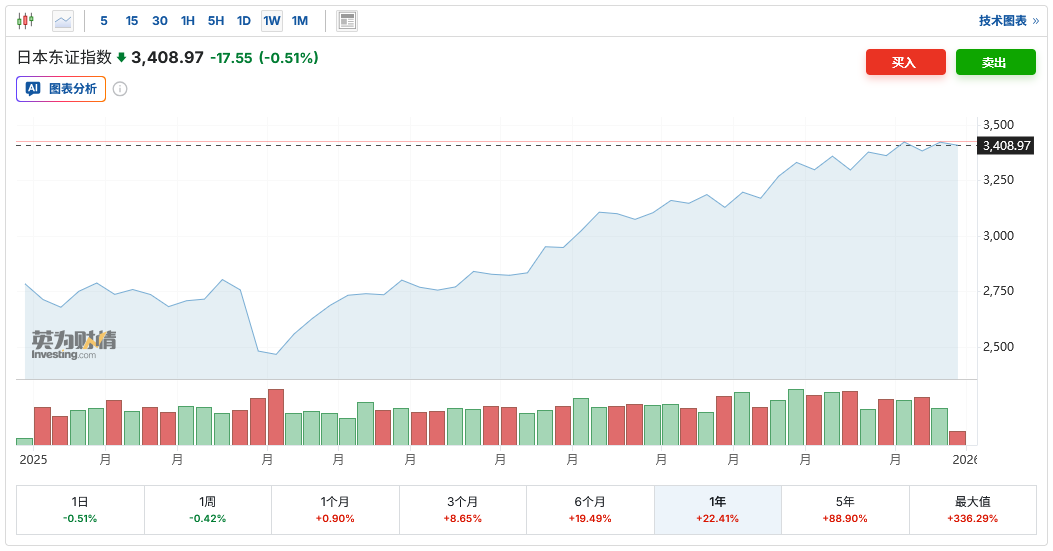

The Tokyo Stock Exchange Index hit a 36-year high at the end of the year! The year-end market showed resilience and may outperform Nikkei 225 next year, driven by corporate governance reforms

The Zhitong Finance App learned that Japan's benchmark stock index, the Tokyo Stock Exchange Index, closed at 3408.97 points on the last trading day of 2025, higher than the closing high of 2881.37 points at the end of 1989; the index has accumulated a cumulative increase of 22% since this year, achieving the third consecutive year of growth. Meanwhile, the Nikkei 225 Index closed at 50339.48 points on Tuesday, setting a new year-end high for the second year in a row; the index rose 26% during the year, outperforming the TSE Index for the third year in a row.

At the beginning of April this year, in the aftershock of US President Trump's large-scale imposition of tariffs on foreign countries, the Eastern Stock Exchange Index plummeted for a while. Subsequently, as trade war concerns abated and the Japanese stock market was undervalued compared to the US and European stock markets, the Japanese stock market regained popularity. Furthermore, the continued weakness of the yen allows foreign investors to buy Japanese assets at a lower cost, thereby boosting demand. Driven by expectations of improved Japanese corporate profits, the Takaichi Sanae government's financial stimulus plan, and global excess liquidity, the Tokyo Stock Exchange Index continued to hit new highs at the end of the year.

At the same time, buying interest has also extended to small-cap stocks, indicating that the appeal of the Japanese stock market is expanding. According to the data, the mid-cap and small-cap sectors of the Eastern Stock Exchange Index rose 27% and 26% respectively this year, outperforming the 21% increase of large-cap stocks for the first time since 2022.

Hideyuki Ishiguro, chief strategist at Nomura Asset Management, said that the new year-end high of the Tokyo Stock Exchange Index shows that “the buying base of the Japanese stock market is expanding.” He said, “With economic, corporate and political changes, the trend of valuation repair is intensifying. This is driving the expansion of the upward range from AI-related stocks to financial stocks such as banks, and domestic demand stocks such as construction and real estate.”

The Nikkei 225 Index is dominated by large blue-chip stocks in the technology and export sectors, and there was a clear correction in November as market concerns about the AI bubble heated up. However, the industry distribution of the constituent stocks of the Eastern Stock Exchange Index is more balanced, including all industries such as finance, consumption, and services, and covers more small and medium-sized companies.

Technology stocks led by Edwin Test SoftBank Group and became the biggest driving force behind the rise in the Japanese stock market in 2025. The market value of Edwin Test surpassed 10 trillion yen for the first time this year, an increase of about 114% during the year. As a test equipment supplier that detects defects in Nvidia (NVDA.US) chips before they leave the factory, Edwin Testing has benefited from a boom in AI spending that is expected to continue for several years, which also prompted the semiconductor equipment leader to raise profit guidelines in October. Tech giant SoftBank Group has also surged more than 90% this year. As the group continues to invest in OpenAI, many investors see its stock price as a key weather vane for the market's confidence in the unlisted company. Other chip and AI-related stocks, such as Mitsubishi Electric, Hitachi Group, and Tokyo Power Science and Technology Innovation, have also achieved significant gains.

It is worth mentioning that although the Nikkei 225 Index has performed better than the TSE Index for a long time, driven by the global AI wave, the recent performance of the TSE Index has shown more obvious resilience. Hideyuki Ishiguro said that the TSE Index is likely to outperform the Nikkei 225 Index in 2026 because “the planned revisions to the Corporate Governance Guidelines will encourage companies to use cash and further improve net market ratios, which will trigger purchases of a wider range of stocks.”

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal