Pinnacle Financial Partners (PNFP): Assessing Valuation After a Year of Losses but Strong Three-Year Returns

Recent Performance and Investor Context

Pinnacle Financial Partners (PNFP) has been drifting slightly lower in recent sessions, and that soft patch comes after a mixed stretch where the stock lost over 15% in the past year but gained over the past 3 years.

See our latest analysis for Pinnacle Financial Partners.

With the share price now around $95.10 after a choppy few weeks, the 1 year total shareholder return of negative mid teens contrasts with a solid 3 year total shareholder return in the mid thirties. This suggests longer term momentum has not fully broken.

If PNFP has you thinking about where regional bank risk and growth could go next, it is worth exploring fast growing stocks with high insider ownership as another set of ideas to consider.

Despite a pullback over the past year, Pinnacle’s strong multi year returns, double digit profit growth, and a meaningful discount to analyst targets raise the key question: is PNFP undervalued or already pricing in future growth?

Most Popular Narrative: 13.7% Undervalued

With Pinnacle Financial Partners closing at $95.10 against a narrative fair value near $110, the story hinges on how aggressively growth compounds from here.

Strategic hiring of experienced revenue producers directly from large competitors, combined with rapid integration and high asset quality, enables organic balance sheet expansion at a pace (10 to 13% asset and deposit growth) far above industry medians, supporting reliable EPS and tangible book value per share growth.

Curious how double digit top line growth, shifting margins, and a surprisingly low future earnings multiple can still point to upside? The full narrative connects those dots.

Result: Fair Value of $110.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharper downturn in Southeast commercial real estate or missteps integrating Synovus could quickly erode today’s growth assumptions and valuation upside.

Find out about the key risks to this Pinnacle Financial Partners narrative.

Another Angle on Valuation

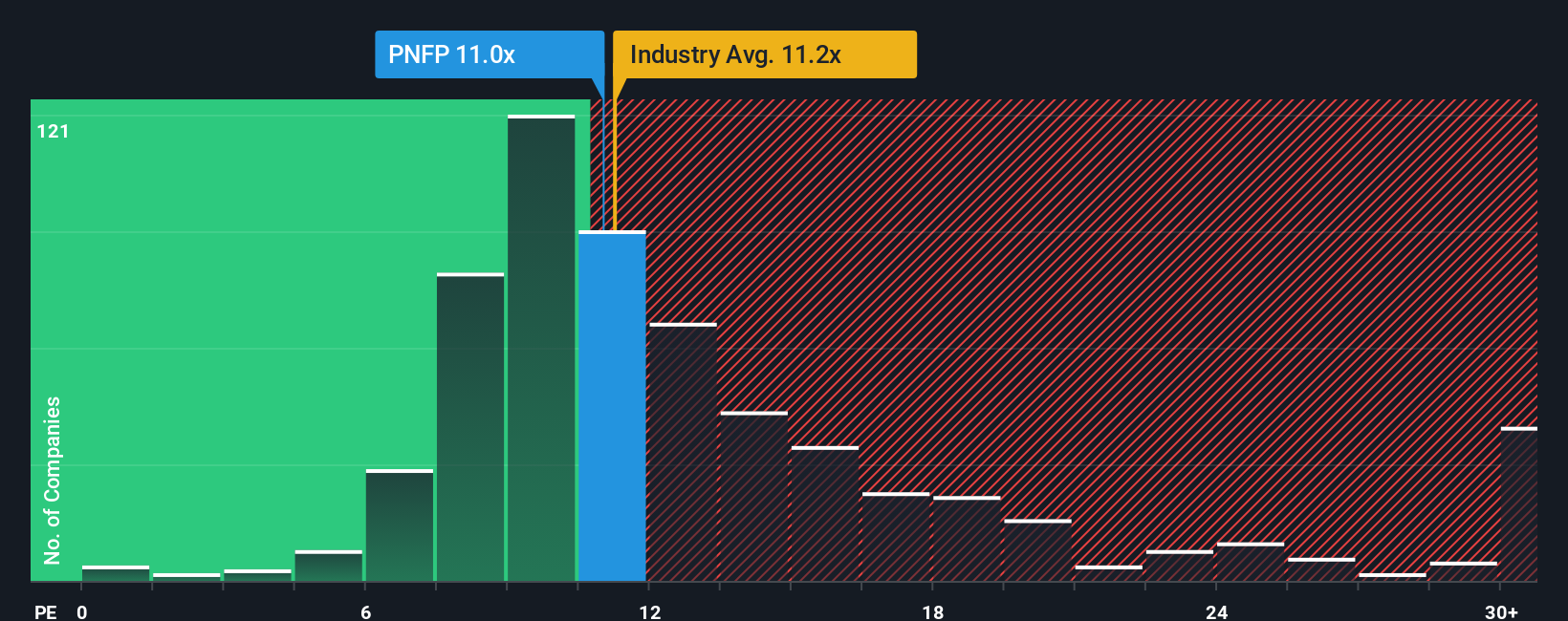

On earnings, PNFP trades at about 12x versus 11.8x for US banks, yet our fair ratio suggests the multiple could stretch toward 25.6x. That gap hints at sizable upside if growth plays out, but also real downside if sentiment turns. Which way will the market lean next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pinnacle Financial Partners Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your Pinnacle Financial Partners research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at PNFP, you risk missing a broader range of opportunities that the Simply Wall St Screener can surface in seconds.

- Explore early stage opportunities through these 3571 penny stocks with strong financials that combine small market capitalizations with resilient fundamentals and positive momentum.

- Focus on recurring revenue businesses involved in smart automation, data intelligence, and next generation platforms with these 25 AI penny stocks.

- Identify potential mispricings by examining cash flow strong companies trading below estimated intrinsic value using these 875 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal