Middle Eastern Market Gems: Fitaihi Holding Group And 2 More Noteworthy Penny Stocks

As geopolitical tensions between Saudi Arabia and the UAE impact Gulf markets, investors are closely monitoring regional indices for signs of stability. Despite these challenges, opportunities remain for those willing to explore lesser-known segments of the market. Penny stocks, often representing smaller or newer companies, can offer significant growth potential when backed by strong financials. This article highlights three noteworthy penny stocks in the Middle East that combine balance sheet strength with promising prospects.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.29 | SAR1.32B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.75 | ₪197.21M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.12B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.54 | SAR914M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.25 | AED384.62M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.54 | AED14.97B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.85 | AED503.03M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.577 | ₪202.29M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 81 stocks from our Middle Eastern Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Fitaihi Holding Group (SASE:4180)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fitaihi Holding Group operates in Saudi Arabia, offering gold, jewelry, and luxury products, with a market cap of SAR731.50 million.

Operations: The company generates revenue from its commercial activity segment, amounting to SAR46.67 million.

Market Cap: SAR731.5M

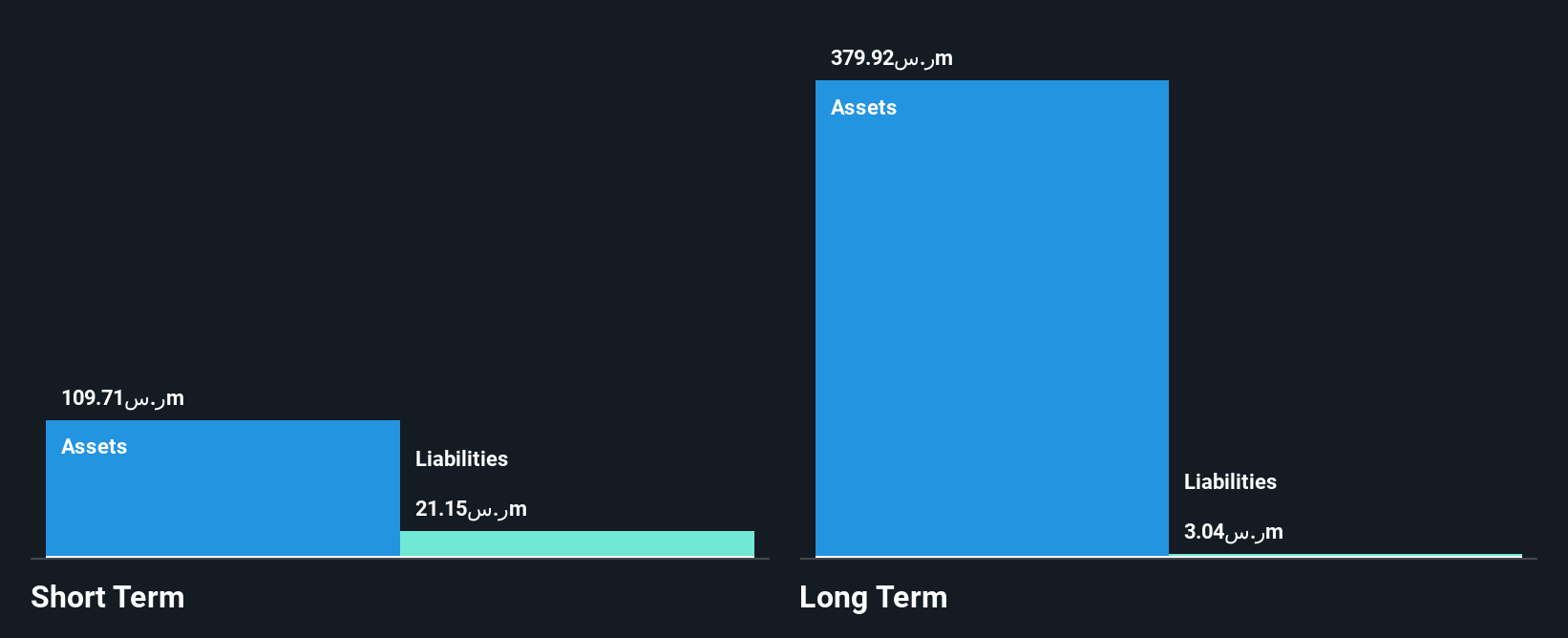

Fitaihi Holding Group, operating in Saudi Arabia's gold, jewelry, and luxury products sector with a market cap of SAR731.50 million, faces challenges as its third-quarter sales declined to SAR11.24 million from SAR12.79 million the previous year, resulting in a net loss of SAR1.87 million. Despite being debt-free and having strong short-term asset coverage over liabilities (SAR108.8M vs SAR11.1M), the company struggles with declining earnings and profit margins (17% down from 31.9%). While dividends were recently affirmed at SAR0.025 per share, the company's return on equity remains low at 1.7%.

- Take a closer look at Fitaihi Holding Group's potential here in our financial health report.

- Examine Fitaihi Holding Group's past performance report to understand how it has performed in prior years.

Al-Modawat Specialized Medical (SASE:9594)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Al-Modawat Specialized Medical Company operates a general hospital in the Aseer region of Saudi Arabia and has a market cap of SAR327.75 million.

Operations: The company generates revenue primarily from Medical Services, amounting to SAR85.43 million, and Pharmaceutical Products, contributing SAR5.38 million.

Market Cap: SAR327.75M

Al-Modawat Specialized Medical Company, with a market cap of SAR327.75 million, has demonstrated robust earnings growth of 22% over the past year, surpassing the healthcare industry average. The company’s financial health is reinforced by having more cash than total debt and well-covered interest payments. Despite a high level of non-cash earnings and stable weekly volatility, its net profit margins have slightly decreased from last year. Recent expansions in their hospital facilities could potentially drive future growth. However, dividends remain modest at SAR0.01 per share and are not well covered by earnings or free cash flows.

- Click here to discover the nuances of Al-Modawat Specialized Medical with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Al-Modawat Specialized Medical's track record.

Avrot Industries (TASE:AVRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avrot Industries Ltd specializes in the lining and coating of steel pipes in Israel, with a market cap of ₪180.70 million.

Operations: The company's revenue is primarily derived from coating and wrapping of steel pipes at ₪77.47 million, followed by plastic pipe manufacturing at ₪34.74 million, and subcontractor activities in water and sewage infrastructure generating ₪21.12 million.

Market Cap: ₪180.7M

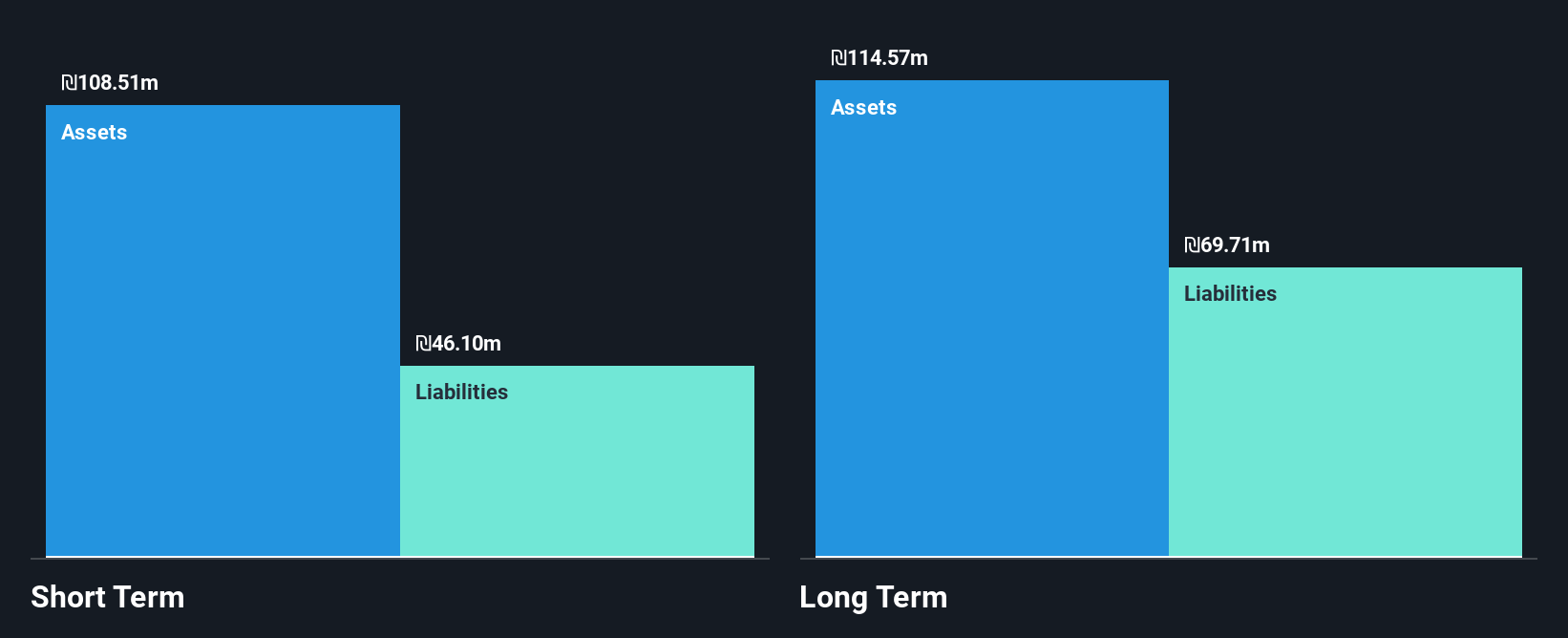

Avrot Industries Ltd, with a market cap of ₪180.70 million, recently achieved profitability, marking significant progress in its financial journey. The company's revenue streams are diverse, with substantial income from coating and wrapping steel pipes and plastic pipe manufacturing. Avrot's debt management is strong; operating cash flow covers 55.1% of its debt while interest payments are well covered by EBIT at 5.6x coverage. Although the stock has experienced high volatility over the past year, its weekly volatility has decreased significantly. The board is seasoned with an average tenure of 4.1 years, enhancing governance stability.

- Get an in-depth perspective on Avrot Industries' performance by reading our balance sheet health report here.

- Learn about Avrot Industries' historical performance here.

Key Takeaways

- Unlock more gems! Our Middle Eastern Penny Stocks screener has unearthed 78 more companies for you to explore.Click here to unveil our expertly curated list of 81 Middle Eastern Penny Stocks.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal