Champion Homes (SKY): Revisiting Valuation After a Recent Pullback and Three-Year Shareholder Outperformance

Champion Homes (SKY) has quietly outperformed over the past 3 years, even as the stock has slipped about 6% in the past year. This makes its latest pullback interesting for patient investors.

See our latest analysis for Champion Homes.

The latest pullback sits in contrast to Champion Homes’ strong 3 year total shareholder return of 55.86%, with a solid 90 day share price return of 22.17% suggesting momentum is still building around its growth story and perceived resilience.

If this steady momentum has you thinking about what else could surprise to the upside, it might be worth exploring fast growing stocks with high insider ownership as your next discovery step.

Yet with shares now trading modestly below analyst targets but at a premium to some housing peers, investors face a key question: Is Champion Homes still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 7.3% Undervalued

With Champion Homes last closing at $84.91 against a narrative fair value of about $91.60, the story leans toward moderate upside rooted in fundamentals.

The fair value estimate has risen slightly, increasing from $87.00 to approximately $91.60 per share.

The revenue growth assumption has ticked up modestly, and the net profit margin forecast has increased moderately, while the future P/E multiple has edged down slightly.

Curious how modest revenue growth, slightly higher margins, and a lower future earnings multiple can still justify a richer valuation? The narrative stitches these moving parts into one cohesive upside case, with assumptions that might surprise you when you see how they interact over time.

Result: Fair Value of $91.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing orders in key channels and renewed material cost inflation could quickly pressure margins and undermine the current upside case.

Find out about the key risks to this Champion Homes narrative.

Another View: Multiples Paint A Richer Picture

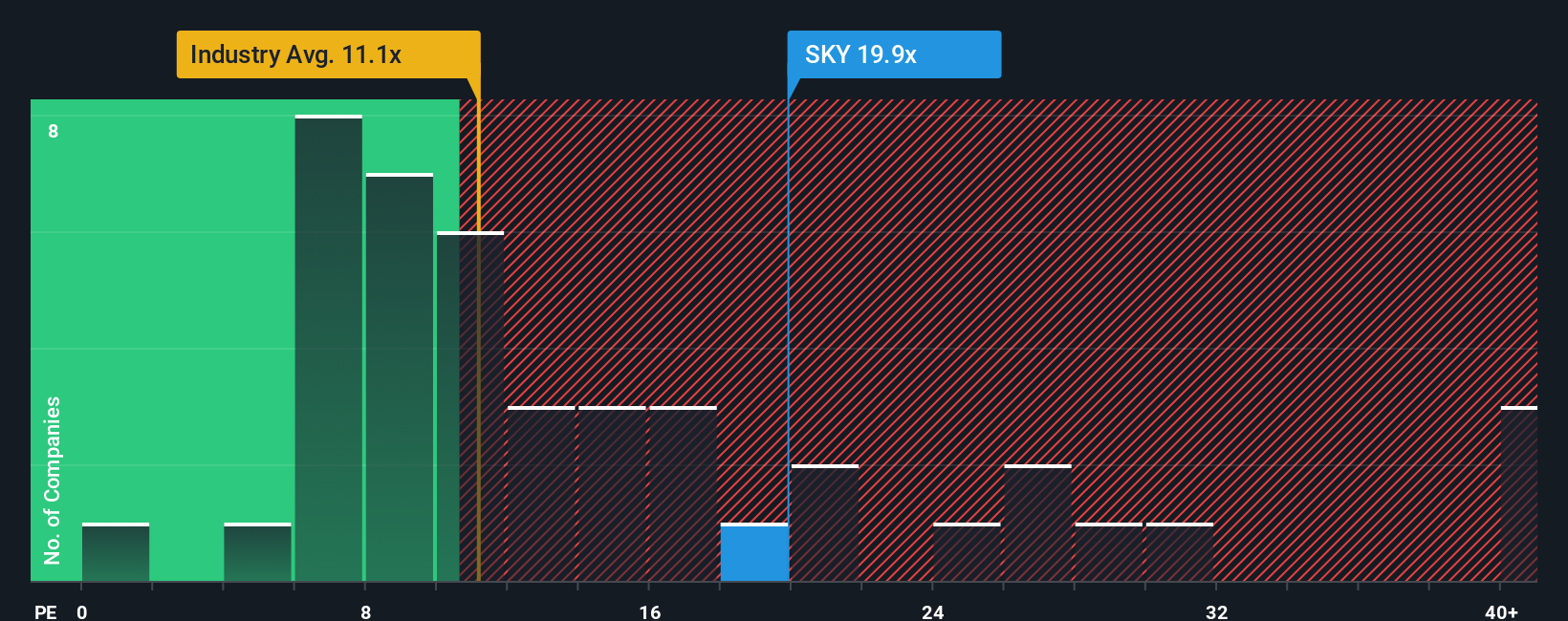

Set against that 7.3% narrative undervaluation, Champion Homes looks far less cheap on earnings. The shares trade on a price to earnings ratio of 21.5x, versus a fair ratio of 14.5x, the US Consumer Durables sector at about 10.5x, and peers near 11.8x. This suggests investors are paying up for quality and growth resilience.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Champion Homes Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Champion Homes.

Ready for your next investing move?

Champion Homes may be compelling, but your next big winner could be just a few clicks away in our hand picked stock ideas built from powerful screeners.

- Capture potential value gaps by targeting companies trading below their estimated cash flow worth using these 875 undervalued stocks based on cash flows before the market catches on.

- Position yourself for the next wave of innovation by focusing on these 25 AI penny stocks that could reshape industries with scalable, real world applications.

- Strengthen your income stream by zeroing in on reliable payers via these 14 dividend stocks with yields > 3% and avoid missing out on attractive, sustainable yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal