Asian Market Value Picks: 3 Stocks Priced Below Estimated Intrinsic Value

As Asian markets continue to navigate a landscape of economic challenges and opportunities, investors are increasingly focused on identifying stocks that offer strong value propositions amid current conditions. In this context, selecting stocks priced below their estimated intrinsic value can be a strategic approach to capitalizing on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | CN¥16.40 | CN¥32.50 | 49.5% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥82.98 | CN¥162.17 | 48.8% |

| Sany Heavy Equipment International Holdings (SEHK:631) | HK$8.42 | HK$16.37 | 48.6% |

| PharmaEssentia (TWSE:6446) | NT$484.50 | NT$946.92 | 48.8% |

| Kuraray (TSE:3405) | ¥1594.50 | ¥3161.62 | 49.6% |

| JINS HOLDINGS (TSE:3046) | ¥5620.00 | ¥11007.05 | 48.9% |

| Forth Corporation (SET:FORTH) | THB5.75 | THB11.20 | 48.7% |

| CURVES HOLDINGS (TSE:7085) | ¥809.00 | ¥1581.32 | 48.8% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥259.79 | CN¥516.30 | 49.7% |

| Aidma Holdings (TSE:7373) | ¥3165.00 | ¥6305.80 | 49.8% |

Here we highlight a subset of our preferred stocks from the screener.

Accelink Technologies CoLtd (SZSE:002281)

Overview: Accelink Technologies Co., Ltd. is engaged in the research, development, manufacturing, sales, and technical services of optoelectronic chips, devices, modules, and subsystem products primarily in China with a market cap of CN¥57.11 billion.

Operations: The company's revenue from Communication Equipment Manufacturing is CN¥11.38 billion.

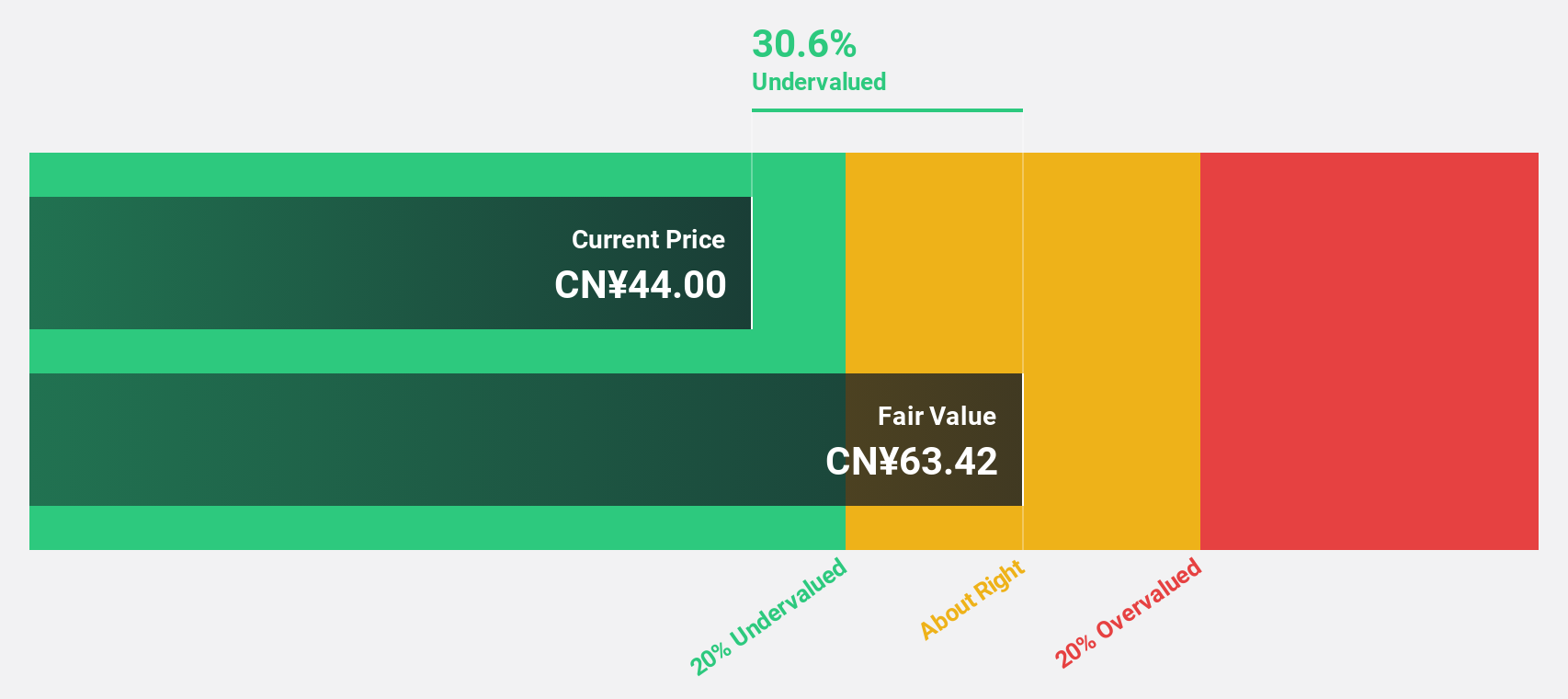

Estimated Discount To Fair Value: 39.3%

Accelink Technologies Co. Ltd. is trading at CN¥70.8, significantly below its estimated fair value of CN¥116.7, suggesting it may be undervalued based on cash flows. Earnings are projected to grow 31.1% annually, outpacing the Chinese market's growth rate of 27.6%, while revenue is expected to increase by over 20% per year, surpassing the market average of 14.6%. Recent changes in company bylaws and board appointments indicate strategic shifts potentially enhancing future performance.

- Upon reviewing our latest growth report, Accelink Technologies CoLtd's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Accelink Technologies CoLtd stock in this financial health report.

TORIDOLL Holdings (TSE:3397)

Overview: TORIDOLL Holdings Corporation operates and manages restaurants both in Japan and internationally, with a market cap of ¥376.56 billion.

Operations: The company generates revenue through its segments, with Marugame Seimen contributing ¥134.37 billion and the Overseas Business segment adding ¥103.21 billion.

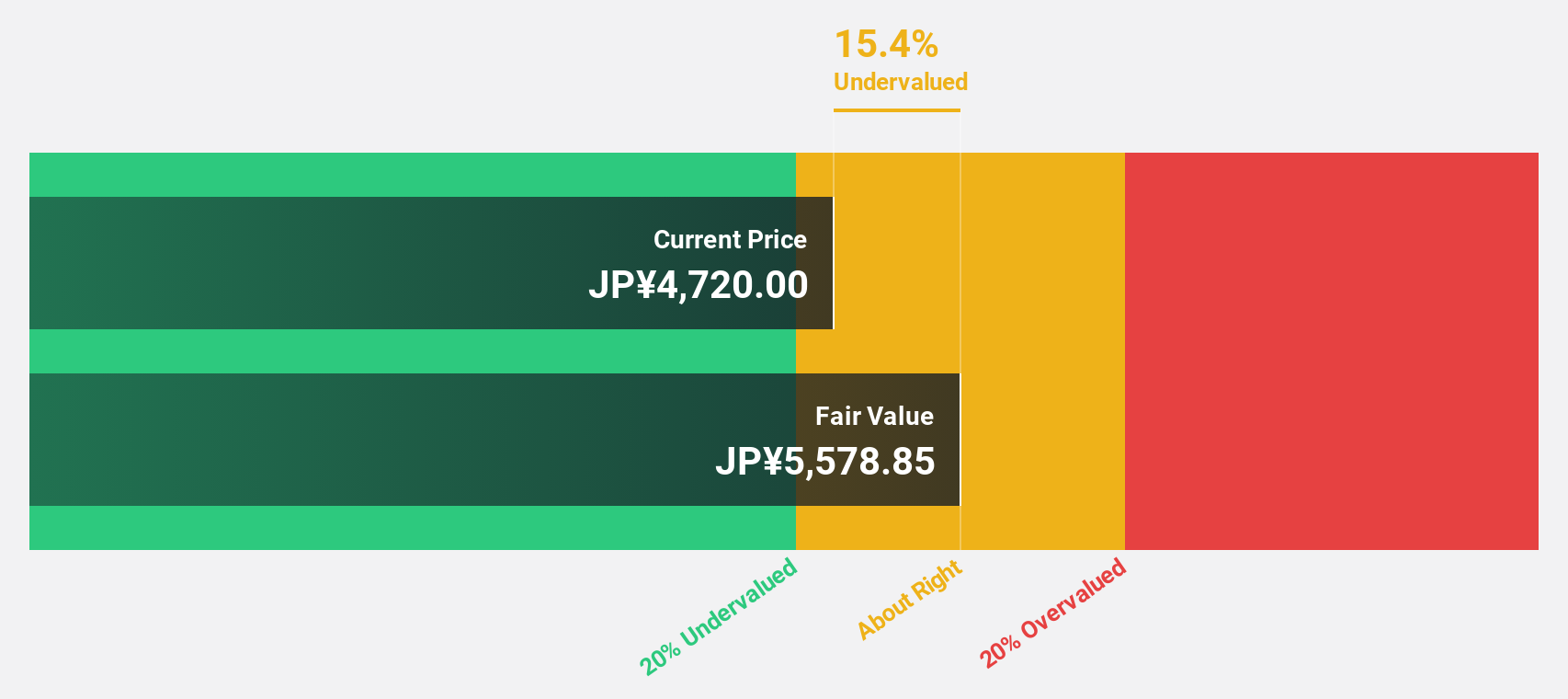

Estimated Discount To Fair Value: 28.8%

TORIDOLL Holdings, trading at ¥4,286, is valued below its estimated fair value of ¥6,016.34, highlighting potential undervaluation based on cash flows. Earnings are expected to grow significantly by 33.7% annually over the next three years, outpacing the Japanese market's 8.6% growth rate. However, revenue growth is forecasted at a modest 6.4% per year and return on equity remains low at an anticipated 11.3%.

- In light of our recent growth report, it seems possible that TORIDOLL Holdings' financial performance will exceed current levels.

- Navigate through the intricacies of TORIDOLL Holdings with our comprehensive financial health report here.

Kyokuto Kaihatsu KogyoLtd (TSE:7226)

Overview: Kyokuto Kaihatsu Kogyo Co., Ltd. is a Japanese company that manufactures and sells special purpose vehicles, environmental equipment and systems, and car parking systems, with a market cap of ¥122.06 billion.

Operations: The company's revenue segments include ¥8.30 billion from parking systems, ¥127.39 billion from special vehicles, and ¥15.54 billion from the environmental business.

Estimated Discount To Fair Value: 31.6%

Kyokuto Kaihatsu Kogyo Ltd., trading at ¥3,175, is priced below its estimated fair value of ¥4,639.82. Despite a dividend reduction to ¥70 per share and low profit margins of 0.8%, the company shows promise with earnings projected to grow significantly by 68.77% annually, surpassing the Japanese market's growth rate. However, revenue growth is moderate at 11.2% per year and return on equity remains low at a forecasted 8.2%.

- The analysis detailed in our Kyokuto Kaihatsu KogyoLtd growth report hints at robust future financial performance.

- Get an in-depth perspective on Kyokuto Kaihatsu KogyoLtd's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Discover the full array of 267 Undervalued Asian Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal