Southern (SO) Valuation Check After a Year of Steady Outperformance and Quiet Share Price Gains

Southern (SO) has quietly outperformed over the past year, and that steady climb is grabbing more attention as investors reassess utilities in a higher-for-longer rate backdrop and look for durable income plus moderate growth.

See our latest analysis for Southern.

With the share price now around $87.18 and a 1 year total shareholder return of roughly 9.5 percent, Southern’s steady earnings progress and dividend track record are reinforcing its reputation as a dependable compounder rather than a high octane trade.

If Southern’s slow and steady climb appeals to you, this could be a good moment to explore other discovery ideas via fast growing stocks with high insider ownership.

But with shares hovering near record highs, solid mid single digit earnings growth, and a modest discount to analyst targets, is Southern still quietly undervalued, or is the market already baking in years of dependable expansion?

Most Popular Narrative: 12.1% Undervalued

With Southern last closing at $87.18 versus a narrative fair value near $99.23, followers see moderate upside grounded in long term regulated growth.

The expansion of large scale electrification projects including hyperscaler data centers and industrial developments across Alabama, Georgia, and Mississippi is materially increasing Southern's load outlook, resulting in regulatory approvals and filings for up to 10 GW of new generation and $13 billion of incremental capital investment, driving long term earnings and rate base growth.

Want to see how steady revenue expansion, rising margins, and a richer future earnings multiple all fit together into this upside case? The financial roadmap may surprise you.

Result: Fair Value of $99.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated capital spending, potential equity dilution, and any wobble in regulatory support could quickly challenge the case for steady multiple expansion.

Find out about the key risks to this Southern narrative.

Another View, Market Multiples Look Less Generous

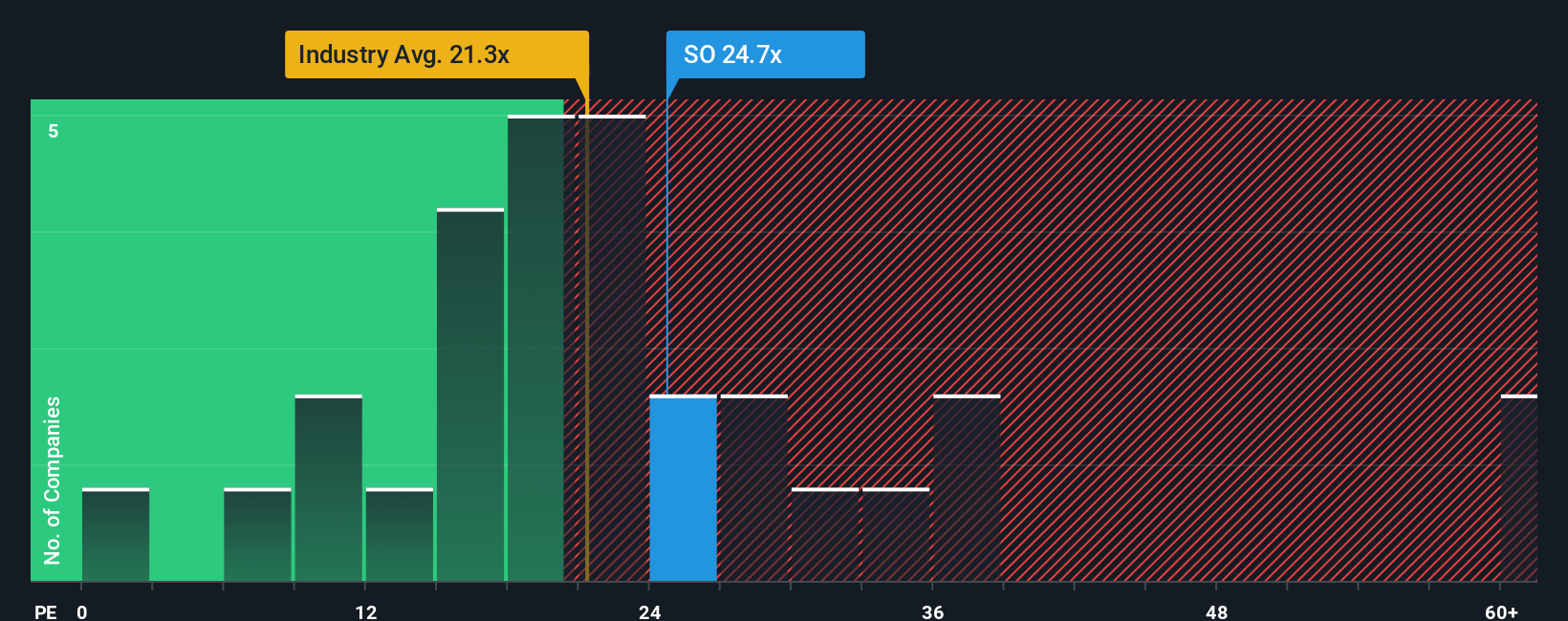

Our narrative fair value suggests upside, but the current earnings multiple paints a cooler picture. Southern trades at about 21.5 times earnings versus roughly 19.7 times for the US electric utilities sector and around 25.8 times for peers, while our fair ratio implies about 24.1 times.

That mix of slightly richer pricing than the sector, but cheaper than peers and below the fair ratio, hints at a stock that is not a clear bargain, but not overpriced either. This leaves investors to judge whether today’s premium really compensates for slower forecast growth and capital intensity.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Southern Narrative

If you would rather dig into the numbers yourself and challenge this view, you can build a custom Southern narrative in minutes: Do it your way.

A great starting point for your Southern research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, strengthen your watchlist with fresh, data backed opportunities from the Simply Wall St screener so you are not leaving easy gains on the table.

- Secure potentially mispriced opportunities by reviewing these 875 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Harness structural growth trends by targeting these 29 healthcare AI stocks at the intersection of medical innovation and machine learning.

- Capitalize on income focused strategies by zeroing in on these 14 dividend stocks with yields > 3% that combine meaningful yields with resilient fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal