European Value Stocks Priced Below Intrinsic Estimates January 2026

As the pan-European STOXX Europe 600 Index edges closer to record highs amid optimism about future earnings and economic recovery, investors are increasingly focused on identifying stocks that may be undervalued relative to their intrinsic worth. In this context, a good stock is often characterized by strong fundamentals and potential for growth, making it an attractive option for those seeking value in a market marked by cautious optimism.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN130.00 | PLN257.58 | 49.5% |

| Streamwide (ENXTPA:ALSTW) | €72.80 | €142.60 | 48.9% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.90 | NOK66.31 | 48.9% |

| Kreate Group Oyj (HLSE:KREATE) | €12.55 | €24.87 | 49.5% |

| KB Components (OM:KBC) | SEK41.90 | SEK83.17 | 49.6% |

| Gesco (XTRA:GSC1) | €14.25 | €27.96 | 49% |

| Fodelia Oyj (HLSE:FODELIA) | €5.40 | €10.72 | 49.6% |

| Exail Technologies (ENXTPA:EXA) | €81.50 | €159.03 | 48.8% |

| Dynavox Group (OM:DYVOX) | SEK102.00 | SEK203.01 | 49.8% |

| Allcore (BIT:CORE) | €1.35 | €2.66 | 49.3% |

Here we highlight a subset of our preferred stocks from the screener.

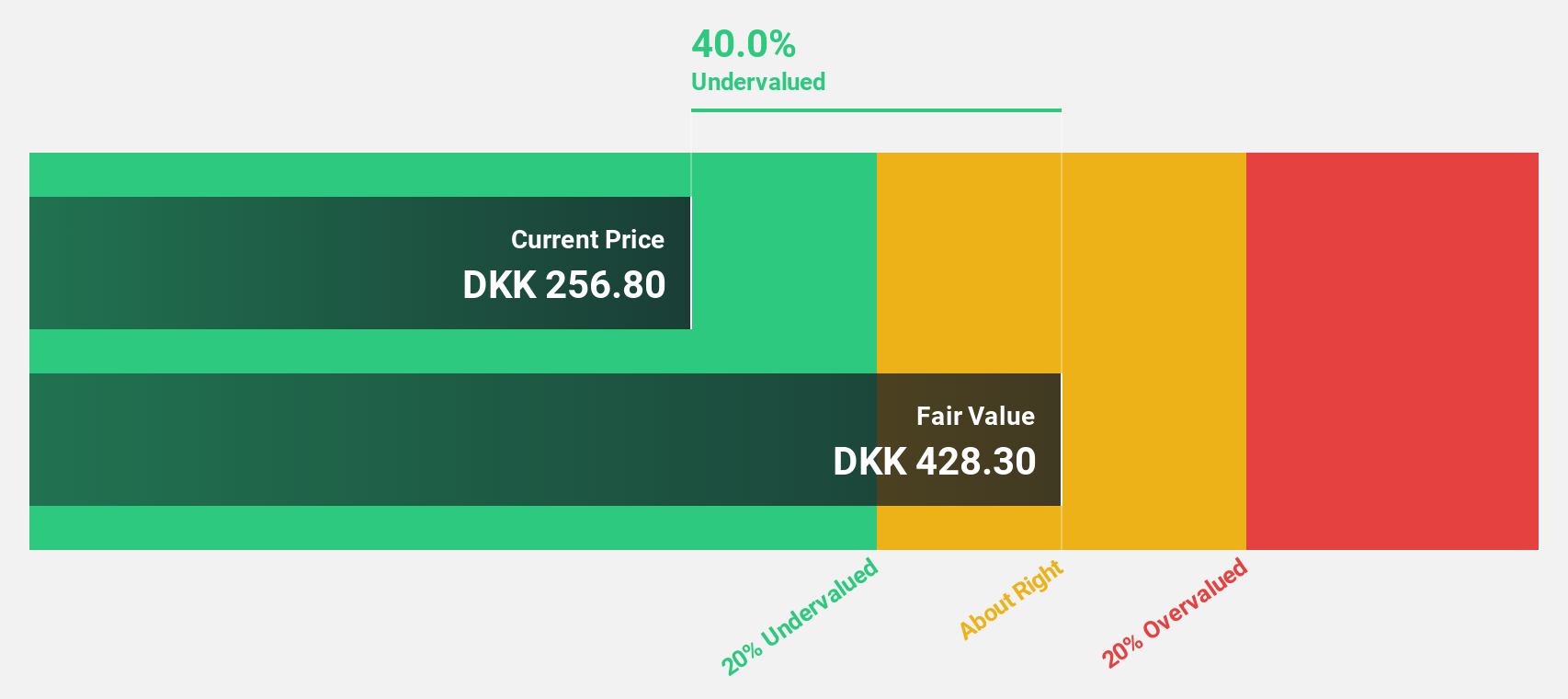

Demant (CPSE:DEMANT)

Overview: Demant A/S is a hearing healthcare company with operations in Europe, North America, Asia, the Pacific region, and internationally, and it has a market cap of DKK45.84 billion.

Operations: The company generates revenue of DKK22.59 billion from its Hearing Healthcare segment across various regions including Europe, North America, Asia, and the Pacific.

Estimated Discount To Fair Value: 27.7%

Demant is trading at DKK215.2, significantly below its estimated fair value of DKK297.52, indicating it is undervalued based on cash flows. Despite a high debt level, Demant's earnings are projected to grow at 10.6% annually, outpacing the Danish market's 6.1%. Recent guidance suggests earnings will be on the lower end of expectations with EBIT between DKK3.9-4.3 billion for 2025. Leadership changes are forthcoming as Niels B. Christiansen steps down in March 2026.

- The analysis detailed in our Demant growth report hints at robust future financial performance.

- Navigate through the intricacies of Demant with our comprehensive financial health report here.

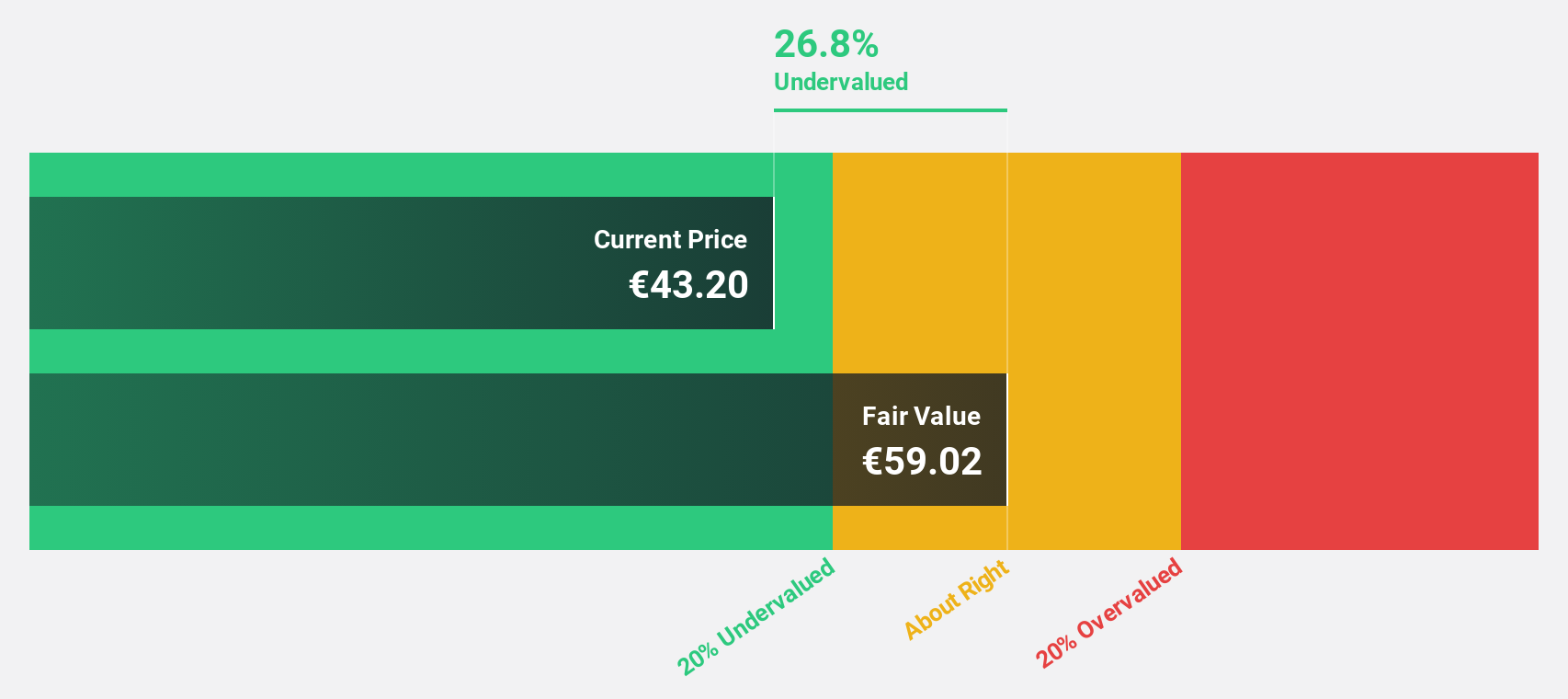

Assystem (ENXTPA:ASY)

Overview: Assystem S.A. offers engineering and infrastructure project management services in France, the United Kingdom, and internationally, with a market cap of €634.17 million.

Operations: The company's revenue is derived from €388.20 million in France and €254.10 million internationally, with a segment adjustment of -€5.90 million.

Estimated Discount To Fair Value: 26%

Assystem is trading at €42.7, below its estimated fair value of €57.68, reflecting an undervaluation based on cash flows. Despite a recent decline in profit margins from 14.6% to 1.2%, earnings are forecasted to grow significantly at 53% annually, surpassing the French market's growth rate of 12.3%. Recent partnerships with Orano for nuclear engineering projects could bolster future revenue streams, aligning with Assystem's guidance for organic revenue growth around 5% in 2025.

- The growth report we've compiled suggests that Assystem's future prospects could be on the up.

- Dive into the specifics of Assystem here with our thorough financial health report.

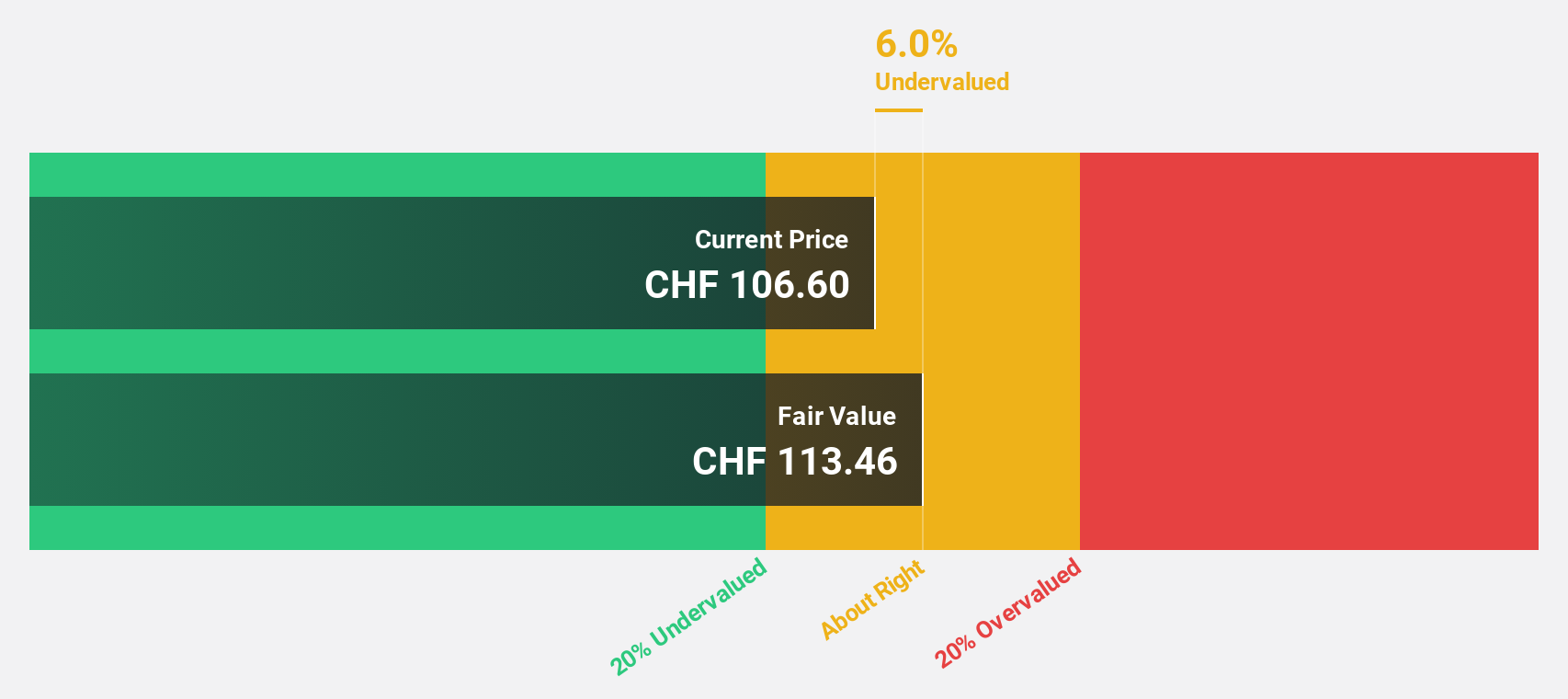

INFICON Holding (SWX:IFCN)

Overview: INFICON Holding AG develops instruments for gas analysis, measurement, and control in Switzerland and internationally with a market cap of CHF2.41 billion.

Operations: The company's revenue segments include sales from instruments for gas analysis, measurement, and control across various international markets.

Estimated Discount To Fair Value: 12.2%

INFICON Holding, trading at CHF98.8, is undervalued compared to its estimated fair value of CHF112.55 based on cash flows. The company's revenue and earnings are projected to grow faster than the Swiss market, at 7.9% and 12.7% per year respectively. Despite narrowing its 2025 earnings guidance due to trade disputes and forex risks, INFICON remains optimistic about orders and market outlooks, supported by a strategic CFO transition for sustained financial leadership stability.

- Insights from our recent growth report point to a promising forecast for INFICON Holding's business outlook.

- Click to explore a detailed breakdown of our findings in INFICON Holding's balance sheet health report.

Summing It All Up

- Click through to start exploring the rest of the 190 Undervalued European Stocks Based On Cash Flows now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal