European Growth Stocks Insiders Are Betting On

As Europe’s STOXX Europe 600 Index nears record highs amid positive sentiment about future earnings and economic prospects, investors are increasingly focused on growth opportunities within the region. In this environment, companies with high insider ownership can be particularly appealing, as they often signal confidence from those closest to the business in its long-term potential.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's review some notable picks from our screened stocks.

Nordic Semiconductor (OB:NOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordic Semiconductor ASA is a fabless semiconductor company that develops and sells integrated circuits for short- and long-range wireless applications across Europe, the Americas, and the Asia Pacific, with a market cap of NOK26.27 billion.

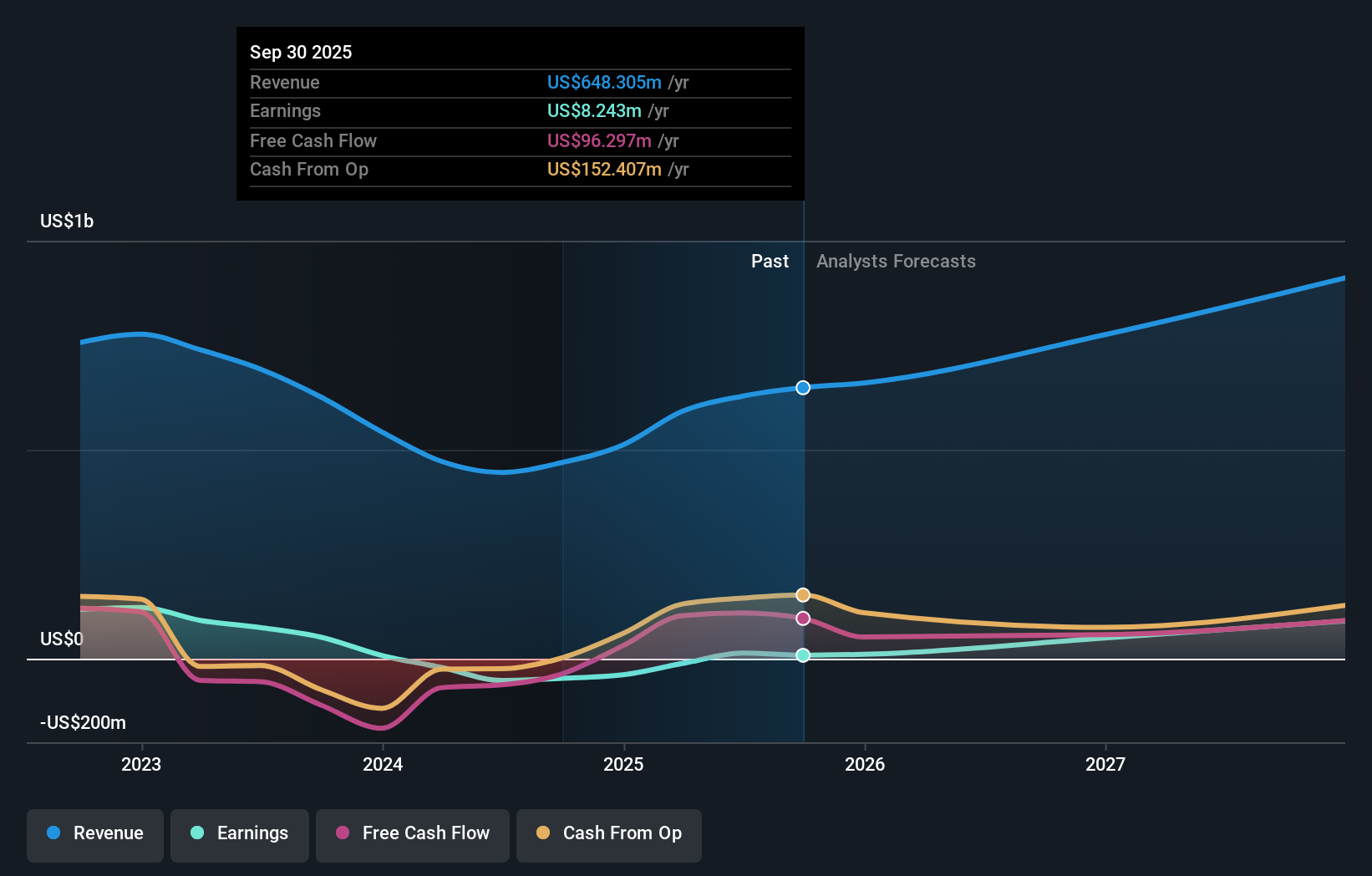

Operations: The company's revenue is primarily derived from the design and sale of integrated circuits and related solutions, amounting to $648.30 million.

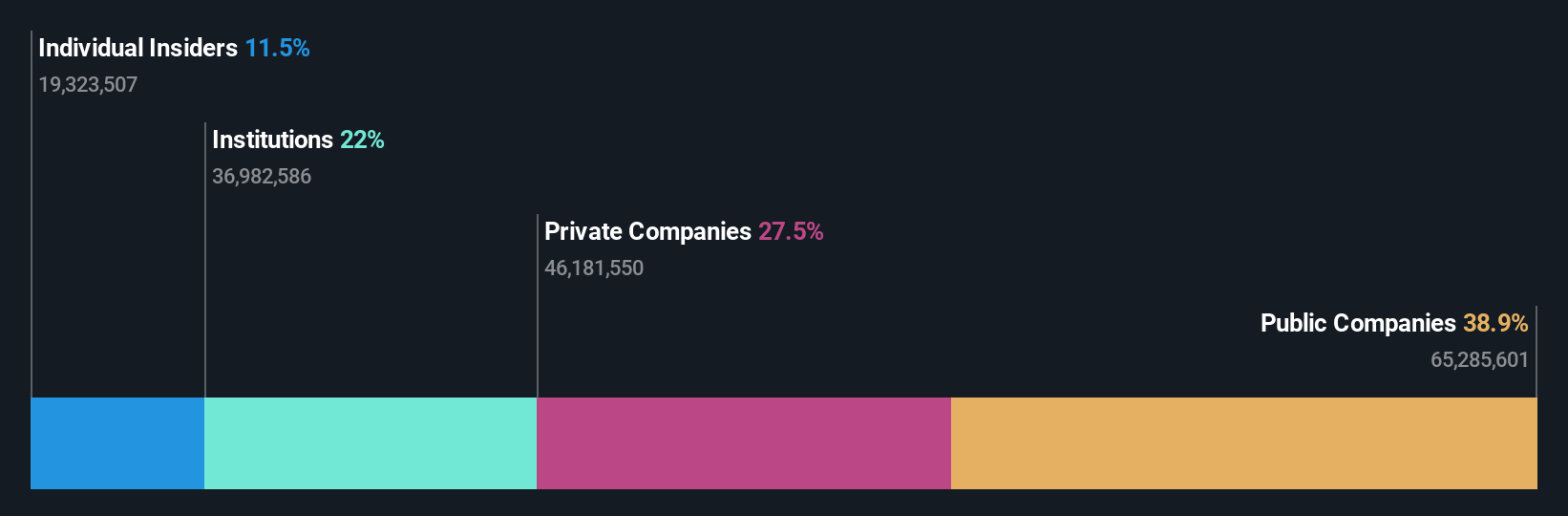

Insider Ownership: 10.4%

Nordic Semiconductor's recent product developments, including the nRF9151 SMA Development Kit, position it well in the cellular IoT and satellite communication markets. Despite a modest net income of US$0.85 million for Q3 2025, earnings are expected to grow significantly at 41.63% per year over the next three years, outpacing both revenue growth and market averages in Norway. Insider activity indicates more buying than selling recently, reflecting confidence despite low forecasted return on equity at 10.5%.

- Take a closer look at Nordic Semiconductor's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Nordic Semiconductor shares in the market.

Swedencare (OM:SECARE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swedencare AB (publ) and its subsidiaries develop, manufacture, market, and sell animal healthcare products for cats, dogs, and horses across North America, Europe, and internationally with a market cap of SEK6.14 billion.

Operations: Revenue segments for Swedencare AB (publ) include SEK599.80 million from Europe, SEK682.50 million from Production, and SEK1.62 billion from North America.

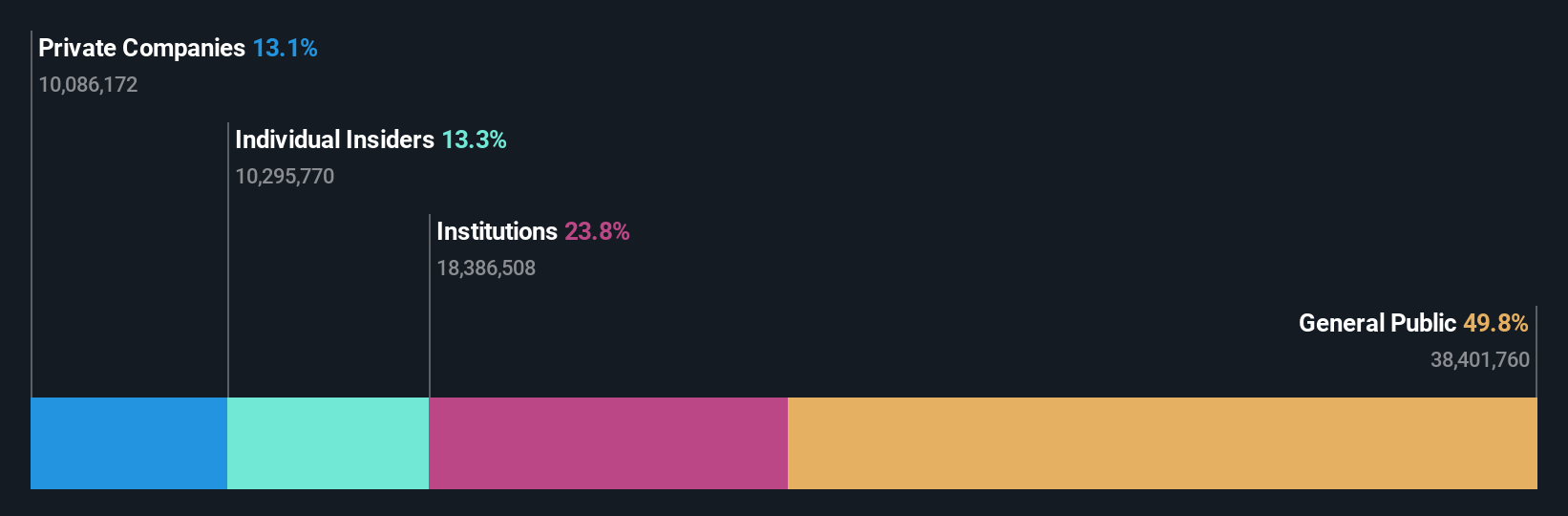

Insider Ownership: 11.6%

Swedencare's recent earnings report shows mixed results, with Q3 2025 sales of SEK 712.9 million and a slight dip in net income to SEK 22.2 million. Despite this, the company is trading significantly below its estimated fair value and is expected to experience substantial earnings growth of over 69% annually, outpacing the Swedish market average. Insider activity shows more buying than selling recently, indicating confidence in future performance despite low forecasted return on equity at 4.2%.

- Get an in-depth perspective on Swedencare's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Swedencare's share price might be on the cheaper side.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of approximately SEK6.48 billion.

Operations: The company's revenue segments include SEK3.48 billion from streaming services and SEK1.24 billion from publishing.

Insider Ownership: 12.7%

Storytel shows potential as a growth company with significant insider ownership, trading well below its estimated fair value. Its earnings are projected to grow at 18% annually, surpassing the Swedish market's average. Recent substantial insider buying suggests confidence in its future prospects. The company became profitable this year and reported strong Q3 results with net income rising to SEK 131.34 million. Strategic partnerships and product innovations like Dolby Atmos enhance its competitive edge in the audiobook market.

- Navigate through the intricacies of Storytel with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Storytel's share price might be too pessimistic.

Next Steps

- Take a closer look at our Fast Growing European Companies With High Insider Ownership list of 209 companies by clicking here.

- Contemplating Other Strategies? Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal