It's Down 27% But Metalpha Technology Holding Limited (NASDAQ:MATH) Could Be Riskier Than It Looks

Unfortunately for some shareholders, the Metalpha Technology Holding Limited (NASDAQ:MATH) share price has dived 27% in the last thirty days, prolonging recent pain. Looking at the bigger picture, even after this poor month the stock is up 57% in the last year.

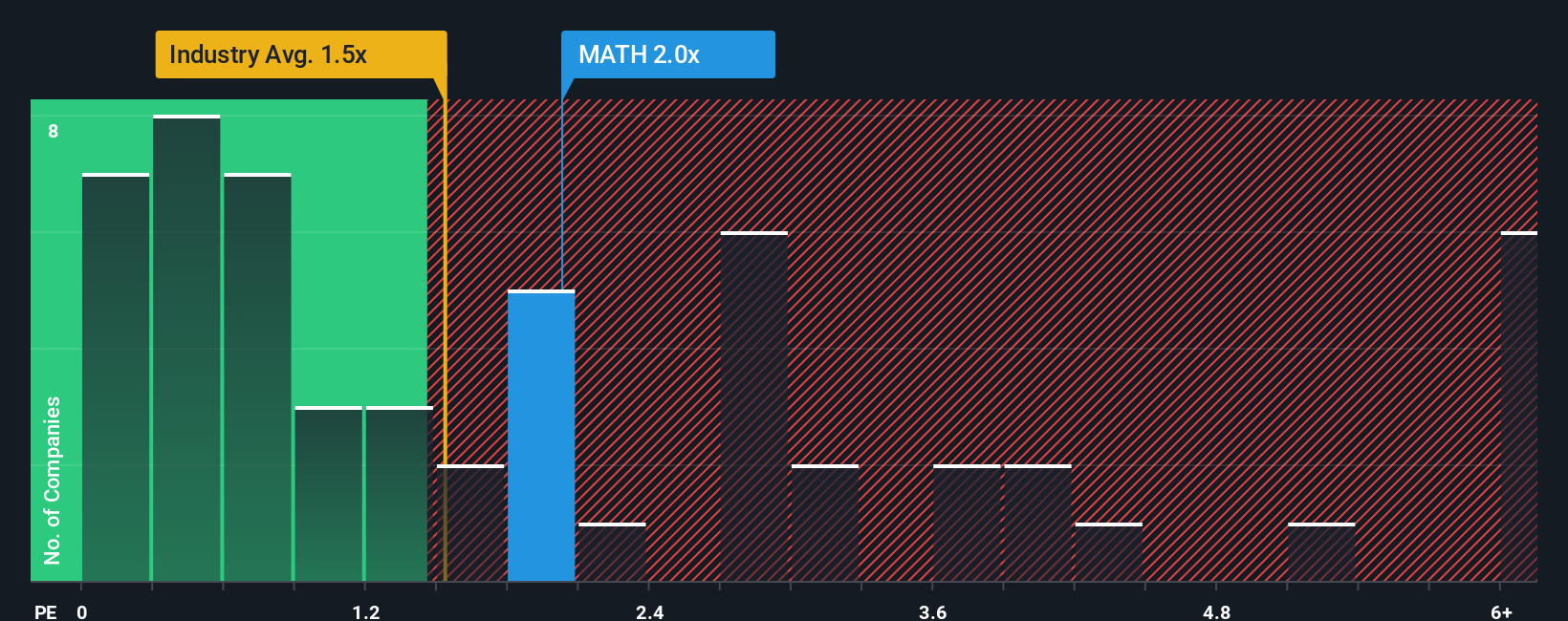

Even after such a large drop in price, there still wouldn't be many who think Metalpha Technology Holding's price-to-sales (or "P/S") ratio of 2x is worth a mention when the median P/S in the United States' Consumer Finance industry is similar at about 1.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Metalpha Technology Holding

How Has Metalpha Technology Holding Performed Recently?

With revenue growth that's exceedingly strong of late, Metalpha Technology Holding has been doing very well. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Metalpha Technology Holding, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Metalpha Technology Holding's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 166% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 49% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Metalpha Technology Holding is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Metalpha Technology Holding's P/S?

Metalpha Technology Holding's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To our surprise, Metalpha Technology Holding revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Before you settle on your opinion, we've discovered 3 warning signs for Metalpha Technology Holding that you should be aware of.

If you're unsure about the strength of Metalpha Technology Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal