Asian Stocks That Could Be Trading Below Their Estimated Value

As Asian markets continue to navigate a landscape of mixed economic indicators and moderate growth projections, investors are increasingly on the lookout for opportunities that may be undervalued amidst these conditions. Identifying stocks trading below their estimated value can offer potential advantages in such an environment, where careful analysis of fundamentals and market positioning is key to uncovering promising investments.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Visional (TSE:4194) | ¥10010.00 | ¥19887.98 | 49.7% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1580.06 | 49.7% |

| Nan Juen International (TPEX:6584) | NT$347.00 | NT$686.60 | 49.5% |

| Kuraray (TSE:3405) | ¥1587.00 | ¥3163.27 | 49.8% |

| JINS HOLDINGS (TSE:3046) | ¥5530.00 | ¥11032.70 | 49.9% |

| Innovent Biologics (SEHK:1801) | HK$76.25 | HK$150.79 | 49.4% |

| Forth Corporation (SET:FORTH) | THB5.75 | THB11.21 | 48.7% |

| Daiichi Sankyo Company (TSE:4568) | ¥3348.00 | ¥6544.37 | 48.8% |

| CURVES HOLDINGS (TSE:7085) | ¥801.00 | ¥1581.79 | 49.4% |

| Aidma Holdings (TSE:7373) | ¥3160.00 | ¥6305.80 | 49.9% |

Here's a peek at a few of the choices from the screener.

Akeso (SEHK:9926)

Overview: Akeso, Inc. is a biopharmaceutical company focused on the research, development, manufacture, and commercialization of antibody drugs globally with a market cap of HK$104.09 billion.

Operations: The company generates revenue of CN¥2.51 billion from its activities in research, development, production, and sale of biopharmaceutical products.

Estimated Discount To Fair Value: 46.9%

Akeso is trading at HK$113, significantly below its estimated fair value of HK$212.62, indicating potential undervaluation based on cash flows. The company is forecasted to achieve high revenue growth of 30.3% annually and become profitable within three years, surpassing market averages. Recent FDA approvals for trials in gastric cancer and advancements in Alzheimer's treatment highlight Akeso's robust pipeline and strategic global expansion efforts, reinforcing its innovative capabilities in biopharmaceuticals.

- According our earnings growth report, there's an indication that Akeso might be ready to expand.

- Take a closer look at Akeso's balance sheet health here in our report.

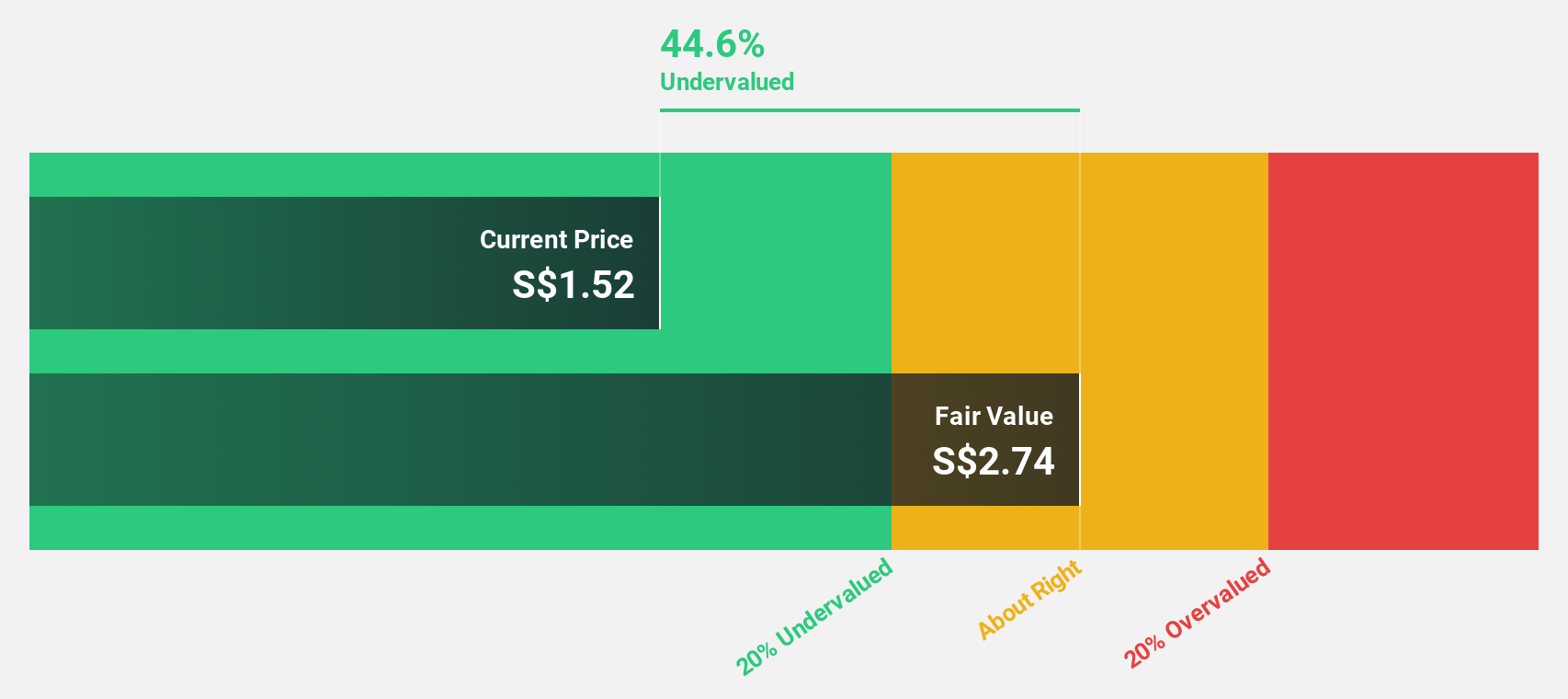

UltraGreen.ai (SGX:ULG)

Overview: UltraGreen.ai Limited, with a market cap of $1.67 billion, manufactures fluorescence imaging surgical devices and pharmaceutical agents.

Operations: The company's revenue segments include Ultralinq at $6.84 million, DxG - Americas at $173.98 million, and DxG - Rest of World at $113.36 million.

Estimated Discount To Fair Value: 30.1%

UltraGreen.ai is trading at $1.51, below its estimated fair value of $2.16, suggesting undervaluation based on cash flows. Despite high debt levels and illiquid shares, earnings are projected to grow significantly at 26.2% annually, outpacing the Singapore market's average growth rate. Following a recent IPO raising $400 million, UltraGreen.ai is positioned for expansion with revenue expected to grow faster than the market at 19.2% per year.

- In light of our recent growth report, it seems possible that UltraGreen.ai's financial performance will exceed current levels.

- Get an in-depth perspective on UltraGreen.ai's balance sheet by reading our health report here.

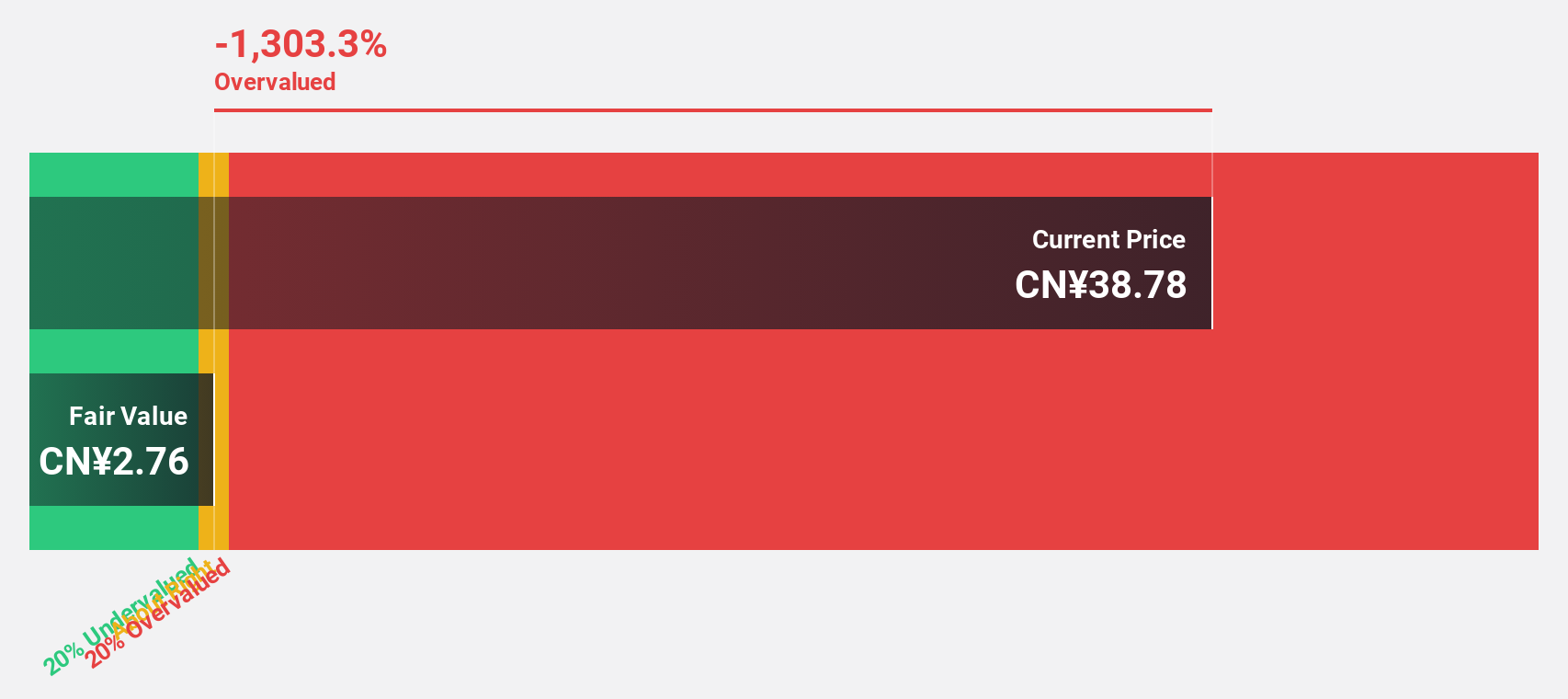

DongHua Testing Technology (SZSE:300354)

Overview: DongHua Testing Technology Co., Ltd. specializes in structural mechanical properties research and provides solutions for electrochemical workstations in China, with a market cap of CN¥6.28 billion.

Operations: DongHua Testing Technology Co., Ltd. generates revenue from its Instrumentation Testing segment, amounting to CN¥533.04 million.

Estimated Discount To Fair Value: 10.1%

DongHua Testing Technology, trading at CN¥45.5, is slightly undervalued compared to its estimated fair value of CN¥50.59. The company reported nine-month sales of CN¥385.01 million and net income of CN¥101.25 million, showing modest growth from the previous year. Earnings are projected to grow significantly at 33.1% annually, surpassing the Chinese market's average growth rate, with revenue expected to increase by 29.3% per year over the next three years.

- Our earnings growth report unveils the potential for significant increases in DongHua Testing Technology's future results.

- Click to explore a detailed breakdown of our findings in DongHua Testing Technology's balance sheet health report.

Summing It All Up

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 257 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal