AI spending, corporate profits, dovish Federal Reserve! The three “four consecutive” pillars of US stocks are indispensable

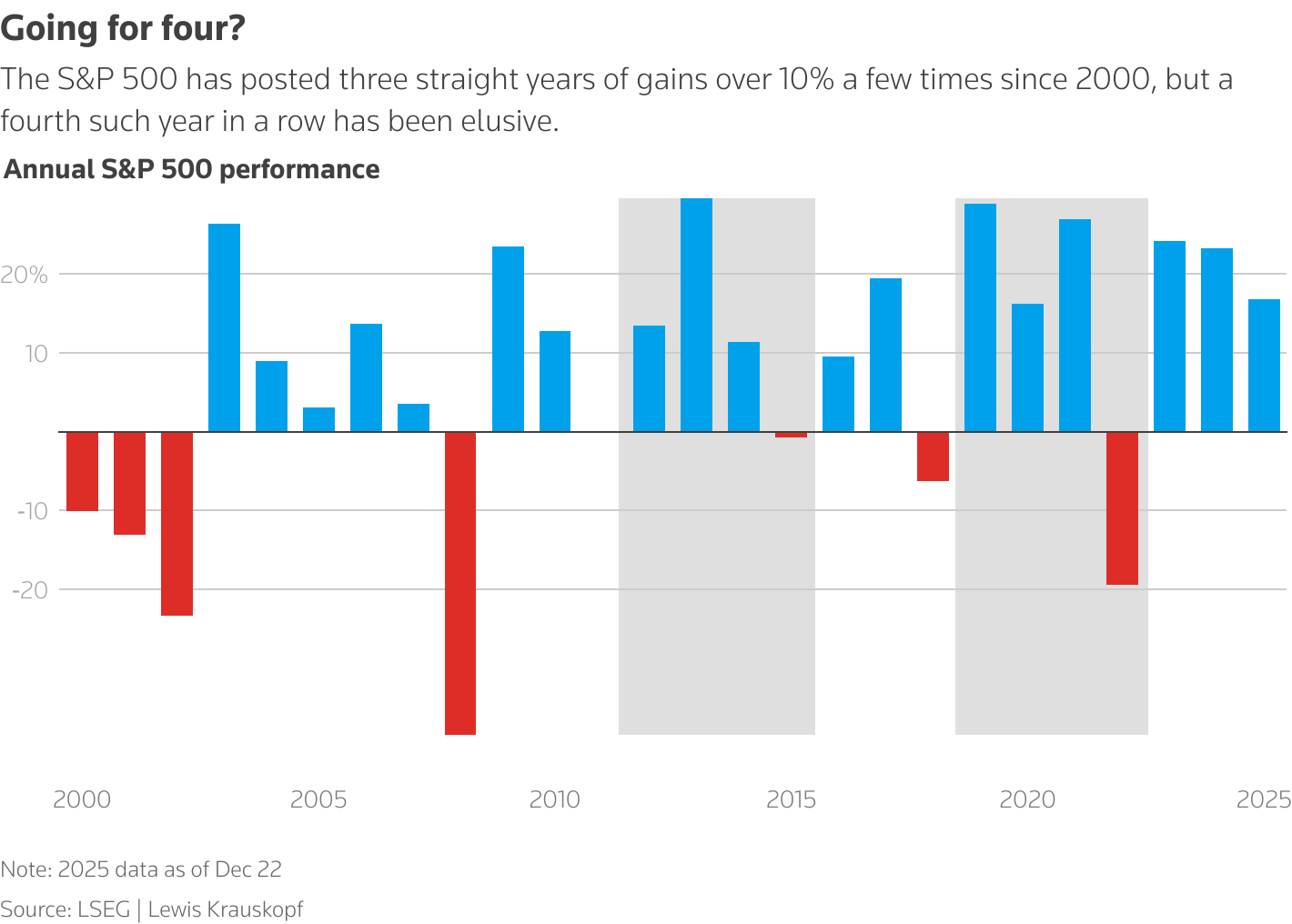

The Zhitong Finance App learned that the US stock market ended 2025 with a third consecutive year of double-digit percentage growth. This round of the US stock bull market, which began in October 2022, has been driven by optimism about AI, falling interest rates, and continued economic growth amid concerns about the recession. The S&P 500 index rose more than 16% in 2025, after rising 23% in 2024 and 24% in 2023. However, achieving outstanding performance for the fourth year in a row in 2026 may be a difficult task, requiring strong corporate profits, the US Federal Reserve, and continued strong artificial intelligence (AI) related spending.

Many market strategists expect US stocks to continue to perform strongly in 2026. Some strategists say that the target point for the S&P 500 index means an increase of more than 10%, including the 8,000 point target given by Deutsche Bank — which means the index will rise by about 17%.

Sam Stovall, chief investment strategist at CFRA, said the market needs to “run at full speed on all sides” to get another year of strong double-digit percentage returns. Sam Stovall's target price for the end of 2026 is 7,400 points, which means an 8% increase from current levels. He said, “The many headwinds made me think that although we may have an unexpectedly good year in the end, I don't think it will be another brilliant year.”

Can corporate profits and AI continue to provide support?

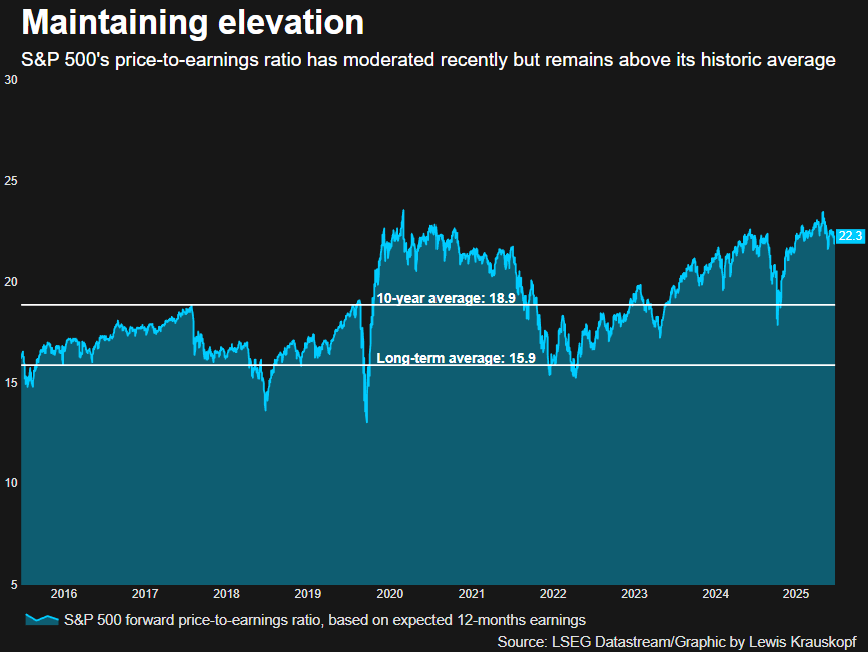

In the current context where US stock valuations have climbed to historic highs and further upward space is limited, profit growth will become another core factor determining market performance. Stock market bulls pointed out that the profit prospects for US companies are optimistic. Tajinder Dhillon, head of earnings research at the London Stock Exchange Group (LSEG), said that the profits of S&P 500 companies are expected to increase by more than 15% in 2026, based on a 13% increase in 2025.

At the same time, the driving force for profit growth will no longer be limited to a few giants in technology and technology-related fields, but will be driven by a wider range of companies. This is because fiscal stimulus policies and loose monetary policies provide strong support for the economy and consumer spending. Tajinder Dhillon pointed out that in 2024, the profit growth rate of the “Big Seven US stocks” reached 37%, while the profit growth rate of the rest of the companies in the S&P 500 index was only 7%. By 2026, this gap is expected to close substantially — the profits of the top seven companies by market capitalization are expected to increase by 23%, while the remaining companies in the index are expected to grow by 13%.

Kristina Hooper, chief market strategist at Inshman Group, also said, “If earnings growth on the other 493 stocks in the S&P 500 index improves — we are already seeing some signs — this will definitely help the stock market achieve double-digit returns next year.”

Another major support for US stock valuations comes from enthusiasm for AI, including large-scale investment in infrastructure and strong demand for its applications. Although questions about the return on AI capital expenditure have previously hit tech stocks and other AI-related stocks, this topic is likely to remain critical in 2026.

Jeff Buchbinder, chief stock strategist at LPL Financial, said, “If companies start cutting capital expenses that have been previously guided, and the market loses confidence in the returns that AI investments can bring... then the market is likely to just move sideways or even decline slightly.”

The dovish Federal Reserve, mixed historical signals and uncertainties

Investors said that another key factor for the stock market to usher in a strong year is that the economy needs to slow down moderately to push back inflation and pave the way for further interest rate cuts, but not weaken to the point of falling into recession. Federal funds rate futures show that after cutting interest rates by a cumulative total of 175 basis points in 2024 and 2025, investors expect the Federal Reserve to cut interest rates at least twice by 25 basis points each time in 2026. Yung-yu Ma, chief investment strategist at PNC Financial Services Group, said, “I think the most important driver is probably whether the Federal Reserve can maintain a dovish stance.”

Investors are watching US President Trump's presidential nomination, which is expected to be announced in early 2026. They hope this is a sign that the central bank will be more dovish, but they are also worried that its independence may be tested.

Historical data gave mixed signals about potential returns in 2026. On the one hand, LPL Research data shows that since 1950, it has successfully entered the fourth year of the seven-round bull market, with an average increase of 12.8% in the fourth year, six of which have achieved positive annual returns. But on the other hand, America often underperforms in midterm election years. Due to the political uncertainty brought about by the new congressional elections, the average increase of the S&P 500 index in the midterm election year was only 3.8%.

In addition, there are many potential “black swans.” For example, after causing extreme fluctuations in early 2025, the importance of the tariff issue declined, but Yung-Yu Ma pointed out that as the world's two largest economies, the US-China relationship may still influence stock market trends in 2026. He said, “In fact, there is a possibility of breakthrough progress between the US and China, which may become a positive catalyst that has not been fully taken into account in market expectations.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal