European Undervalued Small Caps With Insider Action For January 2026

As the pan-European STOXX Europe 600 Index edges closer to record highs, buoyed by optimism about future earnings and economic prospects, small-cap stocks in Europe are capturing investor attention amid this positive sentiment. In this environment, identifying promising small-cap opportunities often involves looking at companies with strong fundamentals and insider activity, which can signal confidence in their potential despite broader market challenges.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| A.G. BARR | 14.2x | 1.6x | 48.96% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 41.52% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.9x | 0.3x | 43.23% | ★★★★★☆ |

| Norcros | 15.0x | 0.8x | 36.24% | ★★★★☆☆ |

| Eurocell | 17.0x | 0.3x | 38.22% | ★★★★☆☆ |

| Eastnine | 12.3x | 7.7x | 48.74% | ★★★★☆☆ |

| Senior | 25.5x | 0.8x | 24.64% | ★★★★☆☆ |

| Gooch & Housego | 46.2x | 1.1x | 23.07% | ★★★☆☆☆ |

| Kendrion | 29.9x | 0.7x | 41.07% | ★★★☆☆☆ |

| CVS Group | 48.1x | 1.3x | 23.06% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Grainger (LSE:GRI)

Simply Wall St Value Rating: ★★★★☆☆

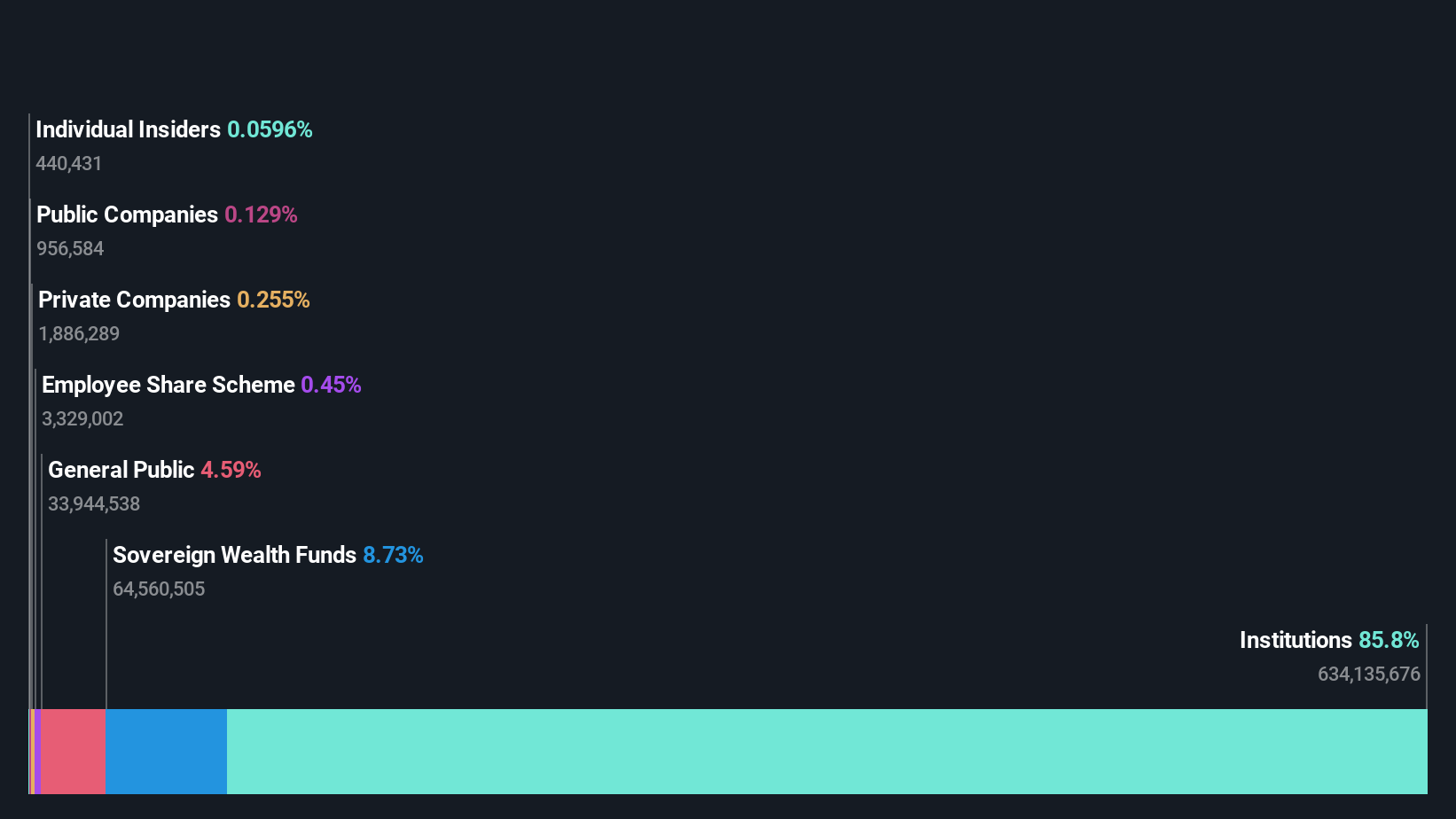

Overview: Grainger is a leading UK-based residential property company focused on the ownership, management, and development of rental homes with a market capitalization of £2.18 billion.

Operations: The company's revenue streams primarily consist of the Private Rented Sector (PRS) and Reversionary segments. Operating expenses, including general and administrative costs, consistently impact profitability. Notably, the net income margin has shown fluctuations over time, reaching a high of 77.12% in Q3 2025 before declining to lower levels in subsequent quarters.

PE: 6.6x

Grainger, a smaller European company, recently reported impressive financial growth with net income soaring to £202.6 million from £31.2 million the previous year. Despite this, earnings are projected to decline by 5.2% annually over the next three years due to reliance on external borrowing for funding and one-off items impacting results. Insider confidence is evident through recent share purchases, and they aim for pre-tax EPRA earnings of £72 million by FY29 amidst higher interest rates challenges.

- Click to explore a detailed breakdown of our findings in Grainger's valuation report.

Assess Grainger's past performance with our detailed historical performance reports.

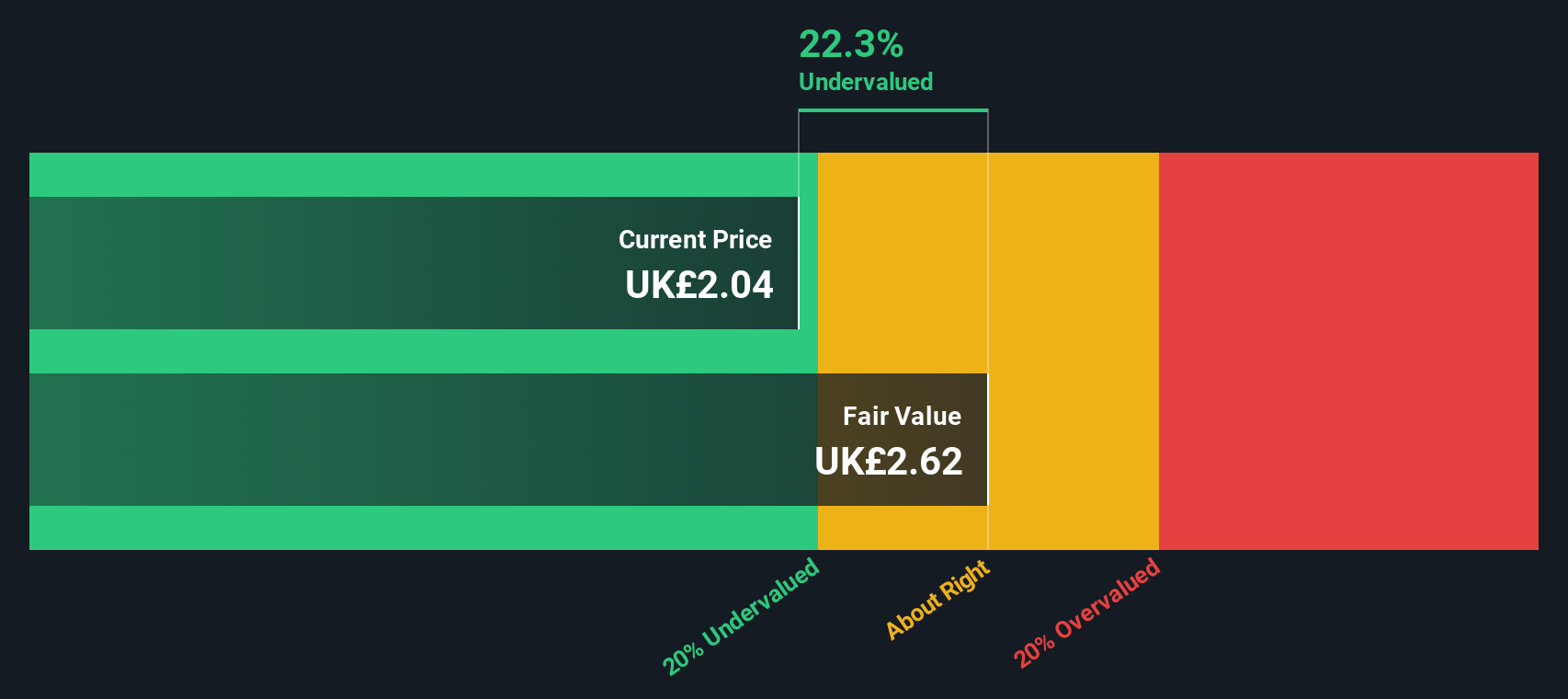

International Personal Finance (LSE:IPF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: International Personal Finance is a financial services company providing consumer credit through its digital and home credit divisions in Europe and Mexico, with a market capitalization of approximately £0.28 billion.

Operations: The company generates revenue primarily from its IPF Digital, Mexico Home Credit, and European Home Credit segments. Over the years, gross profit margin has shown fluctuations, reaching a high of 89.76% in December 2021 and a low of 62.47% in June 2020. Operating expenses are significant, with general and administrative expenses consistently making up a large portion of these costs.

PE: 7.1x

International Personal Finance, a player in the European financial sector, recently issued SEK 1 billion in senior unsecured floating rate notes due 2028, enhancing its funding structure. Despite relying entirely on external borrowing, which carries higher risk compared to customer deposits, they have shown resilience by being added to the FTSE 250 and FTSE 350 indices as of October 2025. Insider confidence is evident with recent share purchases by executives over several months in late 2025, signaling potential growth optimism despite earnings not fully covering interest payments.

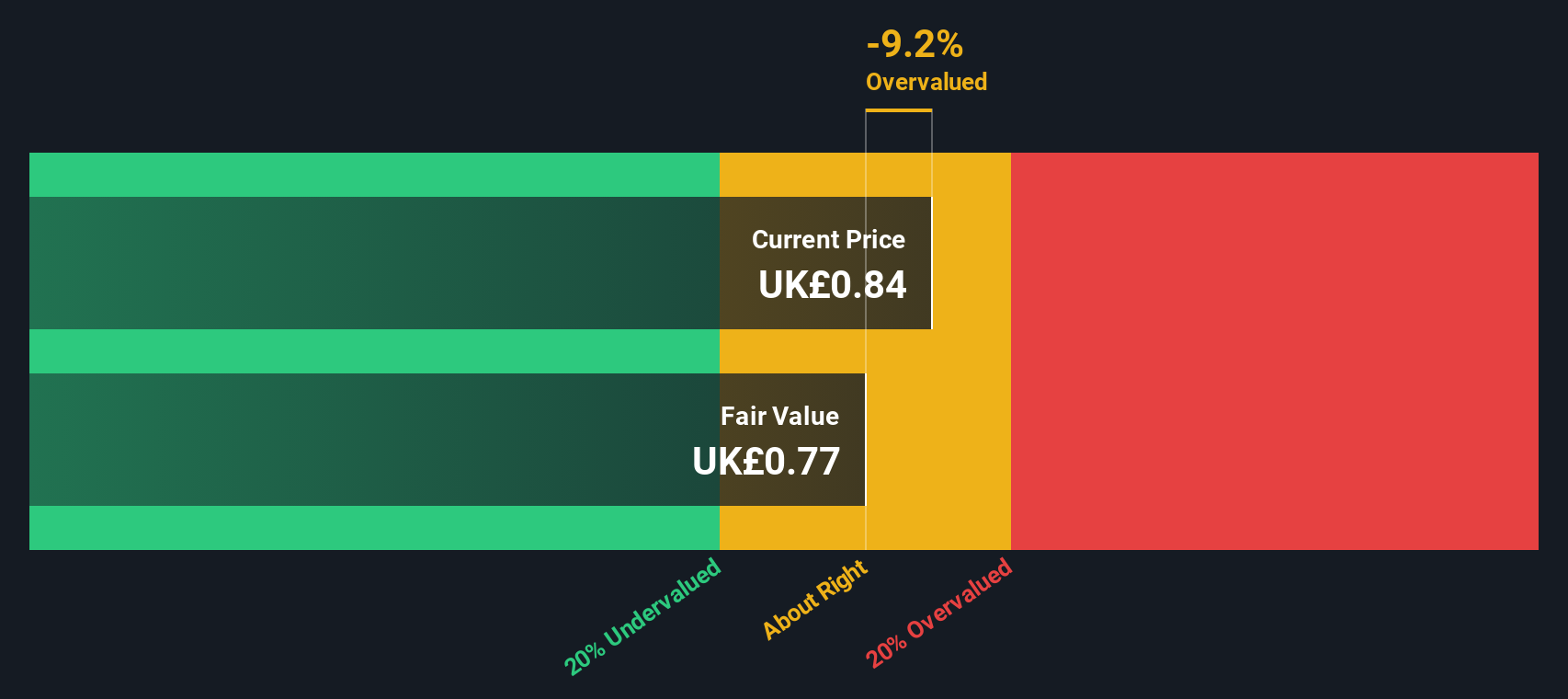

Supermarket Income REIT (LSE:SUPR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Supermarket Income REIT focuses on investing in supermarket property assets, with a market capitalization of approximately £1.02 billion.

Operations: The company generates revenue primarily from its investment in supermarket property assets, with a gross profit margin consistently at 100%. Operating expenses and non-operating expenses significantly impact net income, leading to fluctuations in net income margin. Recent data shows a net income margin of 53.61% as of December 2025, highlighting the effect of these costs on profitability.

PE: 16.5x

Supermarket Income REIT, a small-cap stock in Europe, recently acquired three UK supermarkets for £97.6 million, aligning with its strategy to enhance earnings. Their joint venture with Blue Owl Capital acquired 10 Asda stores for £196 million, reflecting strategic capital deployment. Insider confidence is evident as an independent director purchased 100,000 shares for £69,900 in December 2025. Despite high external borrowing risks and debt not well covered by operating cash flow, growth prospects remain strong with forecasted annual earnings growth of 17%.

Where To Now?

- Embark on your investment journey to our 73 Undervalued European Small Caps With Insider Buying selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal