Beyond Meat (BYND): Assessing Valuation After 2024 Corporate Responsibility Report and New Beyond Burger IV Update

Beyond Meat (BYND) just dropped its 2024 Corporate Responsibility Report, and the headline takeaway is clear: the latest Beyond Burger IV claims huge environmental advantages over beef while sharpening the company’s broader ESG story.

See our latest analysis for Beyond Meat.

The ESG push comes after a tough run for investors, with the latest share price at $0.8814 and a 1 year total shareholder return of around negative 78 percent. This signals that sentiment and momentum are still under pressure despite recent ESG headlines.

If Beyond Meat’s story has you rethinking where growth might come from next, this could be a good moment to explore fast growing stocks with high insider ownership.

With the share price crushed and analysts still seeing upside to their targets, the real question now is whether Beyond Meat is a deeply misunderstood value or if the market already assumes all the growth that lies ahead.

Most Popular Narrative: 45.3% Undervalued

With Beyond Meat closing at $0.88 versus a narrative fair value of $1.61, the current price bakes in a steep discount to long term expectations.

Beyond Meat is accelerating operational efficiency efforts, including substantial cost reduction, portfolio optimization, and manufacturing investments, which are expected to improve gross margins and drive the company toward EBITDA-positive operations. This is expected to benefit future net income and operating cash flow.

Want to see how margin upgrades, earnings normalization, and a richer future multiple all fit together? The underlying projections are far bolder than the share price suggests.

Result: Fair Value of $1.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weak category demand and heavy debt, including potential dilution from convertible notes, could still derail the upside case that investors are hoping for.

Find out about the key risks to this Beyond Meat narrative.

Another View: Market Ratios Flash Caution

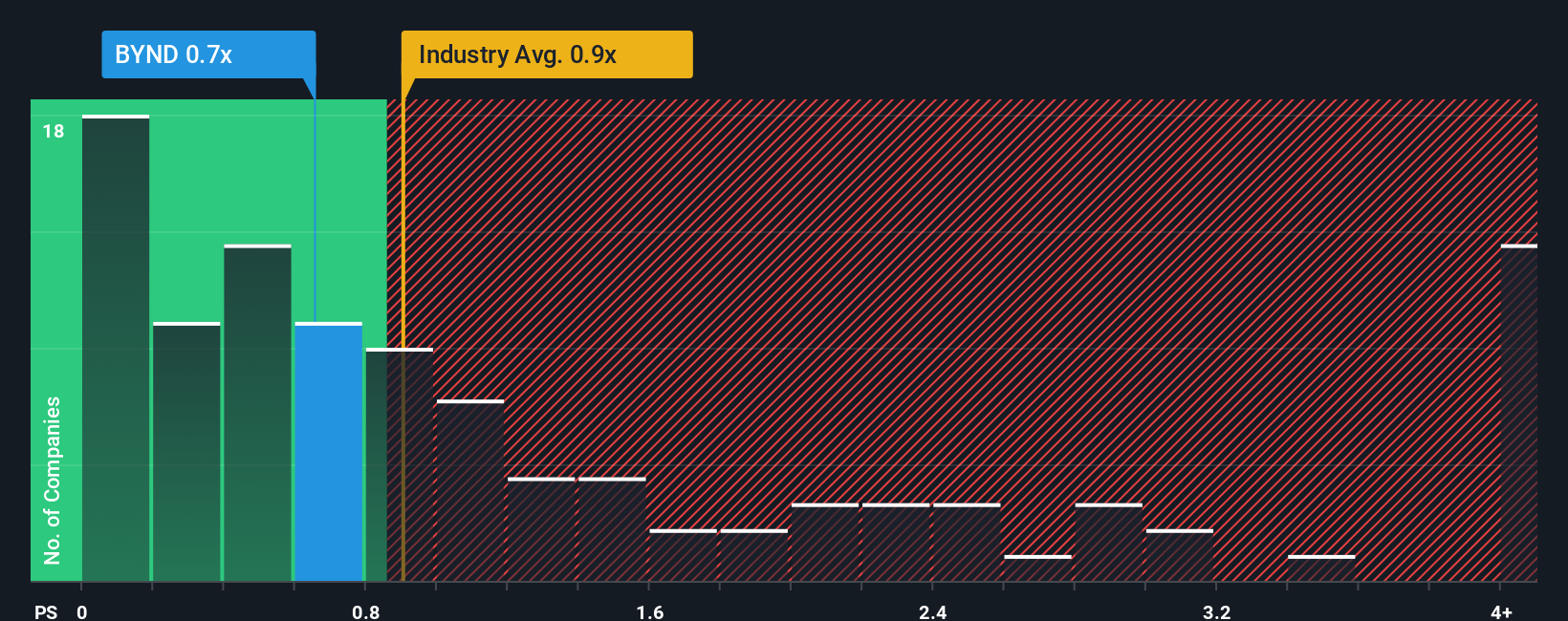

While the $1.61 narrative fair value suggests upside, the market’s own ratios tell a harsher story. Beyond Meat trades at 1.4 times sales versus 0.6 times for the US Food industry and a 0.6 fair ratio, which implies investors may still be overpaying for shrinking revenues and ongoing losses.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beyond Meat Narrative

If this narrative does not match your view and you prefer hands-on research, you can build your own thesis in minutes: Do it your way.

A great starting point for your Beyond Meat research is our analysis highlighting 4 important warning signs that could impact your investment decision.

Looking for your next investing move?

Do not stop at one opportunity. Your best returns may come from the fresh ideas you uncover next using Simply Wall Street’s powerful stock screener tools.

- Capture high-upside potential by targeting companies trading below their cash flow value with these 875 undervalued stocks based on cash flows.

- Tap into cutting edge innovation by focusing on businesses building real solutions in artificial intelligence through these 25 AI penny stocks.

- Strengthen your income stream by zeroing in on companies that consistently reward shareholders with these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal