Asian Penny Stocks: LX Technology Group Among 3 To Watch

As global markets experience shifts in sentiment, particularly with optimism around artificial intelligence and economic growth in major regions like the U.S. and Japan, investors are exploring diverse opportunities across various sectors. Penny stocks, while often associated with smaller or newer companies, remain a relevant investment area for those seeking potential growth beyond well-established names. Despite their vintage connotation, these stocks can offer surprising value when backed by strong financial health and resilience, presenting intriguing opportunities for investors willing to explore them further.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.57 | HK$2.13B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.98 | THB894M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.44 | SGD13.54B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.66 | HK$20.61B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.52 | HK$52.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.84 | NZ$240.51M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 968 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

LX Technology Group (SEHK:2436)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LX Technology Group Limited offers device lifecycle management solutions mainly in the People’s Republic of China and Hong Kong, with a market cap of HK$1.59 billion.

Operations: The company's revenue is primarily derived from device recycling (CN¥2 billion), device subscription (CN¥387.67 million), and IT technical subscription services (CN¥156.17 million).

Market Cap: HK$1.59B

LX Technology Group Limited, with a market cap of HK$1.59 billion, primarily generates revenue from device recycling (CN¥2 billion), device subscription (CN¥387.67 million), and IT technical subscription services (CN¥156.17 million). Despite being unprofitable, it has reduced losses over the past five years at a rate of 38.2% annually and maintains a satisfactory net debt to equity ratio of 36.3%. The company benefits from an experienced management team with an average tenure of 6.6 years and has sufficient cash runway for more than three years based on current free cash flow levels.

- Click here to discover the nuances of LX Technology Group with our detailed analytical financial health report.

- Examine LX Technology Group's past performance report to understand how it has performed in prior years.

Zhejiang Taimei Medical Technology (SEHK:2576)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Taimei Medical Technology Co., Ltd. operates in the medical technology sector and has a market capitalization of approximately HK$2.25 billion.

Operations: The company's revenue is primarily derived from Digital Services, generating CN¥316.66 million, and Cloud-Based Software, contributing CN¥205.65 million.

Market Cap: HK$2.25B

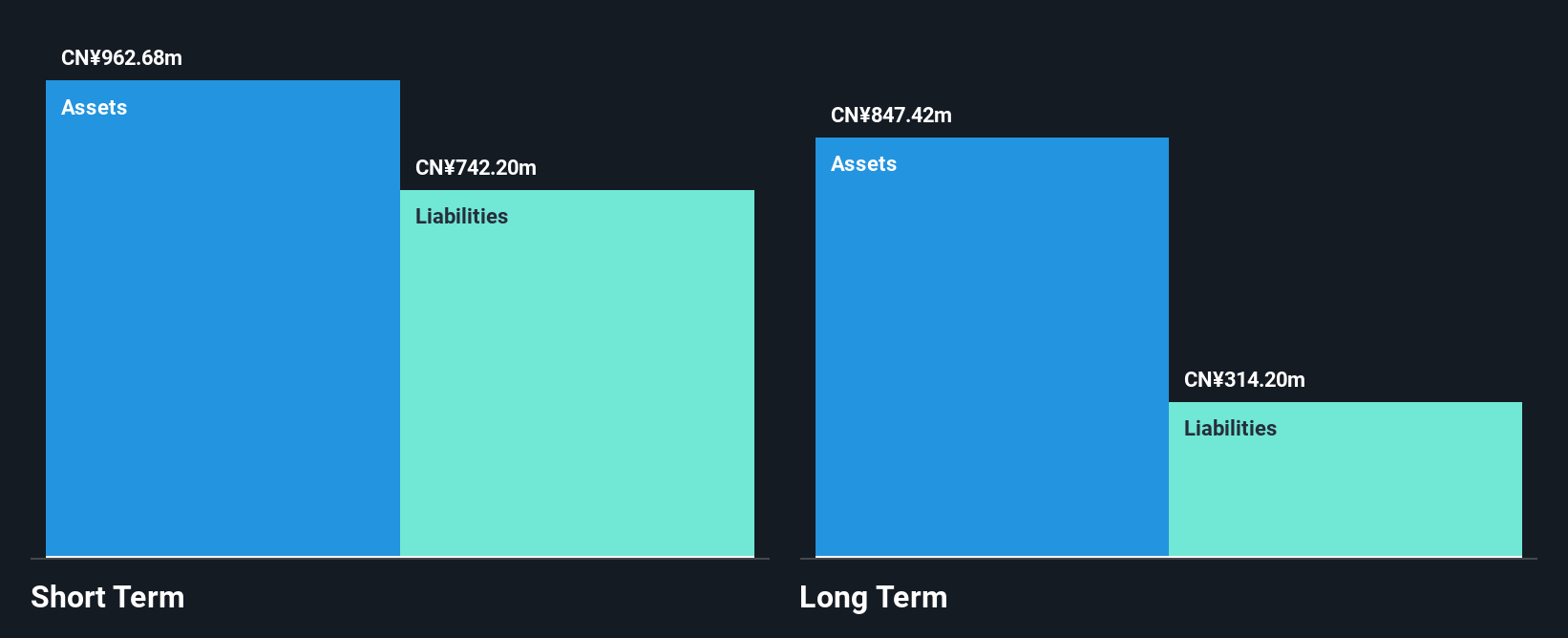

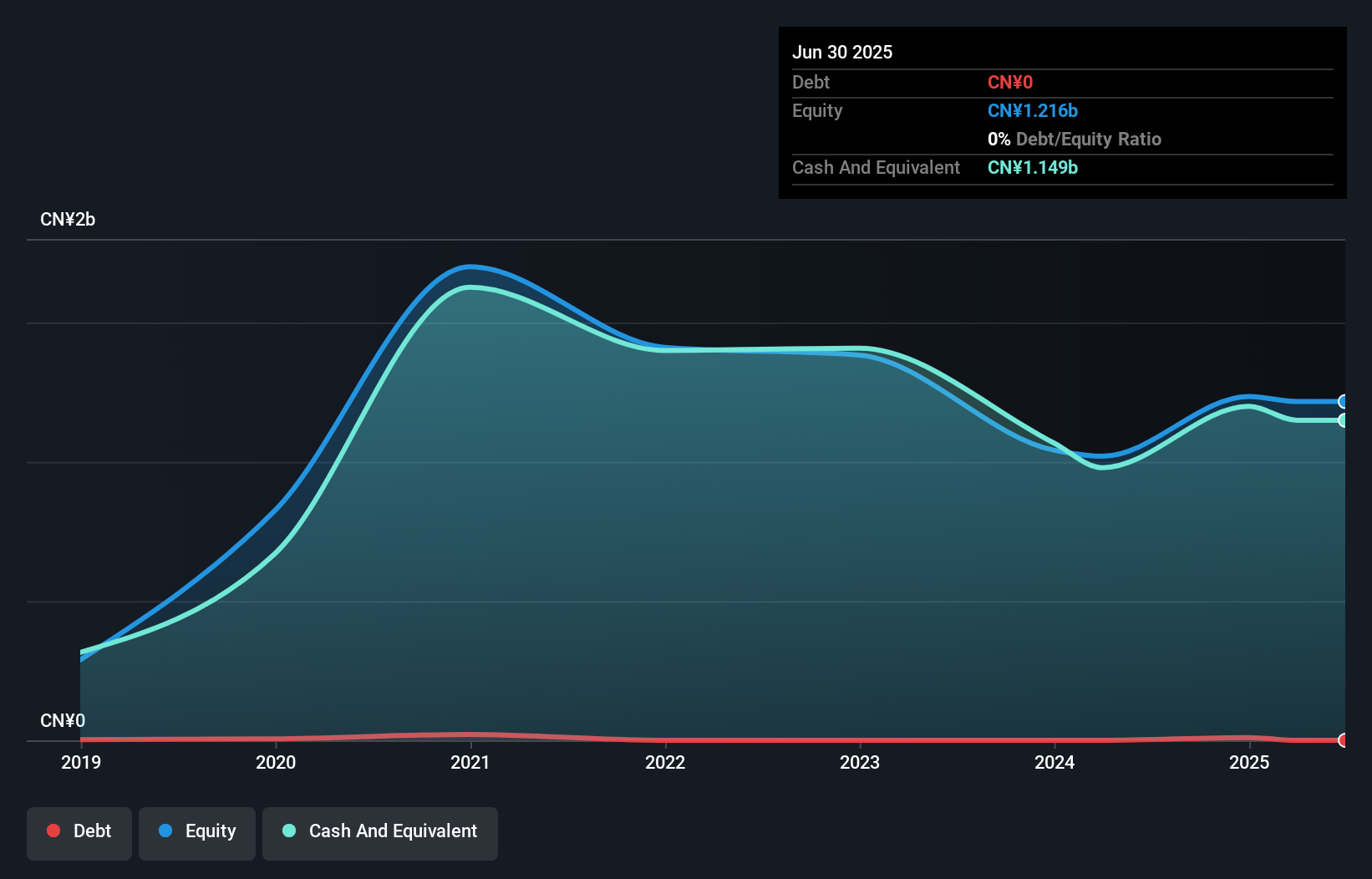

Zhejiang Taimei Medical Technology, with a market cap of HK$2.25 billion, derives substantial revenue from Digital Services (CN¥316.66 million) and Cloud-Based Software (CN¥205.65 million). Despite being unprofitable, it has effectively reduced losses by 30.8% annually over the past five years and maintains a debt-free status with sufficient cash runway for more than three years based on current free cash flow trends. The company's experienced management team averages 2.3 years in tenure, while its board members average 5.3 years, ensuring seasoned leadership as it navigates financial challenges and opportunities within the medical technology sector.

- Click to explore a detailed breakdown of our findings in Zhejiang Taimei Medical Technology's financial health report.

- Assess Zhejiang Taimei Medical Technology's previous results with our detailed historical performance reports.

Ju Teng International Holdings (SEHK:3336)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ju Teng International Holdings Limited is an investment holding company that manufactures and sells casings for notebook computers and handheld devices in China and internationally, with a market cap of HK$1.87 billion.

Operations: The company generates revenue from the manufacture and sale of casings for notebook computers and handheld devices, totaling HK$5.74 billion.

Market Cap: HK$1.87B

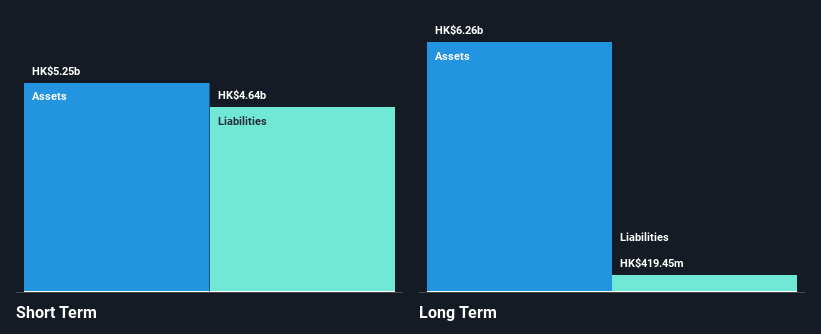

Ju Teng International Holdings, with a market cap of HK$1.87 billion, generates HK$5.74 billion in revenue from manufacturing casings for electronic devices. Despite this, the company remains unprofitable with a negative return on equity of -13.12% and increasing losses over the past five years at 69.1% annually. The company's short-term assets of HK$4.9 billion adequately cover both its short-term and long-term liabilities, though its debt is not well covered by operating cash flow (14.6%). While shareholder dilution hasn't occurred recently, share price volatility remains high compared to most Hong Kong stocks.

- Get an in-depth perspective on Ju Teng International Holdings' performance by reading our balance sheet health report here.

- Gain insights into Ju Teng International Holdings' past trends and performance with our report on the company's historical track record.

Next Steps

- Navigate through the entire inventory of 968 Asian Penny Stocks here.

- Seeking Other Investments? We've found 10 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal