Middle Eastern Penny Stocks: Amanat Holdings PJSC And 2 More Promising Picks

The Middle Eastern stock markets have shown varied performances recently, with Egypt's bourse surpassing its Gulf counterparts in 2025, while oil prices weighed heavily on Saudi Arabia's market. In this context, penny stocks—though an outdated term—still represent a segment of smaller or less-established companies that can offer significant value and growth potential. By focusing on those with strong financials and clear growth prospects, investors may uncover promising opportunities among these under-the-radar companies.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.39 | SAR1.35B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.882 | ₪206.03M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.04 | AED2.18B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.78 | SAR954M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.25 | AED384.62M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.57 | AED15.22B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.829 | AED504.24M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.635 | ₪205.67M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Amanat Holdings PJSC (DFM:AMANAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amanat Holdings PJSC, with a market cap of AED3.20 billion, invests in companies and enterprises within the education and healthcare sectors both in the United Arab Emirates and internationally.

Operations: The company's revenue is derived from two main segments: Education, contributing AED495.94 million, and Healthcare, accounting for AED380.40 million.

Market Cap: AED3.2B

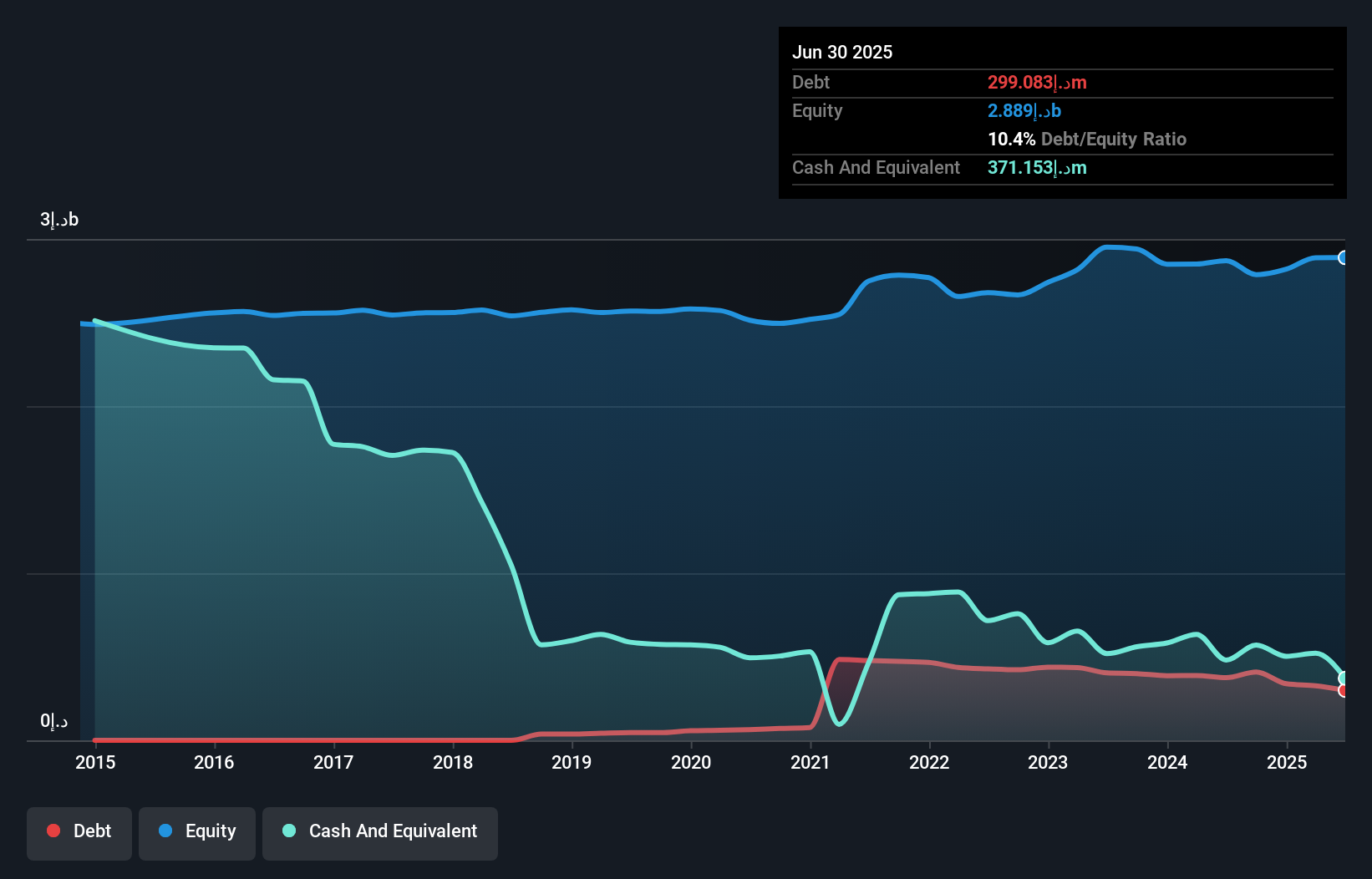

Amanat Holdings PJSC, with a market cap of AED3.20 billion, operates in the education and healthcare sectors. The company has shown significant earnings growth of 330.2% over the past year, although this was partly due to a large one-off gain of AED68.3 million. Its financial health is supported by more cash than total debt and strong short-term asset coverage for liabilities. While its Price-To-Earnings ratio is slightly below industry average, indicating potential value, its Return on Equity remains low at 8.4%. Despite past profit declines over five years, recent performance indicates improved profitability and stability in earnings volatility.

- Click here to discover the nuances of Amanat Holdings PJSC with our detailed analytical financial health report.

- Learn about Amanat Holdings PJSC's historical performance here.

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi (IBSE:AVOD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi operates in Turkey, offering dried vegetables and vegetable-based convenience foods under the Farmer's Choice brand, with a market capitalization of TRY990.90 million.

Operations: The company generates its revenue primarily from its food activities, amounting to TRY1.38 billion.

Market Cap: TRY990.9M

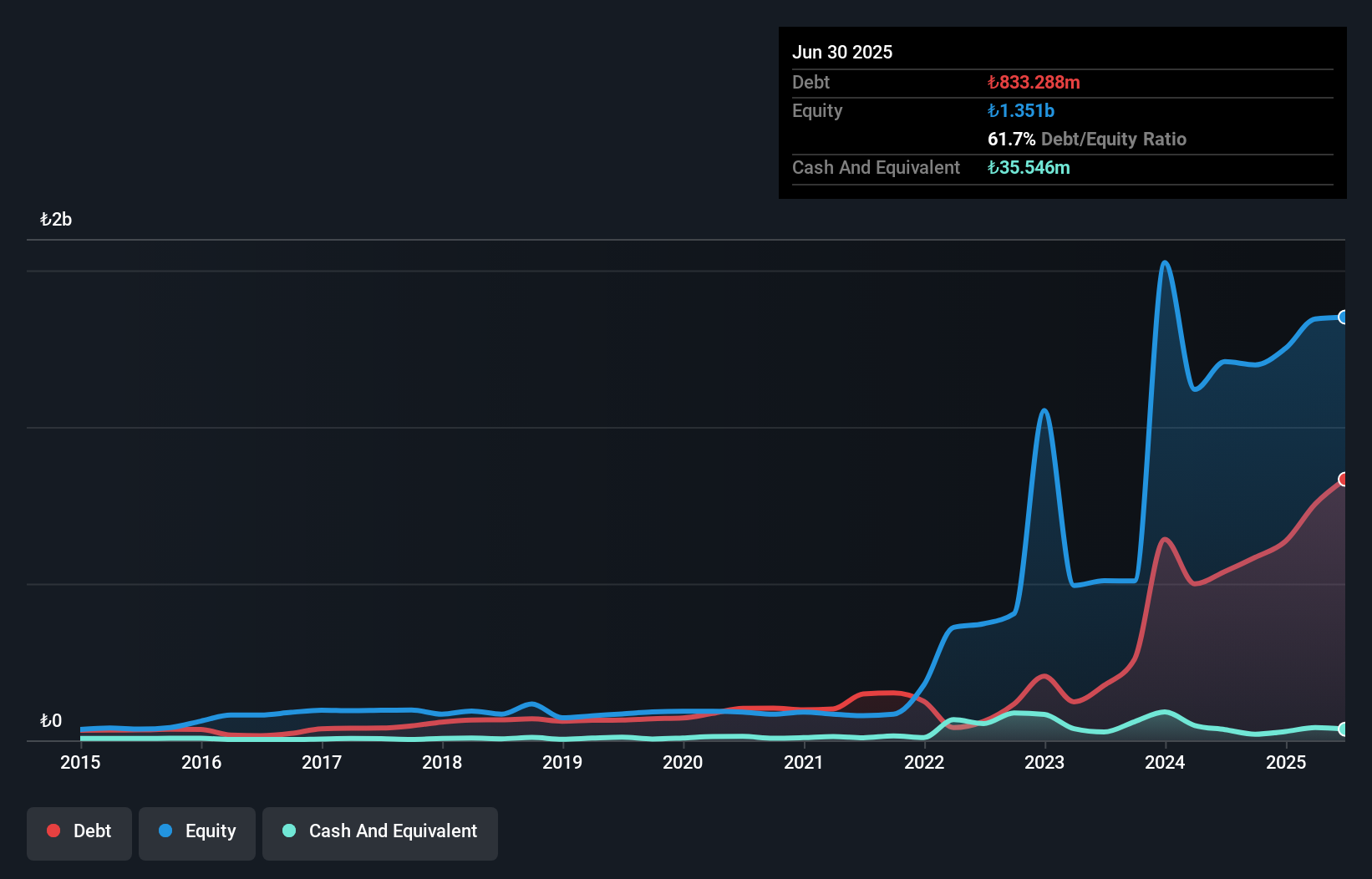

A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi, with a market cap of TRY990.90 million, is currently unprofitable but demonstrates financial resilience through its positive free cash flow and a sufficient cash runway exceeding three years. Despite a high net debt to equity ratio of 58%, the company has reduced its debt significantly over five years. Short-term assets cover both short and long-term liabilities comfortably, indicating robust liquidity. Recent earnings reports show narrowing losses, with a net loss reduction from TRY201.26 million to TRY23.11 million year-over-year in Q3 2025, suggesting potential operational improvements amidst revenue challenges.

- Jump into the full analysis health report here for a deeper understanding of A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi.

- Understand A.V.O.D Kurutulmus Gida ve Tarim Ürünleri Sanayi Ticaret Anonim Sirketi's track record by examining our performance history report.

GSD Holding (IBSE:GSDHO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GSD Holding A.S. operates in finance, shipping, energy, and education sectors through its subsidiaries and has a market capitalization of TRY4.57 billion.

Operations: GSD Holding's revenue is derived from several segments, including Turkey - Banking (TRY762.62 million), Turkey - Holding (TRY285.76 million), Turkey - Factoring (TRY1.63 billion), and Turkey & International - Marine (TRY1.16 billion).

Market Cap: TRY4.57B

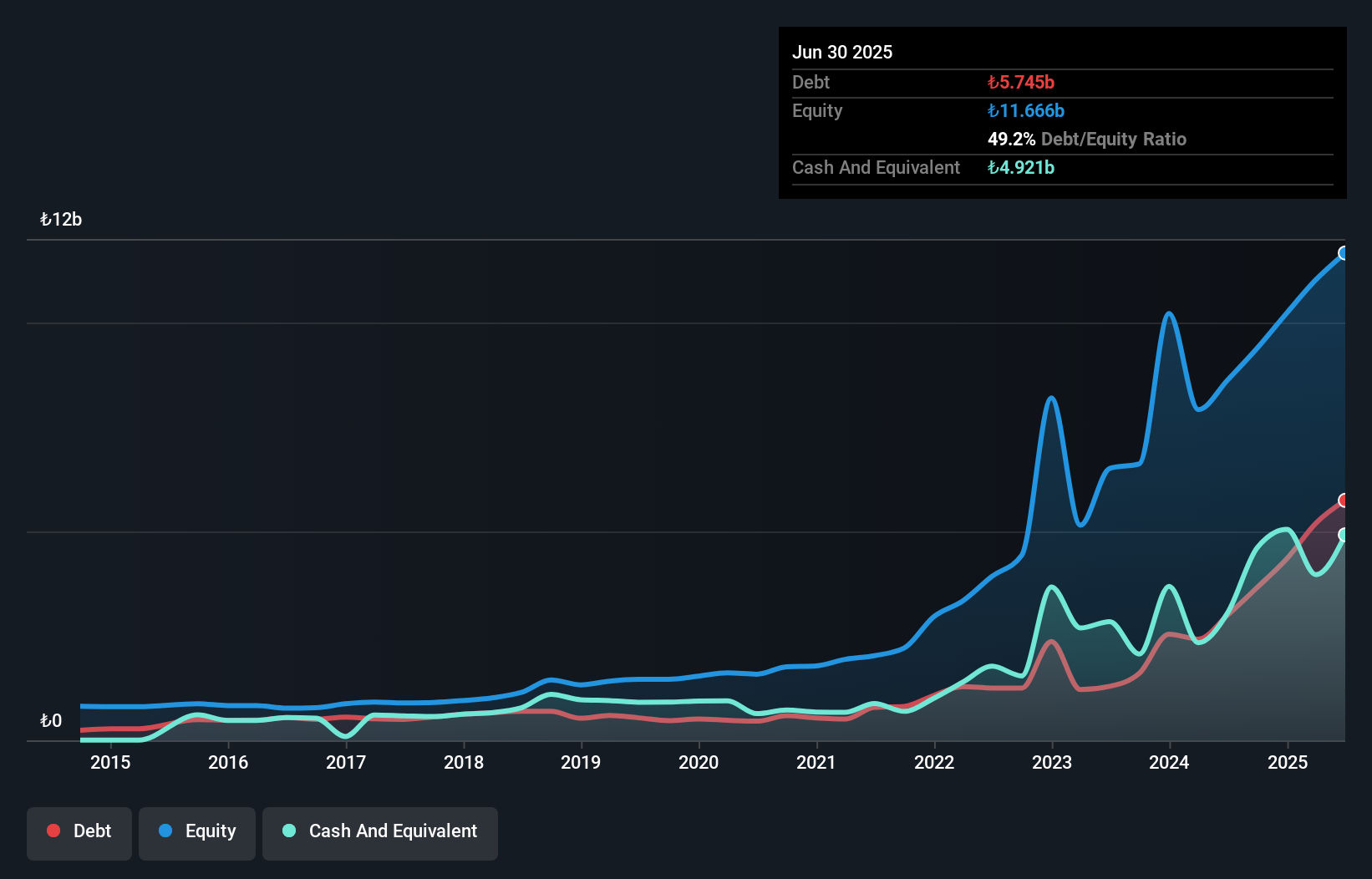

GSD Holding A.S., with a market cap of TRY4.57 billion, operates across diverse sectors including finance and shipping. The company has recently become profitable, though its Return on Equity remains low at 0.1%. GSD's financial stability is evident as short-term assets exceed both short and long-term liabilities, while cash surpasses total debt, ensuring robust liquidity. Despite an increase in the debt-to-equity ratio over five years to 41.6%, operating cash flow covers the debt well at 24.7%. Recent earnings reports show a decline in net income for Q3 2025 compared to the previous year, highlighting ongoing profitability challenges amidst revenue fluctuations.

- Get an in-depth perspective on GSD Holding's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into GSD Holding's track record.

Next Steps

- Dive into all 80 of the Middle Eastern Penny Stocks we have identified here.

- Curious About Other Options? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal