Exploring 3 Undiscovered Gems In Europe With Promising Potential

As the pan-European STOXX Europe 600 Index edges closer to record highs, buoyed by optimism about future earnings and economic prospects, investors are increasingly turning their attention to lesser-known opportunities within the market. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding, especially as we explore three undiscovered gems in Europe that show promising potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Envirotainer | 43.54% | -23.63% | nan | ★★★★★☆ |

| Darwin | 3.03% | 50.55% | 46377.71% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Clínica Baviera (BME:CBAV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics across Spain and Europe with a market capitalization of €795.80 million.

Operations: Clínica Baviera generates revenue primarily from its ophthalmology services, amounting to €296.76 million. The company's market capitalization stands at €795.80 million.

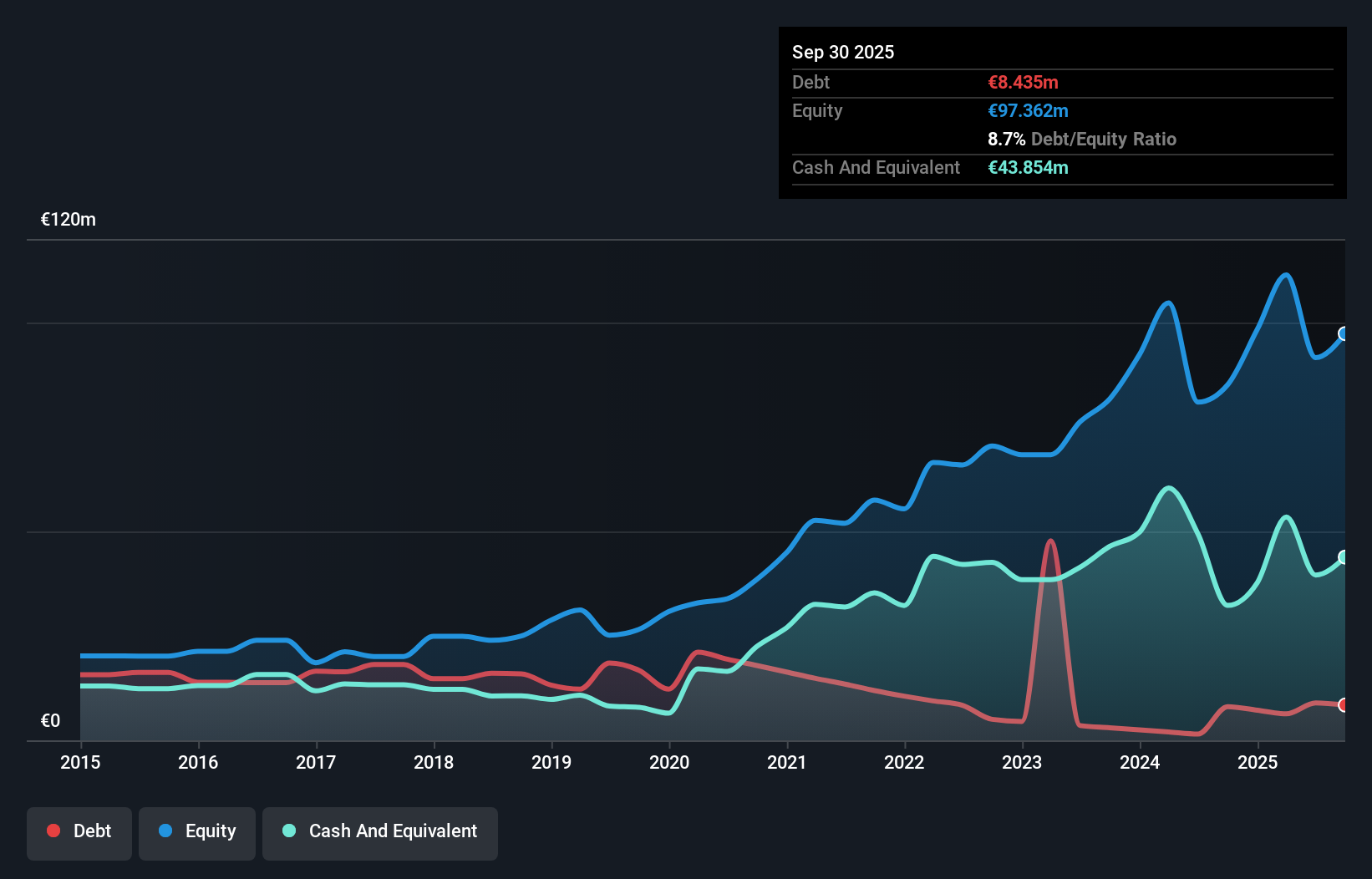

With a strong position in the healthcare sector, Clínica Baviera's earnings growth of 9.2% over the past year outpaced the industry average. The company has significantly reduced its debt to equity ratio from 46.4% to 8.7% in five years, indicating enhanced financial health. Trading at 17.7% below estimated fair value suggests potential undervaluation, while high-quality earnings and positive free cash flow underscore operational efficiency. With interest payments well covered by EBIT at a multiple of 21 times, Clínica Baviera seems well-positioned for continued stability and growth within its niche market segment.

- Unlock comprehensive insights into our analysis of Clínica Baviera stock in this health report.

Evaluate Clínica Baviera's historical performance by accessing our past performance report.

Pexip Holding (OB:PEXIP)

Simply Wall St Value Rating: ★★★★★★

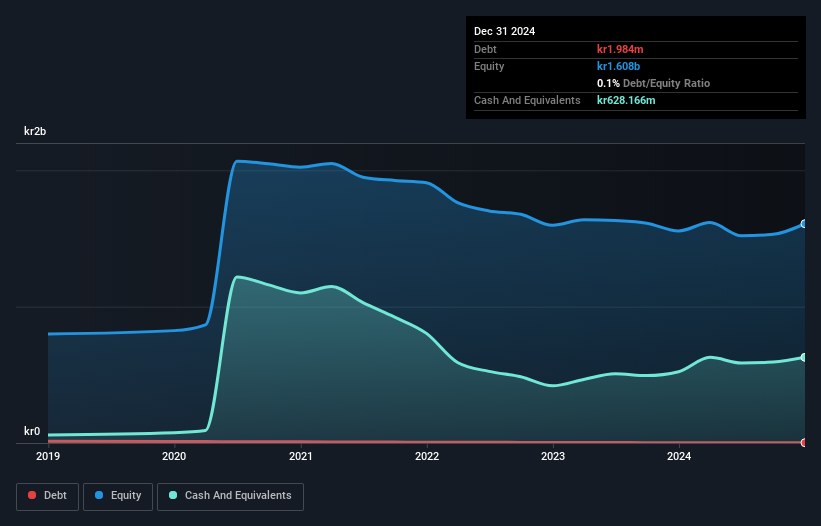

Overview: Pexip Holding ASA is a video technology company that offers an end-to-end video conferencing platform and digital infrastructure across various regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market capitalization of NOK 7.98 billion.

Operations: Pexip generates revenue primarily from the sale of collaboration services, amounting to NOK 1.23 billion. The company's net profit margin trends can provide insights into its profitability dynamics over time.

Pexip Holding, a nimble player in the video conferencing space, has surged ahead with its secure and customizable solutions. The company recently reported third-quarter sales of NOK 265.63 million, up from NOK 228.48 million the previous year, while net income jumped to NOK 25.64 million from NOK 5.8 million. Pexip's strategic focus on data sovereignty and privacy is driving demand, with earnings per share climbing to NOK 0.25 from NOK 0.06 in the same period last year. Despite facing stiff competition, Pexip's innovative pricing and AI enhancements are poised to bolster profit margins further over time.

Alimak Group (OM:ALIG)

Simply Wall St Value Rating: ★★★★☆☆

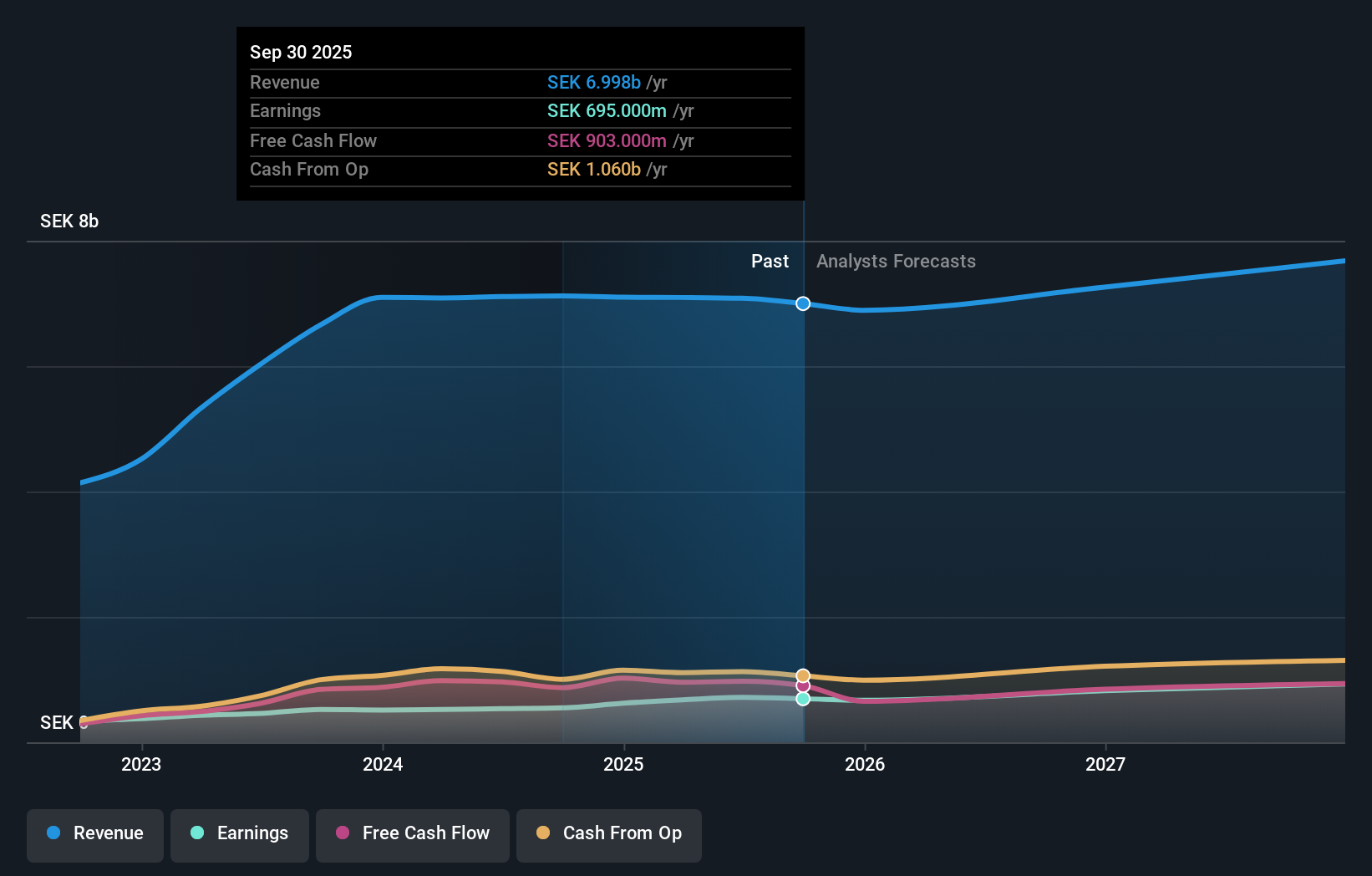

Overview: Alimak Group AB (publ) designs and manufactures vertical access solutions with a market capitalization of approximately SEK15.37 billion, serving markets in Europe, Asia, Australia, South and North America, and internationally.

Operations: Alimak Group generates revenue primarily from five segments: Facade Access (SEK1.997 billion), Construction (SEK1.553 billion), Industrial (SEK1.551 billion), HS & PS (SEK1.298 billion), and Wind (SEK657 million). The Facade Access segment is the largest contributor to revenue, followed closely by Construction and Industrial segments.

Alimak Group, a notable player in the industrial solutions sector, is trading 37% below its estimated fair value and has demonstrated robust earnings growth of 26.6% over the past year, outpacing the broader machinery industry. The company's debt to equity ratio has increased from 24.6% to 45.5% over five years; however, with a satisfactory net debt to equity ratio of 31%, financial health remains stable. Recent strategic acquisitions and digital advancements are expected to bolster profit margins from 10.1% to an anticipated 12.9%, despite challenges in construction and regulatory shifts impacting future prospects.

Make It Happen

- Dive into all 299 of the European Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal