3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 41.9%

As global markets continue to navigate a complex economic landscape, Asian indices have shown resilience with notable gains in major regions like Japan and China. In this environment, identifying undervalued stocks can be an effective strategy for investors seeking opportunities amidst broader market optimism and evolving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | CN¥16.39 | CN¥32.50 | 49.6% |

| Visional (TSE:4194) | ¥10010.00 | ¥19879.01 | 49.6% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1575.22 | 49.5% |

| Nan Juen International (TPEX:6584) | NT$348.50 | NT$686.37 | 49.2% |

| Kuraray (TSE:3405) | ¥1587.00 | ¥3161.17 | 49.8% |

| JINS HOLDINGS (TSE:3046) | ¥5530.00 | ¥11017.42 | 49.8% |

| Giant Biogene Holding (SEHK:2367) | HK$33.54 | HK$65.50 | 48.8% |

| Daiichi Sankyo Company (TSE:4568) | ¥3348.00 | ¥6544.37 | 48.8% |

| CURVES HOLDINGS (TSE:7085) | ¥801.00 | ¥1581.44 | 49.3% |

| Aidma Holdings (TSE:7373) | ¥3160.00 | ¥6305.80 | 49.9% |

Let's uncover some gems from our specialized screener.

Moshi Moshi Retail Corporation (SET:MOSHI)

Overview: Moshi Moshi Retail Corporation Public Company Limited operates in the retail and wholesale sector, focusing on lifestyle products in Thailand, with a market cap of THB11.38 billion.

Operations: Moshi Moshi Retail Corporation generates revenue from its lifestyle products with THB3.07 billion from retail and THB473.09 million from wholesale operations in Thailand.

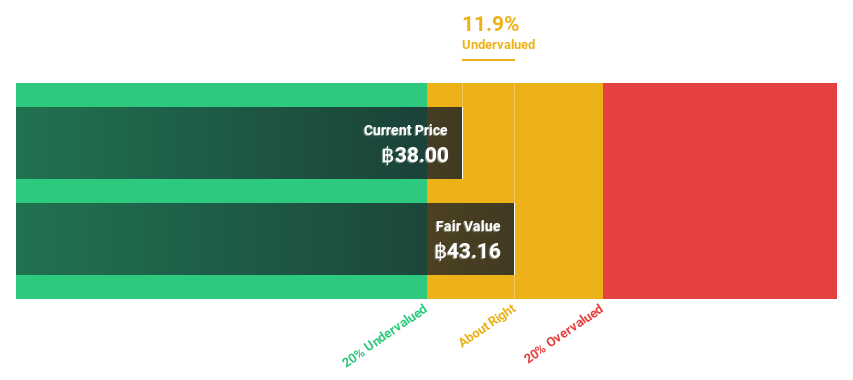

Estimated Discount To Fair Value: 20.4%

Moshi Moshi Retail Corporation's recent earnings report showed strong growth, with third-quarter net income rising to THB 137.23 million from THB 108.14 million a year ago. The stock is trading at THB34.5, which is over 20% below its estimated fair value of THB43.35 based on discounted cash flow analysis, indicating potential undervaluation. Analysts forecast annual earnings growth of 14.9%, outpacing the Thai market average, and revenue growth at 16.6% per year also exceeds market expectations.

- Our comprehensive growth report raises the possibility that Moshi Moshi Retail Corporation is poised for substantial financial growth.

- Dive into the specifics of Moshi Moshi Retail Corporation here with our thorough financial health report.

Kunshan Huguang Auto HarnessLtd (SHSE:605333)

Overview: Kunshan Huguang Auto Harness Co., Ltd. specializes in the R&D, production, and sales of wiring harnesses for passenger vehicles in China, with a market cap of CN¥14.05 billion.

Operations: Kunshan Huguang Auto Harness Co., Ltd. generates revenue primarily through the development, manufacturing, and distribution of wiring harnesses for passenger vehicles in China.

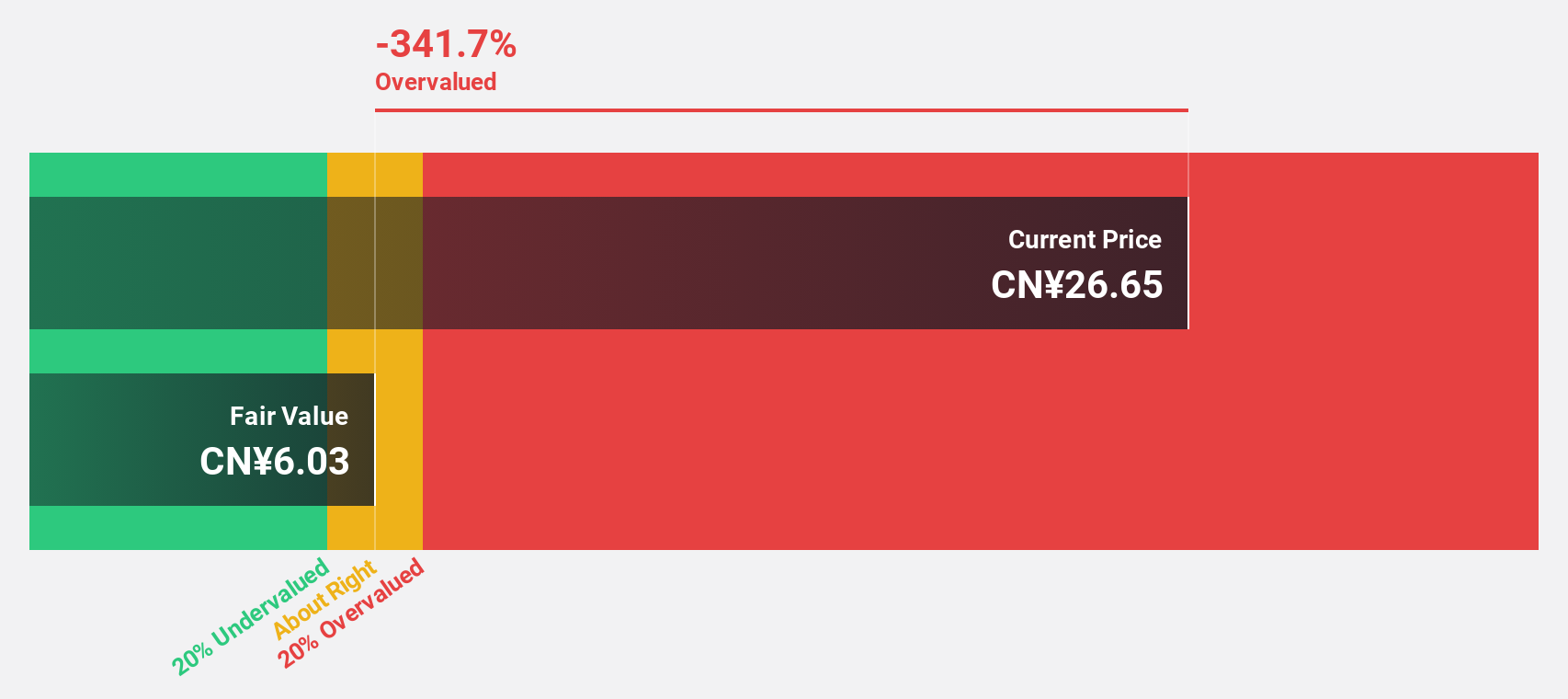

Estimated Discount To Fair Value: 41.9%

Kunshan Huguang Auto Harness Ltd. is trading at CNY 30.28, significantly below its estimated fair value of CNY 52.11, suggesting potential undervaluation based on cash flows. Despite a slight dip in net income to CNY 424.81 million for the first nine months of 2025, earnings are forecasted to grow significantly by over 20% annually over the next three years, with revenue expected to outpace the Chinese market growth rate at 20.9% per year.

- Our earnings growth report unveils the potential for significant increases in Kunshan Huguang Auto HarnessLtd's future results.

- Delve into the full analysis health report here for a deeper understanding of Kunshan Huguang Auto HarnessLtd.

Hanshow Technology (SZSE:301275)

Overview: Hanshow Technology Co. Ltd specializes in electronic shelf labeling solutions and has a market cap of CN¥22.60 billion.

Operations: The company's revenue segment is derived entirely from Electric Equipment, totaling CN¥4.14 billion.

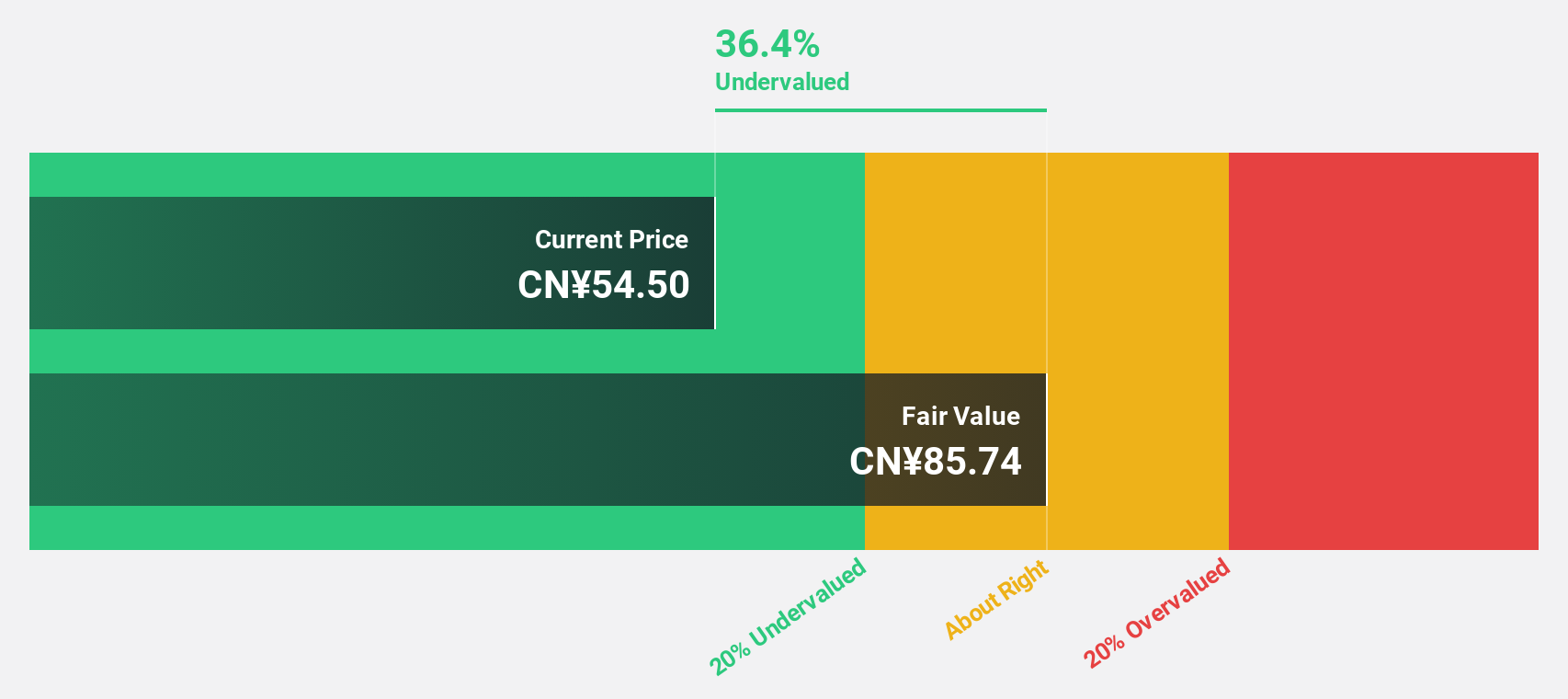

Estimated Discount To Fair Value: 37.8%

Hanshow Technology, trading at CN¥53.5, is undervalued relative to its fair value of CN¥86.07 according to cash flow analysis. Despite a recent decline in earnings, with net income dropping to CN¥314.39 million for the first nine months of 2025, the company anticipates significant annual earnings growth above 20% over the next three years. Recent strategic collaborations with institutions like the University of Cambridge underline Hanshow's commitment to innovation and may enhance future revenue streams.

- Our growth report here indicates Hanshow Technology may be poised for an improving outlook.

- Take a closer look at Hanshow Technology's balance sheet health here in our report.

Seize The Opportunity

- Click this link to deep-dive into the 264 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal