Reassessing Syndax Pharmaceuticals (SNDX) Valuation After Its Strong 1-Year Share Price Rally

Syndax Pharmaceuticals (SNDX) has quietly outperformed many biotech peers, with the stock up roughly 5% over the past month and nearly 50% over the past year. This has drawn fresh attention from cancer-drug investors.

See our latest analysis for Syndax Pharmaceuticals.

That steady 30 day share price return of 4.82 percent, combined with a strong 90 day share price return of 29.88 percent and a 48.23 percent one year total shareholder return, suggests momentum is building around Syndax as investors reassess its growth and risk profile.

If Syndax has caught your eye, this may also be a moment to explore other potential healthcare opportunities through our curated screen of healthcare stocks and see what else fits your strategy.

Yet despite solid top line growth and a sizeable gap to analyst price targets, Syndax still posts steep losses and carries execution risk. This raises a key question for investors: is this a genuine buying opportunity, or is future growth already priced in?

Most Popular Narrative: 45.8% Undervalued

With Syndax Pharmaceuticals last closing at $21.30 versus a narrative fair value near $39.31, the gap points to a striking upside scenario built on aggressive growth.

Fixed operating expense base, together with expanding product sales and cash flow contributions from both franchises, is positioned to drive significant operating leverage, boosting net margins and accelerating the pathway to profitability. Late stage pipeline advancements (including frontline trials, lifecycle management, and expansion into new indications like IPF for Niktimvo), coupled with strong clinical data and market leading positions in precision oncology, provide robust long term growth avenues aligned with surging demand for innovative, targeted therapies supporting sustained multi year earnings momentum.

Curious how a loss making cancer specialist ends up with such a rich upside case? The secret lies in razor sharp revenue ramps and a bold profit trajectory that rivals fast growing tech names. Want to see the specific growth and margin assumptions that power this valuation roadmap?

Result: Fair Value of $39.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors cannot ignore dependency on just two late stage drugs and the threat of tougher safety scrutiny, both of which are capable of derailing those upbeat assumptions.

Find out about the key risks to this Syndax Pharmaceuticals narrative.

Another View: Market Ratios Flash Caution

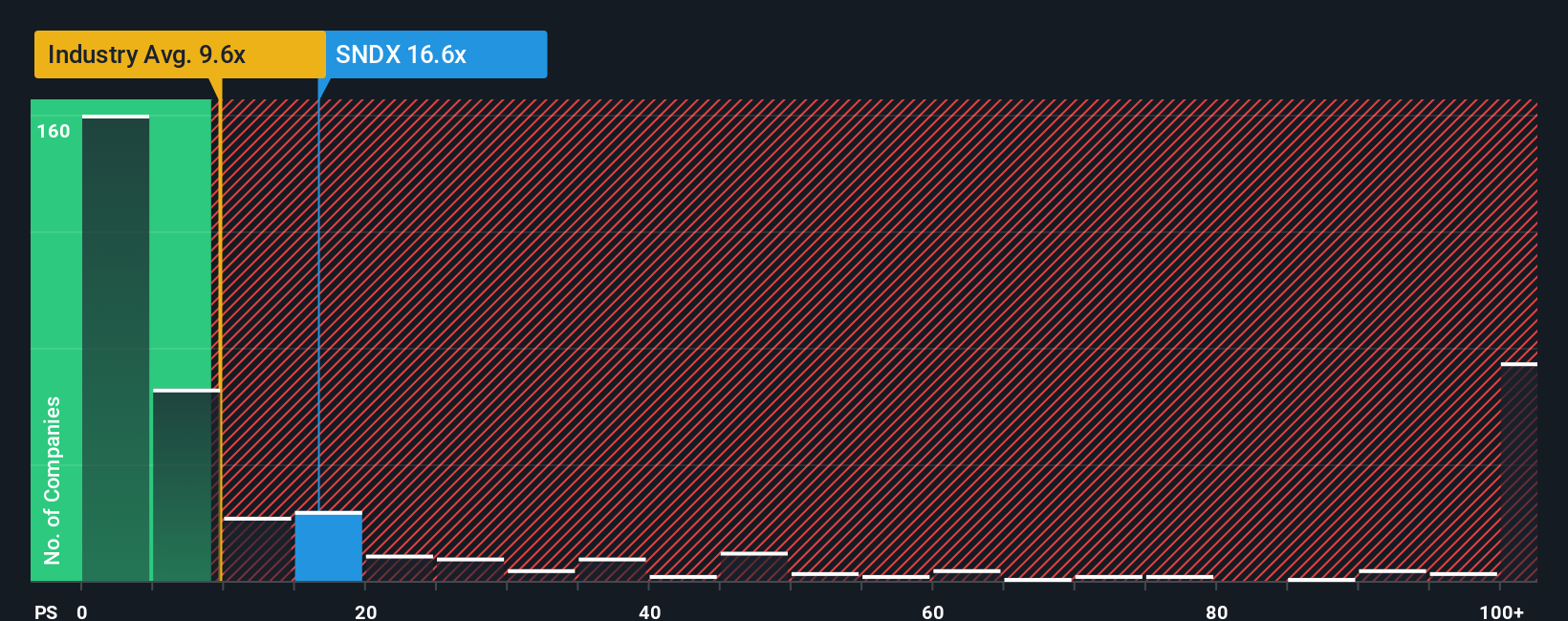

While narratives and analyst targets lean heavily toward upside, the market’s own yardstick tells a tougher story. Syndax trades at about 16.6 times sales, significantly richer than both the US biotech average of 11.7 times and peer levels near 11.6 times, and far above a fair ratio of 1 time.

That kind of gap suggests investors are already paying up for years of rapid growth, leaving less room for error if revenue ramps or margins disappoint. The key question is how much valuation risk you are really willing to hold.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Syndax Pharmaceuticals Narrative

If these views do not fully match your own or you prefer hands on research, you can craft a personalized Syndax narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Syndax Pharmaceuticals.

Looking for more investment ideas?

Now is the moment to broaden your watchlist with fresh, data backed opportunities on Simply Wall St before the next wave of market leaders pulls away.

- Capture powerful growth potential early by scanning these 25 AI penny stocks that could transform entire industries with intelligent automation and next generation software.

- Strengthen your income stream by targeting these 14 dividend stocks with yields > 3% that may offer cash returns alongside capital appreciation potential.

- Position yourself ahead of the crowd by tracking these 80 cryptocurrency and blockchain stocks related to blockchain adoption, digital payments, and new financial infrastructure trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal