Earnings Not Telling The Story For Amadeus IT Group, S.A. (BME:AMS)

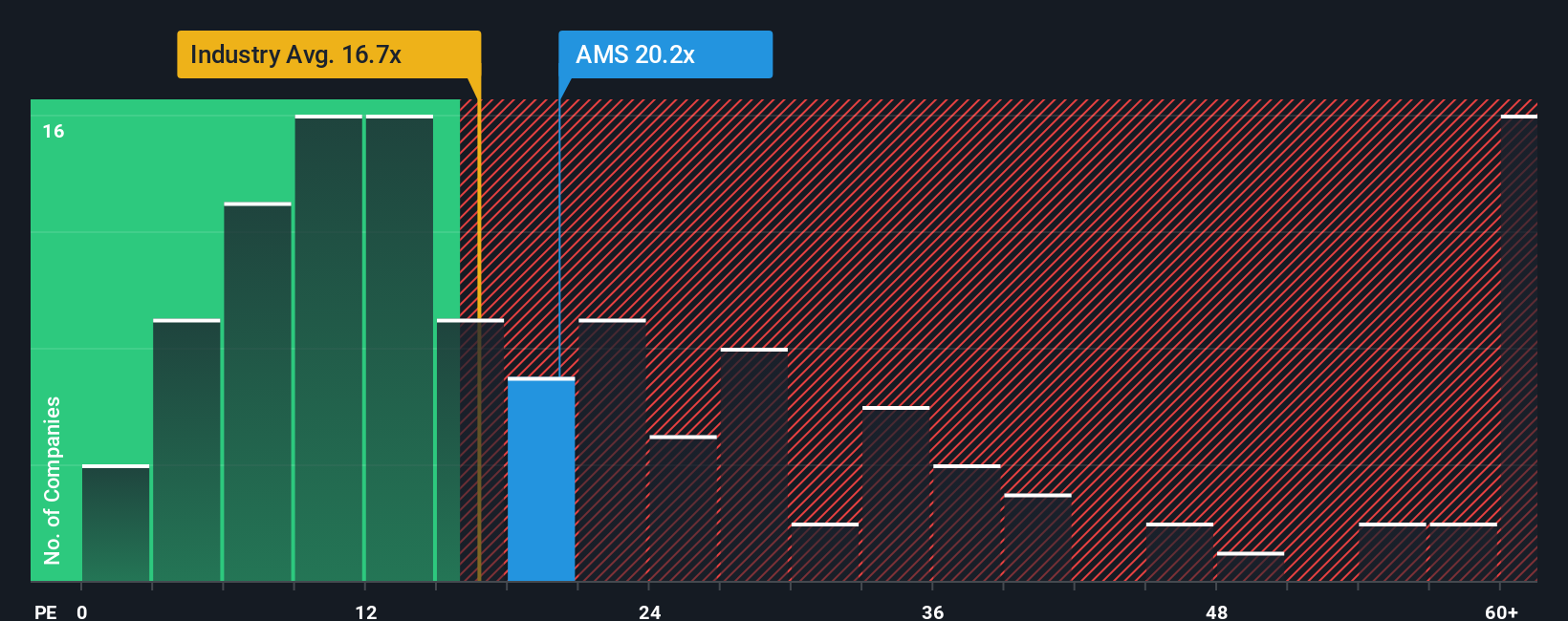

When close to half the companies in Spain have price-to-earnings ratios (or "P/E's") below 16x, you may consider Amadeus IT Group, S.A. (BME:AMS) as a stock to potentially avoid with its 20.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Amadeus IT Group could be doing better as it's been growing earnings less than most other companies lately. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Amadeus IT Group

How Is Amadeus IT Group's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Amadeus IT Group's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 6.3%. This was backed up an excellent period prior to see EPS up by 202% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 7.5% each year during the coming three years according to the analysts following the company. With the market predicted to deliver 11% growth each year, the company is positioned for a weaker earnings result.

With this information, we find it concerning that Amadeus IT Group is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Amadeus IT Group's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Amadeus IT Group, and understanding them should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal