3 Global Stocks Estimated To Be Up To 32.7% Undervalued

As global markets navigate a period of robust economic growth in the U.S. and optimism around artificial intelligence, indices like the S&P 500 and Dow Jones Industrial Average have reached record highs. Amid this buoyant environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that align with favorable economic indicators while managing risks associated with fluctuating consumer confidence and durable goods orders.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Visional (TSE:4194) | ¥10010.00 | ¥19887.98 | 49.7% |

| Unimot (WSE:UNT) | PLN130.00 | PLN257.58 | 49.5% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1580.06 | 49.7% |

| Kuraray (TSE:3405) | ¥1587.00 | ¥3163.27 | 49.8% |

| Kreate Group Oyj (HLSE:KREATE) | €12.55 | €24.87 | 49.5% |

| KB Components (OM:KBC) | SEK41.90 | SEK83.17 | 49.6% |

| JINS HOLDINGS (TSE:3046) | ¥5530.00 | ¥11032.70 | 49.9% |

| Fodelia Oyj (HLSE:FODELIA) | €5.40 | €10.72 | 49.6% |

| Dynavox Group (OM:DYVOX) | SEK102.00 | SEK203.01 | 49.8% |

| Aidma Holdings (TSE:7373) | ¥3160.00 | ¥6305.80 | 49.9% |

Let's explore several standout options from the results in the screener.

EBRO EV Motors (BME:EBROM)

Overview: EBRO EV Motors, S.A. is a Spanish company focused on the research, development, manufacturing, and sales of electric vehicles under the EBRO brand with a market cap of €569.28 million.

Operations: EBRO EV Motors generates revenue primarily from vehicle sales (€20.21 million) and engineering services (€28.02 million).

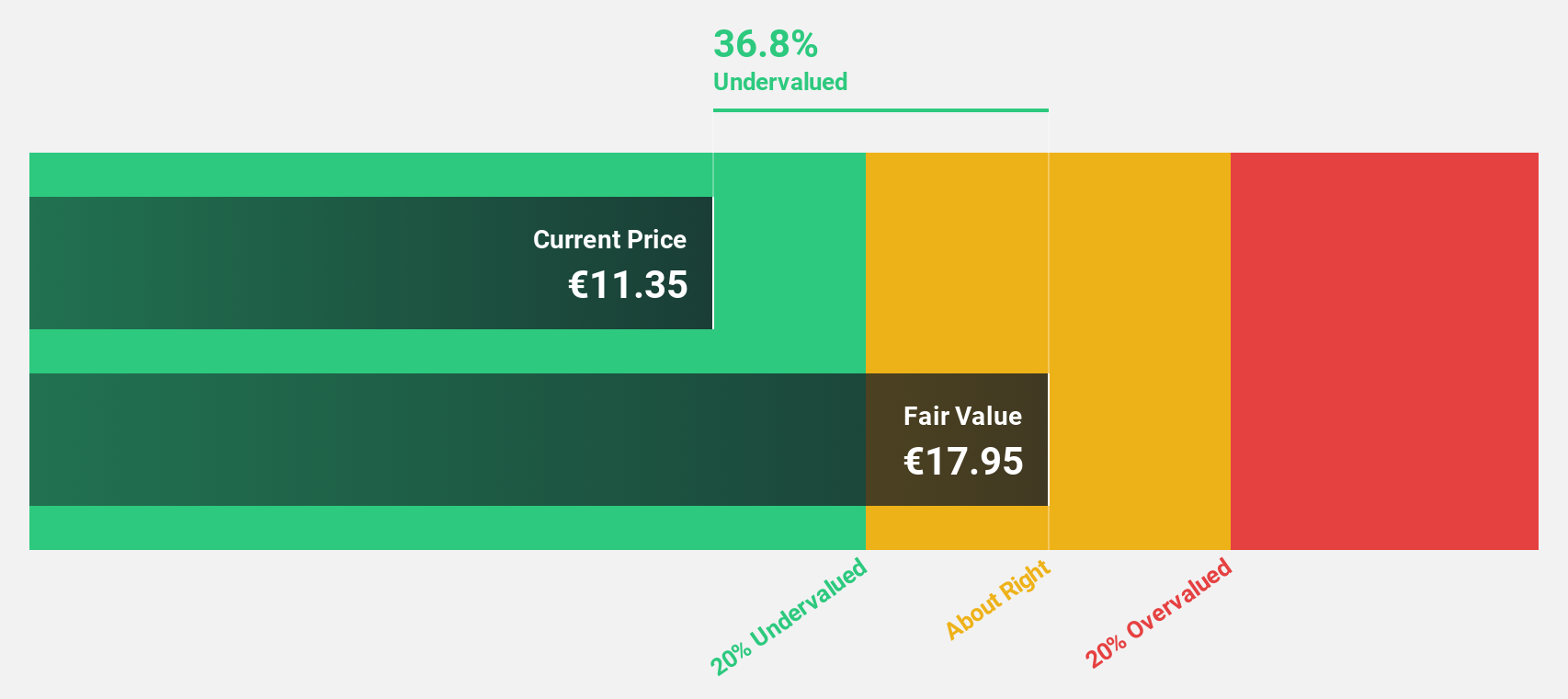

Estimated Discount To Fair Value: 32.7%

EBRO EV Motors is trading at €11.75, significantly below its estimated fair value of €17.46, making it undervalued based on discounted cash flow analysis. The company has shown strong revenue growth of 40% in the past year and is forecast to grow its revenue by 30.6% annually, outpacing the Spanish market's average growth rate. Despite a highly volatile share price recently, EBROM is expected to achieve profitability within three years with a high return on equity forecasted at 29.1%.

- Insights from our recent growth report point to a promising forecast for EBRO EV Motors' business outlook.

- Unlock comprehensive insights into our analysis of EBRO EV Motors stock in this financial health report.

Turkiye Garanti Bankasi (IBSE:GARAN)

Overview: Turkiye Garanti Bankasi A.S. offers a range of banking products and services in Turkey, with a market capitalization of TRY602.70 billion.

Operations: The company's revenue is primarily derived from Retail Banking at TRY208.71 billion and Corporate Banking at TRY188.84 billion, with a negative contribution from Investment Banking of TRY186.27 billion.

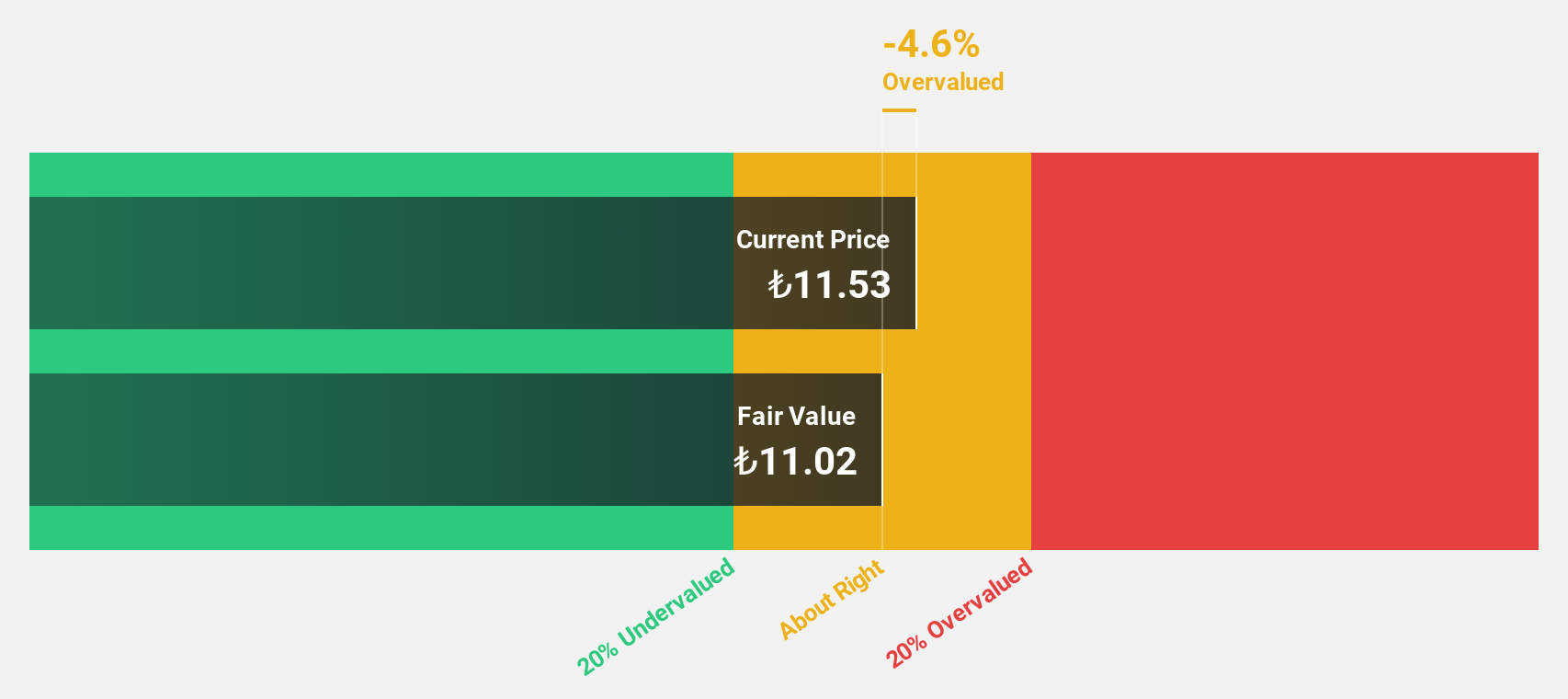

Estimated Discount To Fair Value: 26.3%

Turkiye Garanti Bankasi is trading at TRY 143.5, below its estimated fair value of TRY 194.83, indicating it is undervalued based on discounted cash flow analysis. The bank's earnings have grown significantly, with a forecasted annual growth rate of 21.93%, though slower than the Turkish market average. Recent financing activities include a USD 433.4 million syndicated loan and USD 700 million in subordinated notes issuance, reflecting robust liquidity management amidst high non-performing loans of 2.8%.

- In light of our recent growth report, it seems possible that Turkiye Garanti Bankasi's financial performance will exceed current levels.

- Navigate through the intricacies of Turkiye Garanti Bankasi with our comprehensive financial health report here.

Türkiye Is Bankasi (IBSE:ISCTR)

Overview: Türkiye Is Bankasi A.S. offers a range of banking products and services in Turkey, with a market capitalization of TRY396.89 billion.

Operations: Türkiye Is Bankasi A.S. generates revenue primarily from Corporate/Commercial Banking (TRY168.92 billion), Treasury Transactions and Investment Activities (TRY136.41 billion), and Insurance and Reinsurance Activities (TRY82.67 billion).

Estimated Discount To Fair Value: 10.9%

Türkiye Is Bankasi is trading at TRY 14.09, slightly below its fair value estimate of TRY 15.82, suggesting it may be undervalued based on cash flows. Recent earnings show a substantial increase in net interest income and net income compared to last year, though its non-performing loans ratio remains high at 2.3%. The bank's revenue is forecasted to grow over 20% annually, but this pace lags behind the broader Turkish market expectations.

- Our expertly prepared growth report on Türkiye Is Bankasi implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Türkiye Is Bankasi with our detailed financial health report.

Next Steps

- Click through to start exploring the rest of the 474 Undervalued Global Stocks Based On Cash Flows now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal