KLA (KLAC) Valuation Check After a 96% One-Year Shareholder Return

KLA (KLAC) has quietly delivered a strong run for shareholders over the past year, so the latest move in the stock has investors checking whether current fundamentals still justify the climb.

See our latest analysis for KLA.

At around $1,274.47 per share, KLA’s recent jump caps a solid stretch of gains, with a roughly 5% 1 month share price return and a standout 1 year total shareholder return of about 96%, signalling momentum that investors clearly still trust.

If KLA’s run has you thinking about where else strong demand for chips could show up next, it may be worth exploring high growth tech and AI stocks as potential follow up ideas.

With KLA now trading just below consensus targets after nearly doubling in a year, investors face a key question: is this still an underappreciated compounder, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 2% Undervalued

With KLA closing at $1,274.47 versus a narrative fair value near $1,296.89, the valuation gap is narrow but grounded in detailed growth and margin assumptions.

The analysts have a consensus price target of $929.68 for KLA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the more bullish ones expecting earnings as high as $5.9 billion.

Want to see what powers this higher fair value, even above consensus targets? The narrative leans on durable revenue expansion, firmer margins, and a punchy future earnings multiple. Curious how those pieces fit together into a long term earnings path and justified premium pricing? Dive in to unpack the full set of assumptions behind that valuation call.

Result: Fair Value of $1,296.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer China demand or a slower than expected AI and DRAM capex ramp could quickly challenge the upbeat growth and valuation narrative.

Find out about the key risks to this KLA narrative.

Another View: Rich on Earnings Ratios

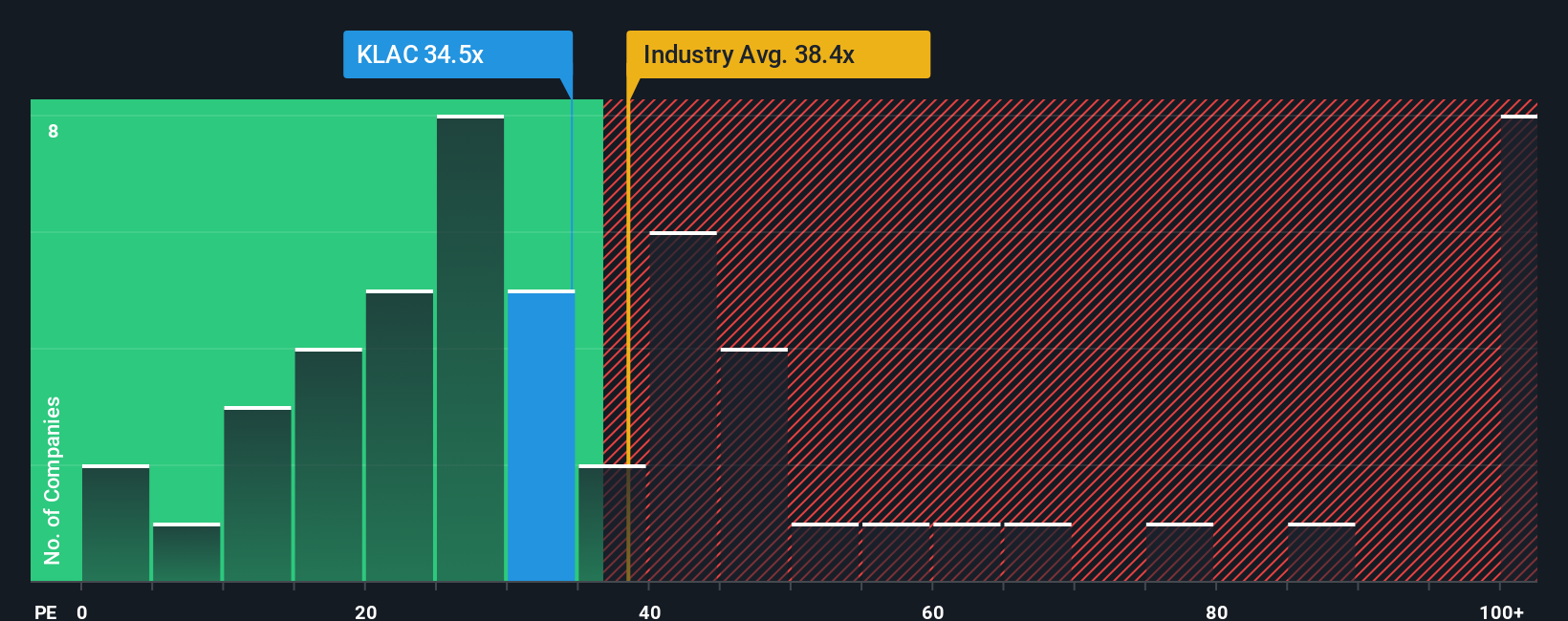

Step away from narrative fair value and KLA looks stretched on simple earnings math. Its P E ratio sits around 39.5 times, higher than the US semiconductor average of 37.3 times and well above a fair ratio near 29.4 times, suggesting less room for disappointment if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KLA Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view in minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding KLA.

Ready for your next investing move?

Do not stop with KLA, use the Simply Wall St Screener to spot fresh ideas before the crowd does and keep your portfolio working harder for you.

- Capitalize on underpriced quality by targeting these 875 undervalued stocks based on cash flows where strong cash flows meet attractive entry points.

- Ride the next wave of innovation with these 25 AI penny stocks capturing businesses at the heart of the AI acceleration.

- Explore resilient income opportunities through these 14 dividend stocks with yields > 3% focusing on reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal