3 Reliable Dividend Stocks Offering Up To 3.5% Yield

As 2025 draws to a close, the U.S. stock market has experienced a robust year despite ending with several sessions of losses, with major indexes like the Nasdaq and S&P 500 posting impressive double-digit gains. In this dynamic environment, investors often seek stability through reliable dividend stocks that offer consistent yields; these can provide a cushion against market volatility while contributing to portfolio income.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.86% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.46% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.81% | ★★★★★★ |

| OceanFirst Financial (OCFC) | 4.46% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.43% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.11% | ★★★★★★ |

| Ennis (EBF) | 5.55% | ★★★★★★ |

| Dillard's (DDS) | 5.15% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.15% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.55% | ★★★★★★ |

Click here to see the full list of 121 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

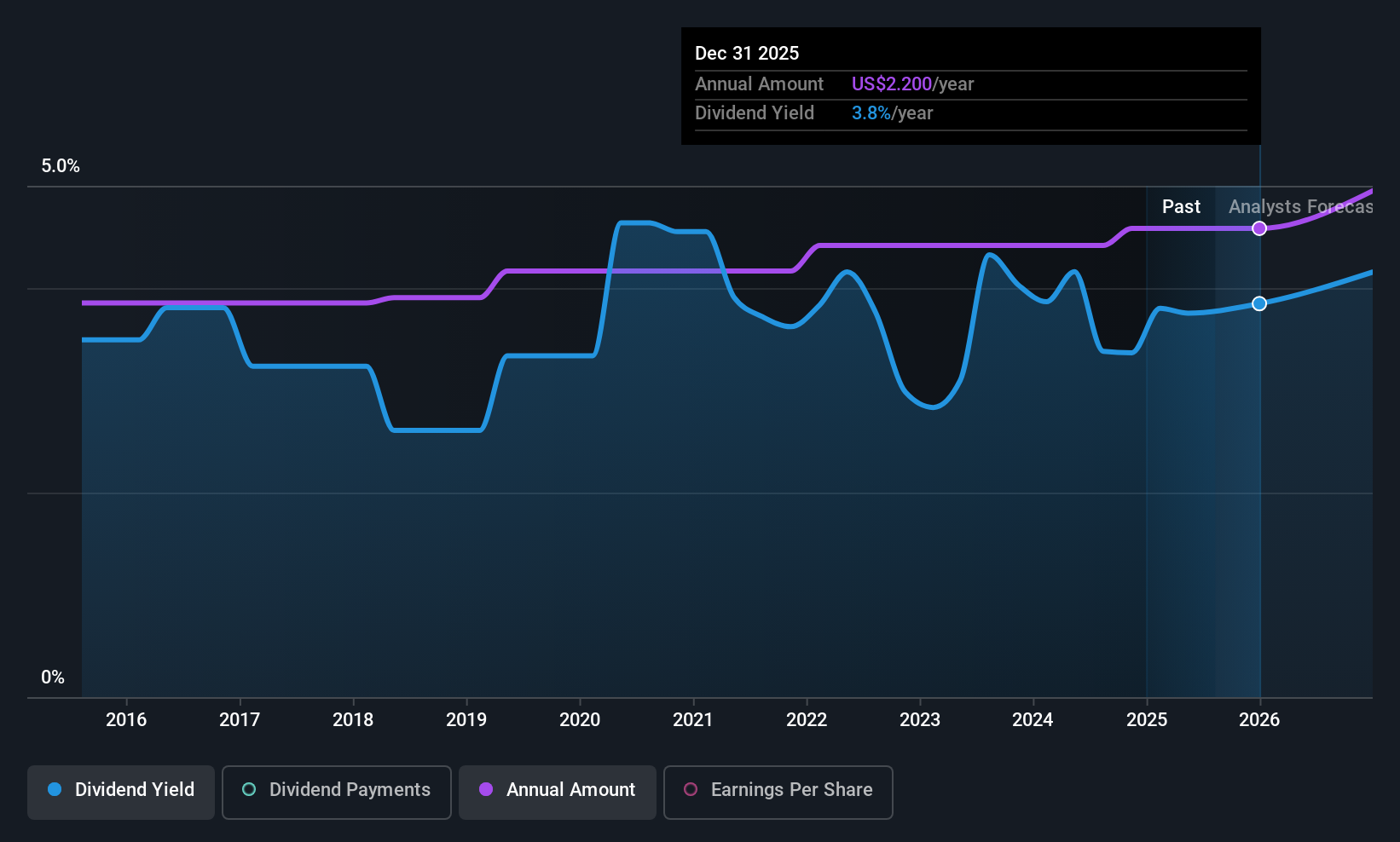

Burke & Herbert Financial Services (BHRB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burke & Herbert Financial Services Corp. is the bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland, with a market cap of $938.53 million.

Operations: Burke & Herbert Financial Services Corp. generates revenue primarily from its Community Banking segment, which accounts for $331.64 million.

Dividend Yield: 3.5%

Burke & Herbert Financial Services provides a stable dividend of 3.53%, with dividends well-covered by earnings at a 31.4% payout ratio, forecasted to improve to 28%. The stock trades at good value relative to peers and below its estimated fair value, though it has a low allowance for bad loans at 76%. Recent developments include a merger agreement with LINKBANCORP valued at approximately US$354.2 million, potentially enhancing future growth and stability.

- Get an in-depth perspective on Burke & Herbert Financial Services' performance by reading our dividend report here.

- Our valuation report here indicates Burke & Herbert Financial Services may be undervalued.

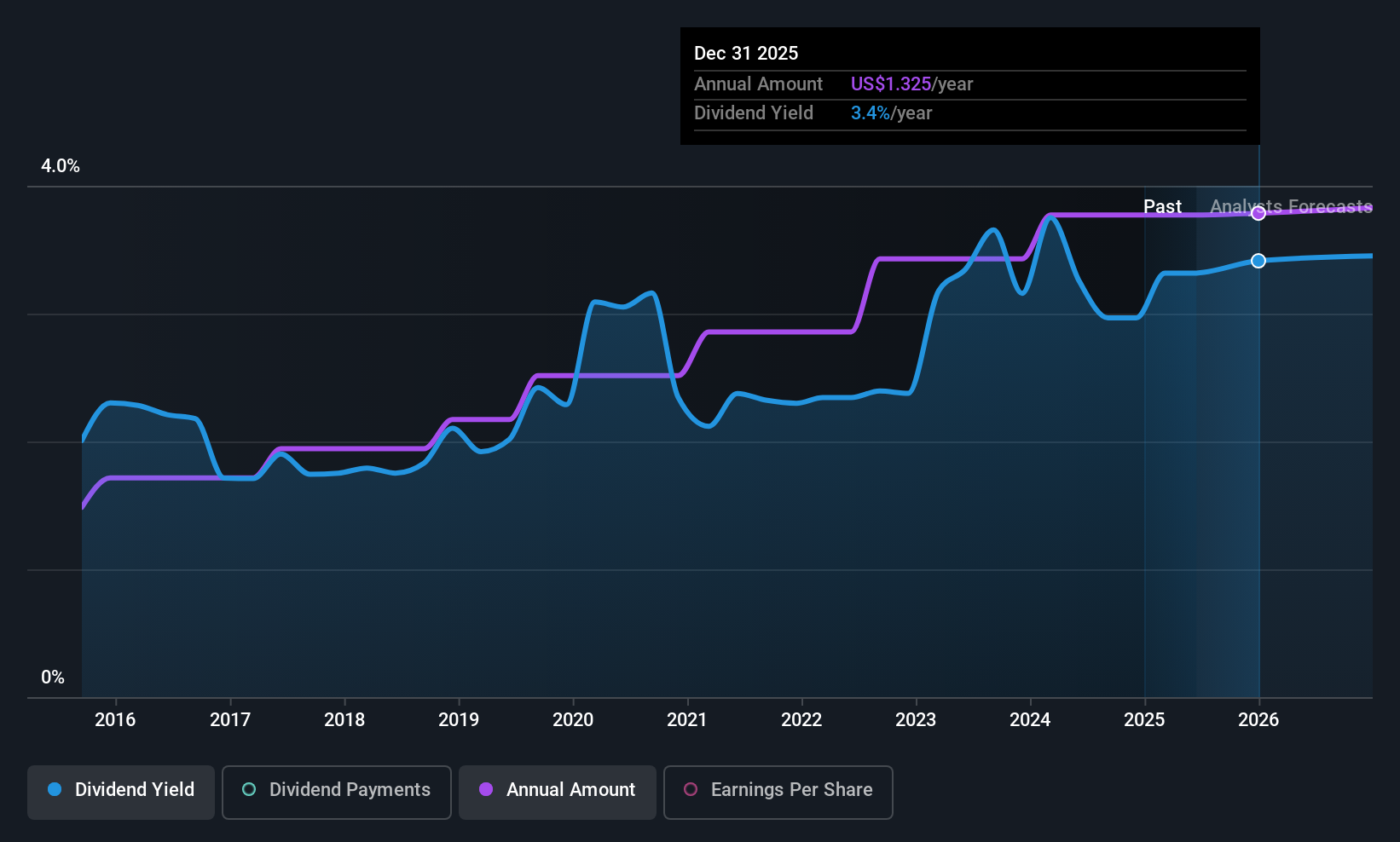

TriCo Bancshares (TCBK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: TriCo Bancshares is a bank holding company for Tri Counties Bank, offering commercial banking services to individual and corporate clients, with a market cap of approximately $1.53 billion.

Operations: TriCo Bancshares generates revenue primarily through its Community Banking segment, which accounted for $399.27 million.

Dividend Yield: 3%

TriCo Bancshares offers a reliable dividend yield of 3.04%, supported by a payout ratio of 37.9%, ensuring dividends are well-covered by earnings and forecasted to remain sustainable with a future payout ratio of 35.2%. The company has consistently increased its dividend over the past decade, reflecting stability despite recent executive changes and charge-offs rising to US$737,000 in Q3 2025. Trading below estimated fair value, TriCo's earnings have shown steady growth, enhancing its appeal for income-focused investors.

- Navigate through the intricacies of TriCo Bancshares with our comprehensive dividend report here.

- Our valuation report here indicates TriCo Bancshares may be overvalued.

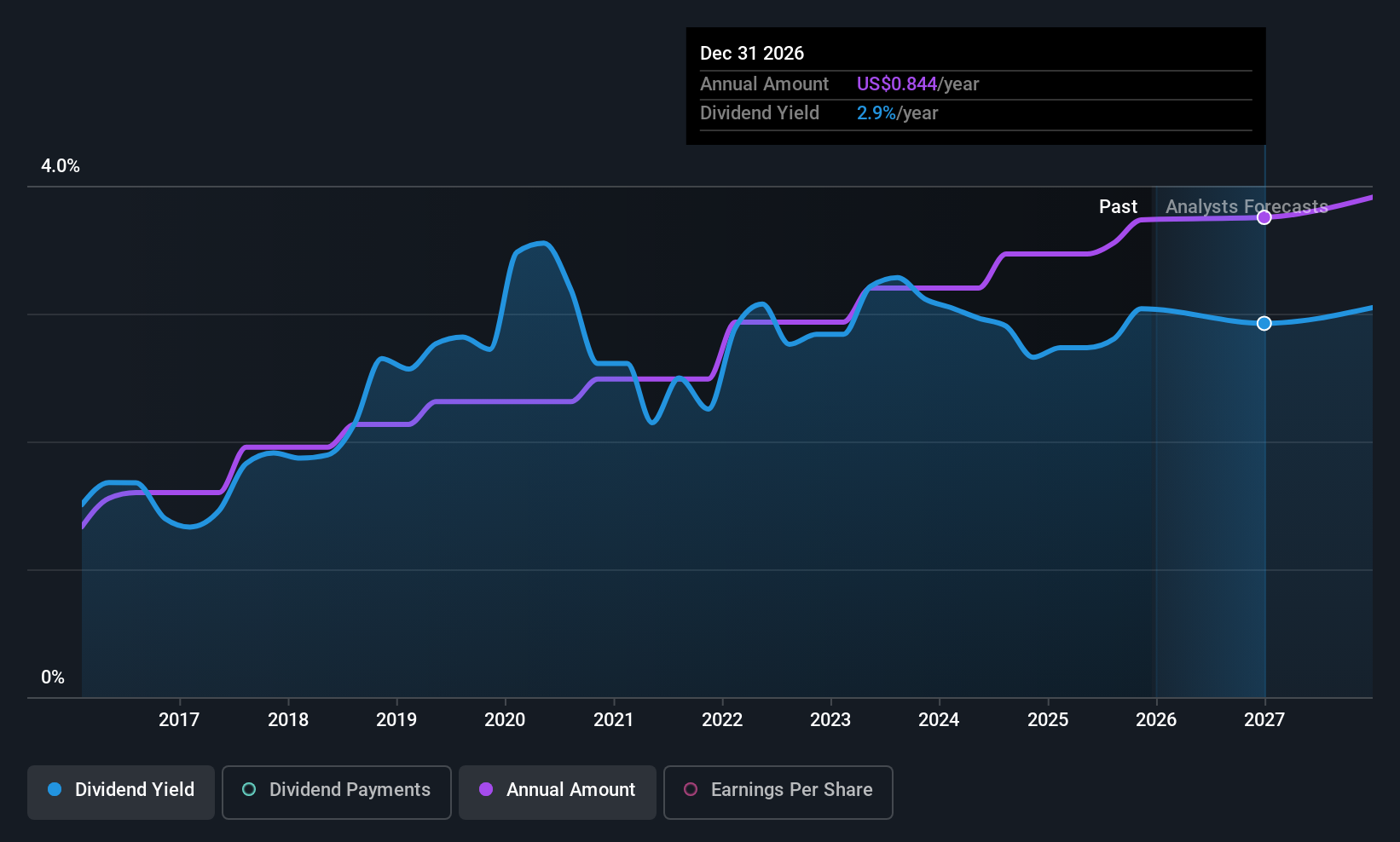

Home Bancshares (Conway AR) (HOMB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Home Bancshares, Inc. (Conway, AR) is a bank holding company for Centennial Bank, offering commercial and retail banking services across the United States with a market cap of approximately $5.47 billion.

Operations: Home Bancshares, Inc. generates revenue primarily through its banking services segment, which accounts for $1.04 billion.

Dividend Yield: 3%

Home Bancshares offers a stable dividend yield of 3.02%, backed by a low payout ratio of 34.2%, ensuring dividends are well-covered and forecasted to remain sustainable with the same future payout ratio. The company has consistently increased its dividend over the past decade, demonstrating reliability despite recent charge-offs of US$2.92 million in Q3 2025. Trading below estimated fair value, Home Bancshares' earnings have grown steadily, supported by strategic acquisitions like Mountain Commerce Bancorp's merger agreement.

- Delve into the full analysis dividend report here for a deeper understanding of Home Bancshares (Conway AR).

- According our valuation report, there's an indication that Home Bancshares (Conway AR)'s share price might be on the cheaper side.

Turning Ideas Into Actions

- Explore the 121 names from our Top US Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal