ASX Penny Stocks To Watch In January 2026

As the Australian market edges towards the end of 2025, it is experiencing a slight dip, likely due to profit-taking ahead of the holiday season, while Wall Street approaches new highs. In this context, penny stocks remain an intriguing area for investors seeking opportunities beyond established names. Although considered a somewhat outdated term, these smaller or newer companies can still offer potential value when supported by solid financials and growth prospects.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.395 | A$113.2M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.41 | A$66.51M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.77 | A$47.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$462.61M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.10 | A$228.98M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.073 | A$39.45M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.00 | A$3.43B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.24 | A$1.37B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.805 | A$115.87M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.24 | A$124.42M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 415 stocks from our ASX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Hyterra (ASX:HYT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hyterra Ltd is engaged in the exploration, development, and production of natural hydrogen in the United States, with a market capitalization of A$36.69 million.

Operations: Hyterra Ltd has not reported any specific revenue segments.

Market Cap: A$36.69M

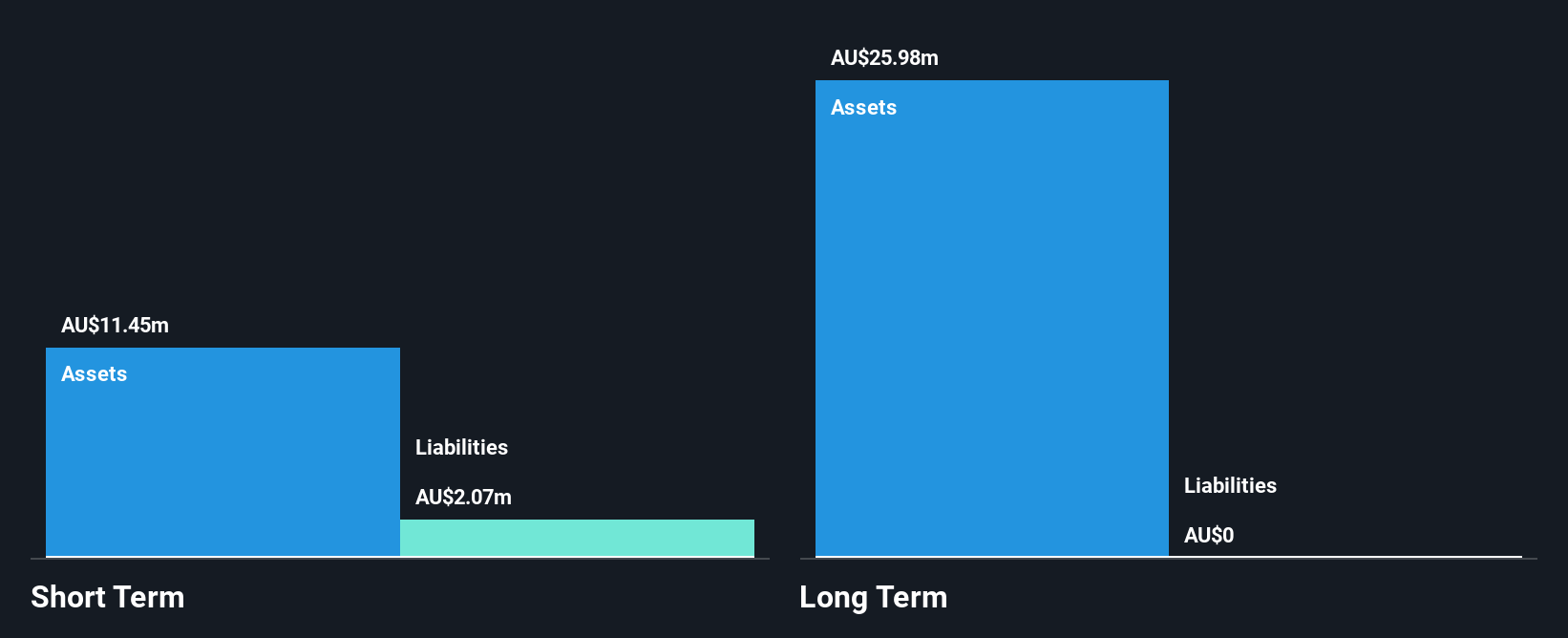

Hyterra Ltd, with a market cap of A$36.69 million, operates in the natural hydrogen sector and is currently pre-revenue. The recent appointment of Riley Kemp as CEO, who brings extensive experience from Fortescue and global energy markets, marks a strategic shift for Hyterra towards commercialisation and growth. Despite having no long-term liabilities and being debt-free, the company faces financial constraints with less than a year's cash runway based on current free cash flow trends. While its management team is considered experienced, Hyterra's board lacks tenure depth. The company's short-term assets comfortably cover its short-term liabilities.

- Click here to discover the nuances of Hyterra with our detailed analytical financial health report.

- Assess Hyterra's previous results with our detailed historical performance reports.

Jupiter Mines (ASX:JMS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jupiter Mines Limited is an independent mining company based in Australia, with a market cap of A$540.32 million.

Operations: The company's revenue is derived from its manganese operations in South Africa, amounting to A$9.43 million.

Market Cap: A$540.32M

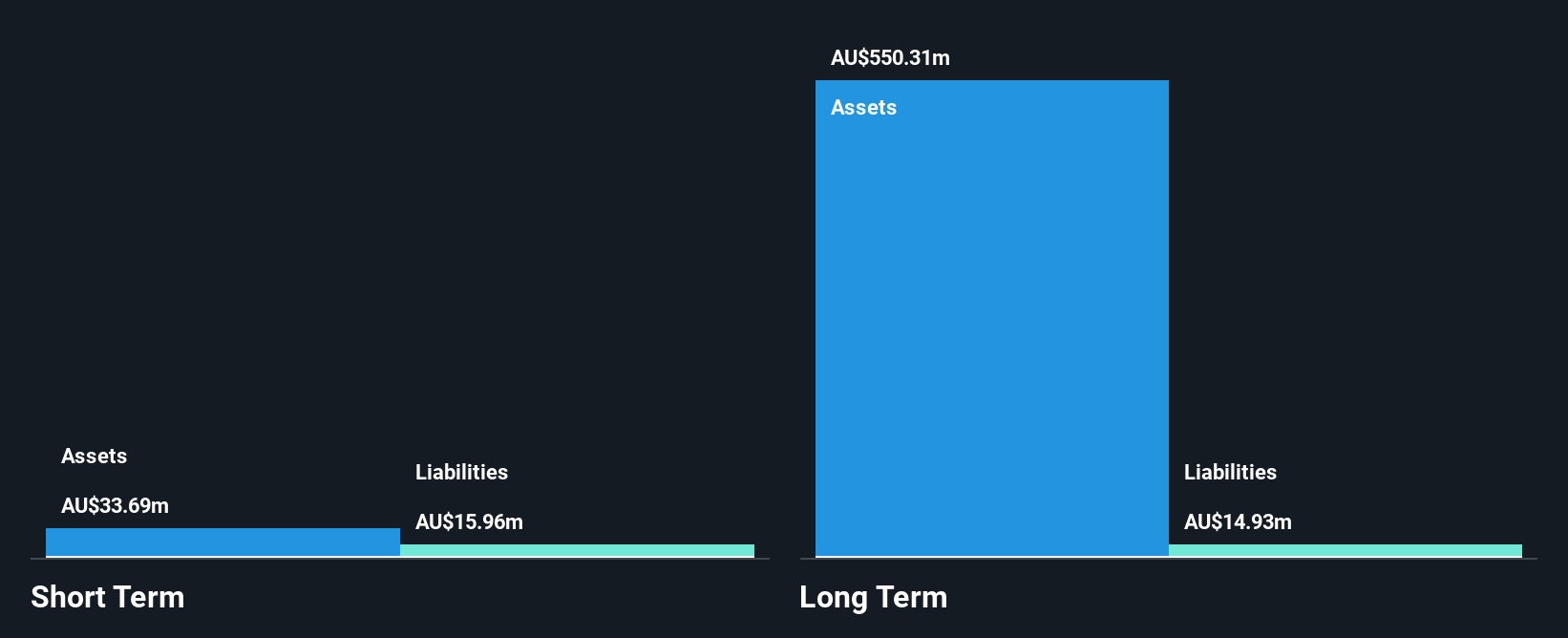

Jupiter Mines Limited, with a market cap of A$540.32 million, derives its revenue from manganese operations in South Africa, generating A$9.43 million. The company is debt-free and maintains stable weekly volatility at 5%. Despite a low Return on Equity of 7.1%, Jupiter's earnings growth over the past year (2.8%) has improved compared to its negative five-year average but still lags behind the industry standard of 10.1%. Its Price-To-Earnings ratio of 13.5x suggests it is valued below the Australian market average, though dividend sustainability remains a concern due to inadequate free cash flow coverage.

- Dive into the specifics of Jupiter Mines here with our thorough balance sheet health report.

- Examine Jupiter Mines' past performance report to understand how it has performed in prior years.

Lunnon Metals (ASX:LM8)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lunnon Metals Limited is engaged in the exploration and development of nickel and gold in Australia, with a market cap of A$74.82 million.

Operations: Lunnon Metals Limited currently does not report any revenue segments.

Market Cap: A$74.82M

Lunnon Metals Limited, with a market cap of A$74.82 million, is pre-revenue and focused on nickel and gold exploration. The company benefits from an experienced management team with an average tenure of seven years and has not faced significant shareholder dilution recently. Lunnon Metals is debt-free, with short-term assets exceeding both short-term and long-term liabilities, providing financial stability despite its unprofitability. While earnings are forecast to grow 31.37% annually, volatility remains stable at 9%. Recent activities include presenting at the Noosa Mining Investor Conference and discussing an Ore Purchase Agreement related to its gold portfolio.

- Take a closer look at Lunnon Metals' potential here in our financial health report.

- Explore Lunnon Metals' analyst forecasts in our growth report.

Seize The Opportunity

- Investigate our full lineup of 415 ASX Penny Stocks right here.

- Looking For Alternative Opportunities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal