IPO News | Jiyi Technology's second submission, Hong Kong Stock Exchange ranks first among China's cross-border import e-commerce operation service providers

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 31, Suzhou Jiyi Technology Co., Ltd. (abbreviation: Jiyi Technology) submitted a listing application to the main board of the Hong Kong Stock Exchange, and CITIC Securities is its sole sponsor. The company submitted a statement to the Hong Kong Stock Exchange on June 18, 2025. According to Frost & Sullivan, in 2024, according to the GMV for cross-border imported e-commerce operations, the company ranked first among China's cross-border import e-commerce operation service providers, accounting for 8.5% of China's cross-border import e-commerce service market.

Company profile

According to the prospectus, Jiyi Technology is one of the leading integrated digital retail operation service providers in China, that is, a type of e-commerce operation service provider that not only provides services for brands but also services for large supermarket chains.

The company has developed diversified solutions and asset management capabilities to more accurately position the brand image for brand partners, expand reach more widely, manage consumer portraits more accurately, and distribute products more efficiently. Depending on whether the company assists brand partners in selling products to consumers, the company mainly provides integrated digital retail operation services to brand partners through brand-to-consumer solutions and brand-to-enterprise solutions. Second, the company also provides brand asset management and IP commercialization operation services and other services to brand partners.

According to Frost & Sullivan, according to the 2024 GMV, Jiyi Technology ranked second among integrated digital retail operation service providers in China and fifth among e-commerce operation service providers in China, accounting for 1.2% of China's e-commerce operation service market. The company is also a Chinese brand product distributor and brand asset manager. It is committed to driving brand growth and achieving brand value through digital intelligence technology and efficient operation. After being deeply involved in the e-commerce operation service industry for ten years, the company has formed a closed-loop service capability for the entire brand value chain. Depending on the specific needs of the brand partners working with the company, the company provides them with integrated digital retail operation services. The company is also a leading e-commerce service provider for cross-border imports in China.

With its rich service matrix and strong service capabilities covering the entire value chain of brands, as of the last practical date, Jiyi Technology has cooperated with more than 200 global brands in various categories such as health, beauty and personal care, fast food (food and beverage, mother and baby), home and home appliances, and most of them are well-known international brands. According to Frost & Sullivan, according to the 2024 GMV from the Big Health category, the company ranked first among all e-commerce operating service providers in China, accounting for 3.5% of China's Big Health e-commerce service market. The company also provides integrated digital retail operation services to many large supermarket chains around the world to help them open up global online and offline channels.

Jiyi Technology helps international retail brands enter and further cultivate the Chinese market through cross-border imports. As of the last practical date, the company has served more than 140 international brands. In 2024, the GMV of the company's cross-border imported e-commerce operations reached RMB 7.4 billion, ranking first among e-commerce operation service providers in China according to Frost & Sullivan. Relying on the industry experience accumulated in the cross-border import business, the company began gradually exploring cross-border export business in 2024, cooperating with Chinese brands interested in developing overseas markets, and building the company's overall distribution capacity in the field of cross-border export e-commerce. The company has gradually expanded its business to global markets such as Australia and Southeast Asia, and launched a market layout in the Middle East and North Africa. According to Frost & Sullivan, the company has become one of the few large-scale e-commerce operation service providers in the Chinese market that also has the ability to provide cross-border import and export services.

Jiyi Technology's outstanding achievements have been widely recognized by the industry and authorities. It has been certified as a national specialist, high-tech enterprise, and a science and technology innovation application case unit of the Ministry of Commerce. The company has also won famous awards such as the Hu Xiao Award (Gold Award) and the ECI Awards International Digital Innovation Award.

Financial data

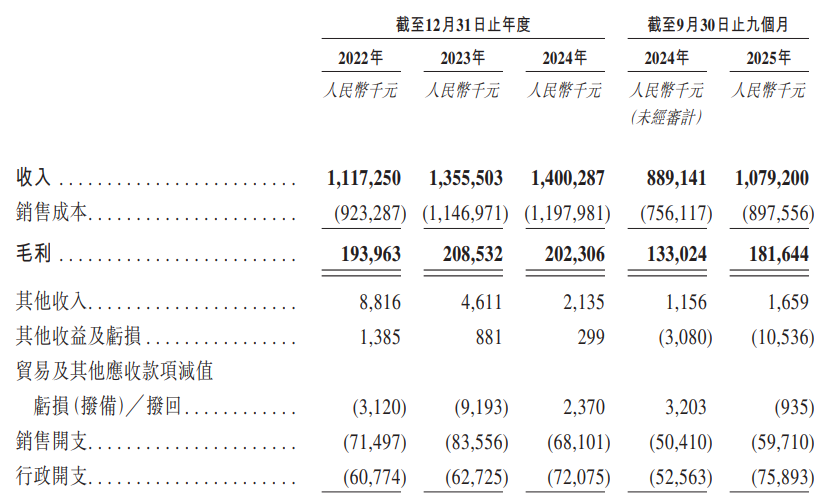

revenue

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company achieved revenue of approximately 1,117 billion yuan (RMB, same below), 1,356 billion yuan, 140 billion yuan, and 1,079 billion yuan, respectively. During the track record period, the company's revenue mainly came from brand-to-consumer solutions and brand-to-enterprise solutions. The company also generates a small amount of revenue from brand asset management and IP commercialization operations and other services.

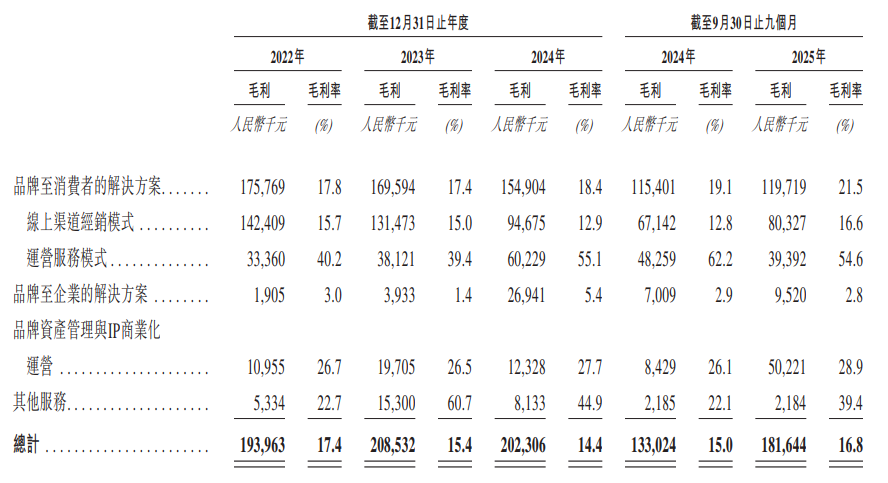

Gross profit and gross profit margin

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded gross profit of about 194 million yuan, 209 million yuan, 202 million yuan, and 182 million yuan respectively, corresponding to gross profit margins of 17.4%, 15.4%, 14.4%, and 16.8%, respectively.

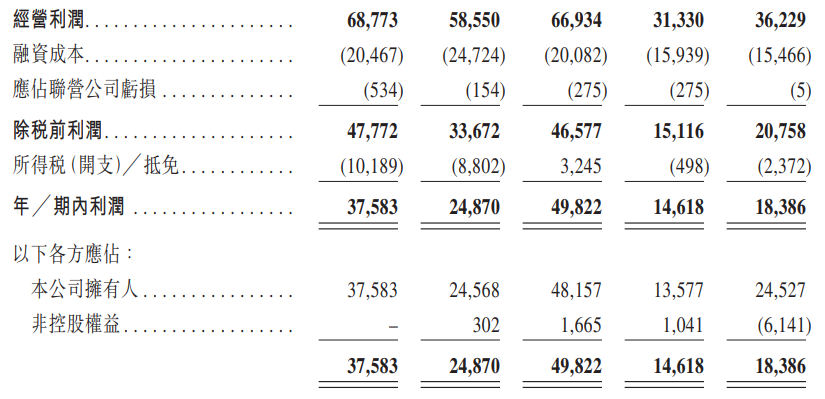

Profit for the year/period

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded annual/period profits of 37.583 million yuan, 24.87 million yuan, 498.22 million yuan, and 18.386 million yuan respectively.

Industry Overview

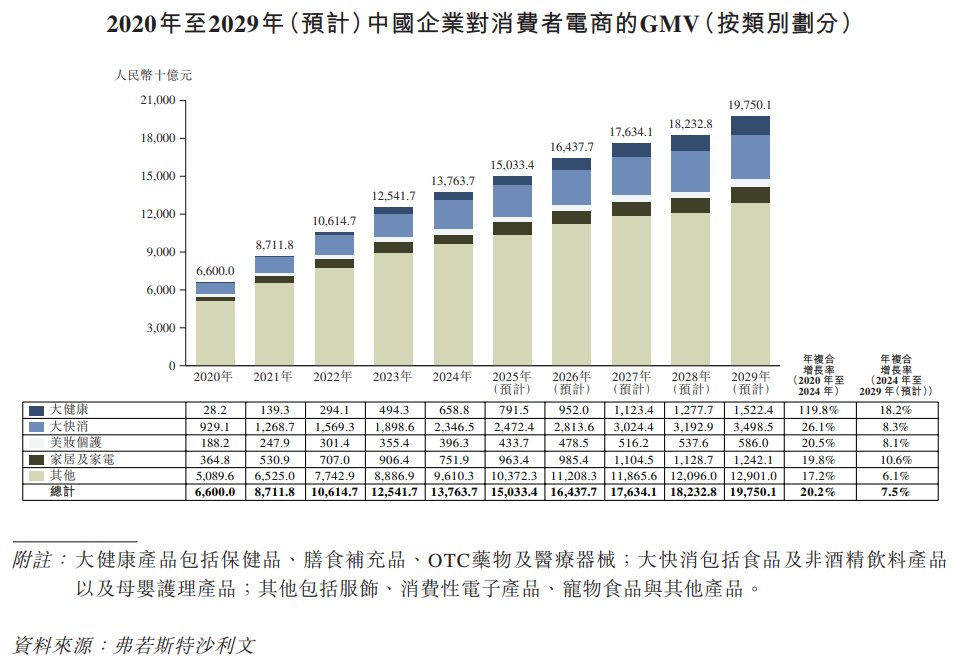

Thanks to China's huge retail market and continuous growth in consumer demand, and innovation in e-commerce platforms to enhance user experience, optimize supply chains, and improve logistics distribution, the size of the Chinese business-to-consumer e-commerce market has increased dramatically from RMB 6.600 billion in 2020 to RMB 137,63.7 billion in 2024, and is expected to continue to grow to RMB 197,50.1 billion in 2029. Because it is closely related to consumers' daily lives, demand is stable and frequent, and is characterized by high-frequency purchases. Therefore, according to GMV, DFAP accounts for the largest share of Chinese business-to-consumer e-commerce, reaching 17.0% in 2024, and is expected to continue to increase its share, reaching 17.7% of the total by 2029, and the total transaction volume will reach RMB 34,98.5 billion.

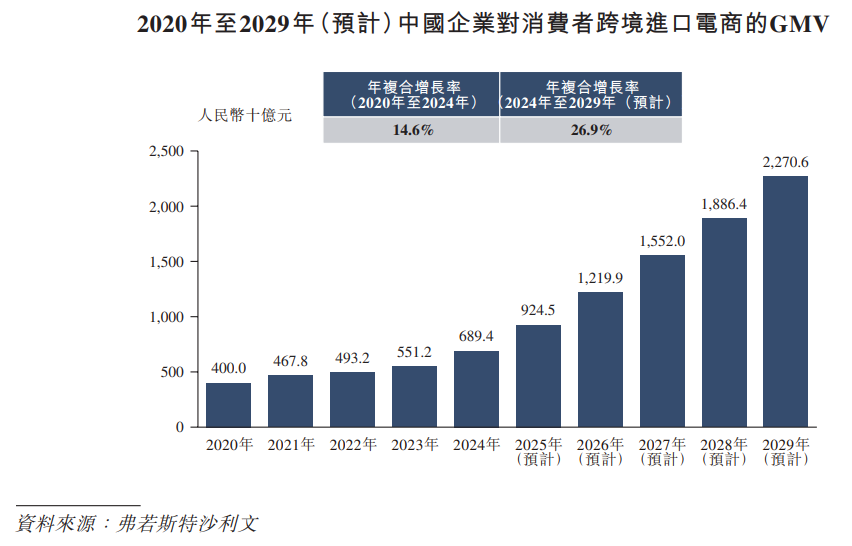

Cross-border e-commerce between Chinese enterprises and consumers refers to a model where enterprises sell foreign products directly to domestic consumers through e-commerce platforms. Under this model, consumers can buy foreign products, while foreign companies can enter the Chinese consumer market.

As China's middle income population expands and income levels rise, consumer demand for high-quality, diversified products is growing. E-commerce imported across borders by Chinese enterprises to consumers satisfies domestic consumers' demand for high-quality overseas products, making it easy for consumers to buy foreign products. Thanks to the strong demand for overseas products from domestic consumers and the advantages of the business-to-consumer model in enhancing the shopping experience, the GMV of Chinese companies' cross-border e-commerce imports has continued to grow in recent years, from RMB 400 billion in 2020 to RMB 689.4 billion in 2024. During the forecast period, the GMV of e-commerce imported across borders by Chinese enterprises to consumers is expected to increase further, to RMB 2,270.6 billion in 2029, with a compound annual growth rate of 26.9% from 2024 to 2029.

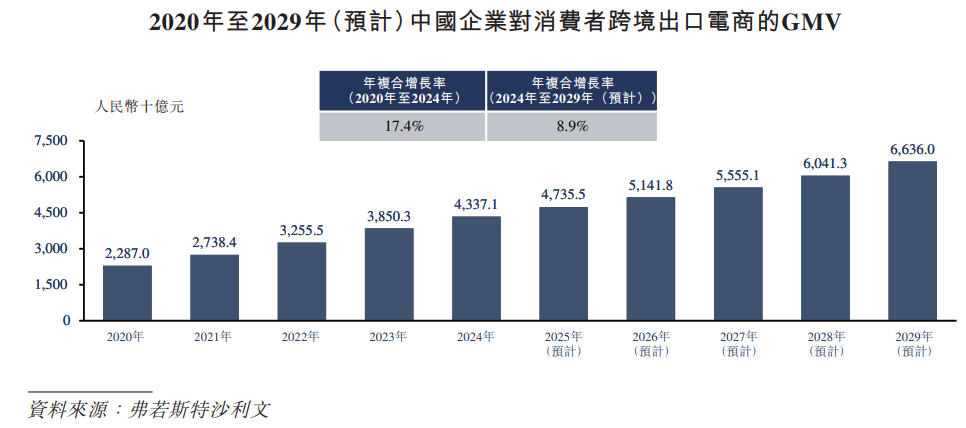

With the digitalization and automation upgrade of the domestic manufacturing industry, the Chinese industry continues to transform and upgrade. Domestic brands have shown strong competitiveness in the global market due to their high cost performance ratio and are favored by overseas consumers. Under the business-to-consumer model, enterprises are more directly influenced by the consumer side, especially in terms of expanding emerging markets and regions, which are more likely to bring new growth points. Domestic SMEs and supply chain factories have succeeded in overseas markets through mature market strategies and innovative hosting models, driving the continuous growth of cross-border e-commerce exports from Chinese enterprises to consumers. The GMV for cross-border e-commerce exports from Chinese enterprises to consumers continued to increase from RMB 2,287 billion in 2020 to RMB 4337.1 billion in 2024. The compound annual growth rate during this period was 17.4%. It is expected to further increase to RMB 66,360 billion by 2029, and the compound annual growth rate from 2024 to 2029 is 8.9%.

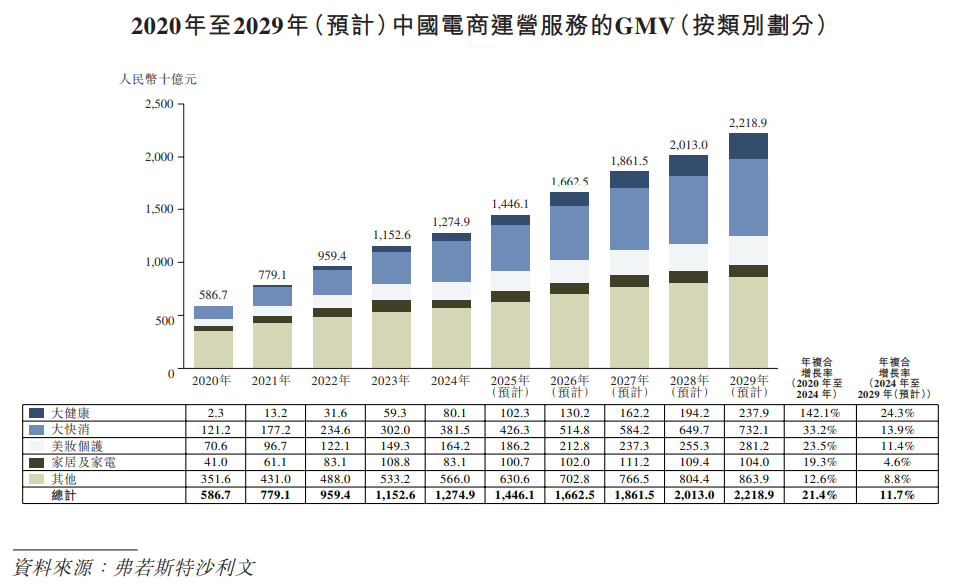

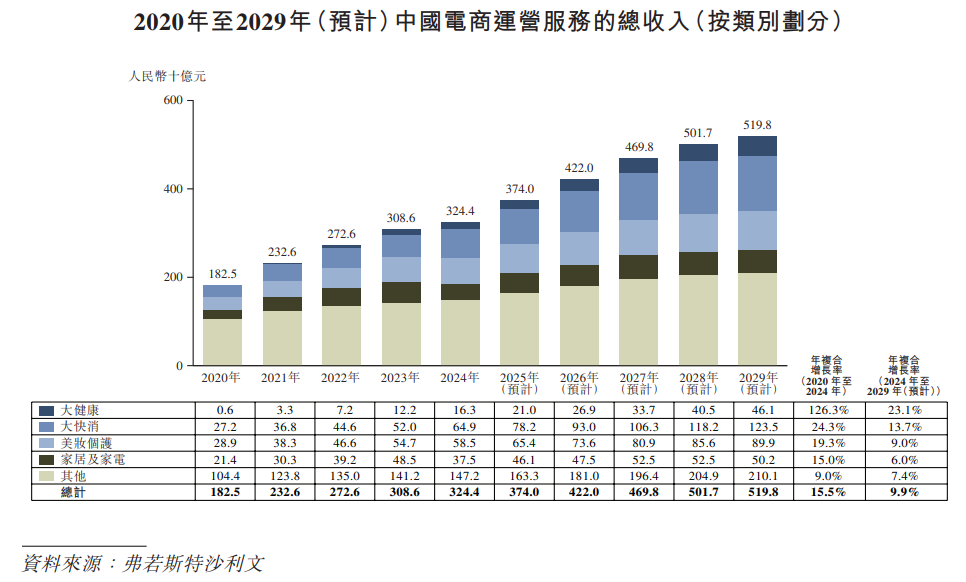

The total GMV of e-commerce operating service providers in China increased from RMB 586.7 billion in 2020 to RMB 1,274.9 billion in 2024, with a compound annual growth rate of 21.4%. It is expected to reach RMB 2218.9 billion in 2029, with a compound annual growth rate of 11.7% from 2024 to 2029.

Among the five major sectors in the e-commerce industry, the big health sector has great potential for GMV growth. As the government introduced policies to support e-commerce platforms to sell big health products, more and more big health brands are expanding to online sales channels. Early on, pharmaceutical industry expertise was critical to the operation of big health brands, so brand partners often preferred to operate independently. With the continuous accumulation of industry experience and channel resources, e-commerce operation service providers have achieved cooperation with more big health brands, driving the rapid growth of total e-commerce transactions in the big health industry. The GMV of e-commerce operating service providers in the health industry increased from RMB 2.3 billion in 2020 to RMB 80.1 billion in 2024, with a compound annual growth rate of 142.1%. It is expected to reach RMB 237.9 billion in 2029, with a compound annual growth rate of 24.3% from 2024 to 2029.

In addition, industries such as FMCG, beauty and personal care also play an important role in the e-commerce market. In 2024, these two industries contributed a high GMV, accounting for 42.8% of the total GMV of e-commerce operations and services. Since FMCG products are frequently purchased in consumers' daily lives and sales are huge, many brand partners seek operational support from e-commerce operation service providers to improve operational efficiency and reduce operating costs. In addition, e-commerce operation service providers also regard FMCG as one of the main sales product categories under the distribution model to improve the stability of the revenue matrix. In the field of beauty and personal care, brand building and refined operation are essential. E-commerce operation service providers need to have the advantage of channel resources and operational capabilities, and be able to charge a high commission ratio.

The increase in total revenue from e-commerce operation services in various industries depends on the increase in GMV received by e-commerce operation services in various industries, as well as return rates and commission ratios in various industries. Generally speaking, the FMCG industry has a relatively high return rate, while the home and appliance industry has a much lower return rate. The commission rate in the beauty and personal care industry is high, while the commission rate in the FMCG industry is relatively low. The revenue received by e-commerce service providers in the health industry increased from RMB 600 million in 2020 to RMB 16.3 billion in 2024, with a compound annual growth rate of 126.3%. It is expected to reach RMB 46.1 billion in 2029, with a compound annual growth rate of 23.1% from 2024 to 2029.

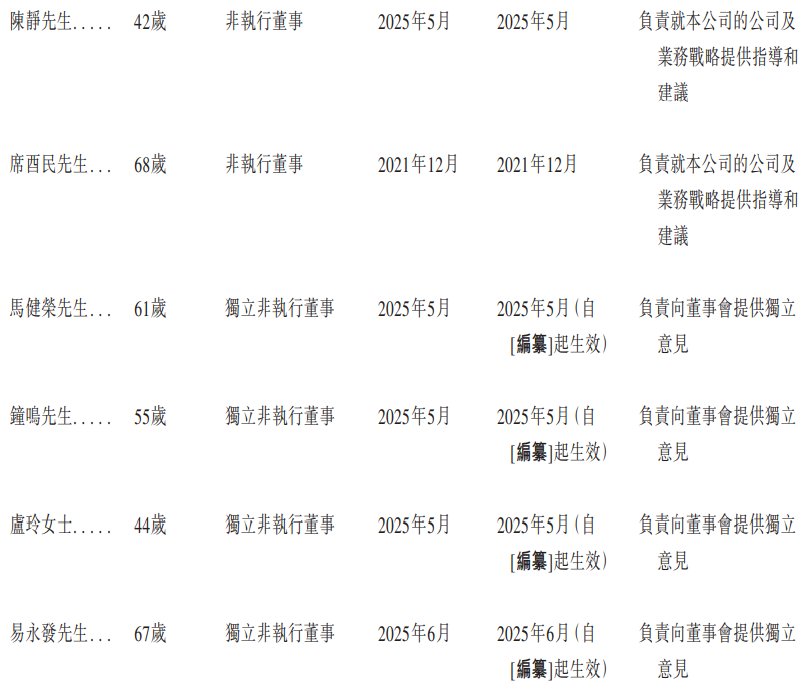

Board Information

The Board consists of 10 directors, including 2 executive directors, 4 non-executive directors and 4 independent non-executive directors.

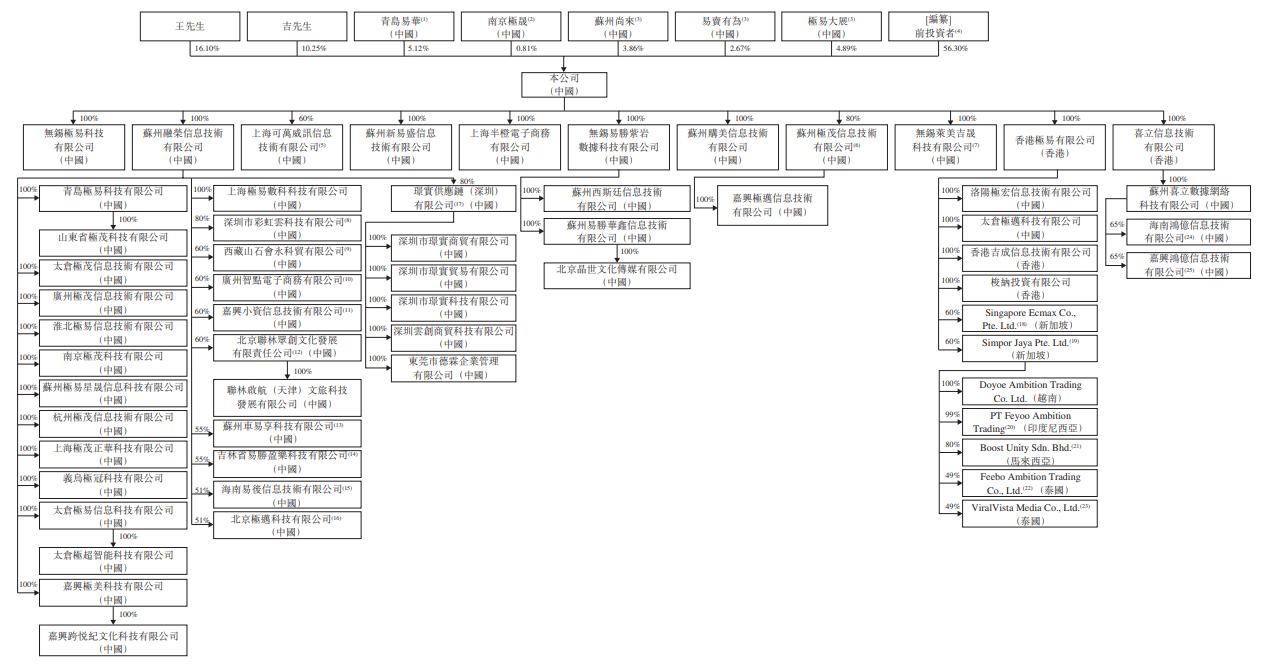

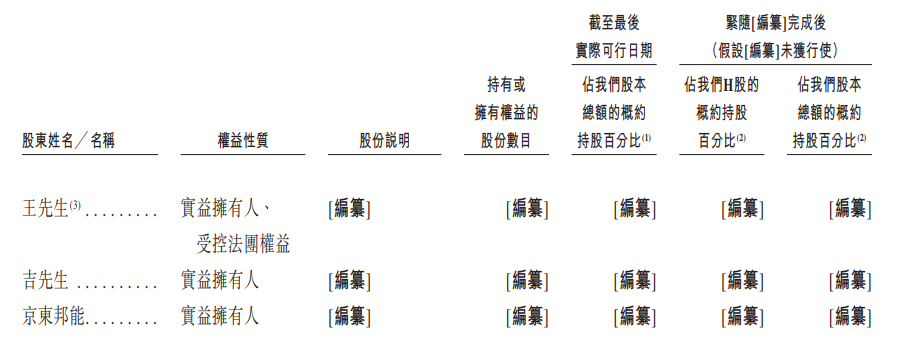

Shareholding structure

Mr. Wang Shan holds 16.10% of the shares, Mr. Ji Rong holds 10.25% of the shares, Qingdao Yihua (China) holds 5.12%, Nanjing Jisheng (China) holds 0.81% of the shares, Suzhou Shanglai (China) holds 3.86% of the shares, Easy Selling Youwei (China) holds 2.67% of the shares, and the total number of pre-listing investors holds 56.30% of the shares.

Qingdao Yihua was established as a limited partnership under Chinese law on September 21, 2017. As of the last practical date, Qingdao Yihua directly held about 5.12% of the company's shares. As of the last practical date, Mr. Wang is the general partner and executive partner. He is responsible for the management of Qingdao Yihua and holds 2.2% of its partnership interests. Qingdao Yihua has five limited partners. Its largest limited partners, Mr. Zhou Ning and Mr. Yan Tiesuo, each hold about 43.3% of their partnership interests. None of the remaining three limited partners held more than 10% of Qingdao Yihua's partnership interests.

According to the voting rights entrustment agreement between Mr. Wang and Nanjing Jisheng on June 8, 2025, Nanjing Jisheng appointed Mr. Wang as its real and legal trustee to vote on all shares of the company held by Nanjing Jisheng. Prior to the voting rights entrustment agreement, Nanjing Jisheng had taken all actions relating to the voting rights attached to Nanjing Jisheng's holding shares in accordance with Mr. Wang's instructions.

Suzhou Shanglai, Yibai Youwei, and Jiyidazhan are all incentive platforms for employees directly holding shares in the company, and each holds less than 5% of the company's shares.

Pre-listing investors include JD Bangneng, Xinlin Phase III, Meishan Sichang, Yipu No. 2, Yuanhe Yuandian, Daohe Ronghai, Wenhui Gaoqi, CCB Science and Technology Innovation, Yangzhou Fuhai, Fujian Dazhi, Guohong No. 3, Junzhuo Equity, Jiaotong University Siyuan, Suzhou Gaoce, Shanghai Miaolin, Wuyi Mountain Daeki, Huaibei Industrial Fund, Wuxi Loufa, Wuxi Xinzhi, Suzhou Qingce, Xinlin Phase IV, Xue Heyou, Suzhou Cultural Foundation, Zhidao Digital, Taicang City, Sugan Culture Nanjing Literature, Wuhan Dolphin, Wobolian Guangzhou Pharmaceutical Foundation, Beijing Century, and Hangzhou Cheers.

Intermediary team

Sole sponsor: CITIC Securities (Hong Kong) Limited.

Company Legal Adviser: On Hong Kong and US Law: Jiali (Hong Kong) Law Firm; On Chinese Law: Global Law Firm.

Sole sponsor legal adviser: Regarding Hong Kong and US law: Herbert Smith Freehills Kramer; relating to Chinese law: Jingtian Gongcheng Law Firm.

Auditor and reporting accountant: Luo Shenmei Certified Public Accountants.

Industry consultant: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch.

Compliance Advisor: New Berry Finance Ltd.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal