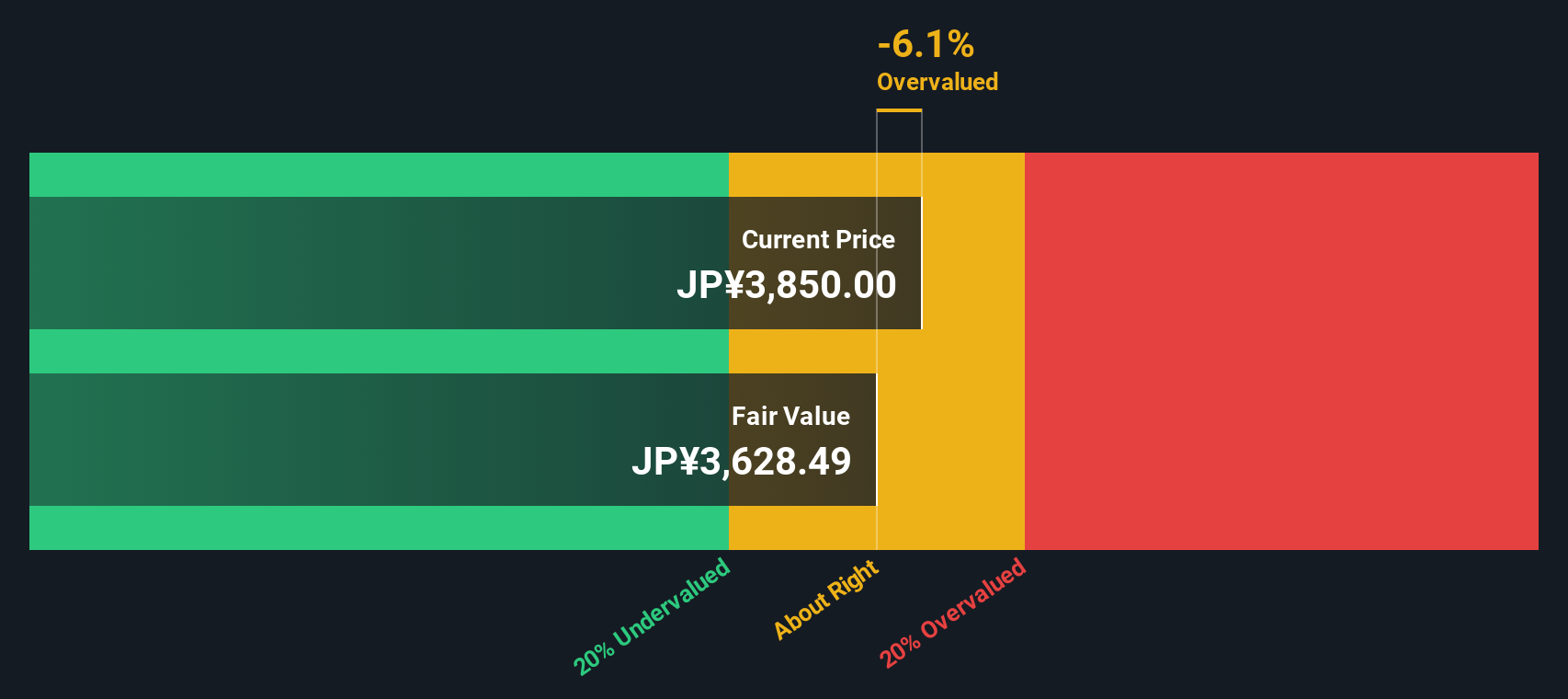

YONEX (TSE:7906) Valuation Check After 56% One-Year Gain and Recent Three-Month Pullback

YONEX (TSE:7906) has quietly rewarded patient shareholders, with the stock up around 56% over the past year, even after a weaker past 3 months. This invites a closer look at what is driving sentiment.

See our latest analysis for YONEX.

That recent 90 day share price pullback contrasts sharply with a powerful 1 year total shareholder return of 56.3% and an impressive 5 year total shareholder return of 471.5%. This suggests that long term momentum is still very much intact.

If YONEX’s run has you thinking about what else could surprise to the upside, this might be a good moment to explore fast growing stocks with high insider ownership.

With earnings still growing double digits and shares trading at a modest discount to analyst targets and estimated intrinsic value, the key question now is whether YONEX remains a mispriced compounder or if the market is already discounting years of future growth.

Price-to-Earnings of 24.6x: Is it justified?

On a headline basis, YONEX trades at a 24.6x price to earnings multiple at ¥3,320 per share, which screens as expensive versus both peers and the broader leisure space.

The price to earnings ratio compares the current share price with per share earnings, capturing how much investors are willing to pay today for each unit of current profit. For a consumer durables and leisure name like YONEX, this multiple often reflects expectations for sustained brand strength, margin resilience, and ongoing profit growth rather than one off earnings.

In YONEX's case, the market appears to be paying up for quality and growth, but perhaps more than its fundamentals alone would suggest. The stock is valued at a premium to the estimated fair price to earnings ratio of 18.2x, implying that if sentiment or growth expectations cool, the multiple has room to compress toward that level.

Compared with the Japan leisure industry average of 13.6x and a peer group average of 12.5x, YONEX's 24.6x multiple stands out as materially higher. That premium signals investors are assigning a significantly richer valuation than the sector norm and even above what our fair ratio work suggests could be a more balanced level.

Explore the SWS fair ratio for YONEX

Result: Price-to-Earnings of 24.6x (OVERVALUED).

However, slowing revenue momentum or a derating toward industry valuation multiples could quickly challenge the idea that YONEX is still a mispriced compounder.

Find out about the key risks to this YONEX narrative.

Another View: Discounted Cash Flow Check

While the 24.6x earnings multiple flags YONEX as expensive, our DCF model points the other way. It suggests the shares trade roughly 24% below fair value at around ¥4,361. If cash flows justify a higher price, is the market underestimating the brand’s staying power?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out YONEX for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own YONEX Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can quickly build a tailored view in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding YONEX.

Looking for more investment ideas?

Do not stop at a single compelling stock; use the Simply Wall Street Screener to uncover fresh opportunities others are overlooking and keep your edge sharp.

- Capture early stage growth potential by scanning these 3571 penny stocks with strong financials that already show resilient balance sheets and improving fundamentals.

- Position your portfolio for structural tech shifts by targeting these 25 AI penny stocks at the forefront of automation, data intelligence, and productivity gains.

- Lock in potential mispricings by focusing on these 875 undervalued stocks based on cash flows where cash flow strength and valuation still appear meaningfully out of sync.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal