ASX Hidden Value Opportunities Cromwell Property Group Plus Two More Stocks With Estimated Discounted Prices

As the Australian market approaches the holiday season, it is experiencing a slight downturn, likely influenced by profit-taking activities and mirroring Wall Street trends. In this environment, identifying undervalued stocks can be an effective strategy for investors looking to capitalize on potential market inefficiencies; Cromwell Property Group and two other intriguing opportunities present themselves as promising candidates with estimated discounted prices.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wrkr (ASX:WRK) | A$0.12 | A$0.21 | 44.2% |

| Smart Parking (ASX:SPZ) | A$1.29 | A$2.26 | 43% |

| Resolute Mining (ASX:RSG) | A$1.23 | A$2.40 | 48.7% |

| Lynas Rare Earths (ASX:LYC) | A$12.59 | A$23.33 | 46% |

| LGI (ASX:LGI) | A$3.92 | A$7.67 | 48.9% |

| Kogan.com (ASX:KGN) | A$3.60 | A$6.87 | 47.6% |

| Guzman y Gomez (ASX:GYG) | A$21.90 | A$38.47 | 43.1% |

| Cromwell Property Group (ASX:CMW) | A$0.475 | A$0.86 | 45% |

| Betmakers Technology Group (ASX:BET) | A$0.185 | A$0.34 | 45.2% |

| Airtasker (ASX:ART) | A$0.34 | A$0.63 | 46.3% |

Let's review some notable picks from our screened stocks.

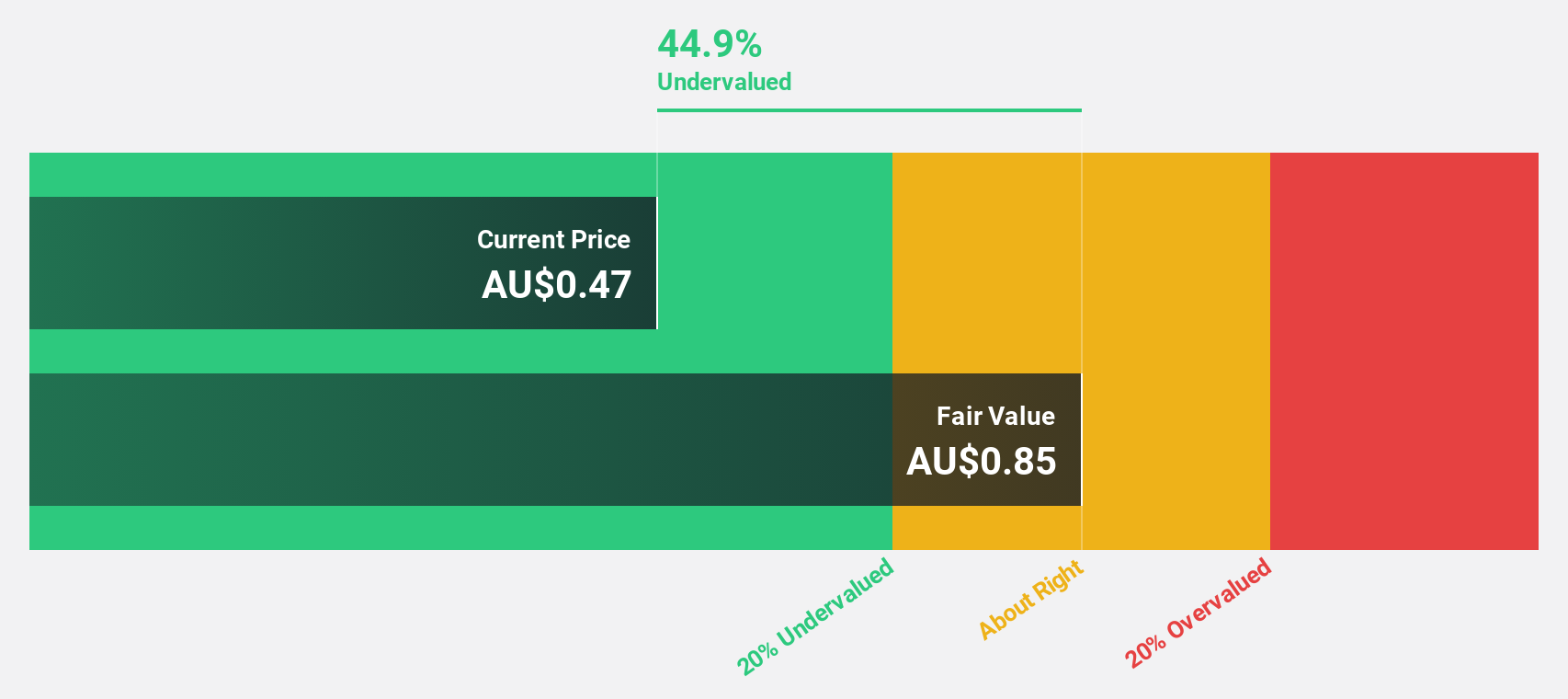

Cromwell Property Group (ASX:CMW)

Overview: Cromwell Property Group (ASX:CMW) is a real estate investment manager overseeing $4.2 billion of assets in Australia and New Zealand, with a market cap of approximately A$1.24 billion.

Operations: The revenue segments for ASX:CMW include Co-Investments at A$19.50 million, Investment Portfolio at A$194 million, and Funds and Asset Management at A$54.70 million.

Estimated Discount To Fair Value: 45%

Cromwell Property Group is trading at A$0.48, significantly below its estimated fair value of A$0.86, suggesting it may be undervalued based on cash flows. Despite revenue growth forecasts of 7.3% annually outpacing the broader Australian market, its earnings are not currently sufficient to cover interest payments or sustain a 6.32% dividend yield. However, with projected earnings growth of 29.67% annually and expected profitability within three years, potential exists for future financial improvement.

- Upon reviewing our latest growth report, Cromwell Property Group's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Cromwell Property Group with our detailed financial health report.

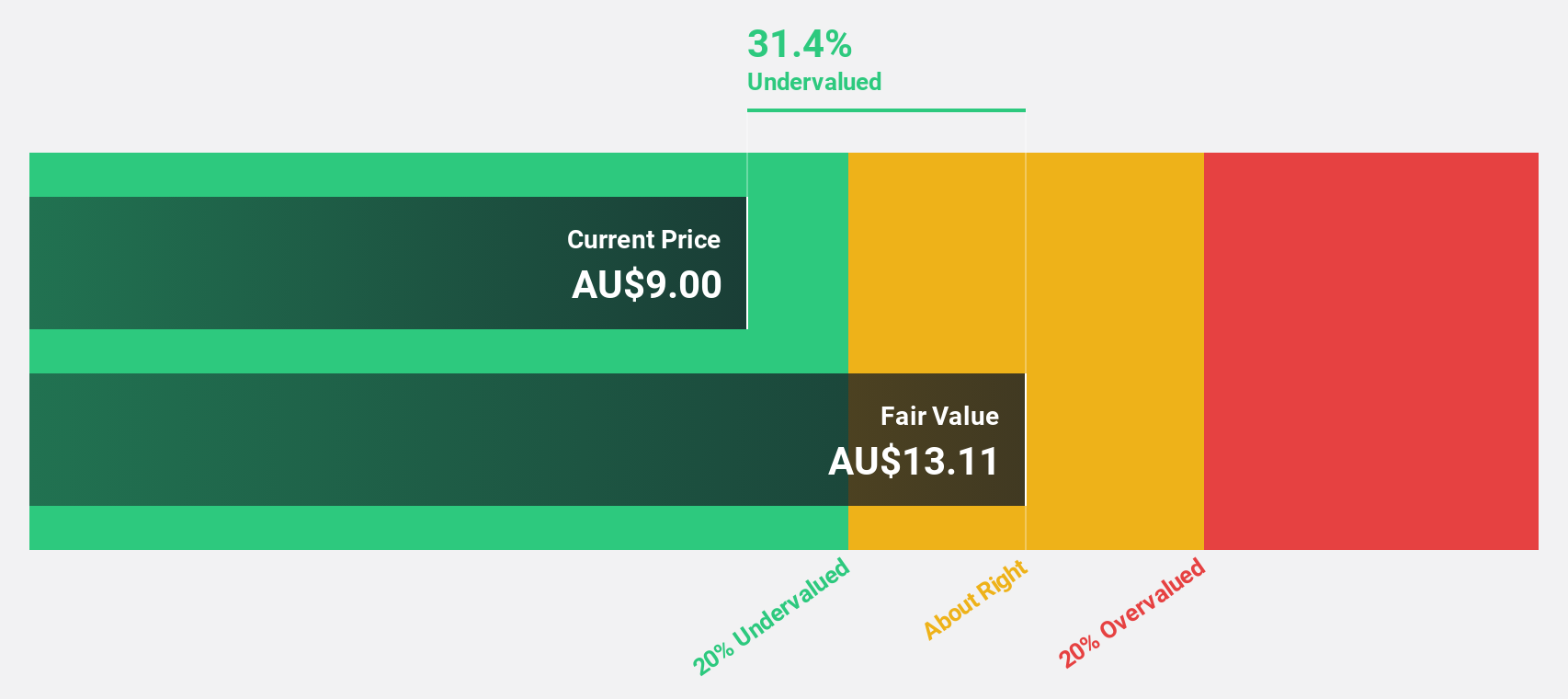

Lynas Rare Earths (ASX:LYC)

Overview: Lynas Rare Earths Limited, with a market cap of A$12.67 billion, is involved in the exploration, development, mining, extraction, and processing of rare earth minerals in Australia and Malaysia.

Operations: The company's revenue is primarily derived from its Rare Earth Operations, which generated A$556.51 million.

Estimated Discount To Fair Value: 46%

Lynas Rare Earths, trading at A$12.59, is considerably below its fair value estimate of A$23.33, highlighting potential undervaluation based on cash flows. Despite a recent decline in profit margins from 18.2% to 1.4%, earnings are projected to grow significantly at 40% annually over the next three years, outpacing the Australian market's growth rate of 12.2%. Recent strategic partnerships and index inclusions may bolster its position in the rare earth sector.

- Our earnings growth report unveils the potential for significant increases in Lynas Rare Earths' future results.

- Navigate through the intricacies of Lynas Rare Earths with our comprehensive financial health report here.

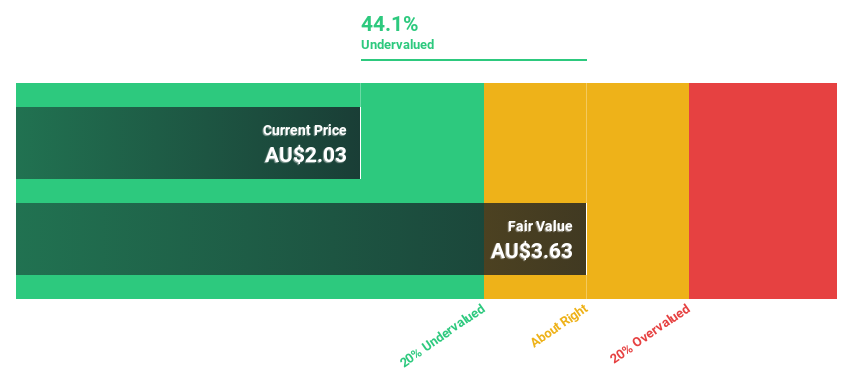

Symal Group (ASX:SYL)

Overview: Symal Group Limited operates in the civil construction industry in Australia, offering services such as construction contracting, equipment hires, material sales, recycling, and remediation with a market cap of A$832.22 million.

Operations: Symal Group's revenue is primarily derived from contracting services at A$713.75 million and plant & equipment at A$183.60 million, serving the civil construction sector in Australia.

Estimated Discount To Fair Value: 26%

Symal Group, trading at A$3.48, is priced below its estimated fair value of A$4.70, indicating undervaluation based on cash flows. The company's earnings are projected to grow significantly at 21.5% annually, surpassing the Australian market's growth rate of 12.2%. Recent executive changes with the CFO transition aim for continuity during this period of anticipated growth and financial stability, while revenue forecasts suggest a robust expansion at 16.5% per year.

- Insights from our recent growth report point to a promising forecast for Symal Group's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Symal Group.

Taking Advantage

- Unlock more gems! Our Undervalued ASX Stocks Based On Cash Flows screener has unearthed 33 more companies for you to explore.Click here to unveil our expertly curated list of 36 Undervalued ASX Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal