IPO News | Courtyard by Marriott Hong Kong Stock Exchange strives to build a platform for physicians' academic development

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on January 1, Shanghai Courtyard Medical Technology Co., Ltd. (abbreviation: Courtyard Medical) submitted a listing application to the main board of the Hong Kong Stock Exchange, and Everbright Securities International is its sole sponsor.

Company profile

According to the prospectus, Courtyard Medical is a leading provider of AI-driven solutions in China and is committed to empowering physicians' talent development. According to Frost & Sullivan, the company ranked first in the comprehensive AI solutions market for medical academics, education, and research in China in terms of comparable earnings in 2024. Through the company's products and services, Courtyard Medical has gradually developed an ecosystem that connects physicians and health care participants in different institutions to accelerate the dissemination of medical knowledge, promote physician education, and promote the transformation of research results into practical application.

During the track record period, Courtyard Medical mainly provided two types of AI-based revenue generation solutions through the company's intelligent productivity tools: (i) full-process medical academic activity solutions delivered through the company's MedEvent platform to facilitate workflow coordination and academic communication among physicians; and (ii) digital solutions for medical learning and education, featuring interactive learning kits developed and delivered through the company's MedAssistant system, and tailored to physicians' expertise, interests and development goals.

Additionally, Courtyard by Marriott Medical has launched MedEvidence, a suite of intelligent tools including intelligent AI evidence-based assistants to support end-to-end physician-led research processes to enrich the functional integrity of the company's products and enhance interaction with physicians and their loyalty to the company ecosystem. Together, Courtyard Medical's products meet the critical needs of physicians at every stage of their career development.

Financial data

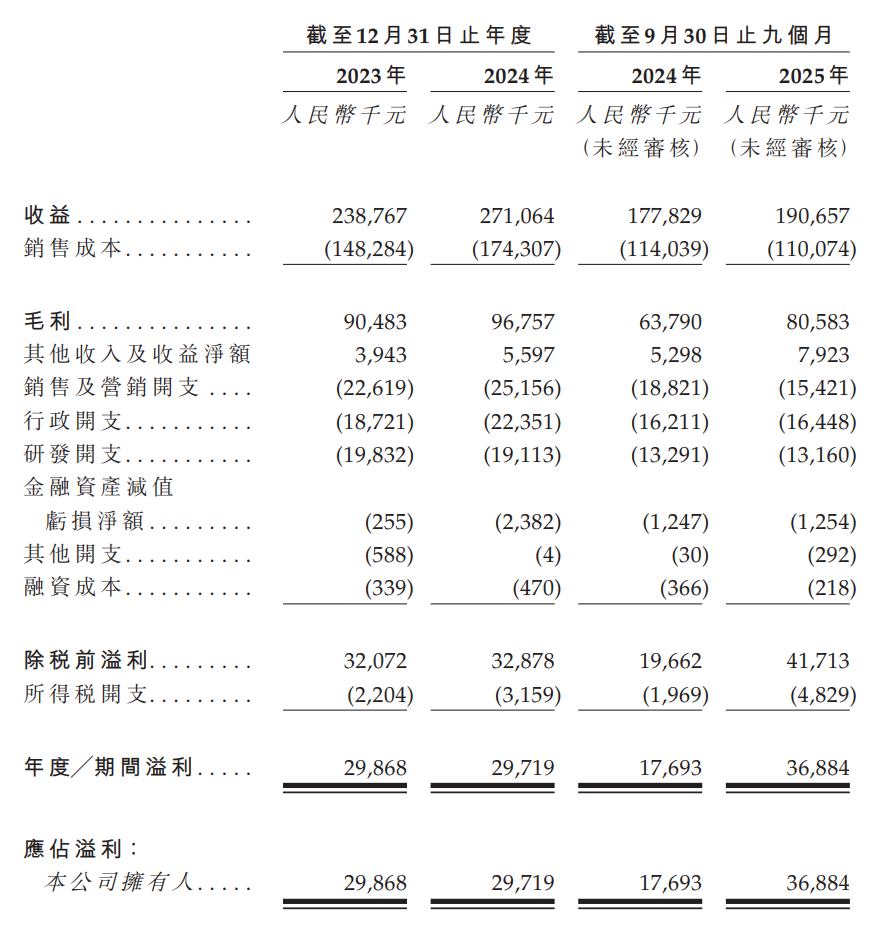

Earnings

In 2023, 2024, and 2025 for the nine months ended September 30, the company achieved revenue of approximately 239 million yuan (RMB, same below), 271 million yuan, and 191 million yuan, respectively.

Annual/period profit

In 2023, 2024, and 2025 for the nine months ended September 30, the company recorded annual/period profit of approximately RMB 298.68 million, RMB 29.719 million, and RMB 36.884 million, respectively.

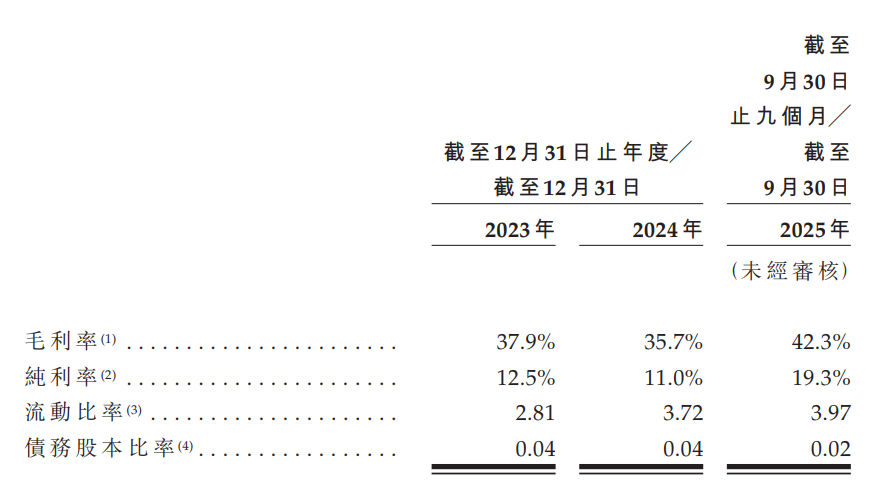

gross profit margin

In 2023, 2024, and 2025 for the nine months ended September 30, the company recorded gross margins of 37.9%, 35.7%, and 42.3%, respectively.

Industry Overview

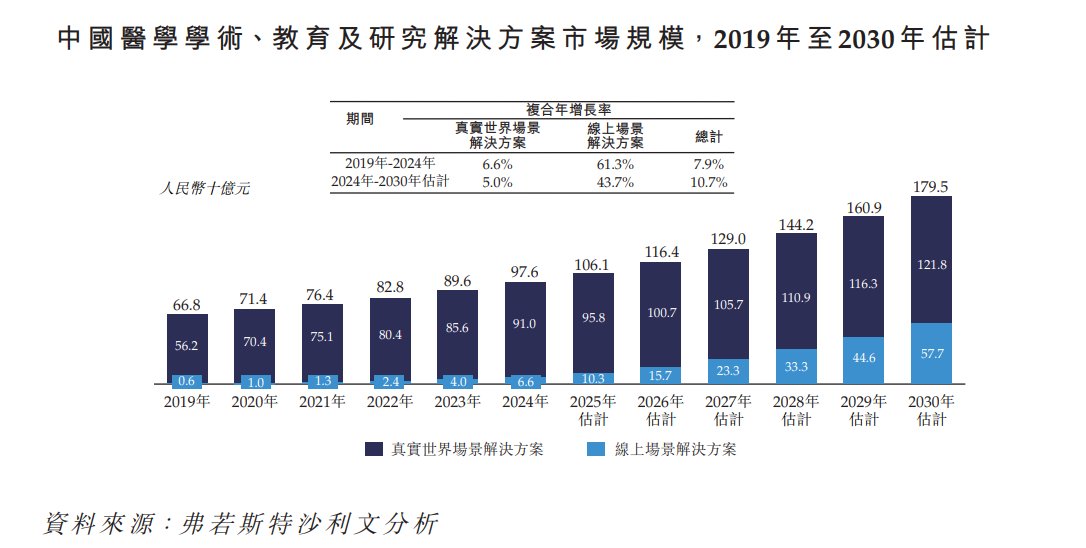

The medical academic, education and research solutions market is centered on physicians' core needs for academic advancement, research advancement, and access to information. In this industry ecosystem, medical society/associations, medical institutions, pharmaceuticals and medical device companies are the main participants, connecting business processes across institutions through the adoption and use of solutions provided by third parties, and jointly using real-world and online scenarios to meet the core needs of physicians.

From 2019 to 2024, China's medical academic, education and research solutions market increased from RMB 66.8 billion to RMB 97.6 billion, with a compound annual growth rate of 7.9% during the period. By 2030, the market size is expected to increase to RMB 179.5 billion, with a compound annual growth rate of 10.7% from 2024 to 2030.

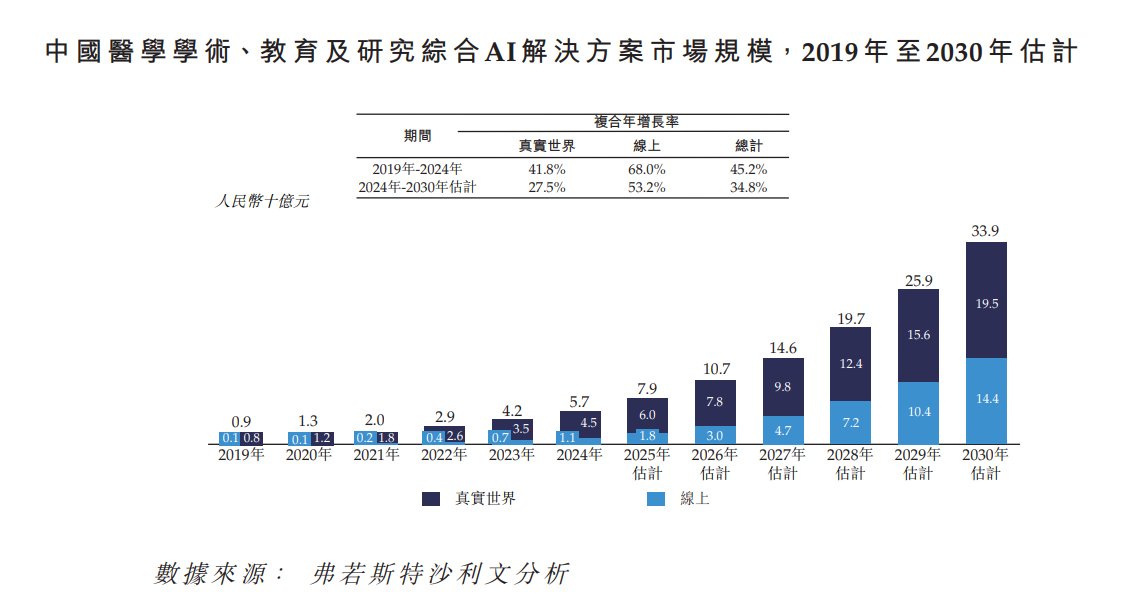

From 2019 to 2024, China's comprehensive AI solutions market for medical academics, education and research increased from RMB 900 million to RMB 5.7 billion, with a CAGR of 45.2% during the period. By 2030, the market size of integrated AI solutions for medical academics, education and research in China is expected to increase to RMB 33.9 billion, with a CAGR of 34.8% from 2024 to 2030.

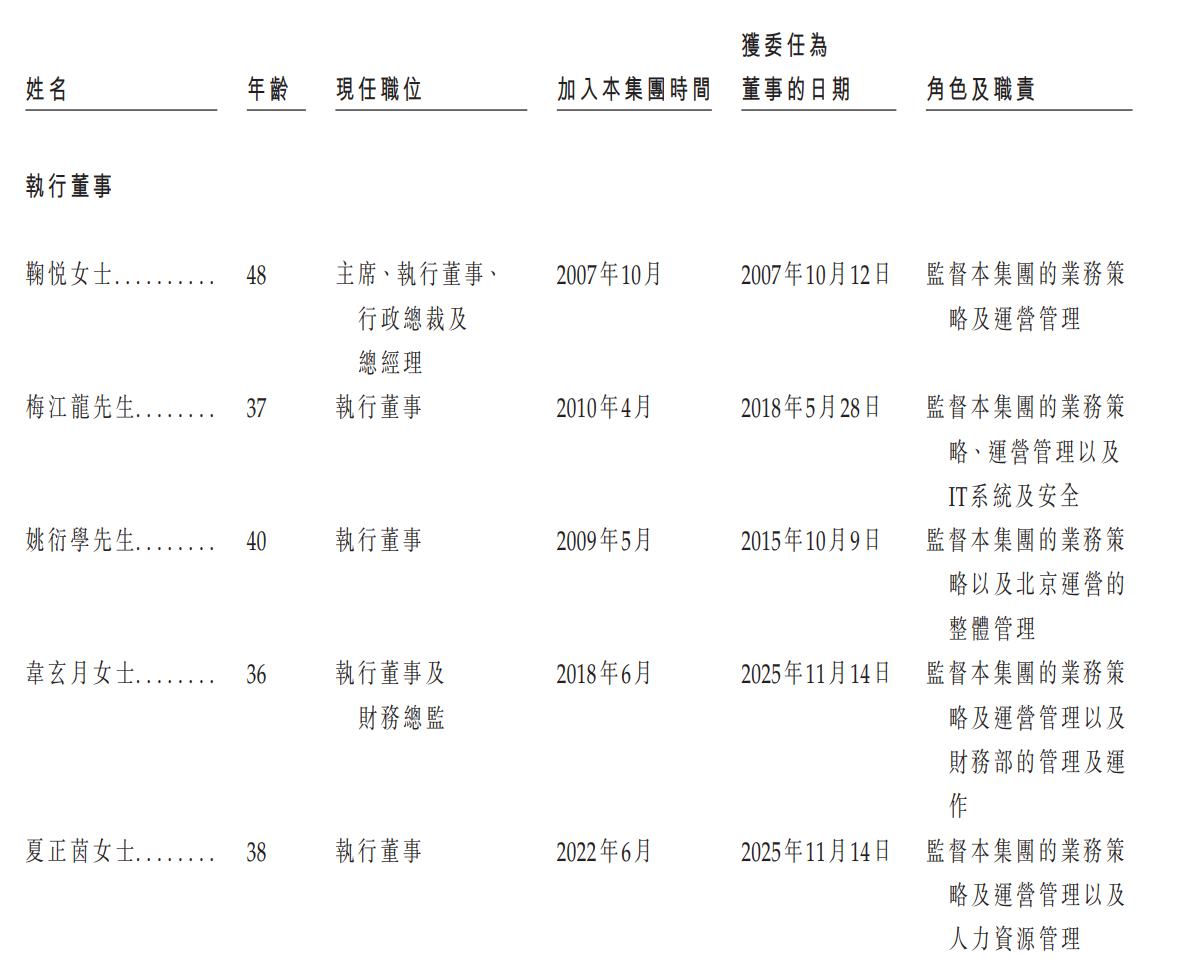

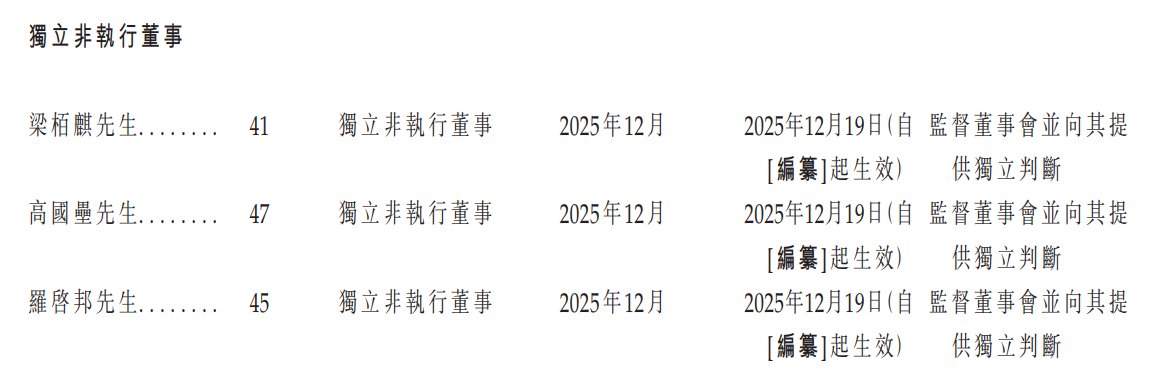

Board Information

The company's board of directors consists of eight directors, including five executive directors and three independent non-executive directors. The term of the company's directors is three years, and they can be re-elected upon re-election. The board of directors is responsible for the management and operation of the company's business and has relevant general powers.

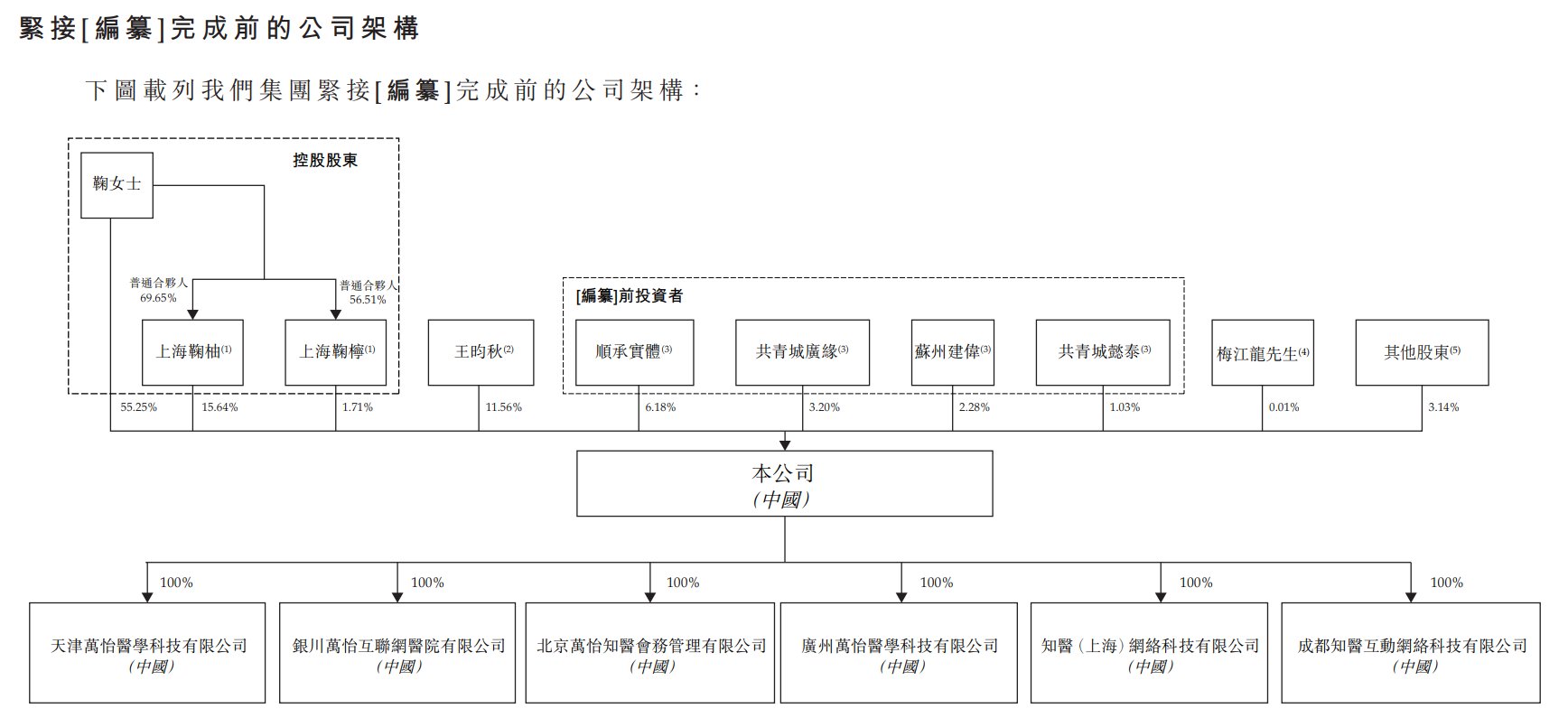

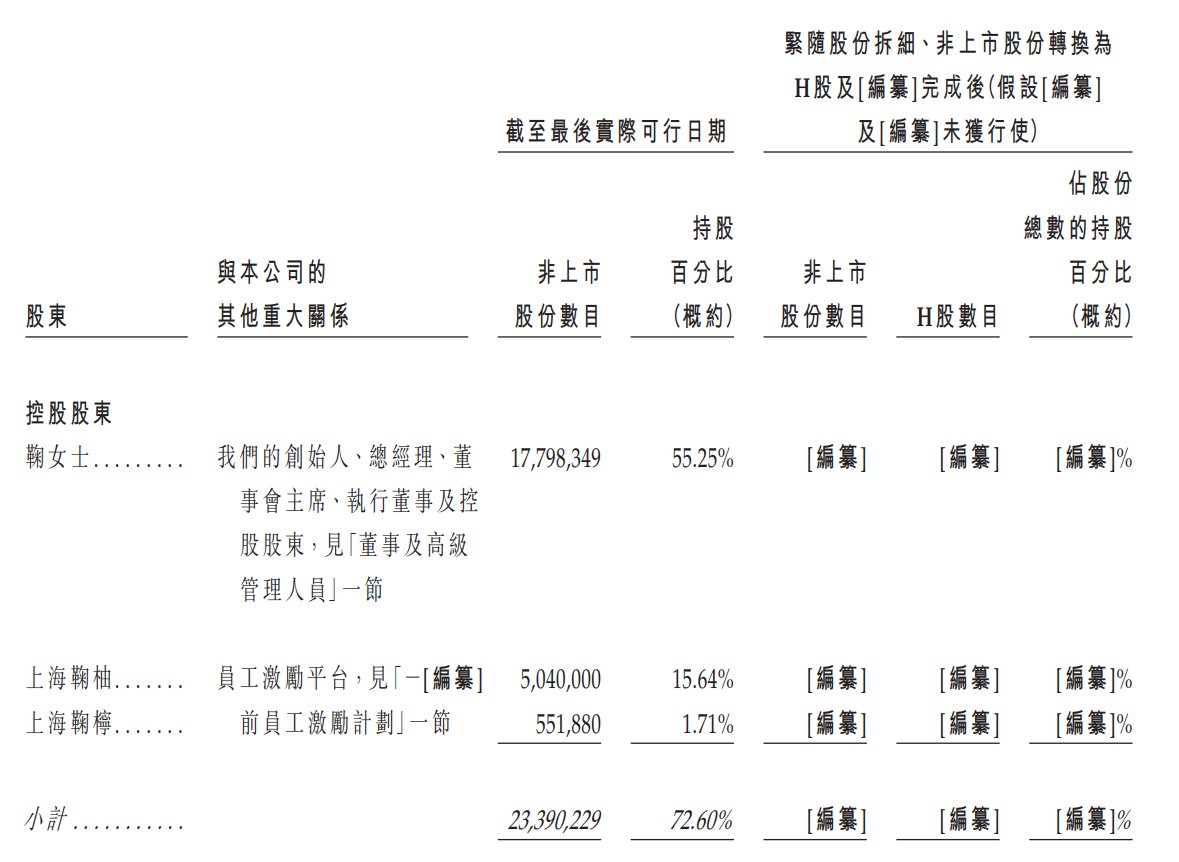

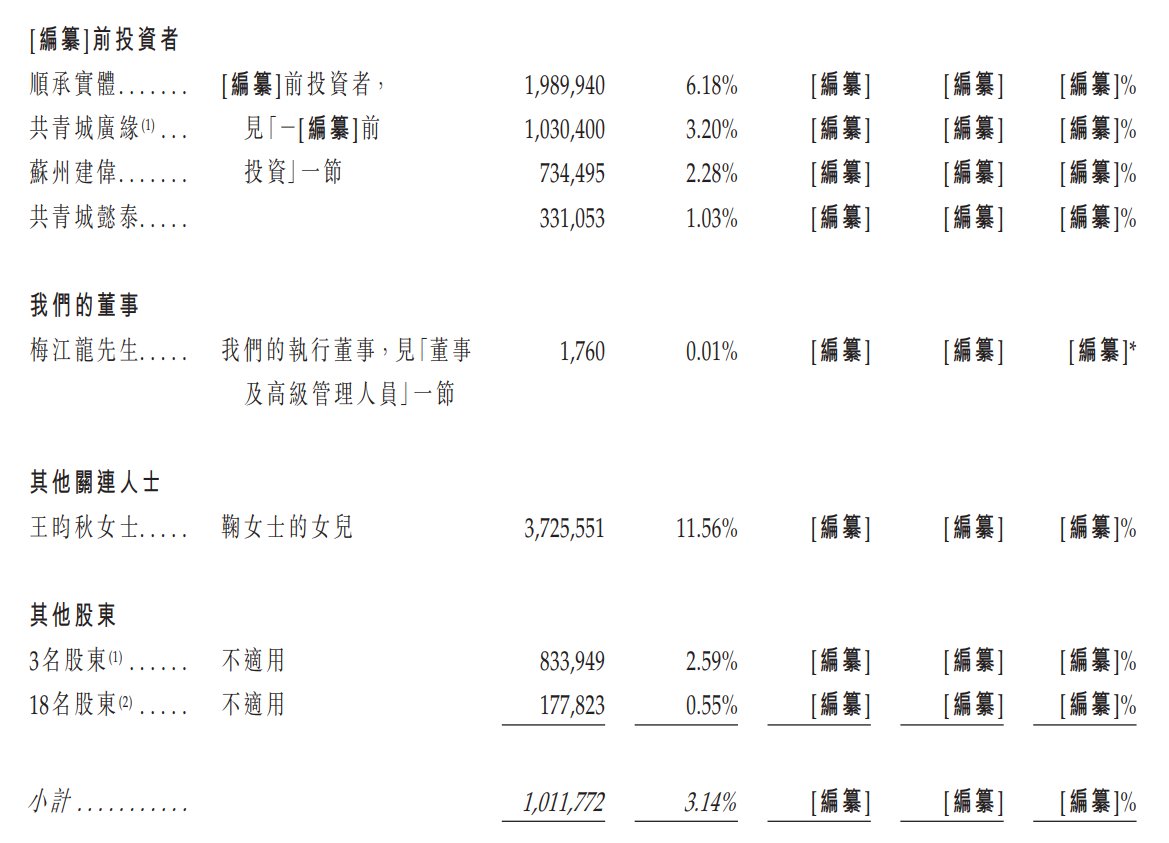

Shareholding structure

With her direct interests in the company and her power to vote on shares held by Shanghai Juyou Management Consulting Partnership (Limited Partnership) and Shanghai Ju Ning Management Consulting Partnership (Limited Partnership), which controls the company's employee incentive platforms, Ms. Ju has been a general partner of these platforms since the establishment of these platforms, and holds 69.65% and 56.51% of their partnership interests, respectively. As a result, Ms. Ju, Shanghai Juyou, and Shanghai Ju Ning jointly formed a group of controlling shareholders.

Intermediary team

Sole sponsor: China Everbright Finance Co., Ltd.

Company legal advisors: Hong Kong and US law: Weikai Law Firm; related to Chinese law: Tianyuan Law Firm.

Sole Sponsor Legal Adviser: Relevant Hong Kong Law: Jingtian Gongcheng Law Firm Limited Liability Partnership; Related Chinese Law: Jingtian Gongcheng Law Firm.

Auditor and reporting accountant: Ernst & Young.

Industry consultant: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch.

Compliance Advisor: China Everbright Finance Co., Ltd.

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal