Wall Street starts 2026 with high expectations after global “equity and debt traders” hit the strongest bull market since 2009

At the beginning of the new year, the market continued the momentum of the end of last year: the market rose, Wall Street confidence remained the same, and there was little sign that the factors driving the market rise in 2025 had subsided. However, it is currently unclear how long this simultaneous trend across assets will last.

On the first trading day of January, global stock markets rose, continuing their gains for most of last year. The boom in artificial intelligence, slowing inflation, and supportive policies of central banks have overshadowed trade disputes, geopolitical tension, and the negative factors of overvaluation. For investors, this once again confirms a simple truth: taking risks always pays off.

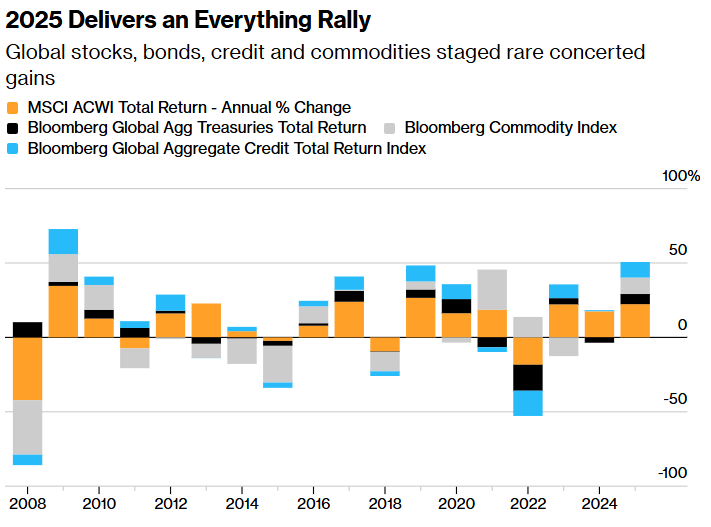

However, what is unusual about this year is not only the strong gains, but also the extent to which it spans a wide range of assets. Stocks and bonds rose at the same time, credit spreads narrowed again, and commodity prices continued to rise even as inflationary pressure eased. The increase was widespread, continuous, and unusually consistent. By the end of the year, the financial environment was close to its most relaxed level since 2025, highlighting rising valuations and the convergence of investors' expectations for economic growth and artificial intelligence.

Looking at global stocks, bonds, credit, and commodities, the cross-asset performance in 2025 was the strongest since 2009 — which was characterized by critical valuations and extensive government policy interventions.

This strategy makes diversification seem effortless — but it also masks the importance of whether the factors driving earnings over the past 12 months have remained the same. Portfolios are less protective when assets that were originally intended to offset each other move in the same direction. The benefits will accumulate, but the room for fault tolerance will shrink.

Jean Boivin, global head of BlackRock Investment Research Institute, said: “We believe 2025 has revealed the false prosperity risks of diversified investments. This is not a story of how diversifying investments into these asset classes can provide protection.”

As the market enters 2026, what people are worried about is not whether last year's rise was irrational, but whether this trend will be difficult to replicate. Wall Street's expectations are still based on the same drivers — huge investments in artificial intelligence, strong economic growth, and the ability of policymakers to relax monetary policy without triggering inflation. Forecasts from more than 60 agencies show that all parties generally agree that these factors still exist.

This optimism stems from the fact that the market has digested a lot of positive news. Speaking about stocks related to artificial intelligence and nuclear energy, Carl Kaufman, portfolio manager at Osterweis, said: “We believe that the rapid expansion of valuations in certain industries is neither sustainable nor replicable. We are cautiously optimistic that a major crash can be avoided, but are concerned that future returns may be weak.”

The strong rise in the stock market last year helps explain why the US stock market returned about 18%, achieving double digit growth for the third year in a row, while the global stock market rose by about 23%. Government bonds have also risen, and global treasury bond prices have risen by nearly 7%, thanks to the Federal Reserve cutting interest rates three times.

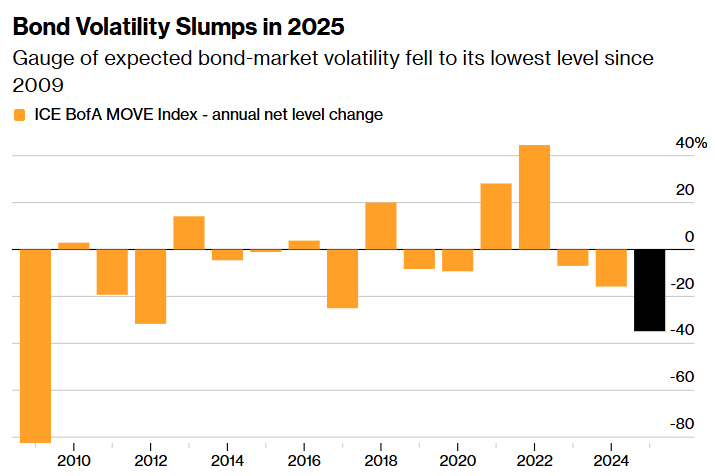

Market volatility has declined sharply, and so has the credit market. The index that measures the volatility of the US bond market recorded the biggest annual decline since the financial crisis, while interest spreads on investment-grade bonds narrowed for the third year in a row, and the average risk premium fell below 80 basis points. Commodities also joined the rise. The index tracking this sector rose about 11%, with precious metals leading the way. Gold prices have repeatedly reached new highs, supported by central bank purchases, the loose monetary policy of the United States, and the weakening US dollar.

Inflation is still the sticking point. Although price pressure eased for most of 2025, some investors warned that energy market or policy mistakes could quickly reverse this progress.

“For us, the key risk is whether inflation will eventually make a comeback,” said Ina Krishnan of Schroder Investments. We anticipate a series of events that could trigger inflation, and we think the most likely path starts with rising energy prices.”

This tension is not only reflected at the market level. According to the Institutional Billionaires Index, the total wealth of the 500 richest people in the world increased by a record 2.2 trillion US dollars last year, while US consumer confidence declined for the fifth month in a row in December.

Last year, traditional Wall Street diversified investment strategies also ushered in a recovery. A portfolio with a 60/40 ratio of stocks and bonds had a return of 14%, while the index tracking the so-called quantitative risk parity strategy rose 19%, the best annual performance since 2020. In contrast, a balanced strategy has yet to attract investors to chase the performance of funds that have experienced capital outflows for a long time.

Asset allocators generally remain optimistic, believing that economic growth momentum and policy support are still strong enough to offset the problem of overvalued valuations. Josh Kutin, head of North American asset allocation at Columbia Threadneedle Investments, said: “We are planning to use as much cash as possible to take full advantage of the current market environment. We don't currently see any signs that we should be worried about a recession in the near future.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal