Assessing GRAIL (GRAL) Valuation After Pathfinder 2 Success and Samsung’s Asian Galleri Deal

GRAIL (GRAL) has been on investors’ radar after its Galleri test delivered strong results in the Pathfinder 2 study and Samsung committed $110 million plus exclusive Asian distribution rights, reshaping expectations for its growth runway.

See our latest analysis for GRAIL.

Those Pathfinder 2 results and the Samsung deal have clearly reset expectations, with the 1 year total shareholder return of 356.92% and a 90 day share price return of 44.04% suggesting momentum is still building despite the recent pullback.

If Galleri’s progress has you rethinking your healthcare exposure, this could be a good moment to explore other promising names using our healthcare stocks for fresh ideas.

With shares up nearly 360% in a year and still trading about 18% below analyst targets, is GRAIL a misunderstood growth story with more upside, or is the market already baking in years of success?

Most Popular Narrative Narrative: 15.4% Undervalued

With GRAIL last closing at $88.87 against a narrative fair value of $105, the story frames today’s price as leaving notable upside on the table.

Ongoing positive clinical trial results including substantially higher cancer detection and positive predictive value with consistent specificity for Galleri in population scale studies are setting the stage for robust FDA approval and broad payer reimbursement, which could unlock significant new revenue streams and accelerate top line growth.

Curious how a loss making company earns a premium style valuation? The narrative leans on aggressive top line expansion and a future margin reset that rivals sector leaders. Want to see which long range earnings path and elevated profit multiple underpin that $105 fair value, and why the discount rate barely restrains it?

Result: Fair Value of $105 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent heavy losses and dependence on favorable regulatory and reimbursement decisions could quickly undermine today’s optimistic growth and valuation assumptions.

Find out about the key risks to this GRAIL narrative.

Another View: Market Ratios Paint a Hotter Picture

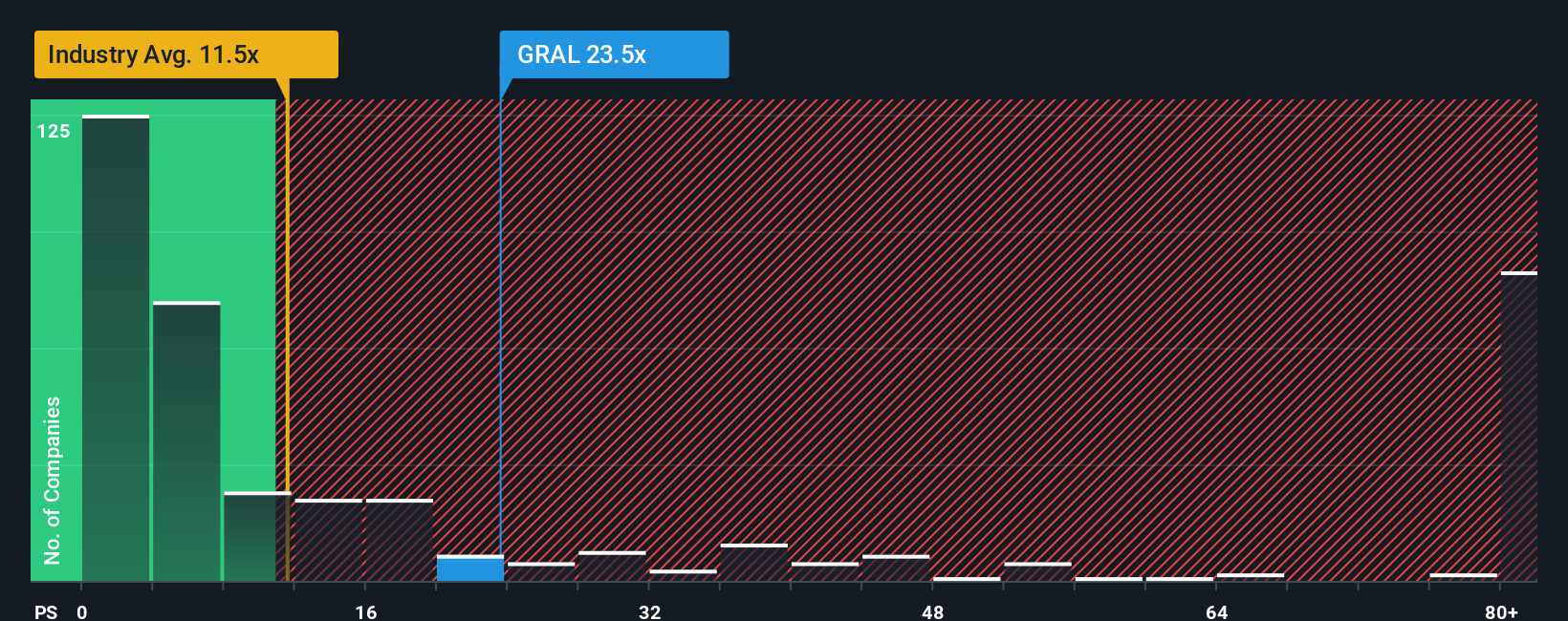

While the narrative fair value points to upside, the market’s own yardsticks tell a different story. GRAIL trades on a price to sales of 24.4x, more than double the US Biotechs average of 11.7x and far above its 1.7x fair ratio. This implies little room for disappointment if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GRAIL Narrative

If you are not fully aligned with this outlook or prefer to dig into the numbers yourself, you can build a complete narrative in minutes: Do it your way.

A great starting point for your GRAIL research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Round out your watchlist now by focusing on opportunities before they gain broader attention, instead of waiting until these themes may already be fully reflected in prices.

- Seek potential mispricings by targeting companies that appear inexpensive on cash flow metrics using these 875 undervalued stocks based on cash flows before sentiment changes.

- Explore the next wave of automation by scanning these 25 AI penny stocks that are using artificial intelligence to reshape industries.

- Identify income potential and potential price resilience by filtering for consistent payers through these 14 dividend stocks with yields > 3% while yields remain attractive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal