Undiscovered Gems In Asia To Explore This December 2025

As global markets continue to navigate a landscape marked by record highs in major U.S. indices and cautious optimism in Asia, investors are increasingly turning their attention to the promising yet often overlooked small-cap segment. With economic indicators suggesting varied growth trajectories across regions, identifying stocks with strong fundamentals and potential for resilience becomes essential in uncovering undiscovered gems within Asia's dynamic markets.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bonny Worldwide | 47.86% | 17.97% | 41.71% | ★★★★★★ |

| Saison Technology | NA | 1.32% | -10.74% | ★★★★★★ |

| Tibet Development | 13.94% | -0.13% | 42.61% | ★★★★★★ |

| Quality Reliability Technology | 18.75% | 0.46% | -43.08% | ★★★★★★ |

| Chin Hsin Environ Engineering | 5.28% | 24.51% | 40.62% | ★★★★★☆ |

| Hi-Lex | 4.66% | 10.06% | 16.32% | ★★★★★☆ |

| Hollyland (China) Electronics Technology | 6.10% | 17.97% | 20.67% | ★★★★★☆ |

| Li Ming Development Construction | 183.36% | 8.59% | 19.98% | ★★★★☆☆ |

| Anfu CE LINK | 70.49% | 7.92% | -8.47% | ★★★★☆☆ |

| Billion Industrial Holdings | 33.11% | 16.86% | -16.10% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Jeju Semiconductor (KOSDAQ:A080220)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jeju Semiconductor Corp. offers memory semiconductor solutions globally and has a market capitalization of ₩887.55 billion.

Operations: The company generates revenue through its global provision of memory semiconductor solutions. It has a market capitalization of ₩887.55 billion.

Jeju Semiconductor, a nimble player in the semiconductor space, showcases an impressive earnings growth of 288.1% over the past year, outpacing the industry average of 32.4%. The company has managed to cut its debt-to-equity ratio from 43.6% to 22% in five years, indicating prudent financial management. With high-quality earnings and more cash than total debt, Jeju Semiconductor is well-positioned financially. Despite a volatile share price recently, its profitability ensures that cash runway isn't a concern. This blend of robust growth and sound financials makes it an intriguing prospect within Asia's emerging market landscape.

- Unlock comprehensive insights into our analysis of Jeju Semiconductor stock in this health report.

Understand Jeju Semiconductor's track record by examining our Past report.

Hangzhou XZB Tech (SHSE:603040)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hangzhou XZB Tech Co., Ltd focuses on the research, development, production, and sale of precision parts both in China and internationally with a market capitalization of approximately CN¥12.41 billion.

Operations: XZB Tech generates revenue primarily through the sale of precision parts. The company's net profit margin is a key financial metric to observe, reflecting its profitability after all expenses.

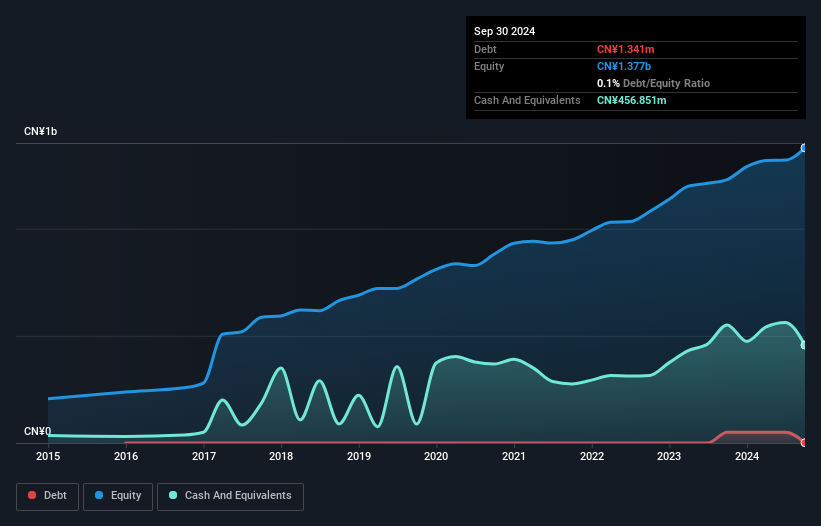

Hangzhou XZB Tech, a smaller player in the tech scene, has shown impressive financial growth with earnings rising by 22.7% over the past year, outpacing the Auto Components industry's 8%. Their net income for nine months ending September 2025 was CNY 209.27 million, up from CNY 161.71 million the previous year, reflecting their robust performance. The company boasts high-quality earnings and a debt-to-equity ratio increase to just 3.3% over five years, indicating manageable leverage levels. Despite recent share price volatility and a special shareholders meeting slated for November, XZB remains profitable with positive free cash flow of CNY 244.45 million as of September-end 2025.

- Dive into the specifics of Hangzhou XZB Tech here with our thorough health report.

Gain insights into Hangzhou XZB Tech's past trends and performance with our Past report.

Zkteco (SZSE:301330)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zkteco Co., Ltd. specializes in biometric solutions and AI cognitive spatial intelligence technologies, with a market cap of CN¥7.74 billion.

Operations: The company generates revenue primarily through its biometric solutions and AI technologies. It has a market capitalization of CN¥7.74 billion.

Zkteco, a notable player in the electronic industry, showcases a promising profile with earnings growth of 19.6% over the past year, outpacing the industry's 9.4%. The company has managed to keep its price-to-earnings ratio at 40.6x, which is competitive compared to the CN market's 45x. Despite an increase in its debt-to-equity ratio from 2.7% to 3.9% over five years, Zkteco maintains more cash than total debt and remains profitable with high-quality earnings and positive free cash flow. Recent developments include amendments to company bylaws and steady net income growth from CNY 120.68 million to CNY 128.21 million for nine months ending September 2025, indicating resilience despite slight revenue dips from CNY 1,410.9 million to CNY 1,401.31 million year-over-year.

- Click to explore a detailed breakdown of our findings in Zkteco's health report.

Evaluate Zkteco's historical performance by accessing our past performance report.

Summing It All Up

- Investigate our full lineup of 2491 Asian Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal