Ramaco Resources (METC): Reassessing Valuation After Rare Earth Pivot, $100m Buyback and Credit Facility Expansion

Ramaco Resources (METC) just put several big chips on the table at once, from a rare earth offtake MOU with Mulberry Industries to a $100 million buyback and a sharply expanded credit facility.

See our latest analysis for Ramaco Resources.

Those moves come after a bruising stretch, with a roughly 51.9% three-month share price return decline from prior highs, even as the one-year total shareholder return sits near 84.7%. This suggests that long-term momentum remains intact, but near-term sentiment is only just starting to repair.

If Ramaco's rare earth pivot has you rethinking where the next big cyclical winner might come from, it is worth scouting other materials names via fast growing stocks with high insider ownership.

With the stock still trading at a steep discount to analyst targets despite surging long term returns and a rare earth growth story taking shape, is Ramaco quietly undervalued, or is the market already pricing in the next upcycle?

Most Popular Narrative: 52.2% Undervalued

With Ramaco closing at $18.71 against a narrative fair value near $39.14, the story implies substantial potential upside if the long range roadmap holds.

The analysts have a consensus price target of $21.667 for Ramaco Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.0, and the most bearish reporting a price target of just $14.0.

It may be useful to understand how a loss making coal producer is assessed to have the potential for significant profit expansion, margin improvement, and a higher future earnings multiple, as well as the assumptions that underpin that valuation change.

Result: Fair Value of $39.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution delays at Brook Mine or weaker government support for domestic rare earths could quickly challenge the market's optimistic long term assumptions.

Find out about the key risks to this Ramaco Resources narrative.

Another Angle on Valuation

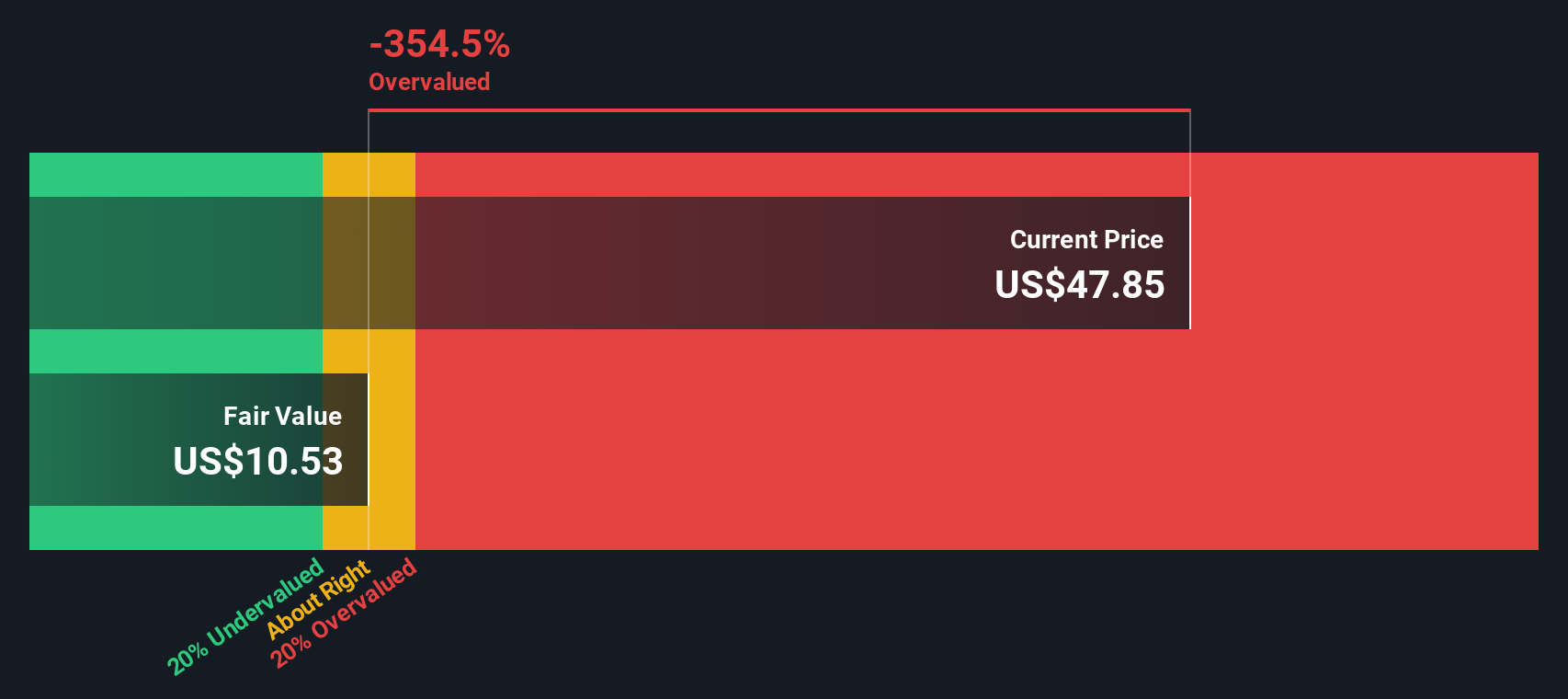

While the narrative view points to Ramaco as 52.2 percent undervalued, our DCF model is less generous, putting fair value around 18.10 dollars versus the current 18.71 dollars. That leans toward slightly overvalued and raises the question: which story do you trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ramaco Resources Narrative

If you would rather dig into the numbers yourself or challenge these assumptions, you can assemble a custom narrative in just a few minutes: Do it your way.

A great starting point for your Ramaco Resources research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity. Your next market win could already be on the radar of the Simply Wall St Screener and waiting for your attention.

- Capture potential multi-baggers early by scanning these 3571 penny stocks with strong financials that already show stronger fundamentals than the typical speculative name.

- Position ahead of the next productivity wave by targeting these 29 healthcare AI stocks transforming diagnostics, treatment planning, and cost efficiency across global health systems.

- Lock in reliable income streams by focusing on these 14 dividend stocks with yields > 3% that pair attractive yields with balance sheets built to withstand volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal