ASX Growth Companies With Insider Ownership Up To 19%

As the Australian market approaches the end of the calendar year, it seems to be winding down with a slight dip, attributed to profit-taking and holiday closures, while international indices flirt with record highs. In this environment, growth companies with high insider ownership can offer unique insights into potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.2% | 96.3% |

| Titomic (ASX:TTT) | 14.8% | 74.9% |

| Sea Forest (ASX:SEA) | 15.1% | 92.6% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Lunnon Metals (ASX:LM8) | 11% | 31.4% |

| IperionX (ASX:IPX) | 17.1% | 94.9% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| BlinkLab (ASX:BB1) | 35.3% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Elsight (ASX:ELS)

Simply Wall St Growth Rating: ★★★★★★

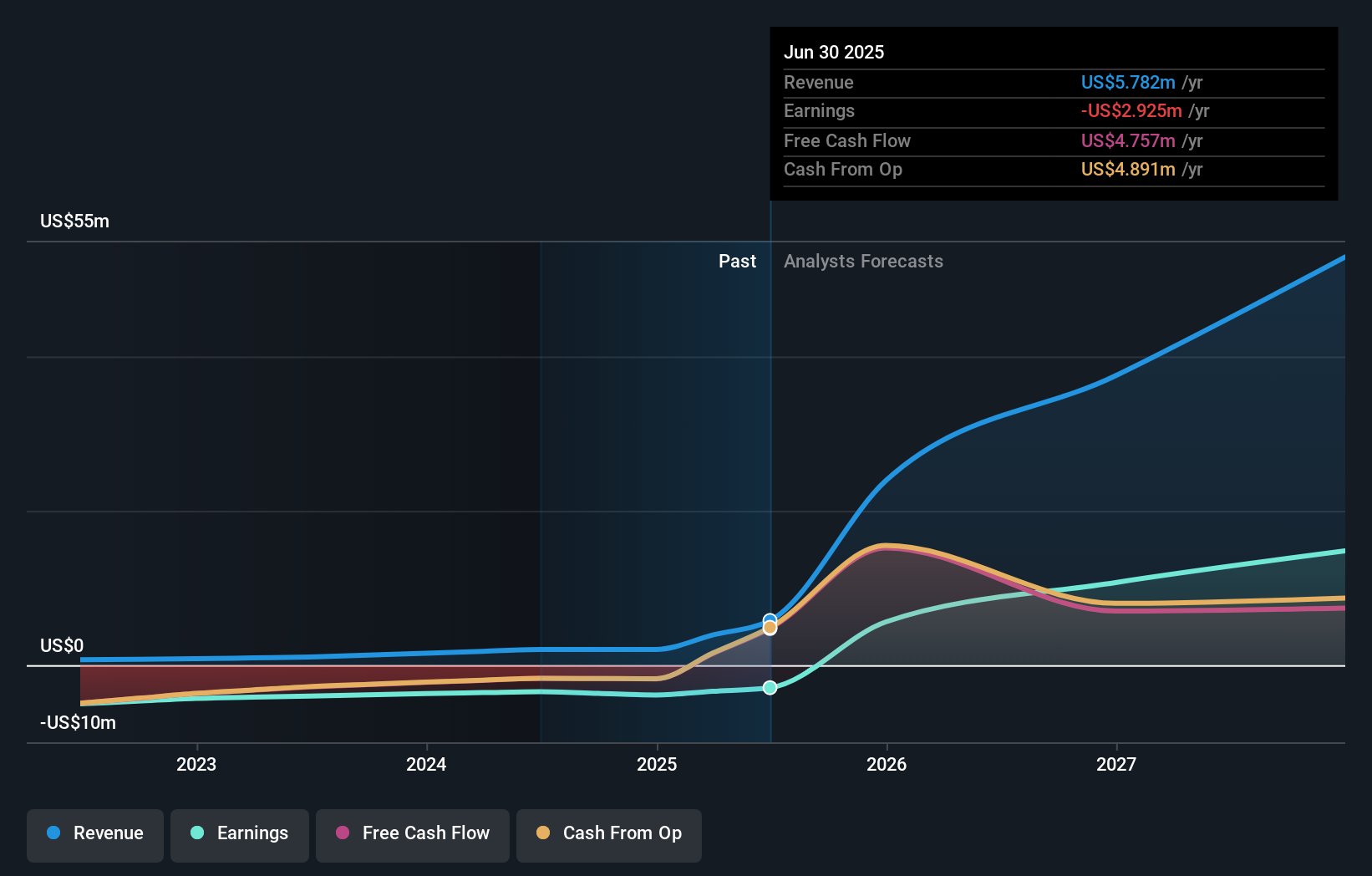

Overview: Elsight Limited offers connectivity solutions across Israel, the United States, and internationally, with a market cap of A$715.65 million.

Operations: The company's revenue is primarily derived from its Electronic Security Devices segment, amounting to $5.78 million.

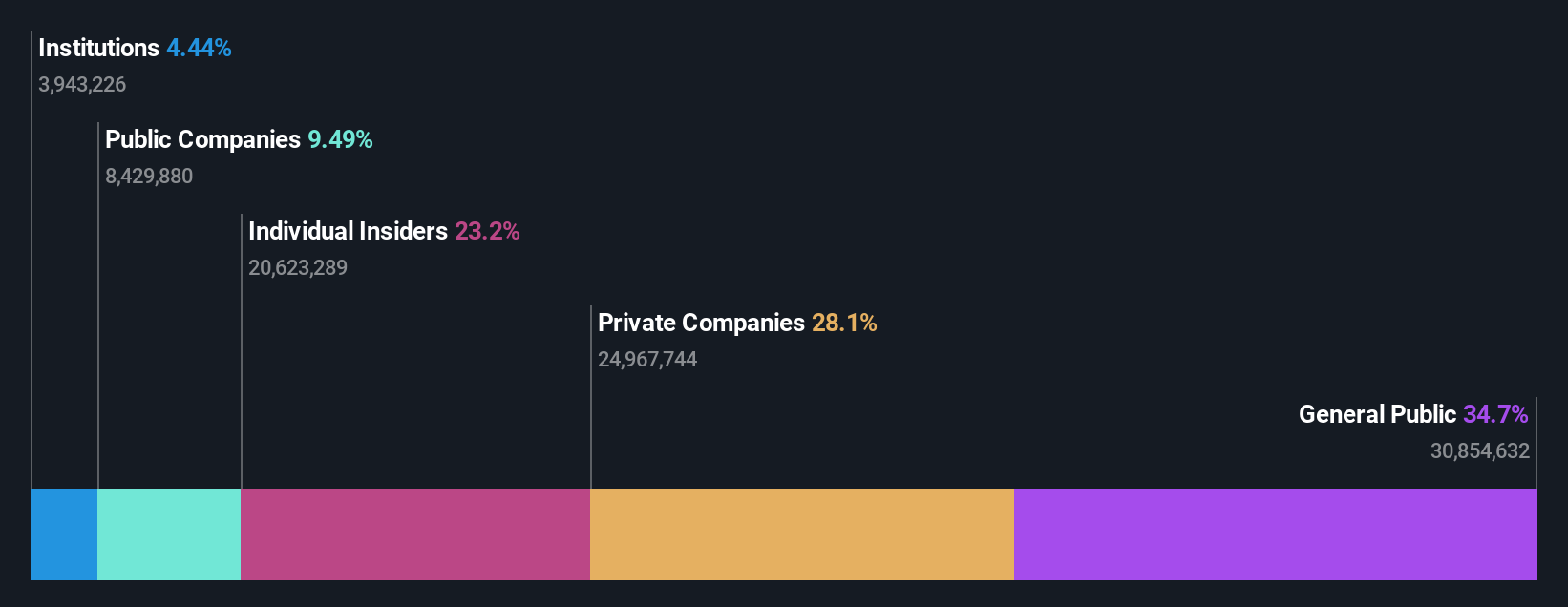

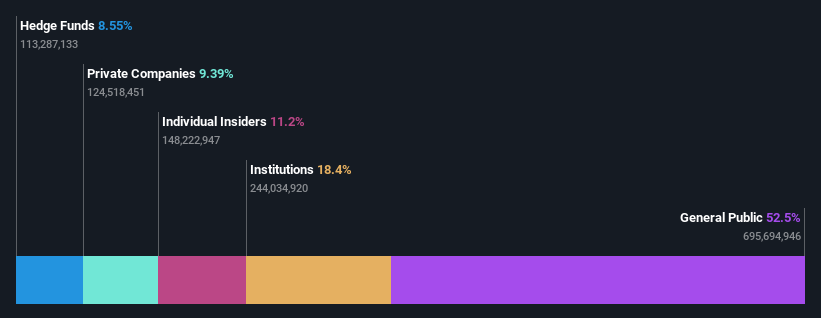

Insider Ownership: 17.3%

Elsight's high insider ownership aligns with its growth trajectory, as it advances in the U.S. Defense Innovation Unit's Project G.I., showcasing its HALO connectivity platform. The company's forecasted revenue growth of 67.2% annually surpasses market averages, though recent shareholder dilution and share price volatility pose challenges. Expected profitability within three years underscores potential, bolstered by strategic defense sector engagements and technological innovation in multilink communication systems for uncrewed operations.

- Get an in-depth perspective on Elsight's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Elsight's shares may be trading at a premium.

LGI (ASX:LGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LGI Limited specializes in carbon abatement and renewable energy solutions using biogas from landfill sites in Australia, with a market capitalization of A$416.86 million.

Operations: The company's revenue is derived from three main segments: Carbon Abatement (A$17.29 million), Renewable Energy (A$17.08 million), and Infrastructure Construction and Management (A$2.37 million).

Insider Ownership: 19.9%

LGI's insider ownership supports its growth potential, with revenue forecasted to grow at 16.9% annually, outpacing the Australian market. However, recent shareholder dilution through equity offerings raises concerns. Amendments to the company's constitution aim to enhance flexibility in virtual meetings, potentially improving shareholder engagement. Despite trading at 47.5% below estimated fair value and a projected earnings growth of 28.6% annually, LGI's return on equity is expected to remain low in three years at 13.5%.

- Unlock comprehensive insights into our analysis of LGI stock in this growth report.

- The valuation report we've compiled suggests that LGI's current price could be inflated.

Titomic (ASX:TTT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Titomic Limited provides manufacturing and technology solutions for high-performance metal additive manufacturing across Australia, the United States, and Europe, with a market cap of A$375.86 million.

Operations: The company's revenue primarily comes from the development and sale of additive manufacturing technology, amounting to A$9.43 million.

Insider Ownership: 14.8%

Titomic's growth potential is bolstered by high insider ownership, with insiders buying more shares than they sold in the past three months. The company's revenue is expected to grow at a robust 46.1% annually, significantly outpacing the broader Australian market. Despite recent shareholder dilution from a A$50.35 million equity offering, Titomic's innovative Kinetic Fusion technology has gained validation through successful aerospace tests, enhancing its position in high-demand sectors like defense and aerospace manufacturing.

- Click here and access our complete growth analysis report to understand the dynamics of Titomic.

- Our comprehensive valuation report raises the possibility that Titomic is priced higher than what may be justified by its financials.

Where To Now?

- Access the full spectrum of 112 Fast Growing ASX Companies With High Insider Ownership by clicking on this link.

- Ready To Venture Into Other Investment Styles? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Index Options

Index Options State Street

State Street CME Group

CME Group Nasdaq

Nasdaq Cboe

Cboe TradingView

TradingView Wall Street Journal

Wall Street Journal