Iridium Communications (IRDM): Valuation Check After Starlink’s Move to Cut Satellite Collision and Debris Risks

Iridium Communications (IRDM) edged about 2% higher after SpaceX’s Starlink said it will lower its satellite orbits to cut collision and debris risks, a move that investors see as improving safety for the entire satellite ecosystem.

See our latest analysis for Iridium Communications.

That safety boost narrative comes against a tougher backdrop, with Iridium’s 1 year total shareholder return down 39.4% while the 90 day share price return of negative 11.29% suggests that momentum is still under pressure rather than turning.

If this shift in satellite risk has you rethinking the broader space and communications landscape, it might be worth exploring adjacent aerospace and defense stocks for other potential opportunities beyond Iridium.

With the shares still well below analyst targets despite positive revenue and earnings growth, the question now is whether Iridium is quietly undervalued or if the market is already discounting any future upside from safer skies.

Most Popular Narrative Narrative: 40.3% Undervalued

With the narrative fair value sitting well above Iridium Communications last close of $17.76, the story hinges on durable cash generation and premium service economics.

The company's fully deployed next-gen constellation and declining capex profile are freeing up significant cash flow for buybacks and steady dividend increases, directly boosting per-share earnings potential and making Iridium's free cash flow yield structurally attractive.

Curious how steady but unspectacular growth, expanding margins, and a richer future earnings multiple are stitched together into that valuation gap? The full narrative spells it out.

Result: Fair Value of $29.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower IoT adoption and intensifying direct to device competition could easily derail the margin expansion and valuation re rating implied by this narrative.

Find out about the key risks to this Iridium Communications narrative.

Another View: Market Multiples Send a Mixed Signal

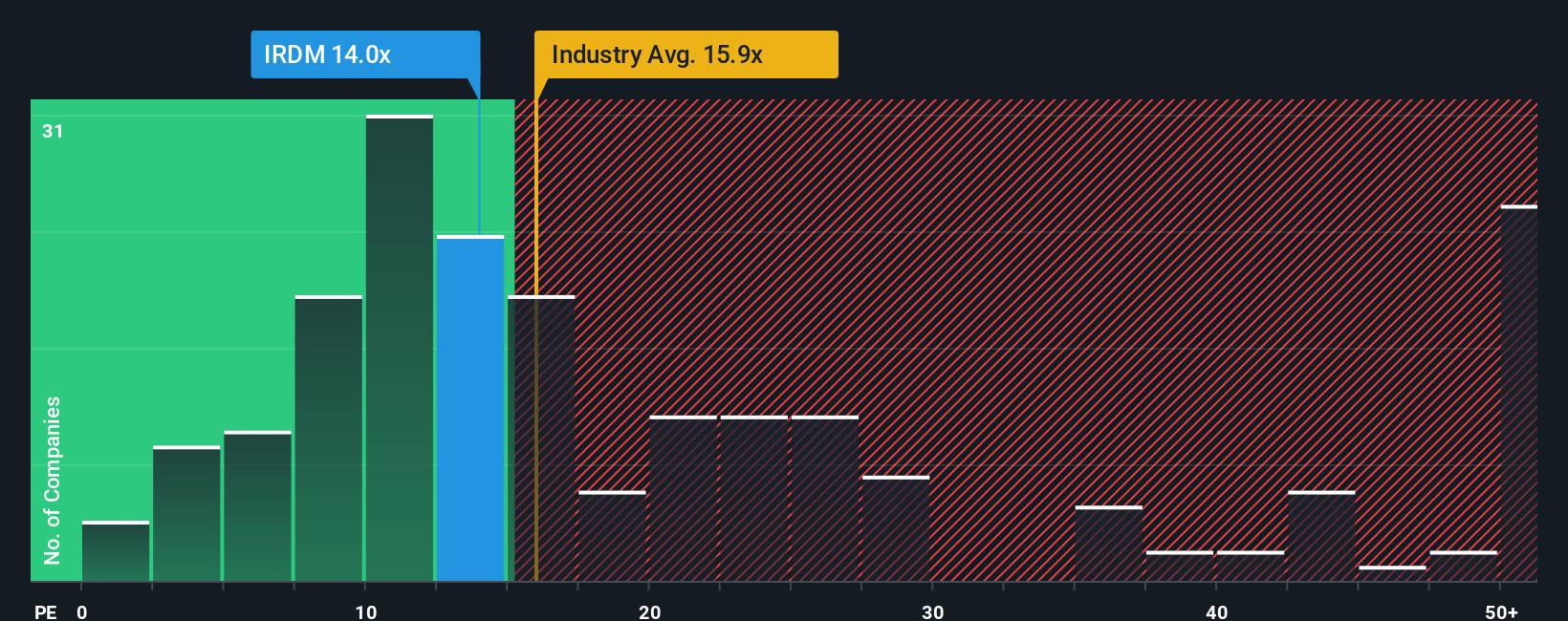

While the narrative fair value points to a large upside, the price earnings lens is less forgiving. Iridium trades on 14.8 times earnings versus US peers at 6.6 times and a fair ratio of 15.5 times, suggesting limited multiple expansion and a more balanced risk reward profile.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Iridium Communications Narrative

If you see the story playing out differently, or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way

A great starting point for your Iridium Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next moves with fresh stock ideas from the Simply Wall Street Screener, tailored to different styles of opportunity hunting.

- Capture mispriced potential by targeting companies trading below their estimated intrinsic value through these 875 undervalued stocks based on cash flows and position yourself ahead of a possible rerating.

- Ride structural growth trends by focusing on innovation leaders using these 25 AI penny stocks, where rapid adoption and scalable business models can be a source of long term returns.

- Strengthen your income stream by zeroing in on reliable cash payers via these 14 dividend stocks with yields > 3%, aiming for sustainable yields above 3% with a continued focus on quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal