3 Dividend Stocks Offering Yields Up To 7.1%

As the year draws to a close, U.S. stock markets have experienced a slight downturn, with major indexes closing lower for three consecutive sessions amidst fluctuating interest rates and economic uncertainty. In this environment, dividend stocks can offer investors an appealing combination of income and potential stability, making them an attractive option for those looking to navigate the current market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.83% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.42% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.76% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.35% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.07% | ★★★★★★ |

| Ennis (EBF) | 5.46% | ★★★★★★ |

| Dillard's (DDS) | 5.09% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.10% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.53% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.63% | ★★★★★☆ |

Click here to see the full list of 123 stocks from our Top US Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

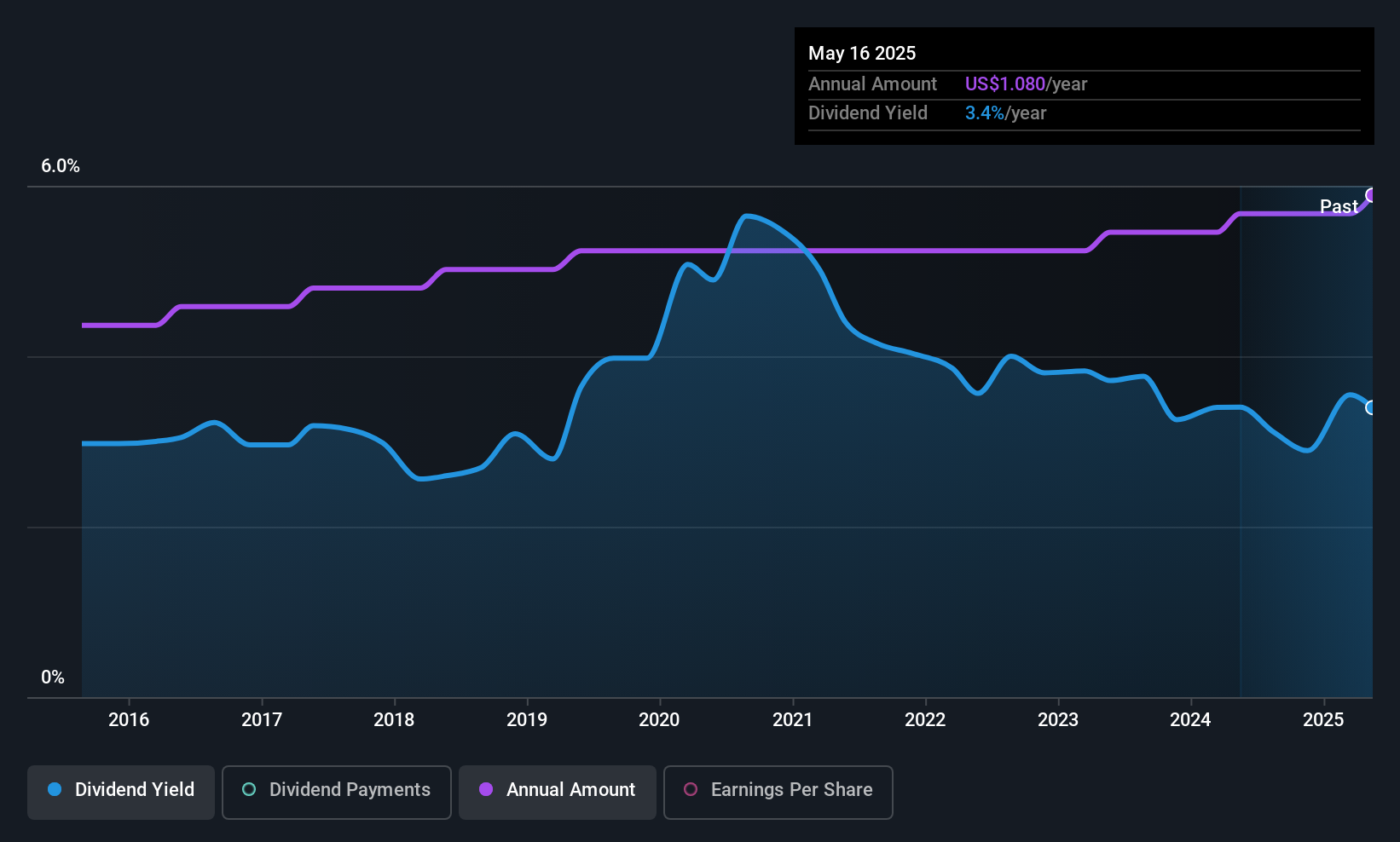

Weyco Group (WEYS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Weyco Group, Inc. designs, markets, and distributes footwear for men, women, and children across several regions including the United States, Canada, Australia, Asia, and South Africa with a market cap of $290.24 million.

Operations: Weyco Group's revenue is primarily derived from its Wholesale segment, which accounts for $220.42 million, followed by its Retail segment at $36.45 million.

Dividend Yield: 3.5%

Weyco Group offers a stable dividend profile with a payout ratio of 41.7%, ensuring dividends are well-covered by earnings and cash flows. The company has consistently grown its dividends over the past decade, currently yielding 3.51%, though below the top tier in the US market. Recent financials show decreased sales and net income year-over-year, but Weyco declared a special $2 per share dividend, signaling confidence in their cash position despite declining earnings.

- Take a closer look at Weyco Group's potential here in our dividend report.

- Our valuation report unveils the possibility Weyco Group's shares may be trading at a discount.

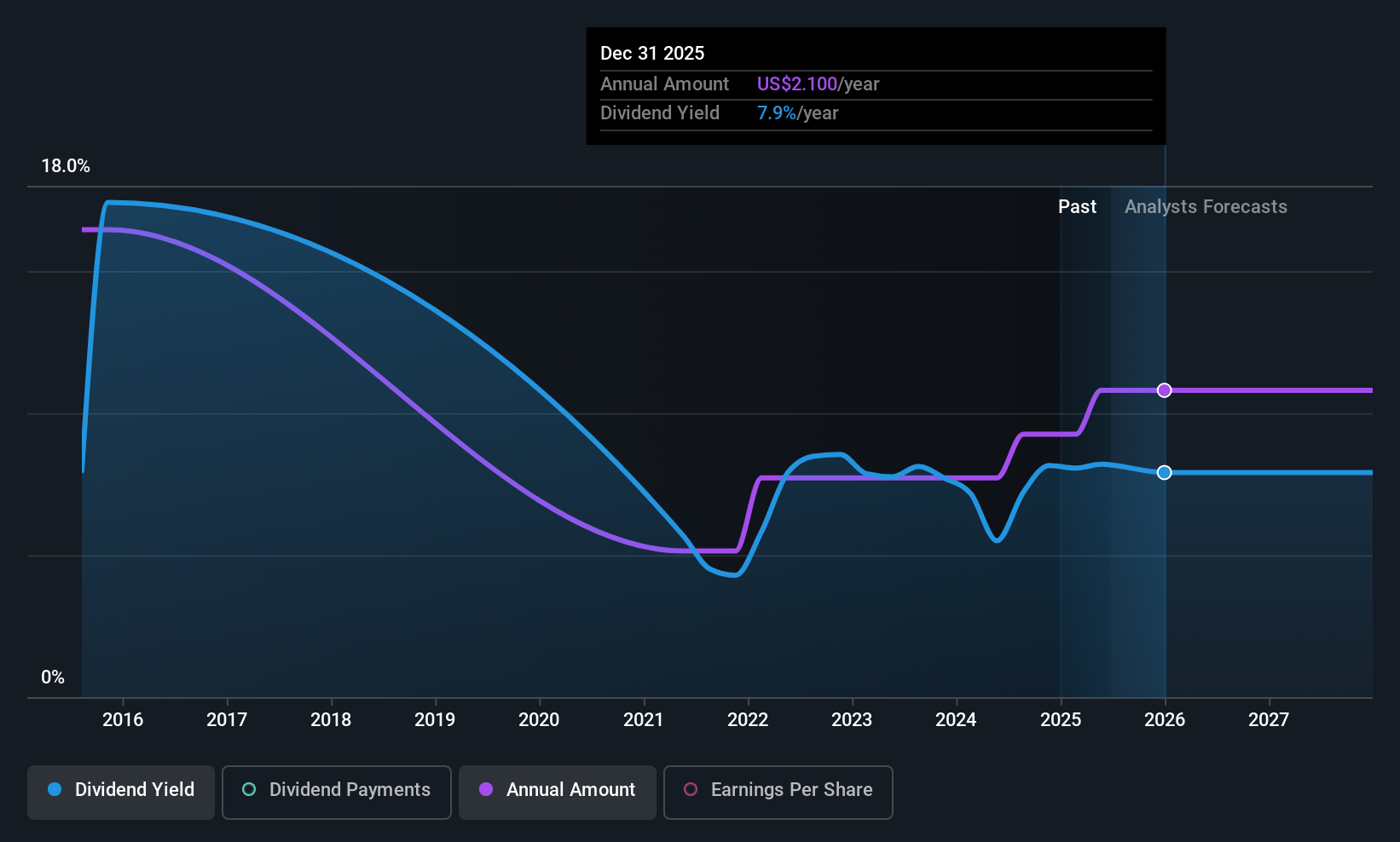

Global Ship Lease (GSL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Global Ship Lease, Inc. operates by owning and chartering containerships under fixed-rate charters to container shipping companies globally, with a market cap of approximately $1.25 billion.

Operations: Global Ship Lease generates its revenue primarily from the transportation and shipping segment, amounting to $747.04 million.

Dividend Yield: 7.2%

Global Ship Lease's dividend yield is among the top 25% in the US market, supported by a low payout ratio of 19.1% and reasonable cash payout ratio of 62.9%. However, its dividend history is marked by volatility and past declines. Recently, it declared a $0.625 per share dividend for Q3 2025 amidst strong financial performance with revenue at $192.67 million and net income at $95.02 million for the quarter, reflecting earnings growth over last year.

- Dive into the specifics of Global Ship Lease here with our thorough dividend report.

- According our valuation report, there's an indication that Global Ship Lease's share price might be on the cheaper side.

Hershey (HSY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Hershey Company, along with its subsidiaries, manufactures and sells confectionery products and pantry items both in the United States and internationally, with a market cap of approximately $36.66 billion.

Operations: Hershey's revenue is primarily derived from its North America Confectionery segment at $9.36 billion, followed by North America Salty Snacks at $1.19 billion, and International operations contributing $940.51 million.

Dividend Yield: 3%

Hershey's dividend, yielding 3.01%, is supported by a payout ratio of 81.7% and a cash payout ratio of 62.9%, indicating coverage by both earnings and cash flows. The company has maintained stable and reliable dividends over the past decade despite its high debt level. Recent amendments to corporate governance practices aim to enhance oversight, while strategic partnerships like with JAKKS Pacific may bolster brand visibility, though recent earnings showed decreased net income despite increased sales at US$3.18 billion for Q3 2025.

- Unlock comprehensive insights into our analysis of Hershey stock in this dividend report.

- Our expertly prepared valuation report Hershey implies its share price may be too high.

Next Steps

- Explore the 123 names from our Top US Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal