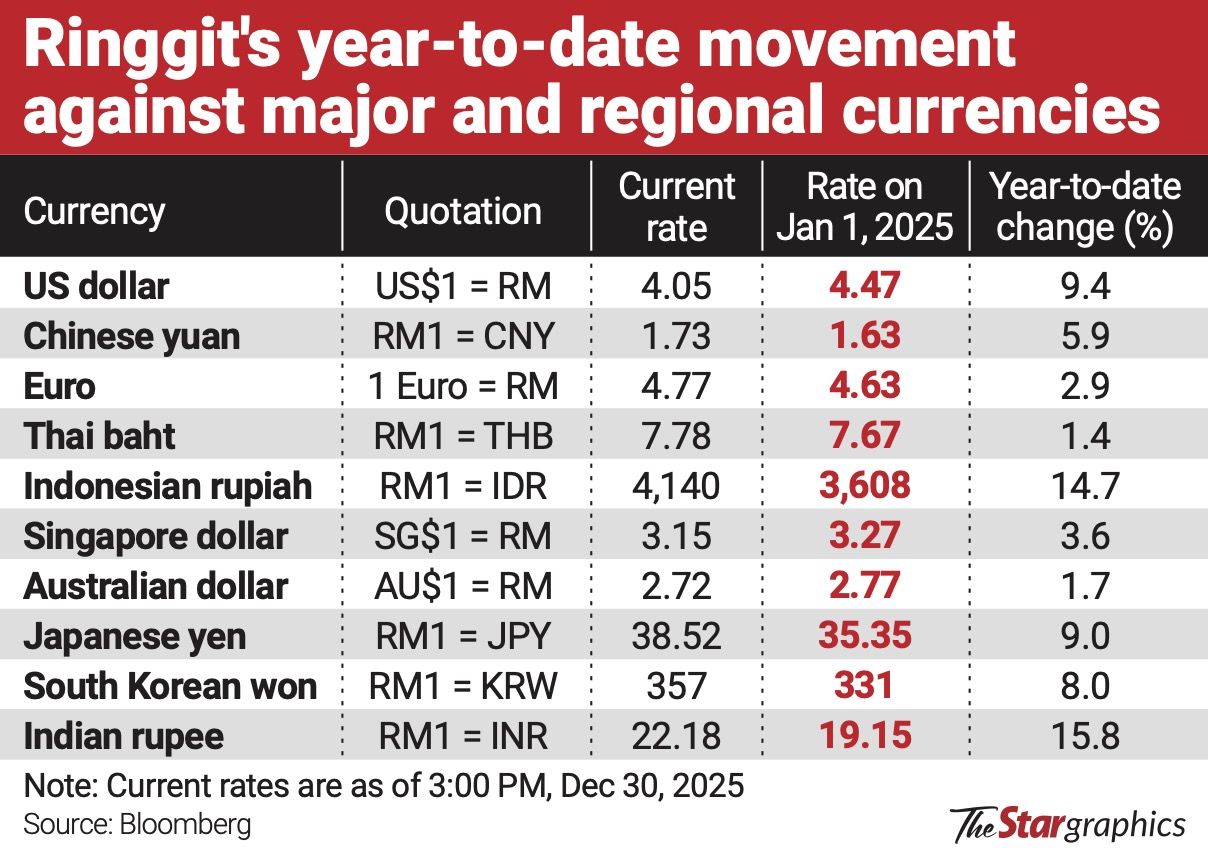

The local unit strengthened by over 9% against the US dollar year-to-date, ending December around RM4.05 versus RM4.47 at the start of the year.

The performance marks one of the ringgit’s strongest annual showings in recent years, underpinned by US interest rate cuts and improving investor sentiment towards regional currencies.

At the start of 2025, interest rate differentials favoured US assets, with the Federal Reserve’s (Fed) policy rate at 4.25% to 4.50% versus Bank Negara Malaysia’s (BNM) overnight policy rate (OPR) of 3%.

By year-end, the Fed had delivered three rate cuts – bringing its policy rate down to 3.50%–3.75% – while BNM lowered the OPR once to 2.75%.

That left the interest differential significantly narrower than at the start of the year, helping to lift sentiment towards Malaysia’s assets and support the ringgit.

Beyond a softer US dollar, the ringgit also recorded broad-based gains against major trading partners in 2025.

It strengthened against the Singapore dollar, Chinese yuan and the euro, while appreciation against several regional and travel-related currencies provided some relief to Malaysians heading overseas. (see chart)

Economists say the ringgit’s strong performance in 2025 is likely to carry into 2026, supported by a more accommodative global monetary environment, relatively steady regional currencies and Malaysia’s improving fundamentals.OCBC Bank foreign exchange strategist Christopher Wong said the ringgit’s continued outperformance was driven by a conducive external backdrop, including the Fed’s easing cycle, a softer US dollar, a relatively stable Chinese yuan and risk-on sentiment amid renewed optimism surrounding artificial intelligence.

“The broad appreciation in regional currencies, including the Japanese yen, South Korean won, Singapore dollar and Thai baht, has also played a stabilising role in supporting sentiment,” he notes in a reply to StarBiz 7.

Looking ahead, Wong expects the ringgit’s “outperformance” seen in 2025 to spill over into 2026, potentially placing it among the better-performing Asian currencies.

“We project the US dollar-ringgit pair to trade lower. Malaysia’s fundamentals remain encouraging, supported by quality foreign direct investment inflows, upside growth surprises, a wider trade surplus and a clear commitment to fiscal consolidation,” he notes.

“These factors can help enhance foreign investor confidence and improve prospects for portfolio inflows,” Wong adds, projecting the US dollar-ringgit rate at 4.04 by mid-2026 and 4.00 by end-2026.

Bank Muamalat Malaysia Bhd chief economist Mohd Afzanizam Abdul Rashid says the bank is maintaining its call for the US dollar-ringgit to range between RM4.05 and RM4.10 by end-2026, although the pair could “intermittently move towards RM4.00”.

Focusing on the US dollar-ringgit pair, Mohd Afzanizam says expectations for further interest rate cuts by the Fed remain “highly fluid”, as policymakers continue to weigh inflation risks against signs of slowing growth.

“The Fed members are still concerned about the inflation rate which is still above the 2% target.

“That seems to be the main foundation why the Fed might opt for a very gradual monetary easing next year,” he says.

However, Mohd Afzanizam notes that there are signs of weaker growth in the United States, particularly in business and consumer sentiment.

“The Institute for Supply Management Index for the manufacturing sector has remained below the 50-point demarcation line for an extended period which means that businesses are generally pessimistic,” he says.

“Such pessimism would translate into slower hiring decisions as well as lower capital expenditure.”

He adds that the Conference Board’s Consumer Confidence Expectations Index has remained below 80 points for 11 consecutive months – a level Mohd Afzanizam says is historically associated with a higher risk of recession.

“If that happens, it will certainly accelerate the interest rate cut decision. Hence, the upside potential (for ringgit) remains fairly visible,” he notes.

Despite the more constructive outlook, OCBC’s Wong cautioned that risks remain on the horizon in 2026.

These include the possibility of the Fed slowing its pace of rate cuts or halting easing earlier than expected, a return of US dollar strength driven by “US exceptionalism”, renewed tariff-related inflation pressures, a sharper global growth slowdown, or heightened geopolitical tensions.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal