Unveiling US Market's 3 Undiscovered Gems

As the U.S. market navigates a holiday-shortened week with major stock indexes closing lower, investors are keeping a close eye on small-cap stocks within the S&P 600, which can often provide unique opportunities amid broader market fluctuations. In this environment, identifying promising stocks involves looking beyond the headlines to find companies with solid fundamentals and growth potential that may be overlooked in the current climate.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Senstar Technologies | NA | -15.82% | 43.55% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

We'll examine a selection from our screener results.

Viemed Healthcare (VMD)

Simply Wall St Value Rating: ★★★★★☆

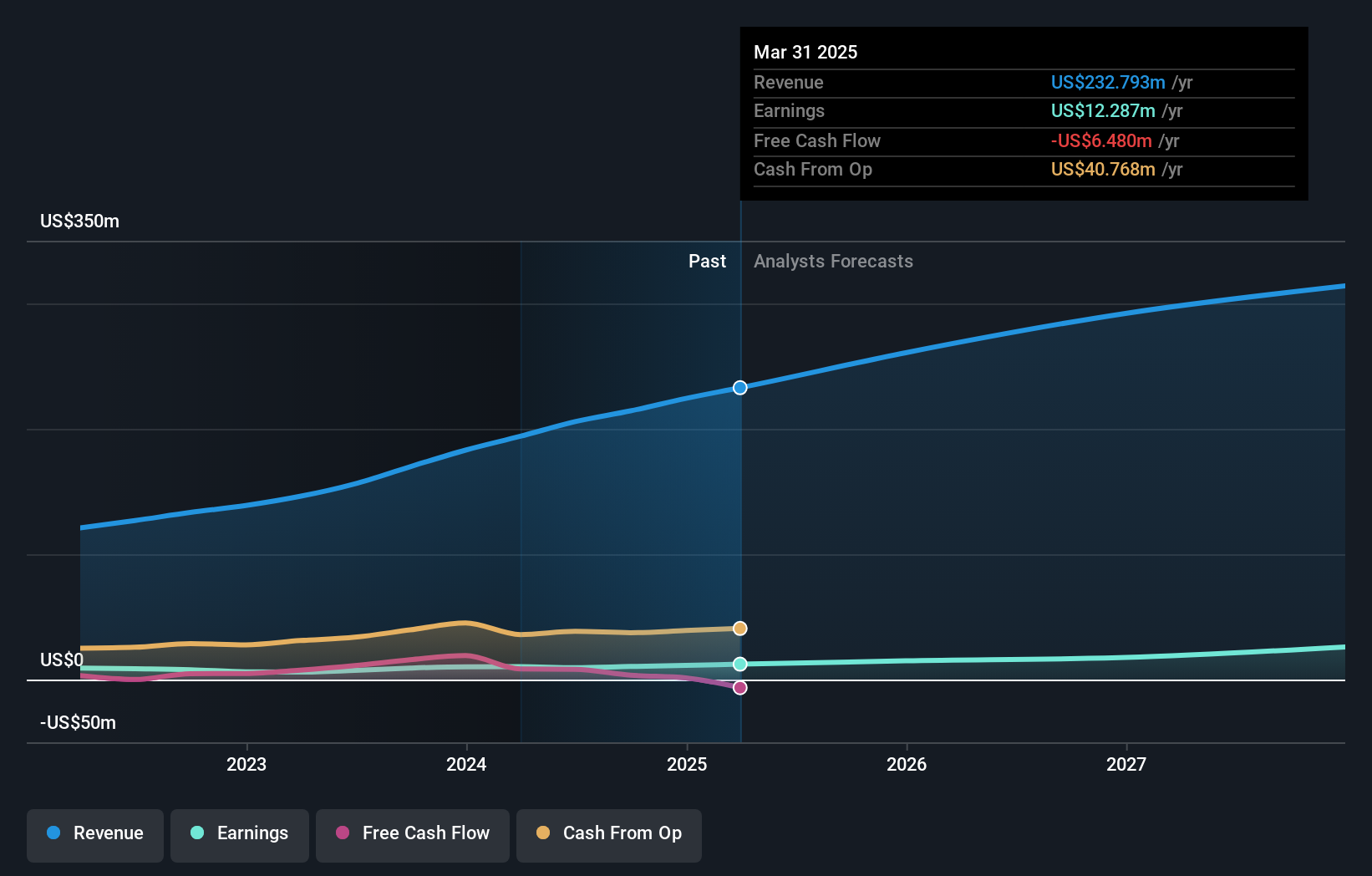

Overview: Viemed Healthcare, Inc. offers home medical equipment and post-acute respiratory healthcare services in the United States, with a market cap of approximately $282.85 million.

Operations: Viemed generates revenue primarily from healthcare facilities and services, amounting to $254.79 million. The company's financial performance is characterized by a focus on providing home medical equipment and respiratory healthcare services in the U.S.

Viemed Healthcare, a promising player in the healthcare sector, showcases a satisfactory net debt to equity ratio of 7.4%, indicating prudent financial management. Despite recent guidance adjustments lowering expected revenue to $271-$273 million for 2025, Viemed's earnings growth of 30.5% over the past year outpaces the industry average of 19.6%. The company reported Q3 sales at US$71.91 million, up from US$58 million last year, though net income slightly dipped to US$3.51 million from US$3.88 million previously. With a price-to-earnings ratio of 20.8x below industry norms and high-quality earnings, Viemed remains an intriguing investment consideration amidst market fluctuations.

Here Group (HERE)

Simply Wall St Value Rating: ★★★★★☆

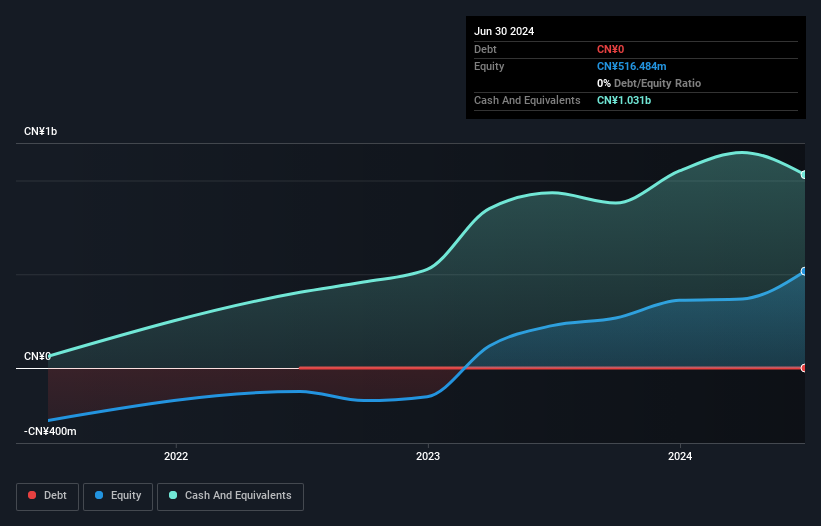

Overview: Here Group Limited designs and sells pop toys in China, with a market cap of $293.68 million.

Operations: Revenue for Here Group is derived from the design and sale of pop toys in China. The company operates with a market capitalization of approximately $293.68 million.

Here Group, a relatively smaller player in its industry, is navigating through challenging times with a recent earnings report showing sales of CN¥127.15 million and net income of CN¥291.61 million for Q1 2026. Despite negative earnings growth of -37.1% over the past year, the company remains optimistic about future prospects, projecting revenues between RMB 750 million to RMB 800 million for fiscal 2026. A strategic move towards share repurchases saw Here Group buy back 500,000 shares worth US$5 million recently. Trading at an attractive valuation, it seems poised for potential growth amidst industry headwinds and opportunities for expansion internationally.

Movado Group (MOV)

Simply Wall St Value Rating: ★★★★★★

Overview: Movado Group, Inc. is a company that designs, sources, markets, and distributes watches globally with a market capitalization of $467.55 million.

Operations: Movado Group generates revenue primarily from its Watch and Accessory Brands segment, contributing $561.20 million, and its Company Stores segment, which adds $100.01 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Movado Group, a notable player in the luxury watch industry, has demonstrated strong financial health with zero debt and an impressive earnings growth of 29% over the past year, outpacing its industry peers. The company reported net income of US$9.58 million for Q3 2025, up from US$4.83 million the previous year, reflecting robust operational performance. Basic earnings per share rose to US$0.43 from US$0.22 a year ago. Additionally, Movado has completed a buyback of 100,000 shares for US$1.59 million under its recent repurchase program and declared a dividend payout of $0.35 per share slated for December 2025.

- Navigate through the intricacies of Movado Group with our comprehensive health report here.

Understand Movado Group's track record by examining our Past report.

Taking Advantage

- Click this link to deep-dive into the 298 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal