Zealand Pharma A/S' (CPH:ZEAL) Share Price Is Matching Sentiment Around Its Revenues

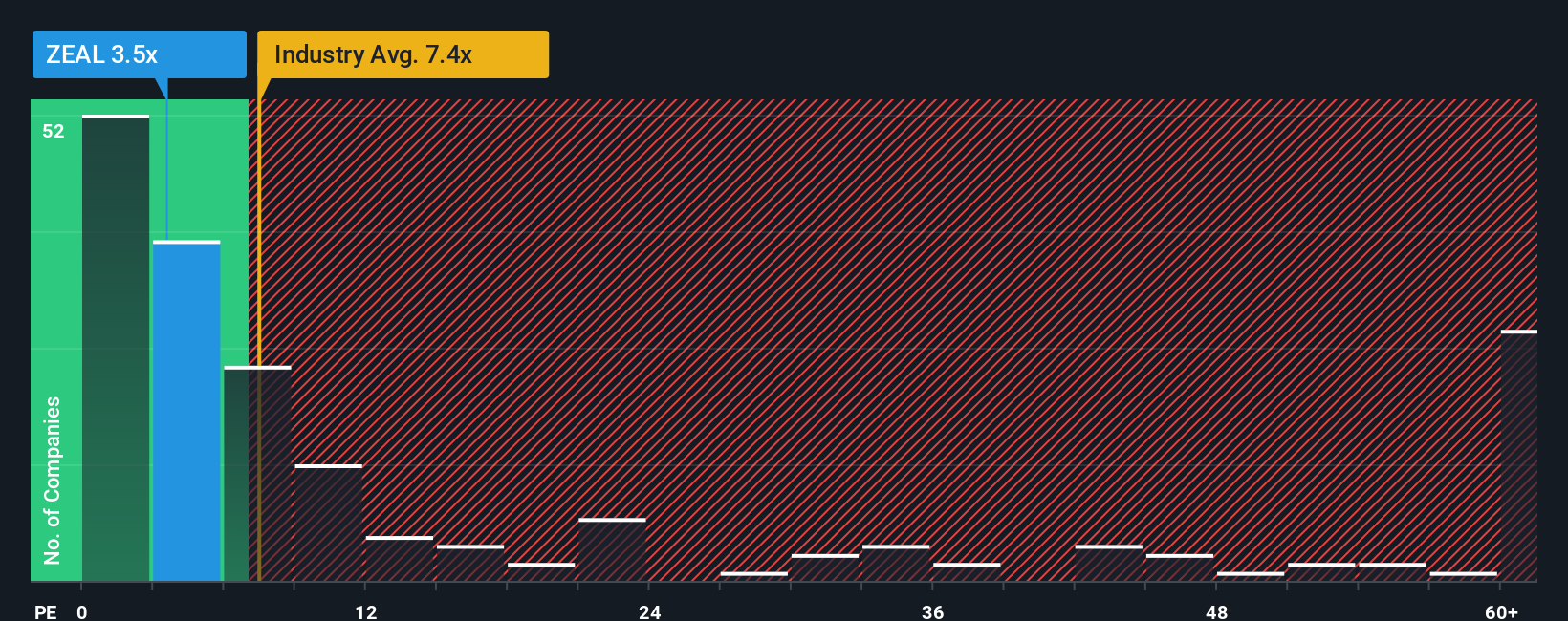

With a price-to-sales (or "P/S") ratio of 3.5x Zealand Pharma A/S (CPH:ZEAL) may be sending very bullish signals at the moment, given that almost half of all the Biotechs companies in Denmark have P/S ratios greater than 7.4x and even P/S higher than 34x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Zealand Pharma

What Does Zealand Pharma's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Zealand Pharma has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Zealand Pharma will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Zealand Pharma?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Zealand Pharma's to be considered reasonable.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The amazing performance means it was also able to deliver huge revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 34% per year over the next three years. That's not great when the rest of the industry is expected to grow by 108% per year.

With this in consideration, we find it intriguing that Zealand Pharma's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Zealand Pharma's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Zealand Pharma's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Zealand Pharma (of which 1 is concerning!) you should know about.

If these risks are making you reconsider your opinion on Zealand Pharma, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal