3 European Growth Stocks With High Insider Ownership Growing Revenues At 42%

In a holiday-shortened week, the pan-European STOXX Europe 600 Index edged slightly higher, buoyed by positive sentiment regarding future earnings and economic prospects. Amid this backdrop of cautious optimism in European markets, growth companies with high insider ownership can be particularly appealing for investors seeking alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Guard Therapeutics International (OM:GUARD) | 13.1% | 103.3% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

We'll examine a selection from our screener results.

Kuros Biosciences (SWX:KURN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kuros Biosciences AG focuses on the commercialization and development of biologic technologies for musculoskeletal care across the USA, EU, and internationally, with a market cap of CHF1.08 billion.

Operations: The company's revenue is primarily derived from its Medical Devices segment, which generated CHF103.35 million.

Insider Ownership: 24%

Revenue Growth Forecast: 22.3% p.a.

Kuros Biosciences is poised for significant growth, with its revenue projected to increase by 22.3% annually, outpacing the Swiss market's 3.9% growth rate. The company has raised its sales guidance for 2025, expecting at least a 70% increase in sales this year. Despite a volatile share price and no recent insider trading activity, Kuros trades at 59.5% below its estimated fair value and is expected to become profitable within three years.

- Take a closer look at Kuros Biosciences' potential here in our earnings growth report.

- Our valuation report unveils the possibility Kuros Biosciences' shares may be trading at a premium.

Circus (XTRA:CA1)

Simply Wall St Growth Rating: ★★★★★★

Overview: Circus SE is a technology company that develops and delivers autonomous solutions for the food service market, with a market cap of €290.26 million.

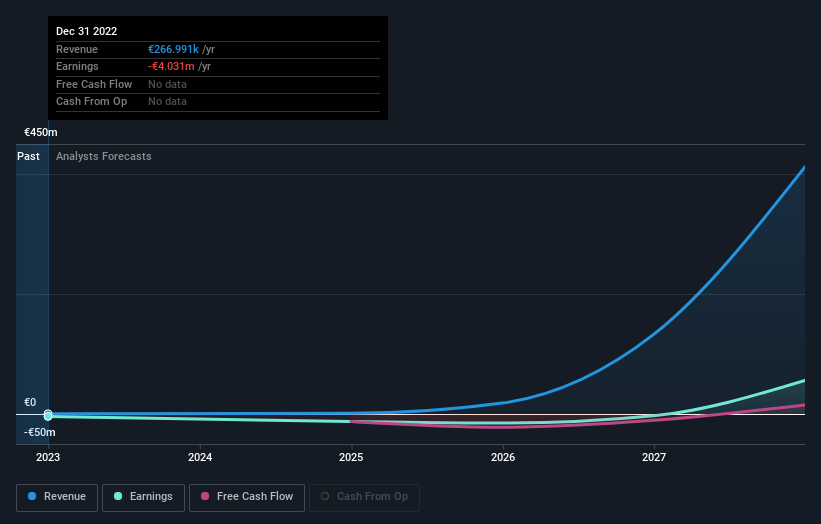

Operations: The company's revenue is primarily derived from its Industrial Automation & Controls segment, totaling €0.98 million.

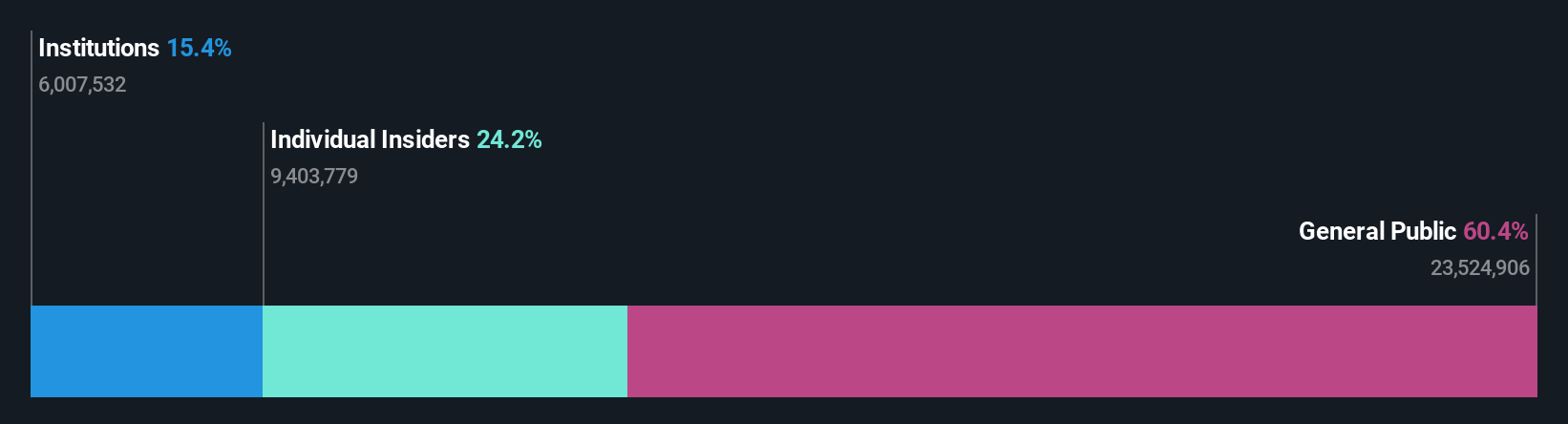

Insider Ownership: 24.1%

Revenue Growth Forecast: 42.4% p.a.

Circus SE is experiencing rapid growth, with revenue projected to rise by 42.4% annually, significantly outpacing the German market's 6.3%. Recent agreements with Ukraine's Armed Forces and Mercedes-Benz highlight its expanding AI robotics applications in defense and commercial sectors. Despite a volatile share price and low current revenue (€979K), Circus trades at 87.9% below its estimated fair value and is expected to become profitable within three years, driven by high insider ownership supporting strategic initiatives.

- Delve into the full analysis future growth report here for a deeper understanding of Circus.

- Upon reviewing our latest valuation report, Circus' share price might be too optimistic.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE is a digital media company that provides ad-software solutions in North America and Europe, with a market cap of €350.60 million.

Operations: The company's revenue segments include Demand Side Platforms (DSP) generating €131.03 million and Supply Side Platforms (SSP) contributing €427.48 million.

Insider Ownership: 24.5%

Revenue Growth Forecast: 13% p.a.

Verve Group SE is poised for substantial growth, with earnings forecasted to expand at 36.5% annually, outpacing the German market. Despite a volatile share price and recent net losses, the company has raised its revenue guidance for 2025 to €560-580 million due to strategic acquisitions and platform unification. Trading at 83.1% below its fair value estimate, Verve's insider ownership supports its growth trajectory amid challenges like lower profit margins and insufficient interest coverage by earnings.

- Get an in-depth perspective on Verve Group's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Verve Group's share price might be on the expensive side.

Key Takeaways

- Take a closer look at our Fast Growing European Companies With High Insider Ownership list of 208 companies by clicking here.

- Contemplating Other Strategies? Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal