Al Waha Capital PJSC And 2 Other Middle Eastern Penny Stocks To Consider

Most Gulf markets have recently experienced gains, buoyed by expectations of further Federal Reserve interest rate cuts, though subdued oil prices have tempered overall sentiment. For investors exploring opportunities beyond traditional large-cap stocks, penny stocks—despite the term's somewhat outdated feel—remain a viable area for potential growth. These smaller or newer companies can offer a mix of affordability and growth potential when backed by solid financials.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.34 | SAR1.32B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.509 | ₪179.93M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.05 | AED2.14B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.66 | SAR932M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.25 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.66 | AED15.52B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.849 | AED517.02M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.61 | ₪204.88M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 82 stocks from our Middle Eastern Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm that manages assets across various sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets with a market cap of AED3.38 billion.

Operations: The company's revenue from its private investments, excluding Waha Land, amounts to AED188.88 million.

Market Cap: AED3.38B

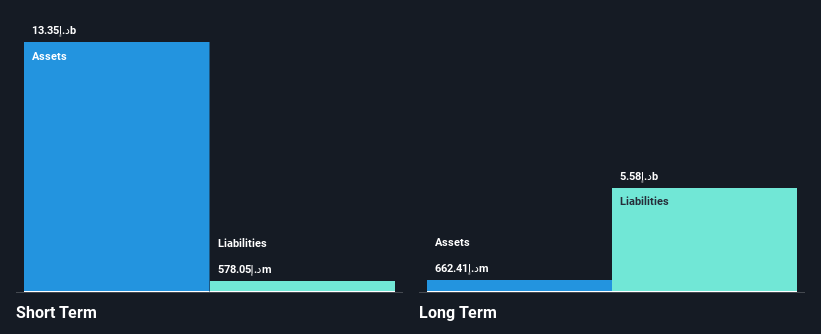

Al Waha Capital PJSC, with a market cap of AED3.38 billion, has shown mixed performance as a penny stock. Despite reporting significant revenue of AED373.19 million for Q3 2025 and net income growth to AED134.38 million, the company faces challenges such as negative operating cash flow and low return on equity at 8.8%. Its debt management is commendable with reduced debt-to-equity from 106.4% to 50.6% over five years and short-term assets exceeding liabilities significantly, but dividends are not well covered by free cash flows. The experienced management team may help navigate these complexities moving forward.

- Dive into the specifics of Al Waha Capital PJSC here with our thorough balance sheet health report.

- Learn about Al Waha Capital PJSC's historical performance here.

Almeda Ventures Limited Partnership (TASE:AMDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Almeda Ventures Limited Partnership is a venture capital firm that focuses on seed, start-up, early venture, and middle market investments, with a market cap of ₪31.78 million.

Operations: The company generates its revenue solely from its venture capital segment, which reported -$3.23 million.

Market Cap: ₪31.78M

Almeda Ventures Limited Partnership, with a market cap of ₪31.78 million, operates as a venture capital firm focused on early-stage investments. The company is pre-revenue, reporting negative earnings of $3.23 million and lacking significant revenue streams. Despite being debt-free with no long-term liabilities, Almeda's financials reveal challenges such as increasing losses over the past five years at a rate of 60.8% annually and a negative return on equity of -19.37%. However, it maintains sufficient cash runway for over a year based on current free cash flow levels and has short-term assets exceeding its liabilities significantly.

- Navigate through the intricacies of Almeda Ventures Limited Partnership with our comprehensive balance sheet health report here.

- Understand Almeda Ventures Limited Partnership's track record by examining our performance history report.

E.E.A.M.I (TASE:EEAM-M)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: E.E.A.M.I Ltd specializes in the development, sale, and maintenance of robotic cleaning solutions for PV modules across Israel, India, and other international markets with a market cap of ₪9.80 million.

Operations: No specific revenue segments are reported for TASE:EEAM-M.

Market Cap: ₪9.8M

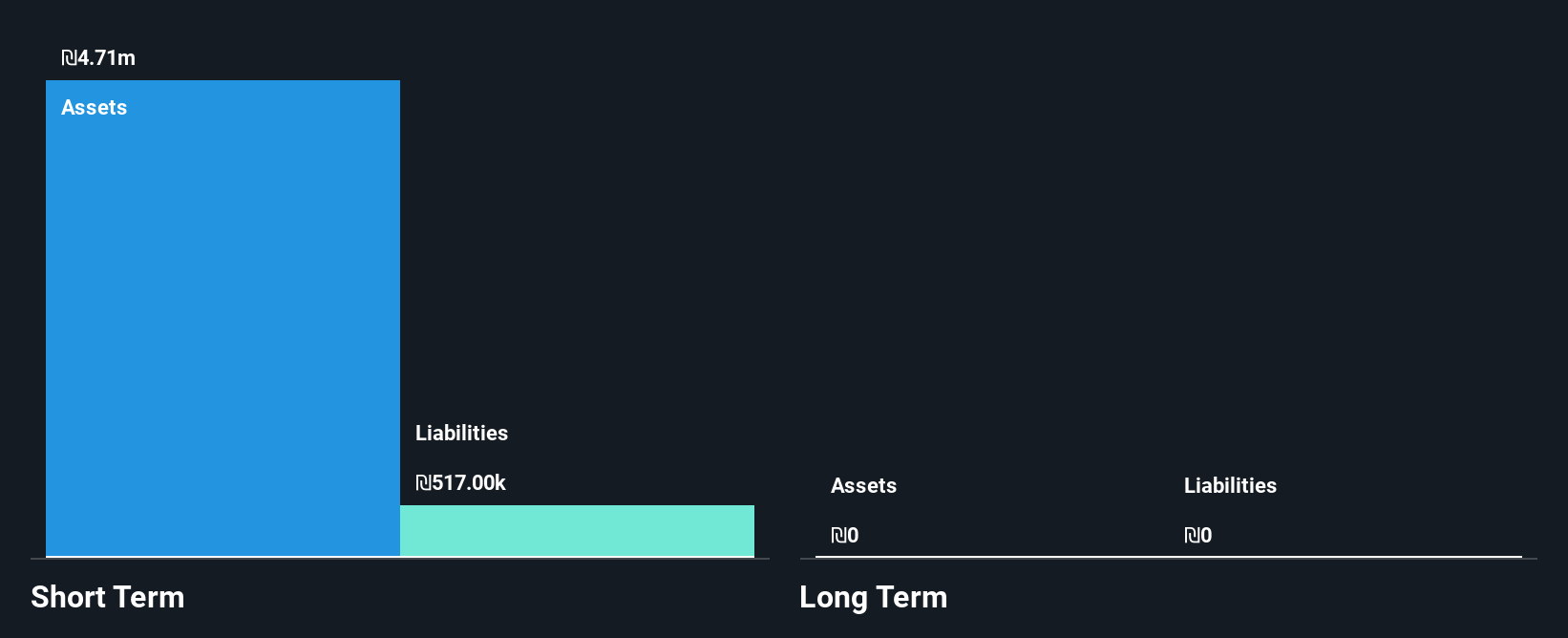

E.E.A.M.I Ltd, with a market cap of ₪9.80 million, specializes in robotic cleaning solutions for PV modules and is currently pre-revenue, generating less than US$1 million. The company recently executed a 1:20 stock split on November 2, 2025. Despite its small revenue base, E.E.A.M.I has turned profitable this year and boasts an outstanding return on equity of 51.9%. It is debt-free with short-term assets of ₪4.7 million exceeding liabilities significantly. However, the stock has shown high volatility recently and the management team lacks experience with an average tenure under two years.

- Get an in-depth perspective on E.E.A.M.I's performance by reading our balance sheet health report here.

- Evaluate E.E.A.M.I's historical performance by accessing our past performance report.

Key Takeaways

- Dive into all 82 of the Middle Eastern Penny Stocks we have identified here.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 29 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal